- Home

- »

- Advanced Interior Materials

- »

-

Resilient Flooring Market Size, Share & Growth Report, 2030GVR Report cover

![Resilient Flooring Market Size, Share, & Trends Report]()

Resilient Flooring Market (2024 - 2030) Size, Share, & Trends Analysis Report By Product (LVT, Vinyl Sheet & Floor Tile, Linoleum, Cork, Rubber), By Application (Residential, Non-residential), By Region, And Segment Forecasts

- Report ID: 978-1-68038-411-6

- Number of Report Pages: 179

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Resilient Flooring Market Size & Trends

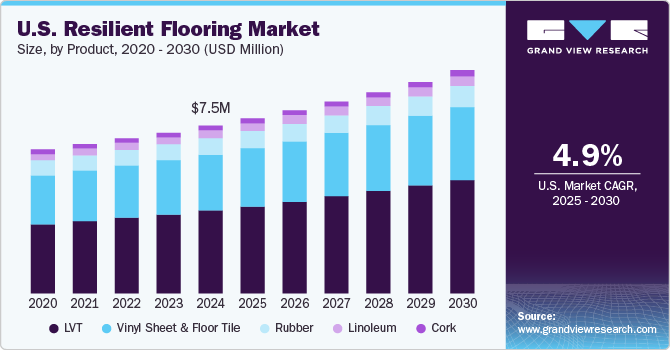

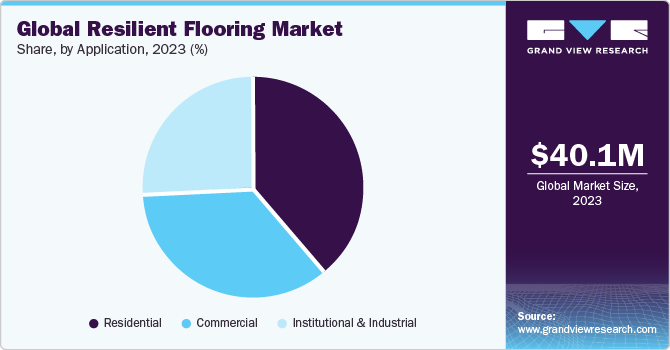

The global resilient flooring market size was USD 40.12 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.4% from 2024 to 2030. This growth is attributed to the benefits of resilient flooring, such as impact & scratch resistance, waterproofing, odor-proofing, and durability, in comparison to other flooring alternatives. In addition, the expansion of ultramodern workspaces and offices and rapid urbanization would further escalate the growth of the resilient flooring market.

The U.S. dominates North America resilient flooring market, accounting for the highest revenue share in terms of consumption, owing to the increased penetration of the product in the residential sector, with an increasing number of single-family houses as well as the strengthening of the residential replacement market across the country. Recovery of the residential construction industry after the great recession in historic years has played an essential role in driving the demand for resilient flooring in a residential application.

Vinyl flooring involves the manufacturing of PVC, which causes environmental problems by releasing mercury and asbestos into the atmosphere. Furthermore, once vinyl floorings serve their purpose, they cannot be recycled or do not decay in landfills and release hazardous dioxins. These factors are expected to restrict the growth of vinyl flooring market and parallelly impacting the market growth of resilient flooring negatively.

The emergence of India, Taiwan, and Mexico as the upcoming manufacturing hubs will not only result in the establishment of factories but also in the migration of large population close to these centers, thus resulting in the development of new cities or expansion of the existing cities. This factor is expected to play an important role in developing the market for resilient flooring over the forecast period.

With an ever-increasing growth in interior segment and real estate, floor covering solutions, accessories, and equipment have gained considerable importance. The product is expected to continue its dominance, as it is economical and offers considerable longevity in comparison to conventional solutions.

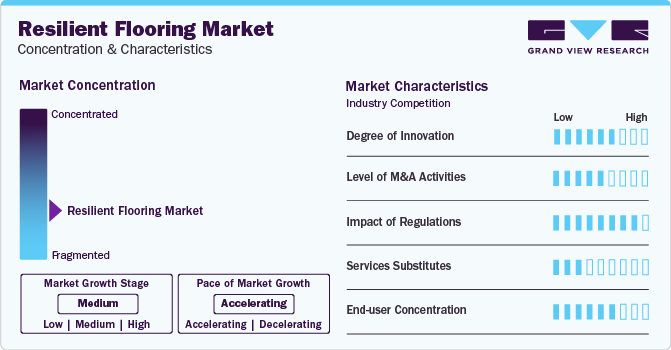

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The global resilient flooring market is characterized by the presence of a large number of players, with established players leading the market trends. The majority of these companies focus on forward integration by providing their products directly to end-users across different industry verticals. Some of these companies also use an established distribution and sales network to connect with their customers across regions easily.

The market exhibits no direct external substitute for resilient flooring, however, there exists a wide range of internal substitutes from traditional flooring materials. This can be attributed to the advancements in technology, which has fostered the development of new alternatives. The development of eco-friendly solutions including cork, natural linoleum, bamboo, and rubber poses a threat to market growth. Furthermore, polyolefin floor coverings are direct substitutes for polyvinyl flooring and pose a threat for vinyl resilient flooring products such as luxury vinyl tile and vinyl sheet & floor tile. Therefore, the threat of substitutes is anticipated to be medium over the forecast period.

The market has witnessed extensive competition on account of increasing innovations and growing demand for resilient flooring products across the globe. A large number of manufacturers operating in the market are engaged in research & development activities to introduce sustainable flooring materials.

Product Insights

Luxury vinyl tiles led the market and accounted for the largest revenue share of more than 39% in 2023. Luxury Vinyl Tile (LVT) is one of the favorable product segments in the global resilient flooring market on account of the durability and low-cost benefits of these tiles. LVTs can be used to create exceptional visual appeal by replicating concrete, natural stone, metal, wood, and several other unique finishes in both designs and texture.

The demand for vinyl sheet and floor tiles is likely to witness substantial growth on account of their cost effectiveness, high durability, and low maintenance cost. In addition, the water resistance property of vinyl sheets and floor tiles makes them the most preferred flooring material for use in bathrooms, kitchens, laundry rooms, and moisture-prone areas in homes. Vinyl sheet floors are more comfortable as compared to tiled floors and offer a softer feel while walking as compared to ceramic or wood tile floors, which makes them a preferable resilient flooring product.

The rising awareness toward the use of biodegradable materials in matured markets, including the U.S., Germany, the UK, and Canada on account of the increasing importance of waste management and recycling is expected to open new growth opportunities for the linseed oil-based linoleum in the resilient flooring market.

Rubber floorings are majorly used as resilient flooring in institutions and commercial spaces on account of their waterproof and slip resistance properties, which make them suitable for harsh environments. Rubber floorings are available in different surface textures, including smooth marbleized to raised textures such as circular, flagstone, square, and diamond-plate, among several others. Both natural and synthetic rubbers are used in the manufacturing of rubber tiles, which are highly durable and warm to walk on. However, rubber flooring has a high installation cost and requires experienced professionals for installation.

Application Insights

The non-residential segment led the resilient flooring market in 2023.Improved technology used in the manufacturing of resilient flooring helps imitate natural stone and wood flooring and create textures and patterns similar to such flooring, which is projected to play a major role in driving the product demand from application industries. In addition to natural colors and patterns, any pattern and color combination of customer choice can be created in resilient flooring. The non-residential application segment is expected to witness significant growth over the projected period on account of the rapid expansion of the non-residential construction sector across the globe.

The residential application segment of resilient flooring is inclusive of residential buildings, apartments, complexes, and small houses. Resilient floorings are majorly used in residential applications on account of their low cost, highly durable nature, and resistance to shock, stain, and dirt. The flooring is available in various patterns and shades, making it a perfect choice to create patterns resembling natural stone and wood. The growing housing sector in developed markets, including the U.S. and Germany, in light of regulatory support is expected to increase the demand for resilient flooring products owing to their high anti-slip and scratch resistance properties.

Favorable growth of the housing sector in emerging markets, including South Africa, Turkey, India, China, and Middle East countries, on account of the easy availability of home loans to individuals is expected to have a strong impact on the market growth over the forecasted years. Resilient floorings are available in a wide range of colors, patterns, shapes, and sizes suitable for outdoor and indoor residential spaces, and are highly comfortable to walk on. They can be textured or smoothed and are available in a range of natural stone and wood finishes. Innovation in product varieties using advanced technology and hassle-free installation of resilient flooring is projected to drive the market growth from the residential application segment over the forecast period.

The rising demand for highly durable and cost-efficient resilient flooring for use in commercial and industrial sectors is projected to drive market growth over the forecast period. The development of new products and hassle-free installation techniques have considerably driven the commercial flooring market. Resilient flooring is projected to witness growth over the projected period in various sectors, including healthcare, office, institution, retail, and other commercial areas, with the rising demand for flooring solutions having anti-bacterial, anti-slip, and water-resistant properties that will also be cost-effective and eco-friendly.

Regional Insights

Asia Pacific region dominated the market and accounted for a revenue share of over 37% in the global resilient flooring demand in 2023. The growing economic prominence of China, India, and countries in Southeast Asia owing to the presence of a large consumer base, low labor cost, and abundant resources are expected to drive the construction industry in the region, which, in turn, is expected to propel the demand for resilient flooring in the region.

North America dominates the global resilient flooring market, in terms of consumption, owing to the increased demand from the residential application segment, well-established service industry, extensively developed manufacturing industry, and government initiatives to develop social infrastructure across the region. In addition, stringent government regulations restricting the use of hazardous flooring solutions are expected to drive the demand for linoleum and cork flooring over the projected period.

Europe resilient flooring accounted for a significant share, owing to the increased demand from innovative and technologically advanced flooring products from residential segments in the region. In addition, extensively developed manufacturing and service industries across developed economies including Germany, the UK, France, Italy, and Spain, are projected to drive the demand for resilient flooring products in non-residential applications over the forecast period.

The rising number of mega construction projects in Qatar, Oman, and Saudi Arabia is anticipated to provide considerable scope for the growth of commercial floorings. Rising inclination of the South African government toward encouraging the construction and refurbishment of healthcare and educational facilities is expected to surge the requirement for resilient flooring products over the forecasted years. Furthermore, social, economic, and environmental development in Qatar, Bahrain, Kuwait, and Oman on account of the higher standard of living of citizens, which can be attributed to increased employment and higher wages, is projected to drive the construction industry. This, in turn, is projected to fuel the demand for building materials such as resilient floorings over the forecast period.

Key Companies & Market Share Insights

Tarkett S.A. and Mohawk Industries, Inc. are two significant players in the industry with a large number of subsidiaries operating across the globe. Tarkett S.A. is the leading player in the European flooring market and caters to a wide range of flooring products including resilient and non-resilient floorings across the globe. Mohawk is a North American company with numerous subsidiaries including IVC Group, Unilin, Pergo, etc., which account for a significant share of the global market.

Prominent market players in the industry have strategic tie-ups with a large number of distributors to access larger customer base. Some of the distributors operating in the market include Carpet & Flooring (Trading) Ltd, Carpet One, Harvey Norman Flooring, and Webber’s Carpet Warehouse.

-

In December 2023, Karndean acquired GO RESILIENT, a distributor of premium resilient flooring products. This acquisition will help Karndean to expand its sales and operations in North America to cater to the growing need for resilient flooring products in the region.

-

In July 2022, Armstrong Flooring, Inc. was acquired by AHF Products. Armstrong Flooring, Inc. is a U.S. based manufacturer and distributor of flooring products. This will help AHF Products to increase its manufacturing facilities and expand its customer base.

Key Resilient Flooring Companies:

- Beaulieu International Group

- Mohawk Industries Inc.

- Shaw Industries Group, Inc.

- Gerflor

- Forbo Flooring Systems

- Fatra a.s.

- Interface, Inc.

- Tarkett S.A

- IVC Group

- MONDO S.p.A

Resilient flooring Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 42.65 million

Revenue forecast in 2030

USD 65.29 million

Growth Rate

CAGR of 7.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in thousand sq. meters, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Austria; Germany; UK; Spain; Italy; France; Russia; Australia; China; South Korea; Japan; India; Singapore; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Beaulieu International Group; Mohawk Industries, Inc.; Shaw Industries Group, Inc.; Gerflor; Forbo Flooring Systems; Fatra A.S.; Interface, Inc.; Tarkett S.A.; IVC Group; Mondo S.p.A

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

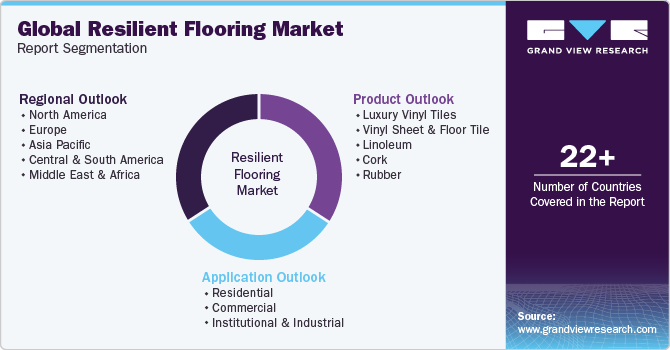

Global Resilient flooring Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the resilient flooring market on the basis of product, application, and region:

-

Product Outlook ( Volume, Thousand Sq. Meters; Revenue, USD Million; 2018 - 2030)

-

Luxury Vinyl Tiles

-

Vinyl Sheet & Floor Tile

-

Linoleum

-

Cork

-

Rubber

-

-

Application Outlook (Volume, Thousand Sq. Meters; Revenue, USD Million; 2018 - 2030)

-

Residential

-

Commercial

-

Institutional & Industrial

-

-

Regional Outlook (Volume, Thousand Sq. Meters; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

Spain

-

Italy

-

France

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Singapore

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global resilient flooring market size was estimated at USD 38.39 million in 2022 and is expected to reach USD 40.12 million in 2023.

b. The global resilient flooring market is expected to grow at a compound annual growth rate a CAGR of 6.9% from 2023 to 2030 to reach USD 65.29 million by 2030.

b. The Luxury Vinyl Tile (LVT) accounted for the largest revenue share in 2022 due to their cost effectiveness, high durability, and low maintenance cost.

b. Some key players operating in the resilient flooring market include Beaulieu International Group, Mohawk Industries, Inc., Shaw Industries Group, Inc., Gerflor, Forbo Flooring Systems, Fatra A.S., Interface, Inc., Tarkett S.A., IVC Group, Mondo S.p.A

b. The key factors that are driving the market growth is the increasing investments in the construction sector coupled with rising demand for improvements in aesthetics of the building.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.