- Home

- »

- Consumer F&B

- »

-

Ice Cream Market Size And Share, Industry Report, 2033GVR Report cover

![Ice Cream Market Size, Share & Trends Report]()

Ice Cream Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Cartons, Tubs, Cups, Cones, Bars), By Type (Dairy & Water-based, Vegan), By Flavor (Chocolate, Vanilla, Fruit), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-072-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ice Cream Market Summary

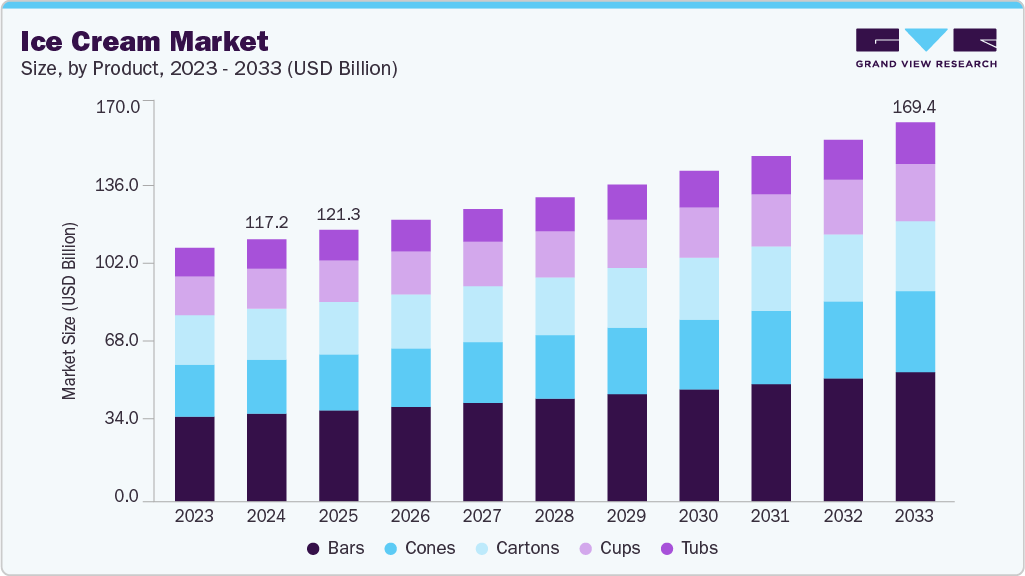

The global ice cream market size was estimated at USD 117.22 billion in 2024 and is expected to reach USD 169.40 billion by 2033, growing at a CAGR of 4.3% from 2025 to 2033. Ice cream manufacturers are continuously innovating, introducing a diverse range of flavors, textures, and formats to entice consumers, including vegan, dairy-free, premium, and artisanal varieties.

Key Market Trends & Insights

- By region, Asia Pacific led the market with a share of 37.28% in 2024.

- By product, bars led the global ice cream market and accounted for a share of 33.48% in 2024.

- By type, dairy & water-based ice creams led the global market and accounted for a share of 96.28% in 2024.

- By flavor, chocolate led the global market and accounted for a share of 32.83% in 2024.

- By distribution channel, retail channels led the global market and accounted for a share of 78.72% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 117.22 Billion

- 2033 Projected Market Size: USD 169.40 Billion

- CAGR (2025-2033): 4.3%

- Asia Pacific: Largest market in 2024

Concurrently, there is a rising demand for healthier options, driven by health and wellness trends, as well as products made with natural and organic ingredients. Despite its seasonal nature, efforts to promote year-round consumption through targeted marketing campaigns are expanding the market growth.The industry is being shaped by shifting consumer demographics and cultural trends. As disposable incomes rise in emerging markets and urbanization accelerates globally, there is a growing demand for ice cream as an affordable indulgence and a symbol of the Western lifestyle. Moreover, cultural diversity and globalization have led to the adoption of exotic flavors and dessert traditions from around the world, enriching the market's offerings and appealing to diverse consumer tastes.

In April 2024, California-based Alec's Ice Cream announced the launch of nine new premium flavors, meticulously crafted with sustainably sourced, regenerative organic ingredients and A2/A2 dairy. All flavors are gluten-free and offer luxurious indulgence. These latest additions will be available in the U.S, expanding the company's lineup to 14 flavors. Select Whole Foods Market locations, as well as numerous independent stores, will stock the entire range of flavors.

Additionally, changing consumer lifestyles and rising disposable incomes have led to a greater emphasis on quality and indulgence in food choices. Premium ice creams, with their superior ingredients, unique flavors, and artisanal production processes, appeal to consumers seeking an elevated sensory experience and a touch of luxury in their desserts.

According to Kerry Group, an international food company, premium and luxury ice cream options in Europe are swiftly adapting to meet the increasing demand for satisfying and indulgent dessert experiences. Similarly, in Australia, there is a consensus that ice cream flavors can range from sweet to savory, but indulgence remains a key factor in selecting items from the freezer aisle. In Mexico, it is anticipated that indulgent ingredients, including toppings, fillings, and natural flavors, will continue to gain popularity in the future.

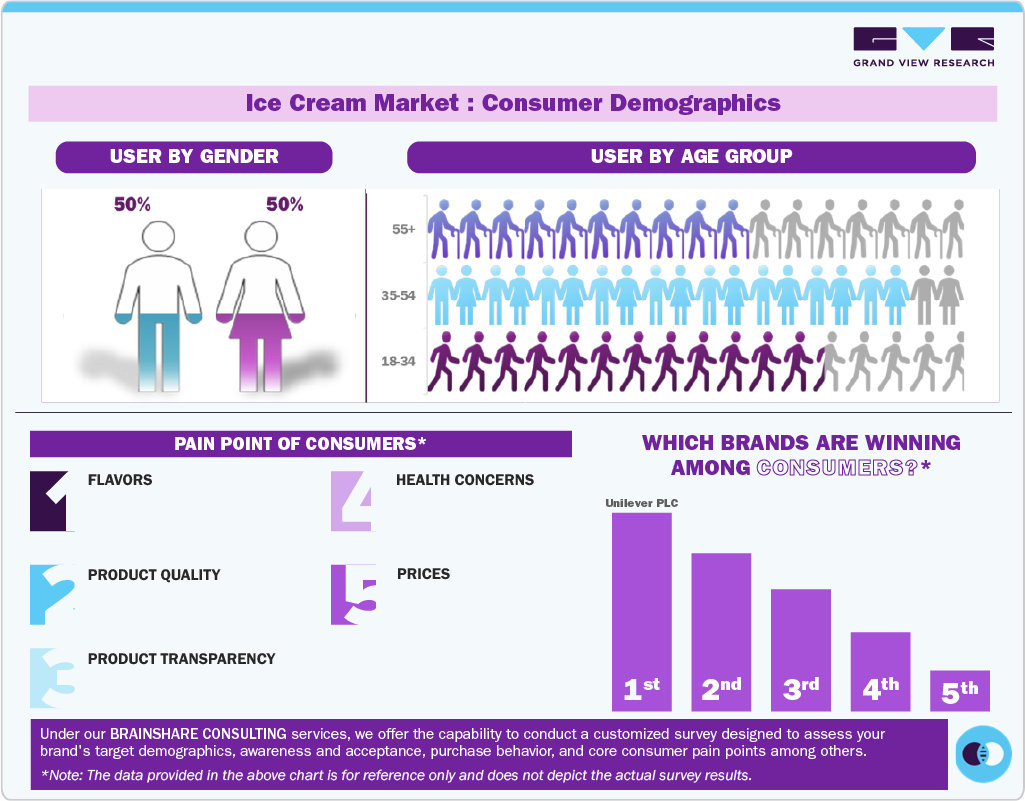

Consumer Insights

People of all ages enjoy ice cream, but certain age groups have stronger preferences for it. Children and teenagers often have a higher affinity for ice cream, while adults and older adults also form a significant customer base. Children and teenagers have a strong affinity for ice cream, often viewing it as a treat or reward. Ice cream manufacturers that cater to this demographic with playful flavors, colorful presentations, and family-friendly atmospheres attract a loyal customer base.

Product Insights

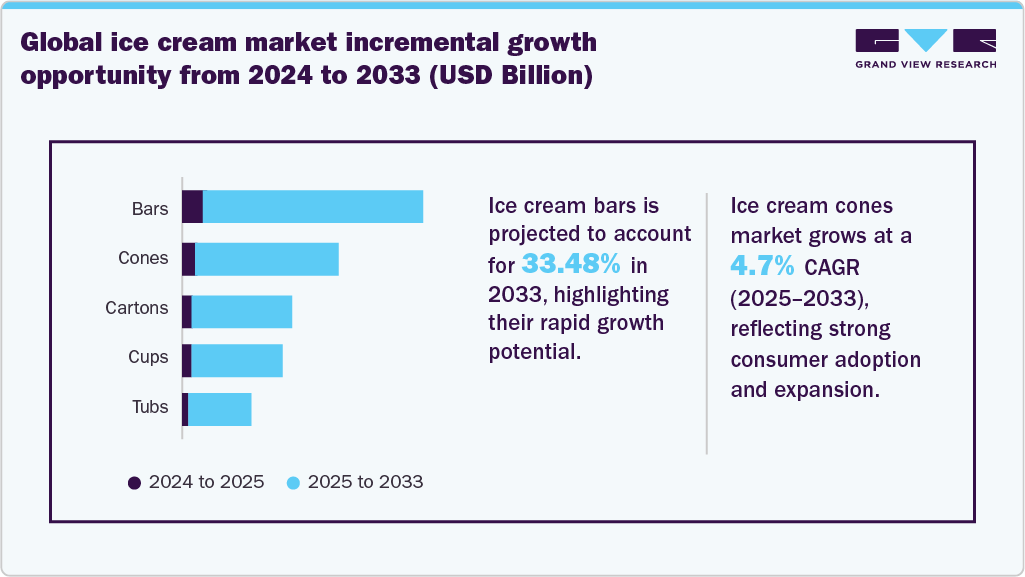

Ice cream bars held the largest revenue share of the global ice cream industry in 2024, accounting for a share of 33.48%. Consumer demand for convenience and on-the-go snacking options has significantly increased. Ice cream bars offer a quick and easy way to enjoy a sweet treat without the need for utensils or bowls, making them an attractive option for busy consumers seeking instant gratification. This convenience factor is particularly appealing to younger demographics who prioritize portability and ease of consumption in their food choices.

Ice cream cones are anticipated to witness a CAGR of 4.7% from 2025 to 2033. The nostalgic appeal of ice cream cones evokes fond memories of childhood for many adults, making them a popular choice among people of all ages. Additionally, Innovation in flavors and cone types is another critical factor propelling the segment. Ice cream manufacturers continually experiment with new and exotic flavors to attract adventurous consumers and keep their product offerings exciting. Unconventional flavors, such as matcha, lavender, and salted caramel, alongside traditional favorites, provide a broad spectrum of choices that cater to diverse taste preferences.

Type Insights

The dairy & water-based segment held the largest revenue share of the global ice cream industry in 2024, accounting for a share of 96.28%. Ice cream is a dairy-based frozen delicacy that is typically eaten as a sweet or snack. According to federal laws and standards of identity, ice cream must contain at least 20% milk solids by weight and a minimum of 10% milk fat. Blended dairy ingredients are pasteurized and homogenized to create ice cream, a popular dessert. Moreover, the mixture includes emulsifiers, stabilizers, flavorings, colorings, and sweeteners. Occasionally, extra toppings such as fruits, nuts, colored sugar, and candy bits are added, followed by the freezing process, which involves incorporating air into the frozen mixture to achieve the desired ice cream flavor.

Vegan ice creams are anticipated to witness a CAGR of 9.6% from 2025 to 2033. Ice cream manufacturers utilize a range of plant-based alternatives to milk, including oats, almonds, soy, and pea milk, depending on their specific functional requirements. Plant-based innovations are rapidly gaining popularity in the ice cream industry. The demand for non-dairy/vegan ice cream is on the rise due to the growing prevalence of lactose intolerance and dairy-related allergies worldwide, particularly in North America. The enzyme lactase, which is required to digest lactose, is not produced in sufficient amounts in people who are lactose intolerant. According to the National Institute of Health, 30 to 50 million adults in the U.S. suffer from lactose intolerance.

Flavor Insights

Chocolate flavor held the largest revenue share of the global industry in 2024, accounting for a share of 32.83%. Chocolate has always been a perennial favorite flavor among ice cream enthusiasts, with a rich, indulgent taste that satisfies sweet cravings. Its popularity is deeply rooted in its ability to evoke feelings of comfort, nostalgia, and pleasure, making it a timeless classic in the world of frozen desserts. Moreover, chocolate-flavored ice cream has witnessed a surge in demand due to the proliferation of innovative flavor variations and premium offerings. Manufacturers are constantly experimenting with different cocoa blends, chocolate sources, and additional ingredients such as nuts, cookies, and caramel swirls to create unique and decadent flavor profiles.

Fruit flavor is anticipated to witness a CAGR of 4.4% from 2025 to 2033. There is a growing demand among consumers for healthier and more natural food options. Fruit-flavored ice creams are often perceived as healthier alternatives to traditional flavors due to their association with real fruit ingredients. With an increasing emphasis on wellness and nutrition, consumers are gravitating toward products that offer a balance between indulgence and healthfulness, making fruit-flavored ice creams an attractive choice. Additionally, the rise of vegan and plant-based diets has also fueled the demand for fruit-flavored ice creams.

Distribution Channel Insights

Retail channels held the largest revenue share of the global ice cream industry in 2024, accounting for a share of 78.72%. Convenience and accessibility are key factors driving ice cream consumption, supported by the expansion of modern retail formats, such as supermarkets, hypermarkets, and convenience stores, as well as the growing use of online grocery platforms and home delivery services. Retailers are further boosting demand with visually appealing, well-organized freezer sections that make product selection easier. For instance, in January 2024, Häagen-Dazs introduced two new ice cream bar flavors: Dulce de Leche and Chocolate Cookie Crumble, launching exclusively through retail channels, with nationwide distribution planned for later in the year.

Food service channel is anticipated to witness a CAGR of 3.7% from 2025 to 2033. Food service providers are increasingly experimenting with unique and exotic flavors, catering to adventurous consumers looking for novel experiences. This trend is also reflected in the growing popularity of artisanal and gourmet ice creams, which emphasize quality ingredients and distinct flavor profiles. Seasonal and limited-time offerings also create a sense of urgency and exclusivity, encouraging consumers to try new products.

Regional Insights

An increasing demand for high-end ice creams characterizes the Asia Pacific. The changing consumption habits of consumers and the vast diversity in the region have led to the demand for varied flavor combinations and innovative ice creams. The area has also seen the introduction of new brands to the market, leading to increased competition in the industry. Additionally, shifting lifestyle trends, growing acceptance of vegan products, and rising instances of lactose intolerance in the Asia Pacific are projected to support the demand for plant-based artisanal ice creams at parlors. Although most consumers in the region still purchase ice cream from supermarkets and drugstores, introducing new and innovative flavors can help attract customers to ice cream parlors.

Europe Ice Cream Market Trends

European consumers are increasingly drawn to innovative and creative ice cream flavors. Therefore, ice cream manufacturers are introducing a wide range of exotic and international flavors inspired by cuisines from around the world, as well as those from various European countries. Ice cream manufacturers in Europe are collaborating with renowned chefs to introduce new and exciting flavors, offering consumers a unique ice cream experience and driving further market growth.

The European ice cream market is primarily driven by innovation in ice cream products and the development of new products. Italy, Germany, the U.K., France, Spain, and the Netherlands are among the key countries in Europe in terms of ice cream consumption. Gelato ice creams are gaining popularity globally, but demand for them is growing rapidly in Europe. Gelato ice cream brands in Europe are expanding their presence to different countries. For instance, in February 2023, Italian gelato brand Amorino announced the expansion of its U.K. franchise via a partnership with food franchise specialist Seeds Consulting. The brand has received numerous awards due to its focus on organic flavors and emphasis on environmentally friendly production methods.

Key Ice Cream Company Insights

Key players operating in the ice cream market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Ice Cream Companies:

The following are the leading companies in the ice cream market. These companies collectively hold the largest market share and dictate industry trends.

- Unilever PLC

- Inspire Brands, Inc. (Baskin Robbins)

- General Mills, Inc.

- American Dairy Queen Corporation

- Nestlé SA

- Blue Bell Creameries

- Cold Stone Creamery

- Danone S.A.

- NadaMoo

- Wells Enterprises

Recent Developments

-

In August 2025, Cornetto by Unilever launched a premium new range called Cornetto Max, designed to appeal especially to Gen Z’s appetite for indulgence and layered textures. The product combines a chocolate disc top, sauce layers, and a duo of ice creams in two bold flavor variants: Hazelnut & Chocolate and Mango & Vanilla, and has already exceeded expectations in Europe and Turkey.

-

In July 2025, Britannia Bourbon (by Britannia Industries) teamed up with NIC Ice Creams to launch a new ice cream variant named NIC Bourbon Ice Cream, which blends NIC’s rich chocolate ice cream with the signature chocolate-crumb biscuit pieces of the Bourbon brand. The campaign, created by The Womb, playfully dramatizes the choice between biscuit and ice cream, solved by this hybrid product offering “both in one bite”.

-

In April 2024, Unilever’s Magnum brand introduced the Magnum Pleasure Express, a trio of mood-inspired ice cream flavors that represent a significant innovation for the brand. The three new Magnum Pleasure Express flavors are Magnum Euphoria, a lemon ice cream with a raspberry sorbet core and white chocolate shell with popping candy; Magnum Wonder, toffee-flavored ice cream with a dated core, golden chocolate, and caramelized almonds; and Magnum Chill, a vegan option with vanilla-biscuit ice cream, blueberry sorbet core, cookie pieces, and vegan chocolate couverture.

Ice Cream Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 121.35 billion

Revenue Forecast in 2033

USD 169.40 billion

Growth rate (revenue)

CAGR of 4.3% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, flavor, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Unilever PLC; Inspire Brands, Inc. (Baskin Robbins); General Mills, Inc.; American Dairy Queen Corporation; Nestlé SA; Blue Bell Creameries; Cold Stone Creamery; Danone S.A.; NadaMoo; Wells Enterprises

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ice Cream Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global ice cream market report by product, type, flavor, distribution channel and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cartons

-

Tubs

-

Cups

-

Cones

-

Bars

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Dairy & Water-based

-

Vegan

-

-

Flavor Outlook (Revenue, USD Billion, 2021 - 2033)

-

Chocolate

-

Vanilla

-

Fruit

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Foodservice

-

Retail

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ice cream market was estimated at USD 117.22 billion in 2024 and is expected to reach USD 121.35 billion in 2025.

b. The global ice cream market is expected to grow at a compound annual growth rate of 4.3% from 2025 to 2033 to reach USD 169.40 billion by 2033.

b. Ice cream bars held the largest revenue share of the global ice cream industry in 2024, accounting for a share of 33.48%. Consumer demand for convenience and on-the-go snacking options has significantly increased.

b. Some of the key players operating in the ice cream market include Unilever PLC; Inspire Brands, Inc. (Baskin Robbins); General Mills, Inc.; American Dairy Queen Corporation; Nestlé SA; Blue Bell Creameries; Cold Stone Creamery; Danone S.A.; NadaMoo; Wells Enterprises

b. Key factors that are driving the ice cream market growth include rising demand for innovative flavors, formats, and growing demand for impulsiveness to consume the product in developing countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.