- Home

- »

- Plastics, Polymers & Resins

- »

-

Flexible Paper Packaging Market Size & Share Report, 2030GVR Report cover

![Flexible Paper Packaging Market Size, Share & Trends Report]()

Flexible Paper Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Kraft Paper, Greaseproof Paper), By Product (Pouches, Rollstock, Bags), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-455-4

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flexible Paper Packaging Market Summary

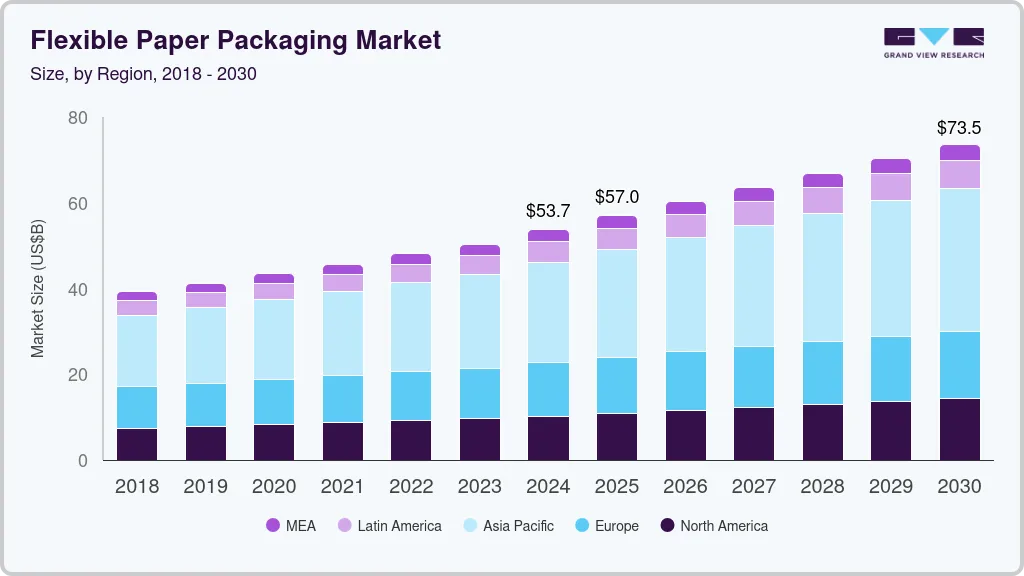

The global flexible paper packaging market size was estimated at USD 53,659.8 million in 2024 and is projected to reach USD 73,540.0 million by 2030, growing at a CAGR of 5.2% from 2025 to 2030. The global market is experiencing significant growth, driven by the rising consumer demand for sustainable and eco-friendly packaging solutions.

Key Market Trends & Insights

- Asia Pacific dominated the flexible paper packaging market with the revenue share of 43.50% in 2023.

- The flexible paper packaging market in China is one of the largest packaging markets in the world.

- Based on material, the kraft paper segment led the market with the largest revenue share of 26.25% in 2023.

- Based on end-use, the pouches segment led the market with the largest revenue share of 60.35% in 2023.

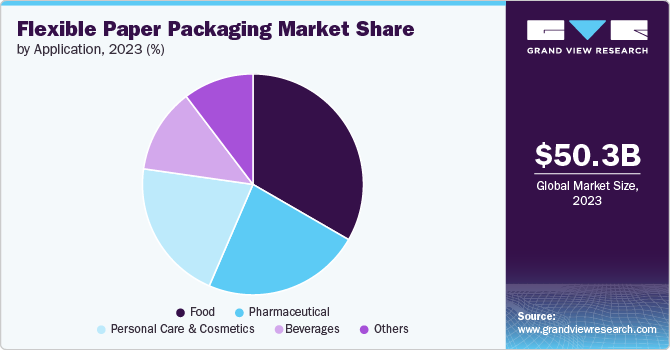

- Based on application, the food segment led the market with the revenue share of 33.33% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 53,659.8 Million

- 2030 Projected Market Size: USD 73,540.0 Million

- CAGR (2025-2030): 5.2%

- Asia Pacific: Largest market in 2023

With increasing environmental concerns and stringent regulations on plastic use, many industries are transitioning from plastic-based packaging to paper alternatives, particularly in sectors like food, beverages, and personal care. This shift is accelerating the development of innovative paper-based materials that maintain the necessary barrier properties while being biodegradable or recyclable.

Brands such as Nestlé and Unilever have launched paper-based packaging for products like chocolates and ice creams, offering a sustainable alternative to plastic wraps. Similarly, PepsiCo’s commitment to introducing compostable and recyclable packaging across its product lines is driving market demand. Flexible paper packaging also aligns with consumer preferences for products with minimal environmental impact, offering companies a competitive edge in gaining customer loyalty.

The rise in e-commerce has further spurred demand for flexible packaging materials, as online retailers require lightweight and protective packaging. Furthermore, the food and beverage industry, in particular, has benefited from flexible paper packaging's ability to preserve product freshness, extend shelf life, and provide aesthetic branding options. This combination of functionality, sustainability, and adaptability has opened up significant opportunities for manufacturers to invest in R&D and new product launches to cater to evolving market needs.

Material Insights

Based on material, the kraft paper segment led the market with the largest revenue share of 26.25% in 2023 and is also anticipated to grow at the fastest CAGR during the forecast period. Known for its durability and high tear resistance, it is widely used across multiple sectors, including food, retail, and e-commerce. The eco-friendly nature of kraft paper, being both recyclable and biodegradable, makes it a popular choice as businesses and consumers shift toward sustainable packaging solutions. Its versatility allows it to be used in various forms, such as bags, pouches, and wraps, making it essential for applications that require strong, protective packaging. The food and beverage industry, in particular, heavily utilizes kraft paper for packaging due to its excellent barrier properties that preserve product freshness.

Greaseproof paper is essential for the food industry, particularly in applications where oily or greasy foods are involved. This material's ability to resist moisture and oil without compromising the quality of the packaging makes it a preferred choice for fast food outlets, bakeries, and confectioneries. It offers a clean and practical solution for wrapping greasy foods such as pastries, sandwiches, and fried products. With the growing trend toward eco-friendly alternatives to plastic packaging, greaseproof paper has gained traction in restaurants and food packaging as it is both biodegradable and functional.

Parchment paper is favored for its heat resistance and non-stick properties, making it ideal for food packaging, especially in baking and cooking applications. The food industry relies on parchment paper for packaging items that require direct oven use, such as baked goods. Unlike plastic-based materials, parchment paper provides a sustainable alternative, being both compostable and recyclable. With the increasing demand for natural and safe packaging materials, especially in the organic and specialty food sectors, parchment paper usage continues to grow.

Product Insights

The pouches segment led the market with the largest revenue share of 60.35% in 2023. They are versatile, lightweight, and offer superior barrier protection for products, making them widely used in food, beverage, and personal care industries. The rising demand for resalable and easy-to-use packaging solutions has fueled the popularity of pouches, especially as brands look to improve convenience for consumers. Moreover, with sustainability becoming a key factor, paper-based pouches are increasingly preferred over plastic counterparts due to their recyclability and biodegradable properties. In the food industry, pouches are used for snacks, cereals, and ready-to-eat meals, offering a flexible yet durable packaging solution. They also allow for clear branding and product information, contributing to their widespread use across retail channels.

Rollstocks, essential for form-fill-seal applications, are widely used in the food packaging industry for products such as chips, cookies, and dried fruits. The adaptability of rollstocks, which are used in high-speed packaging lines, makes them a go-to option for manufacturers looking for efficiency and cost-effectiveness.

Bags and envelopes form a significant part of the market growth, particularly in the retail and e-commerce sectors. These products provide a durable yet sustainable alternative to plastic bags, often used for shopping, mailing, and product protection during transportation.

Application Insights

Based on application, the food segment led the market with the revenue share of 33.33% in 2023. Flexible paper packaging, particularly in the form of pouches, wraps, and bags, is extensively used to package various food items such as snacks, baked goods, fresh produce, and frozen foods. One of the key drivers of market growth is the rising concern over food safety and the need for packaging that preserves product freshness without using harmful chemicals. In addition, food packaging needs to be functional, lightweight, and visually appealing, making flexible paper packaging an ideal solution. The trend of using recyclable and compostable packaging materials, especially in organic and premium food products, continues to fuel market demand, with brands and retailers pushing for sustainable alternatives.

Personal care and cosmetics brands are increasingly adopting flexible paper packaging due to consumer demand for eco-friendly and aesthetically pleasing packaging. Paper-based tubes, sachets, and wraps are replacing plastic packaging for products like creams, lotions, and face masks. With sustainability becoming a core brand value for many beauty companies, the shift towards paper packaging allows brands to align with environmentally conscious consumers. The industry’s focus on reducing carbon footprints, combined with government regulations on single-use plastics, is expected to boost demand for flexible paper packaging solutions in this segment.

The beverage segment is gradually incorporating flexible paper packaging, especially for labeling and bottle wraps. Paper shrink sleeves and wraps offer an eco-friendly alternative to traditional plastic packaging, providing brands with a sustainable solution that doesn’t compromise on aesthetic appeal. Companies like Coca-Cola and PepsiCo have started integrating paper-based solutions to meet their sustainability goals. While the transition in this sector is slower compared to food or personal care, innovations in water-resistant paper materials are paving the way for broader adoption of flexible paper packaging in the beverage industry.

Regional Insights

The flexible paper packaging market in North America is experiencing steady growth due to increasing consumer awareness of sustainability and strict regulations surrounding plastic usage. The United States and Canada are at the forefront of this market, with companies in sectors like food, pharmaceuticals, and personal care rapidly adopting flexible paper solutions to replace plastic. In the food and beverage industry, flexible paper packaging is gaining popularity due to its lightweight, biodegradable properties and ability to provide good protection for perishable goods.

U.S. Flexible Paper Packaging Market Trends

The flexible paper packaging market in the U.S.hold a major share in North America region. This growth can be attributed to E-commerce giants such as Amazon have committed to reducing plastic waste, turning to paper-based solutions to package their products. This trend is pushing the market forward as businesses seek out sustainable, cost-effective alternatives to meet consumer demands. In addition, advancements in material technology, including water-resistant and greaseproof papers, are opening up new opportunities for flexible paper packaging across multiple industries in North America.

Asia Pacific Flexible Paper Packaging Market Trends

Asia Pacific dominated the flexible paper packaging market with the revenue share of 43.50% in 2023, driven by high population density, rapid urbanization, and growing environmental awareness. Countries such as India, Japan, and Indonesia are witnessing a surge in demand for flexible paper packaging due to government regulations banning single-use plastics and promoting sustainable alternatives. The food and beverage sector, which dominates the packaging market in the region, is increasingly adopting paper-based solutions to reduce plastic consumption. In addition, e-commerce expansion has pushed demand for lightweight, flexible packaging solutions that can provide protection during transit while being eco-friendly.

In the personal care and cosmetics industries, brands in Asia are switching to flexible paper-based packaging to appeal to environmentally conscious consumers. With a focus on innovation, companies are investing in research and development to produce flexible paper materials with high barrier properties that can replace plastic in packaging. This region's increasing inclination towards sustainable packaging practices and regulatory initiatives is expected to fuel market growth further.

The flexible paper packaging market in China is one of the largest packaging markets in the world, is leading the adoption of flexible paper packaging solutions, driven by strict government regulations on plastic waste and consumer demand for sustainable products. The Chinese government's commitment to achieving carbon neutrality by 2060 has resulted in a significant shift toward eco-friendly packaging solutions. The country's booming e-commerce and food delivery sectors have created a growing need for sustainable, lightweight, and cost-effective packaging materials.

Brands like Alibaba and JD.com are adopting flexible paper-based packaging to align with environmental goals and reduce the carbon footprint of their logistics operations. Moreover, in the food and beverage industry, companies are transitioning from traditional plastic packaging to flexible paper alternatives, such as paper pouches and wraps, to meet both consumer and regulatory demands. This trend is expected to continue growing in China, with more investments in R&D and innovative solutions.

Europe Flexible Paper Packaging Market Trends

The flexible paper packaging market in Europe has long been a leader in sustainable packaging solutions, with countries like Germany, France, and the Netherlands taking proactive measures to reduce plastic waste. The market in Europe is driven by strong regulatory frameworks, such as the EU's ban on single-use plastics, and consumer preferences for eco-friendly products. The food and beverage industry dominates the region's demand for flexible paper packaging, as companies seek sustainable options for items like pouches, wraps, and bags.

The Germany flexible paper packaging market accounted for the revenue share of over 25% share in Europe market in 2023. Innovation plays a key role in the German market, with companies focusing on creating flexible paper packaging that offers the same protective qualities as plastic while being biodegradable or recyclable. Major brands in the personal care and cosmetics industry, like L’Oréal and Unilever, are also shifting toward paper-based packaging to meet sustainability goals. In addition, Europe’s well-established recycling infrastructure supports the growth of flexible paper packaging, making it easier for companies to adopt eco-friendly practices.

Key Flexible Paper Packaging Company Insights

The market is highly fragmented with presence of a sizable number of small and medium-sized companies. Key players mainly cater to food and beverage, pharmaceuticals, and cosmetics industries. Flexible plastic packaging industry has been witnessing a significant number of mergers & acquisitions and new product launches over the past few years.

Key Flexible Paper Packaging Companies:

The following are the leading companies in the flexible paper packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor Limited

- Sealed Air Corporation

- Mondi Group

- Coveris Holdings S.A.

- Huhtamaki Oyj

- DS Smith PLC

- International Paper Company

- WestRock Company

- Smurfit Kappa Group

- Stora Enso Oyj

- Gordon Paper Company

- Canadian Kraft Paper Ltd

- Nordic Paper AS

- Rengo Co. Ltd

- JK Paper Ltd

Recent Developments

-

On February 21, 2024, Mondi has expanded production of its innovative range of paper-based EcoWicketBags. EcoWicketBags are made from Mondi’s FunctionalBarrier Paper 95/5 - an exceptionally strong kraft paper which can be customised with specific barrier and protective properties to meet diverse product needs. They are available in a variety of sizes for different applications and provide protection from filling to transporting and storage, as well as being ideal for printing customer branding

-

In August 2023, Amcor launched curbside-recyclable AmFiberTM Performance Paper packaging, part of the company's AmFiber portfolio. AmFiber Performance Paper is a high-barrier laminated paper that is recyclable in most paper recycling waste streams, earning the How2Recycle prequalification of "widely recyclable." It provides improved barrier and packer efficiency compared to the existing coated papers and is PVdC-free

Flexible Paper Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 56973.1 million

Revenue forecast in 2030

USD 73,540.0 million

Growth rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons; Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume Forecast, Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Sonoco Products Company; Sealed Air; Sonoco Products Company; Amcor Plc.; Constantia Flexible Group GmBH; Berry Global Group Inc.; Huhtamaki Oyj; Sonoco Products Company; Bemis Company, Inc.; AR Packaging Group AB; Mondi Group; DS Smith Plc.; CCL Industries Inc.; Westrock Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flexible Paper Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flexible paper packaging market report based on material, product, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Kraft Paper

-

Parchment Paper

-

Greaseproof Paper

-

Sulfite Paper

-

Glassine Paper

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pouches

-

Rollstock

-

Shrink Sleeves

-

Wraps

-

Others (Bags & Envelopes)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food

-

Beverages

-

Pharmaceutical

-

Personal Care & Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flexible paper packaging market was estimated at USD 50.35 billion in 2023 and is expected to reach USD 52.69 billion in 2024.

b. The global flexible paper packaging market is expected to grow at a compound annual growth rate of 4.2% from 2024 to 2030, reaching around USD 67.56 billion by 2030.

b. Kraft paper holds the highest market share in 2023. Known for its durability and high tear resistance, it is widely used across multiple sectors, including food, retail, and e-commerce. Kraft paper's eco-friendly nature, being both recyclable and biodegradable, makes it a popular choice as businesses and consumers shift toward sustainable packaging solutions.

b. Key players in the market include Sonoco Products Company, Sealed Air, Sonoco Products Company, Amcor Plc., Constantia Flexible Group GmBH, Berry Global Group Inc., Huhtamaki Oyj, Sonoco Products Company, Bemis Company, Inc., AR Packaging Group AB, Mondi Group, DS Smith Plc., CCL Industries Inc., and Westrock Company.

b. The global flexible paper packaging market is experiencing significant growth, driven by the rising consumer demand for sustainable and eco-friendly solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.