- Home

- »

- Display Technologies

- »

-

Flexible Display Market Size, Share & Trends Report, 2030GVR Report cover

![Flexible Display Market Size, Share & Trends Report]()

Flexible Display Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (LCD, OLED, EPD, Others), By Panel Size, By Material (Glass, Plastic, Metal), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-137-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flexible Display Market Summary

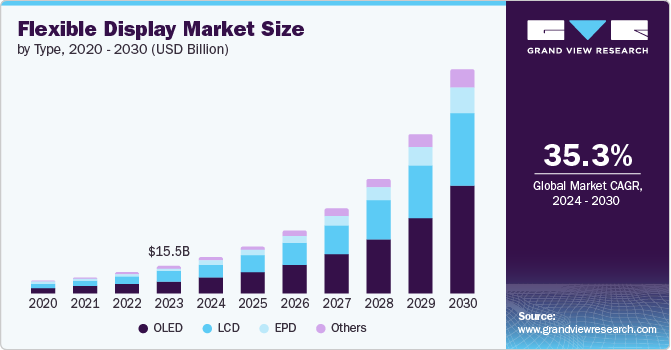

The global flexible display market size was estimated at USD 15.46 billion in 2023 and is projected to grow at a CAGR of 35.3% from 2024 to 2030. This market is experiencing significant growth due to increasing consumer demand for innovative electronic devices and expanding application areas.

Key Market Trends & Insights

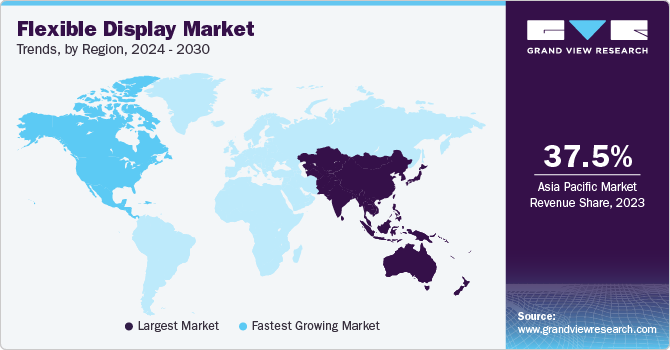

- North America dominated the global flexible display market with the largest revenue share in 2023.

- The flexible display market in the U.S. led the North America market and held the largest revenue share in 2023.

- By type, the OLED segment led the market, holding the largest revenue share of 46.3% in 2023.

- By panel size, the 20-50” segment is expected to grow at the fastest CAGR from 2024 to 2030.

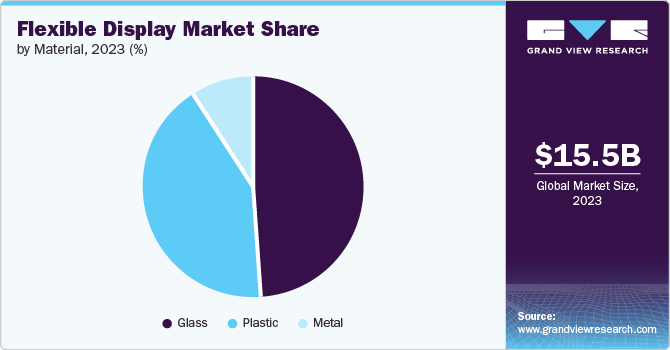

- By material, the glass segment held the dominant position in the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 15.46 Billion

- 2030 Projected Market Size: USD 123.49 Billion

- CAGR (2024-2030): 35.3%

- North America: Largest market in 2023

It includes a variety of display technologies, such as OLED, LCD, EPD, and others, which are being integrated into products ranging from smartphones and wearables to automotive displays.

The versatility of flexible displays has led to utilization applications across different sectors, further driving market growth. In healthcare, flexible displays are integrated into medical devices and wearable health monitors, providing better patient outcomes and enhanced monitoring capabilities. The retail sector also adopts flexible displays for dynamic advertising and information displays, which attract more customers and enhance their shopping experience. This broad range of applications of flexible display technology contributes significantly to market expansion.

Consumers are looking for sleek, lightweight, and multifunctional gadgets. Flexible displays offer the unique advantage of being bendable and foldable, creating new form factors and enhancing user experiences. Additionally, the growing popularity of wearable technology, such as smartwatches and fitness bands, relies heavily on flexible display technology to provide comfort and durability.

Companies increasingly enter into strategic alliances to leverage each other’s technological expertise and market reach. For instance, in April 2022, Asus ordered 10,000 foldable OLED displays and cover films from SKC, BOE, and Kolon Industries for its ZenBook 17 Fold OLED laptop with a flexible screen. These partnerships facilitate sharing research and development costs, speeding up the innovation cycle. Moreover, joint ventures and acquisitions are aiding companies in expanding their product portfolios and entering new market segments, thereby driving overall market growth.

Type Insights

The OLED segment dominated the market and accounted for a revenue share of 46.3% in 2023. Due to its superior image quality and flexibility, OLED displays are increasingly used in smartphones, tablets, laptops, and televisions in the consumer electronics sector. The automotive industry also adopts OLED displays for digital dashboards, infotainment systems, and head-up displays, offering enhanced functionality. This expanding range of applications is significantly contributing to the growth of the OLED flexible display market.

The EPD (Electronic Paper Display) segment is expected to register the fastest CAGR during the forecast period. EPDs have low power consumption and are ideal for battery-powered devices. Due to their reflective display technology, they are readable in direct sunlight and suitable for e-readers, outdoor signage, and other applications where readability in bright light conditions is essential. Improved EPD materials enable the creation of high-resolution, full-color displays that are bent, rolled, or folded without compromising image quality. These advancements are expanding the use of EPD and driving its demand in the market.

Panel Size Insights

The up to 6" segment accounted for the largest market revenue share in 2023. Devices with screens up to 6 inches, such as smartphones and portable gaming consoles, are prevalent due to their convenient size that fits easily in pockets and bags. This segment caters to the growing demand for handheld devices that combine functionality with ease of use. Due to smaller devices' portability and ergonomic benefits, which are suitable for one-handed use and on-the-go activities, are rising. The increasing dependence on smartphones for various daily tasks, from communication to entertainment, further increases the demand for flexible displays.

The 20-50” segment is expected to witness the fastest CAGR over the forecast period. Manufacturers explore new ways to incorporate large flexible displays into products, offering customizable and adaptable solutions that meet specific consumer and business needs. Consumers are increasingly pursuing high-quality visual experiences in their home entertainment systems, driving demand for large-screen televisions and monitors with superior display technology.

Material Insights

Glass segment accounted for the largest market revenue share in 2023. Glass offers efficient transparency and clarity, ensuring that displays deliver sharp, vibrant images with high color accuracy and brightness. Glass display does not degrade over time, maintaining its optical properties throughout the lifespan of the device. This ensures a consistently high-quality viewing experience, which is especially important for applications such as smartphones, tablets, and high-end displays. The superior visual quality provided by glass drives demand for its use in flexible displays.

The plastic segment is anticipated to register the fastest CAGR over the forecast period. Plastic offers flexibility and durability, making it an ideal material for flexible displays. Plastic substrates are able to bend, fold, and roll without breaking or losing their structural integrity. This flexibility allows for innovative design possibilities in various devices, such as foldable smartphones, rollable televisions, and wearable technology. The durability of plastic enables it to withstand impacts, drops, and other physical stresses better than glass, making it more suitable for everyday use in portable and wearable devices.

Application Insights

The smartphone segment accounted for the largest market revenue share in 2023. As smartphone users pursue more advanced features and unique experiences, manufacturers constantly innovate to meet these expectations. Flexible displays enable the development of foldable and rollable smartphones, offering new form factors that provide larger screens without increasing the overall device size. For instance, Tecno launched Phantom V Flip, a foldable smartphone in India. The smartphone has an internal 6.9-inch AMOLED display and a circular outer display with an encircled camera unit. These innovations are driving consumer's demand for flexible devices.

TV segment is expected to witness the fastest CAGR over the forecast period. Flexible displays allow for the creation of ultra-large curved or rolled screens, providing a more engaging and cinematic viewing experience. This is essential to consumers who prioritize home entertainment and are willing to invest in premium television models. Consumer demand for larger and more immersive viewing experiences drives the demand for flexible TV displays.

Regional Insights & Trends

The North America flexible display market is expected to witness significant growth over the forecast period. The region's consumers are strongly interested in the latest technology, including smartphones, tablets, wearable devices, and televisions with advanced features such as flexible displays. The growing trend towards smart homes and connected devices further fuels this demand. As consumers seek more versatile, portable, and high-performance devices, the demand for flexible displays continues to rise, driving market growth.

U.S. Flexible Display Market Trends

The U.S. flexible display market accounted for the largest market revenue share in 2023. Strong consumer demand for advanced electronic devices in the U.S. drives the flexible display market. Consumers are highly interested in devices with advanced features, such as flexible displays. This includes smartphones, tablets, wearable devices, and televisions that offer superior performance, portability, and unique form factors. As consumers seek more versatile and high-performance devices, the market for flexible displays in the U.S. continues to expand.

Asia Pacific Flexible Display Market Trends

Asia Pacific flexible display market accounted for the largest revenue share of 37.5% in 2023. Flexible displays are used in various smart city applications, such as digital signage, interactive information panels, and smart transportation systems. The development of smart cities involves integrating advanced technologies to improve urban living and efficiency, and flexible displays play an essential role in this transformation. The region's focus on smart city initiatives and infrastructure development creates demand for flexible display solutions that enhance public services and urban environments.

China flexible display market is expected to witness significant growth over the forecast period. As consumers pursue more advanced and versatile wearable technology, smartwatches with flexible displays offer numerous advantages, such as enhanced durability, lightweight design, and the ability to conform to various wrist shapes. These features make smartwatches more comfortable and user-friendly, increasing their use. Additionally, integrating smartwatches' health monitoring, fitness tracking, and connectivity features aligns with the growing consumer demand for health and fitness technology. Therefore, the rising adoption of smartwatches increases the demand for flexible displays, contributing to the market's growth in China.

Europe Flexible Display Market Trends

The Europe flexible display market is expected to witness significant growth over the forecast period. Flexible displays are being integrated into a wide range of devices, including foldable smartphones, curved monitors, automotive dashboards, medical devices, and digital signage. Their versatility and advanced features make them suitable for diverse applications, driving their adoption across different sectors. The increasing adoption of flexible displays in various applications, such as consumer electronics, automotive, healthcare, and retail, is driving market growth in Europe.

The UK flexible display market is expected to witness significant growth over the forecast period. Flexible displays are increasingly used in smartwatches, fitness trackers, augmented reality (AR) glasses, and other wearable devices. These displays offer advantages such as lightweight design, durability, and flexibility, essential for wearable technology. The expansion of the wearable technology market, driven by consumer interest in health monitoring and connected devices, creates opportunities for flexible displays and drives their growth in this segment.

Key Flexible Display Company Insights

Key industry players operating in the flexible display market include LG DISPLAY CO., LTD., SAMSUNG, Corning Incorporated, Japan Display Inc. and others.

-

LG Display Co., Ltd. is a subsidiary of LG Corporation, a leading innovator in the display technology industry. The company specializes in designing and manufacturing advanced display panels. Its product offerings include high-quality displays and panels, such as OLED (Organic Light Emitting Diode), LCD (Liquid Crystal Display), and others.

-

Japan Display Inc. is a prominent display technology company formed by merging the display divisions of Sony, Toshiba, and Hitachi. The company's product offerings include LCD Modules, Automotive Displays, Micro LED Displays, and others for various applications, such as smartphones, tablets, automotive displays, wearable devices, and industrial equipment.

Key Flexible Display Companies:

The following are the leading companies in the flexible display market. These companies collectively hold the largest market share and dictate industry trends.

- BOE Technology Group Co., Ltd.

- Corning Incorporated

- Innolux Corporation

- AUO Corporation

- Japan Display Inc.

- LG DISPLAY CO., LTD.

- Royole Corporation.

- SAMSUNG ELECTRONICS CO., LTD.

- SHARP CORPORATION

- Visionox Company

Recent Developments

-

In January 2021, TCL CSOT introduced two flexible displays, the 17-inch Printed OLED Display and the 6.7-inch AMOLED Rollable Display. These products are part of TCL CSOT's range of touch modules and display panels used in various applications, such as interactive whiteboards, gaming monitors, automotive displays, and video walls.

-

In September 2023, LG announced its entry into the foldable laptop market with the launch of the LG Gram Fold laptop. Fold features a touchscreen display that can be used as a tablet or a computer when fully unfolded. It offers a 17-inch OLED screen with a QXGA+ (2560 x 1920 pixel) resolution. It also supports stylus pens, which are used for art, architecture, and calligraphy.

Flexible Display Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 20.10 billion

Revenue forecast in 2030

USD 123.49 billion

Growth Rate

CAGR of 35.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, Panel Size, Material, Application, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE South Arabia and South Africa

Key companies profiled

BOE Technology Group Co., Ltd., Corning Incorporated, Innolux Corporation, AUO Corporation, Japan Display Inc., LG DISPLAY CO., LTD., Royole Corporation., SAMSUNG ELECTRONICS CO., LTD., SHARP CORPORATION, Visionox Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flexible Display Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the flexible display market report based on type, panel size, material, application, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

LCD

-

OLED

-

EPD

-

Others

-

-

Panel Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Up To 6”

-

6-20”

-

20-50”

-

Above 50”

-

-

Material Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Glass

-

Plastic

-

Metal

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smartphone

-

Smartwatch

-

Wearable (Excluding Smartwatches)

-

TV

-

E-reader

-

Automotive & Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

South Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.