- Home

- »

- Advanced Interior Materials

- »

-

Flooring Adhesive Market Size, Share, Industry Report, 2030GVR Report cover

![Flooring Adhesive Market Size, Share & Trends Report]()

Flooring Adhesive Market (2025 - 2030) Size, Share & Trends Analysis Report By Resin (Acryclic, Polyeurethane, Polyvinyl Acetate), By Application, By End-use (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-123-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flooring Adhesive Market Size & Trends

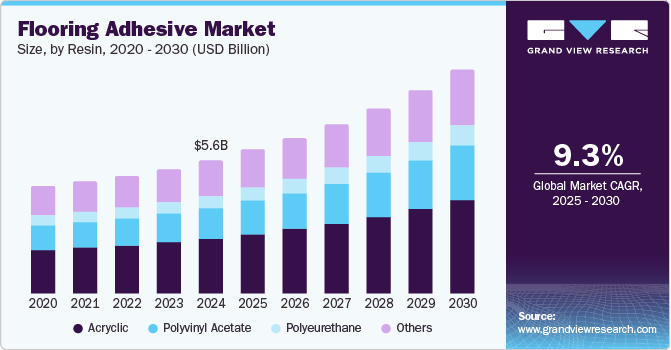

The global flooring adhesive market size was estimated at USD 5.64 billion in 2024 and is projected to grow at a CAGR of 9.3% from 2025 to 2030. The market growth is significantly propelled by the expanding construction industry in multiple regions. In India, residential construction projects have experienced a notable 20% increase in 2023. As investments in both residential and commercial sectors rise, the demand for flooring adhesives is becoming increasingly vital for securely bonding various flooring materials, presenting manufacturers with considerable opportunities for development in this sector.

Renovation trends are significantly boosting demand in the flooring adhesive market, as homeowners prioritize aesthetic improvements. In South Africa, the growing DIY culture is particularly notable, with homeowners undertaking projects to reduce costs and achieve personal satisfaction. This focus on property enhancement necessitates high-quality flooring solutions, which rely heavily on effective adhesive products to ensure optimal results.

The industry is witnessing a shift towards sustainability, with both consumers and manufacturers prioritizing eco-friendly and low-VOC products. This heightened awareness encourages manufacturers to innovate and produce eco-compliant adhesives that meet environmental standards while offering superior performance. The commitment to sustainability transcends ethical considerations, aligning with market demands and facilitating the development of products that appeal to environmentally conscious consumers.

Technological advancements are transforming the flooring adhesive sector, with innovative formulations that deliver enhanced bond strength, moisture resistance, and reduced curing times. These innovations are appealing to both consumers and contractors who prioritize efficient and reliable solutions for their flooring projects. Moreover, the growth of the DIY culture has driven increased sales of flooring adhesives, as consumers are increasingly motivated to undertake home improvement projects independently.

Resin Insights

Acrylic adhesives dominated the market and accounted for a share of 41.2% in 2024, driven by their exceptional bonding strength, rapid setting times, and versatility across diverse flooring applications. Acrylic adhesives are increasingly preferred for their effectiveness on challenging substrates and durability against moisture and heat, while the trend towards sustainable construction practices enhances demand for eco-friendly acrylic options.

Polyvinyl acetate (PVA) is expected to grow at the fastest CAGR of 10.2% over the forecast period. PVA adhesives, being water-based, offer easy cleanup and safety for indoor applications, appealing to environmentally conscious consumers. Their strong adhesion to various flooring materials, coupled with cost-effectiveness, has driven demand, especially among DIY homeowners seeking reliable solutions for both residential and commercial projects.

Application Insights

Resilient flooring led the market with a revenue share of 52.7% in 2024 due to durable, cost-effective, and versatile resilient flooring materials, such as vinyl and linoleum, which excel in moisture, scratch, and stain resistance, making them well-suited for high-traffic areas. Renovation trends and new construction projects further stimulate demand, while their aesthetic appeal and low maintenance requirements underscore the necessity for effective adhesives to ensure lasting installations.

Wooden flooring is expected to register the fastest CAGR of 9.7% over the forecast period. Increasing disposable incomes and a trend toward home improvement have driven homeowners to invest in high-quality wooden flooring, which offers excellent returns on investment and enhances property value. Moreover, demand for eco-friendly, low-VOC adhesives aligns with consumer preferences, prompting manufacturers to innovate adhesives tailored for wooden flooring applications.

End-use Insights

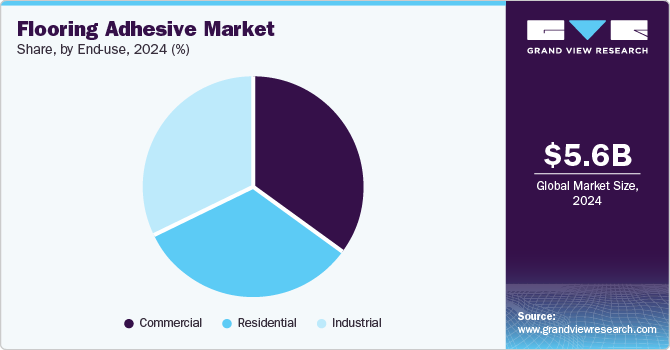

The commercial segment dominated the market and accounted for a share of 34.9% in 2024, fueled by the increasing construction of commercial spaces, including offices, retail stores, and shopping malls, which necessitate durable flooring solutions capable of withstanding high foot traffic. Urbanization and economic growth further enhance demand, as businesses prioritize aesthetically appealing and functional flooring to improve their image and customer experience.

The residential segment is projected to grow lucratively over the forecast period, aided by rising disposable incomes, fostering increased home renovations and new construction. Homeowners are investing in durable, aesthetically pleasing flooring, driving demand for effective adhesives. Government initiatives, alongside a trend in DIY projects, further enhance the need for reliable adhesives across hardwood, laminate, and tile flooring.

Regional Insights

North America flooring adhesive market is expected to register significant growth over the forecast period. The region’s established infrastructure and increasing focus on sustainable building practices are propelling demand for high-quality adhesives. As consumers place greater importance on home aesthetics and functionality, the market is poised for significant growth in the upcoming years.

U.S. Flooring Adhesive Market Trends

The flooring adhesive market in the U.S. dominated the North America flooring adhesive market in 2024. This dominance stems from increased consumer spending on home renovations and new construction, fueled by rising disposable incomes. Moreover, a robust DIY culture, with around 75% of homeowners engaging in such projects, amplifies demand for flooring materials and effective adhesives.

Asia Pacific Flooring Adhesive Market Trends

Asia Pacific flooring adhesive market dominated the global market with a revenue share of 38.8% in 2024. By rapid urbanization and substantial construction investments in countries such as China and India. The expanding middle class is more inclined to pursue home improvement projects, thereby increasing demand for flooring adhesives.

The flooring adhesive market in China dominated the Asia Pacific flooring adhesive market with a revenue share of 54.6% in 2024, reflecting a robust construction sector and strong demand for residential and commercial flooring solutions. Government initiatives promoting infrastructure development further reinforce this position, alongside a rising trend for eco-friendly alternatives among consumers.

Europe Flooring Adhesive Market Trends

Europe flooring adhesive market held substantial market share in 2024, bolstered by continuous investments in residential and commercial construction worldwide. The rising demand for sustainability has prompted European consumers to prefer eco-friendly adhesive solutions, aligning with broader environmental objectives.

The flooring adhesive market in Germany is expected to grow lucratively in the forecast period. Germany’s strong economy facilitates ongoing renovations and new construction, thereby increasing demand for effective flooring adhesives. With approximately 66% of consumers willing to pay a premium for sustainable products, this trend aligns with the growing preference for eco-friendly solutions, creating growth opportunities for manufacturers in both residential and commercial markets.

Key Flooring Adhesive Company Insights

Some key companies operating in the market include Bostik; Dow; Forbo Management SA; H.B. Fuller Company; among others. Strategic initiatives involve developing eco-friendly, low-VOC products and expanding distribution networks in emerging markets, alongside investments in R&D to improve adhesive performance and address evolving consumer demands.

-

MAPEI is a manufacturer of flooring adhesives, providing a wide array of products suitable for tile, wood, and resilient flooring applications. The company emphasizes innovation and sustainability, offering eco-friendly solutions that adhere to rigorous performance standards while prioritizing research and development.

-

Parker-Hannifin Corporation excels in motion and control technologies, offering high-performance adhesives for flooring applications. The company delivers advanced solutions prioritizing durability and strength, serving both residential and commercial markets while emphasizing innovation and quality to meet industry demands.

Key Flooring Adhesive Companies:

The following are the leading companies in the flooring adhesive market. These companies collectively hold the largest market share and dictate industry trends.

- Bostik

- Dow

- Forbo Management SA

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- LATICRETE International, Inc.

- MAPEI

- Parker-Hannifin Corporation

- Pidilite Industries Ltd.

- Sika AG

Recent Developments

-

In November 2024, Sika AG completed the acquisition of Chema, enhancing its position in Peru’s mortar segment and expanding its Building Finishing portfolio with complementary products and distribution capabilities.

-

In September 2024, Dow launched its first bio-circular product for carpet tile backing, enhancing the ENGAGE REN Polyolefin Elastomers portfolio and supporting sustainability goals in the flooring industry.

-

In September 2024, Henkel launched the Pattex No More Nails Stick & Peel, an innovative removable construction adhesive, enhancing DIY projects with strong hold, easy removability, and suitability for various surfaces.

-

In June 2024, Sika AG opened a manufacturing plant in Liaoning, China, to produce diverse products, enhancing efficiency and reducing logistics while serving over 98 million customers in northeastern regions.

-

In May 2024, H.B. Fuller acquired ND Industries Inc., enhancing its product offerings in specialty adhesives and sealing solutions, thereby accelerating growth in high-margin market segments.

Flooring Adhesive Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.12 billion

Revenue forecast in 2030

USD 9.53 billion

Growth rate

CAGR of 9.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Resin, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Brazil; Saudi Arabia

Key companies profiled

Bostik; Dow; Forbo Management SA; H.B. Fuller Company; Henkel AG & Co. KGaA; LATICRETE International, Inc.; MAPEI; Parker-Hannifin Corporation; Pidilite Industries Ltd.; Sika AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flooring Adhesive Market Report Segmentation

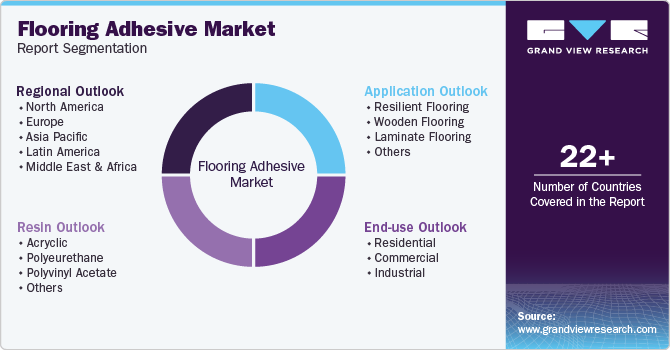

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flooring adhesive market report based on resin, application, end-use, and region:

-

Resin Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Acryclic

-

Polyeurethane

-

Polyvinyl Acetate

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Resilient Flooring

-

Wooden Flooring

-

Laminate Flooring

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.