- Home

- »

- Advanced Interior Materials

- »

-

Vinyl Flooring Market Size, Share & Growth Report 2030GVR Report cover

![Vinyl Flooring Market Size, Share & Trends Report]()

Vinyl Flooring Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Vinyl Sheets, Vinyl Tiles, Luxury Vinyl Tiles), By Application (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-733-9

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vinyl Flooring Market Summary

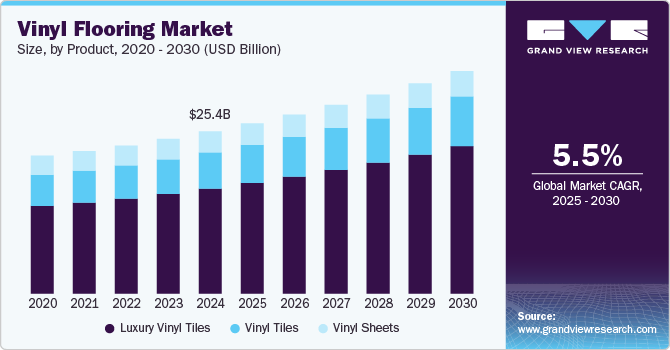

The global vinyl flooring market size was estimated at USD 25.37 billion in 2024 and is projected to grow at a CAGR of 5.5% from 2025 to 2030. Increasing development of new innovative floor covering solutions and consumer trends in construction solutions and floor design have been critical in the industry development over the last few years.

Key Market Trends & Insights

- North America dominated the global vinyl flooring market with a revenue share of 13.8% in 2024.

- By product, the luxury vinyl tiles (LVT) segment led the market with the largest revenue share of 64.7% in 2024

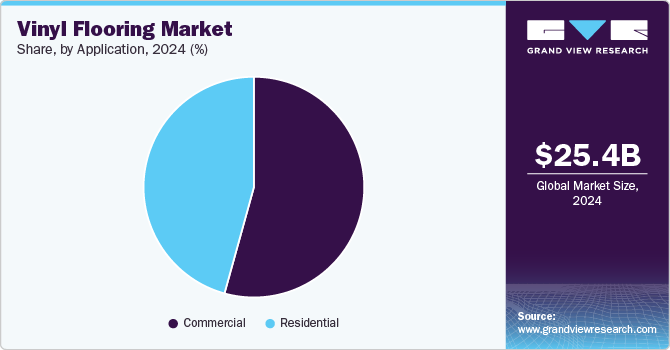

- By application, the commercial segment led the market with the largest revenue share of 54.3% in 2024.

- Vinyl floorings are mainly used in residential applications, hence the residential segment is estimated to expand at the fastest CAGR of 5.2% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 25.37 Billion

- 2030 Projected Market Size: USD 34.1 Billion

- CAGR (2025-2030): 5.5%

- North America: Largest market in 2024

The expansion of enhanced offices and workspaces, along with increasing consumer lifestyles and rapid urbanization, has led to the growth of the industry.

Significant and continual growth in urbanization and the building & construction industry in the emerging Asia Pacific economies, such as China, India, and Japan, has substantially driven the industry’s commercial end-use segment. Consumers are becoming more aware of environmental conservation, which has driven the use of environment-friendly floor-covering solutions.

The U.S. accounted for the largest share in North America owing to increased demand from residential applications, a well-established service industry, an extensively developed manufacturing industry, and government initiatives to develop social infrastructure across the region. The high prevalence of sports activities in the U.S. is anticipated to result in the construction of new stadiums and fitness centers, which, in turn, is likely to promote the use of vinyl flooring products over the forecast period.

The value chain of the market is characterized by raw material suppliers, manufacturers, distributors & suppliers, flooring installers/contractors, and end users. Vinyl sheets, vinyl tiles, and luxury vinyl tiles are some of the prime flooring products under the vinyl flooring category that are installed in residential, commercial, and industrial applications.

Participants in the global market primarily compete on the basis of product quality, customer service, and product pricing. However, product quality is considered a minimum competing factor by the industry players. Customer service is estimated to be the most influencing factor for the industry players to maintain the competition. Major companies are focusing on developing a strong distribution network across major geographies in the world to cater to the increasing demand for resilient floorings.

Product Insights

The luxury vinyl tiles (LVT) segment led the market with the largest revenue share of 64.7% in 2024 and is expected to grow at the fastest CAGR of 5.9% during the forecast period. LVT, also known as wide plank vinyl flooring, is becoming increasingly popular among consumers for residential and commercial applications due to its ease of installation, durability, and water resistance. Higher LVT benefits, such as stain, dent, and scratch resistance, as well as comfort underfoot, are replacing industry staples such as engineered wood flooring, solid wood flooring, and porcelain, which is expected to drive segment revenue growth.

The vinyl sheets segment is expected to exhibit at the fastest CAGR of 3.3% over the forecast period, owing to its ease of maintenance and durability are the primary factors contributing to the growth of vinyl-based products. Moreover, color and texture customization offered by the manufacturers is further propelling the product demand. These sheets are used as a substitute for natural stone flooring, ceramic tiles, hardwood flooring, and others. Vinyl sheets have flooring applications in moist areas such as the kitchen, bathroom, and laundry room. In addition, these floorings are used in indoor playgrounds for their cushioned effect to reduce the chances of injuries.

The vinyl tiles segment accounted for a market share of 22.4% in 2024. Floor covering made of PVS, stabilizers, and pigments that is covered in UV-cured urethane to resist scratches, stains, and scuffs. Because of their water resistance and traffic handling, these tiles are widely used in commercial applications. Vinyl tiles used in dining, drawing, bedrooms, kitchens, playrooms, and bathrooms provide a quiet and comfortable underfoot, moisture resistance, and a wide range of designs and colors in the market, which is expected to support demand for vinyl tiles in flooring.

Application Insights

Based on application, the commercial segment led the market with the largest revenue share of 54.3% in 2024 and is expected to witness at a significant CAGR over the forecast period. Due to its adaptability, affordability, durability, and ease of upkeep, vinyl flooring is becoming more and more popular for use in commercial settings such as offices, residences, and other hospitality sectors. Due to the fact that this flooring can be used in areas with heavy foot traffic, the demand for vinyl flooring for commercial uses is anticipated to rise.

The commercial application are holding the market share, like hotels and shopping malls are the key users of these tiles due to the tile's benefits, cost-effectiveness coupled with superior aesthetics. The use of vinyl flooring in the growing influence of designers and architects is predicted to accelerate the demand for the product. The features like easy cleaning & sterilization, stylish designs, and slip & water resistance are boosting the demand for the products in commercial applications.

The residential segment is estimated to expand at the fastest CAGR of 5.2% over the forecast period. The residential application segment includes residential buildings, apartments, complexes, and small houses. Vinyl floorings are majorly used in residential applications on account of their low cost, highly durable nature, and resistance to shock, stain, and dirt. The flooring is available in various patterns and shades, thus making it a perfect choice to create patterns resembling natural stone or wood.

Germany, in light of regulatory support is expected to boost the demand for these flooring products owing to their high anti-slip and scratch resistance properties. The rising number of single-family houses in developing economies and the growing disposable income of consumers are projected to drive the product demand in the residential application segment.

Regional Insights

The North America vinyl flooring market accounted for a market share of 13.8% in 2024 and is predicted to remain the major market for vinyl flooring by 2030. North America dominates the global market in terms of consumption, owing to increased demand from residential applications, a well-established service industry, an extensively developed manufacturing industry, and government initiatives to develop social infrastructure across the region.

U.S. Vinyl Flooring Market Trends

The U.S. vinyl flooring market is anticipated to grow at the fastest CAGR during the forecast period. Factors such as the rising number of single-family houses and strengthening residential replacement in the country have supported the market growth in the U.S. In addition, the well-established manufacturing industry in the country along with the presence of MNCs operating across all manufacturing industries, has played a major role in driving the demand for vinyl flooring in non-residential applications in the U.S.

Asia Pacific Vinyl Flooring Market Trends

Asia Pacific dominated the vinyl flooring market with the largest revenue share of 50.9% in 2024. The Asia-Pacific region contains a high population that offers a huge potential for infrastructural development and new housing demand which is boosting the market growth in this region. The largest construction market in this region is China. The changing building and construction trends to develop modern architectural structures in the country are boosting the product market growth in this region. Due to the increasing population, investments are rising for single-family constructions are showing a positive impact on the market growth in this region.

Europe Vinyl Flooring Market Trends

The Europe vinyl flooring market is expected to grow at the fastest CAGR of 5.3% during the forecast period, owing to increased demand for innovative and technologically advanced flooring products from the residential application segment in the region. In addition, the extensively developed manufacturing and service industries in Germany, the UK, France, Italy, and Spain are projected to drive the demand for flooring products in commercial applications over the forecast period.

The Germany vinyl flooring market is one of the largest manufacturing destinations for the automotive, chemicals, fast-moving goods, food & beverage, and pharmaceutical industries. As a result, the companies operating in the abovementioned sectors have established their commercial offices as well as manufacturing units in Germany. This is projected to offer a vast application scope for flooring products in new establishments as well as renovation of old commercial and industrial structures over the forecast period.

Key Vinyl Flooring Company Insights

Some of the key players operating in the market include Armstrong Flooring, Inc. and Mohawk Industries, Inc.

-

Armstrong Flooring, Inc. is headquartered in Braeside, Australia. The Australian subsidiary of the company operates with the name Armstrong Flooring Pty. Ltd. and majorly serves residential and commercial construction segments. Armstrong Flooring, Inc. operates as a subsidiary of AFI Licensing LLC and has a worldwide presence for flooring materials. The company operates through two major business segments, namely resilient flooring and wood flooring. The company caters its products for commercial flooring purposes to healthcare, educational facilities, retail spaces, corporate offices, multifamily spaces, and industrial & public spaces. The residential flooring applications served by the company include single-family homes, residential complexes, and private houses.

-

Mohawk Industries, Inc. was incorporated in 1992. The company is headquartered in Georgia, U.S., and is primarily engaged in the production of flooring components. It designs, sources materials, manufactures, and distributes different types of flooring materials to markets, including residential new construction, residential replacement and commercial constructions. The company operates its business through segments: Global Ceramics, Flooring North America, and Flooring Rest of the World.

-

Gerflor was established in 1937 and is headquartered in Villeurbanne, France. The company designs, manufactures, and markets flooring solutions and wall finishes for the construction sector. The company’s floor business has a global presence. It offers its products under various brands, including Mipolam, DLW, Taraflex, Tarabus, Connor Sports, Sport Court, and Gradus. It mainly serves indoor flooring applications, including healthcare, schools, retail, sports, housing, office, hospitality, and transport vehicles.

Key Vinyl Flooring Companies:

The following are the leading companies in the vinyl flooring market. These companies collectively hold the largest market share and dictate industry trends.

- Armstrong Flooring, Inc.

- Forbo Flooring Systems

- Mohawk Industries, Inc.

- Tarkett S.A.

- Mannington Mills, Inc.

- Shaw Industries Group, Inc.

- LG Hausys

- Gerflor

- Fatra A.S.

- Beaulieu International Group

- Polyflor Ltd.

Recent Developments

-

March 2021: Armstrong Flooring introduced three LVT collections: Biome, Terra, and Coalesce, all of which include unique diamond ten technology. The thinner profile of these three collections, with a 2.5 mm structure, reduces the number of raw materials and energy consumed during manufacture, resulting in a 31 % reduced carbon footprint

-

September 2023: Mannington Mills launches new luxury vinyl plank collection with a focus on sustainability: Mannington Mills, a leading US flooring manufacturer, launched a new luxury vinyl plank (LVP) collection called "Revive". The collection is made with recycled content and is designed to be environmentally friendly.

Vinyl Flooring Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 26.63 billion

Revenue forecast in 2030

USD 34.81 billion

Growth rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Volume in million/billion Square Meters, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Russia; China; India; Japan; South Korea; Singapore; Australia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Armstrong Flooring, Inc.; Forbo Flooring Systems; Mohawk Industries, Inc.; Tarkett S.A.; Mannington Mills, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vinyl Flooring Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vinyl flooring market report based on product, application, and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Vinyl Sheets

-

Vinyl Tiles

-

Luxury Vinyl Tiles

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global vinyl flooring market size was estimated at USD 25.37 billion in 2024 and is expected to reach USD 25.64 billion in 2025.

b. The global vinyl flooring market is expected to grow at a compound annual growth rate a CAGR of 5.5% from 2025 to 2030 to reach USD 34.81 billion by 2030.

b. Asia Pacific dominated the vinyl flooring market with a share of 43.3% in 2024. Increased construction activities and demand for eco-friendly floorings are expected to generate ample growth opportunities in the region.

b. Some key players operating in the vinyl flooring market include Armstrong Flooring, Inc., Forbo Flooring Systems, Mohawk Industries, Inc., Tarkett S.A., Mannington Mills, Inc.

b. Key factors driving the vinyl flooring market is growth in construction spending in the emerging Middle Eastern and Asia Pacific economies can be attributed to the strong industrial and economic development coupled with population expansion, which is likely to have a positive impact on the demand for vinyl flooring in these regions over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.