- Home

- »

- Power Generation & Storage

- »

-

Flow Battery Energy Storage Market, Industry Report, 2033GVR Report cover

![Flow Battery Energy Storage Market Size, Share & Trends Report]()

Flow Battery Energy Storage Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Vanadium Redox Flow Batteries, Zinc-Bromine Flow Batteries, Iron Flow Batteries, Hybrid Flow Batteries), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-788-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flow Battery Energy Storage Market Summary

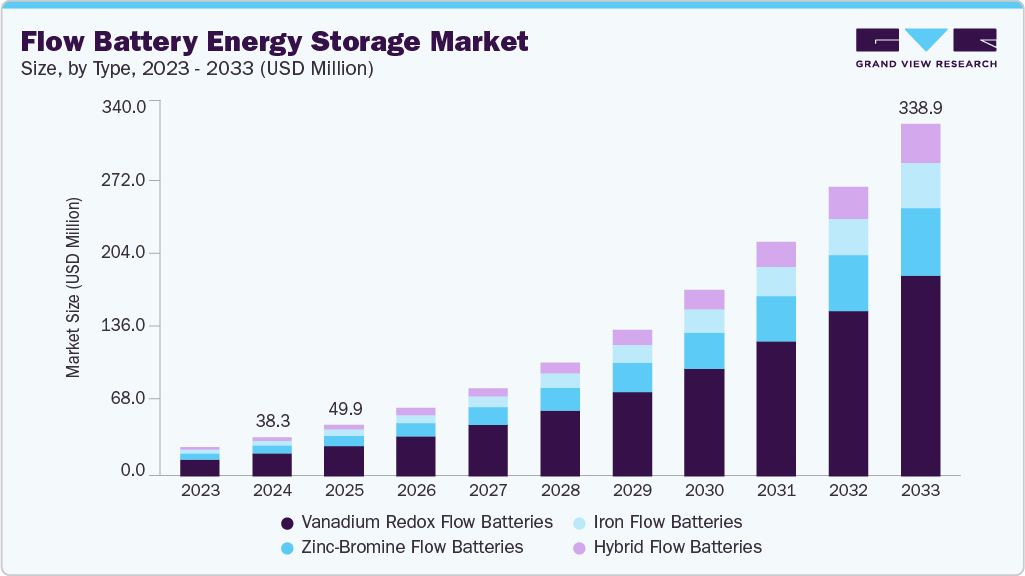

The global flow battery energy storage market size was estimated at approximately USD 38.34 million in 2024 and is projected to reach USD 338.87 million by 2033, growing at a CAGR of 27.05% from 2025 to 2033. The increasing need for large-scale, long-duration storage solutions to stabilize renewable power generation and improve grid reliability drives the adoption of flow batteries worldwide.

Key Market Trends & Insights

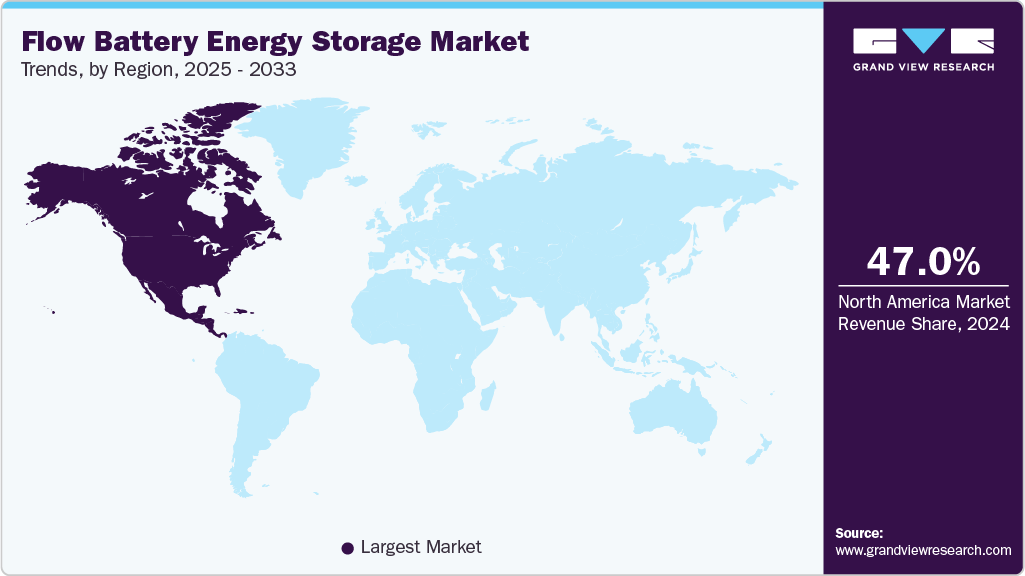

- North America flow battery energy storage market held the largest share of 47% of the global market in 2024.

- The flow battery energy storage market in the U.S. is expected to grow significantly over the forecast period.

- By type, Vanadium Redox Flow Batteries held the highest market share of 59% in 2024.

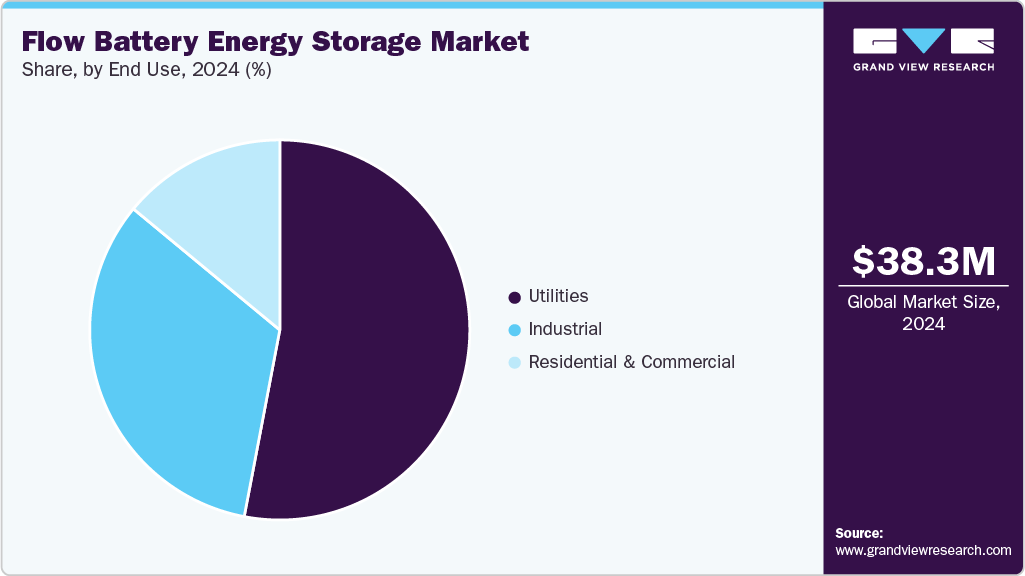

- Based on the end use, the Utilities segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 38.34 Million

- 2033 Projected Market Size: USD 338.87 Million

- CAGR (2025-2033): 27.05%

- North America: Largest market in 2024

Unlike conventional lithium-ion systems, flow batteries offer extended lifespans, flexible scalability, and enhanced safety, making them well-suited for utility, industrial, and commercial end uses. Growing investments in renewable integration and advancements in vanadium redox and hybrid flow chemistries are further supporting the market's expansion. Strategic partnerships among energy developers, storage technology firms, and government agencies are also helping accelerate commercialization and deployment across regions.North America's market growth is primarily driven by federal and state-level initiatives that encourage renewable energy deployment and grid modernization. Flow battery adoption is gaining momentum in utility-scale projects to support peak load management, renewable integration, and energy resilience. The United States is leading regional deployment, leveraging abundant solar and wind resources while exploring new business models around storage-as-a-service. With rising electricity demand and corporate sustainability commitments, the region is expected to see steady investment in flow battery installations over the forecast period.

Europe represents a significant growth hub for the flow battery market, with Germany, the UK, and the Netherlands spearheading adoption. Supportive policy frameworks, ambitious renewable energy targets, and strong EU-level funding for energy storage projects create a favorable environment for large-scale flow battery installations. Technology’s long-duration storage capability is increasingly deployed to support grid balancing and reduce dependence on fossil-fuel-based peaking plants. Technological advancements and partnerships between European utilities and technology developers foster innovation, reinforcing the region's role as a leading contributor to the global flow battery energy storage market.

Drivers, Opportunities & Restraints

The global flow battery energy storage market is primarily driven by the growing demand for long-duration, large-scale energy storage systems that can effectively integrate intermittent renewable power into electricity grids. Unlike lithium-ion batteries, flow batteries provide longer cycle life, greater safety, and flexible scalability, making them an attractive solution for utility, industrial, and commercial end uses. Supportive government policies, renewable energy integration targets, and increasing investments in grid modernization further propel market growth. Rising electricity demand and the urgent need for resilient and low-carbon power infrastructure also encourage the deployment of flow batteries as a viable alternative for balancing supply-demand fluctuations.

Opportunities in the flow battery energy storage market are expanding rapidly, driven by advancements in vanadium redox, zinc-bromine, and hybrid chemistries that improve efficiency and reduce costs. The technology’s suitability for large-scale renewable integration, microgrids, and off-grid end uses creates strong potential in developed and emerging economies. Growing focus on decarbonization in the power and industrial sectors, public-private partnerships, and international funding for clean energy projects are expected to accelerate deployment. In addition, the rising adoption of storage-as-a-service models and corporate sustainability initiatives presents new avenues for commercialization and long-term market growth.

However, challenges persist. High upfront costs of flow battery systems, limited supply chains for key raw materials such as vanadium, and the lack of standardized testing protocols hinder widespread adoption. Technical complexities, including system efficiency and energy density limitations, constrain competitiveness against more established storage technologies such as lithium-ion. Regulatory uncertainties, permitting hurdles for large-scale projects, and difficulties in securing financing for emerging technologies further add to market barriers. Moreover, competition from advanced lithium-ion, sodium-ion, and other next-generation storage solutions continues restraining the near-term expansion of the flow battery energy storage market.

Type Insights

The Vanadium Redox Flow Batteries (VRFB) segment held the largest revenue share of around 59% in 2024. Vanadium redox flow batteries dominate the type segment in the global flow battery energy storage market, reflecting their maturity, scalability, and proven performance in utility-scale and industrial end uses. Their ability to deliver long-duration storage, provide stable discharge cycles, and ensure enhanced safety compared to conventional lithium-ion technologies makes them a preferred choice for large-scale renewable energy integration and grid balancing. With a strong deployment and commercial viability track record, VRFBs continue to play a central role in enabling energy transition strategies worldwide.

Vanadium redox flow batteries are well-suited for end uses requiring high durability and frequent cycling, such as renewable load shifting, microgrids, and grid stabilization. Their long lifespan, non-flammable electrolyte, and recyclability of vanadium contribute to significant sustainability advantages, aligning with global decarbonization goals. Ongoing technological advancements reinforce the segment’s growth to improve efficiency, reduce costs, and expand production facilities and supply chains for vanadium electrolytes. Supportive government incentives, international collaborations, and corporate commitments to low-carbon energy further accelerate adoption. As utilities and industries increasingly prioritize resilience and renewable integration, VRFBs’ scalability, environmental benefits, and strong technological foundation position them as the leading driver of growth in the global flow battery energy storage market.

End Use Insights

The utilities segment held the largest market share of approximately 53% in 2024 within the global flow battery energy storage market. Utilities are leading adopters of flow batteries because they need large-scale, long-duration energy storage solutions that support renewable integration, peak load management, and grid stability. The ability of flow batteries to deliver consistent discharge over extended periods, withstand thousands of charge-discharge cycles, and operate safely with low risk of thermal runaway makes them highly attractive for utility-scale projects. This dominance is further reinforced by supportive policies, renewable portfolio standards, and ongoing investments in modernizing electricity infrastructure.

As renewable energy generation expands globally, utilities prioritize flow battery installations to balance supply-demand fluctuations and reduce reliance on fossil-fuel-based peaking power plants. For instance, flow battery systems are increasingly deployed in solar and wind farms to provide backup, load shifting, and energy arbitrage. In addition, utilities are adopting flow batteries for microgrids, rural electrification, and resilience against extreme weather events. Government incentives, international funding programs, and strategic partnerships between utilities and storage providers further accelerate deployment. With rising electricity demand and ambitious decarbonization targets, the utilities segment will remain the leading driver of flow battery adoption globally throughout the forecast period.

Regional Insights

North America held over 47% revenue share of the global flow battery energy storage market in 2024. Strong government policies, large-scale investments in grid modernization, and rising corporate commitments to renewable energy integration drive the region’s leadership. The U.S. remains at the forefront, with federal initiatives such as the Inflation Reduction Act and Department of Energy funding programs encouraging deployment of long-duration storage technologies.

Flow batteries are increasingly adopted in utility-scale projects for peak load management, renewable integration, and microgrid applications, providing resilience against grid instability and extreme weather events. Canada also contributes meaningfully through provincial clean energy policies and pilot projects focused on energy storage innovation. With continued policy backing, technological progress, and rising renewable penetration, North America will remain the largest and most dynamic regional market for flow battery energy storage throughout the forecast period.

U.S. Flow Battery Energy Storage Market Trends

The U.S. represents the largest single-country market within North America, contributing a substantial share of the region’s 47% global market share in 2024, with federal and state-level initiatives supporting renewable integration and long-duration energy storage fuel adoption. Flow batteries are being deployed in utility-scale renewable projects, community microgrids, and industrial facilities to provide load shifting, energy arbitrage, and grid stabilization. R&D investments and demonstration projects, often backed by public-private partnerships, are accelerating commercialization. With the increasing focus on decarbonization, corporate sustainability commitments, and resilience against climate-driven grid disruptions, the U.S. is expected to remain a key driver of global flow battery market growth through 2033.

Asia Pacific Flow Battery Energy Storage Market Trends

The Asia Pacific region is emerging as a key growth hub, supported by rapid industrialization, urbanization, and ambitious renewable energy goals. Countries such as China, Japan, South Korea, and India are investing heavily in energy storage infrastructure to support their clean energy transitions. China is leading in vanadium redox flow battery manufacturing and deployment, leveraging its strong vanadium reserves and government-backed energy storage programs. Japan and South Korea focus on grid resilience, renewable balancing, and advanced R&D collaborations. India, driven by rapid solar and wind expansion, is exploring flow batteries for long-duration storage and rural electrification. With growing energy demand, favorable policies, and increasing public-private investments, the Asia Pacific market is expected to grow robustly and significantly expand its global flow battery storage sector share over the forecast period.

Europe Flow Battery Energy Storage Market Trends

Europe continues to play a critical role in the flow battery energy storage market, underpinned by strict emission reduction policies, net-zero commitments, and strong investments in renewable integration. Countries such as Germany, the UK, and the Netherlands are leading in adopting and deploying flow batteries for grid-scale renewable balancing, industrial decarbonization, and energy security. EU-level funding and supportive regulatory frameworks encourage R&D in advanced chemistries and hybrid storage systems. The region’s focus on phasing out fossil-fuel-based peaking plants and enhancing grid flexibility positions Europe as a strong contributor to market growth throughout the forecast period.

Latin America Flow Battery Energy Storage Market Trends

Latin America is gaining traction in the flow battery energy storage market, with Brazil, Chile, and Mexico emerging as frontrunners. The region benefits from abundant renewable energy potential, particularly solar and wind, and is increasingly adopting flow batteries for grid integration and energy security. Pilot projects and international funding support early deployment, while public-private partnerships foster technology transfer and infrastructure development. As clean energy initiatives expand, Latin America is expected to evolve into a high-potential market for flow battery adoption in the coming years.

Middle East & Africa Flow Battery Energy Storage Market Trends

The Middle East & Africa region is gradually expanding its adoption of flow battery energy storage, driven by energy diversification goals and climate action initiatives. Countries such as the UAE, Saudi Arabia, and South Africa are investing in pilot and commercial-scale projects to support renewable energy integration and grid resilience. In Sub-Saharan Africa, flow batteries are being explored for microgrids and off-grid electrification, providing reliable power in remote areas. With growing awareness of the benefits of long-duration storage, international partnerships, and increasing renewable investments, MEA is poised to steadily enhance its role in the global flow battery market over the forecast period.

Key Flow Battery Energy Storage Company Insights

Some of the key players operating in the global flow battery energy storage market include ESS Tech, Inc., Invinity Energy Systems, Rongke Power, Primus Power, CellCube, Sumitomo Electric Industries, Lockheed Martin, Largo Inc., Enerox GmbH, and Elestor. These companies invest heavily in research and development, large-scale flow battery deployments, vanadium and zinc-based battery technologies, grid-scale renewable integration projects, and long-duration energy storage solutions.

Key Flow Battery Energy Storage Companies:

The following are the leading companies in the flow battery energy storage market. These companies collectively hold the largest market share and dictate industry trends.

- ESS Tech, Inc.

- Invinity Energy Systems

- Rongke Power

- Primus Power

- CellCube

- Sumitomo Electric Industries

- Lockheed Martin

- Largo Inc.

- Enerox GmbH

- Elestor

Recent Developments

- In April 2025, Invinity Energy Systems announced the deployment of a 20.7 MWh vanadium redox flow battery system in the UK. This project, the largest of its kind in the country, is designed to enhance grid stability and facilitate the integration of renewable energy sources.

Flow Battery Energy Storage Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 49.92 million

Revenue forecast in 2033

USD 338.87 million

Growth rate

CAGR of 27.05% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025-2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

ESS Tech, Inc.; Invinity Energy Systems; Rongke Power; Primus Power; CellCube; Sumitomo Electric Industries; Lockheed Martin; Largo Inc.; Enerox GmbH; Elestor

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flow Battery Energy Storage Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global flow battery energy storage market report on the basis of type, end use and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Vanadium Redox Flow Batteries

-

Zinc-Bromine Flow Batteries

-

Iron Flow Batteries

-

Hybrid Flow Batteries

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Utility

-

Industrial

-

Residential & Commercial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global flow battery energy storage market size was estimated at USD 38.34 million in 2024 and is expected to reach USD 49.92 million in 2025.

b. The global flow battery energy storage market is expected to grow at a compound annual growth rate of 27.05% from 2025 to 2033 to reach USD 338.87 million by 2033.

b. Based on the type segment, Vanadium Redox Flow Batteries held the largest revenue share of more than 59% in 2024.

b. Some of the key players operating in the global flow battery energy storage market include ESS Tech, Inc., Invinity Energy Systems, Rongke Power, Primus Power, CellCube, Sumitomo Electric Industries, Lockheed Martin, Largo Inc., Enerox GmbH, and Elestor.

b. The key factors driving the flow battery energy storage market include the increasing need for long-duration, large-scale energy storage to support renewable energy integration, grid stability, and peak load management. Utilities, industrial players, and commercial operators seek reliable storage solutions to decarbonize electricity generation and reduce dependence on fossil-fuel-based peaking plants.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.