- Home

- »

- Medical Devices

- »

-

Fluid Management & Visualization Systems Market Report, 2027GVR Report cover

![Fluid Management & Visualization Systems Market Size, Share & Trends Report]()

Fluid Management & Visualization Systems Market (2020 - 2027) Size, Share & Trends Analysis Report By Product (Instrument, Accessories), By Application (Urology, Gynecology), By End Use, And Segment Forecasts

- Report ID: GVR-4-68038-866-4

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global fluid management and visualization systems market size was valued at USD 8.39 billion in 2019 and is projected to grow at a compound annual growth rate (CAGR) of 5.1% from 2020 to 2027. Fluid management promotes body fluid balance and helps in preventing severe complications arising from undesired fluid levels during a medical intervention. Increasing susceptibility to gastrointestinal, cardiac, orthopedic, and laparoscopic diseases due to changing lifestyle results in frequent hospital admissions.

Fluid management and visualization systems allow easy management during minimally invasive surgeries, hence provide shorter recuperative durations to the patients. Additionally, endoscopic procedures with proven efficient outcomes are a common area of application for these devices during colonoscopy, gastroscopy, and laparoscopy.

Fluid management significantly reduces complications and decrease in length of stay (LOS). Thus, preoperative and postoperative fluid management is as critical as intraoperative management as it offers multiple associated benefits to the patients. Most of the hospitalized patients require IV fluid to help maintain hydration and electrolyte balance. Moreover, the economic and clinical evidence indicates that intravenous fluid management and visualization systems save millions of dollars by improving surgery outcomes.

Certain guidelines implemented by the organizations make it mandatory for medical settings to adopt fluid management and visualization systems. The American Urological Association (AUA) guidelines recommend saline irrigant in uncomplicated ureteroscopy (URS) because risks associated with water irrigant have been reported in other endoscopic procedures. On 26th May 2020, Olympus partnered with Rocamed for the U.S. distribution of rocaflow double chamber pump system and tubing sets for use in urology procedures.

The geriatric population is highly susceptible to various chronic conditions, which further leads to the growth in the number of surgical procedures. According to the National Council Aging, around 80% of older adults have a chronic disease during their lifetime, while 77% have at least two. The NCA further stated that cancer, heart disease, stroke, and diabetes are the major conditions causing two-thirds of all deaths annually. According to the United Nations Department of Economic and Social Affairs, the global aging population (60 years and above) was around 1 billion in 2017. This is expected to have a positive impact on the demand during the forecast period.

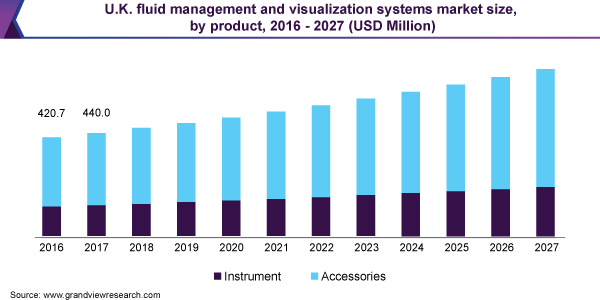

Product Insights

The accessories segment accounted for the largest revenue share of 69.8% in 2019 as accessories are being replaced by one-time use or disposable ones to ensure patient safety. According to the study published in Elsevier, April 2016, an estimated 100 million catheters are fitted annually globally and are the most commonly used medical devices that stay inside the body. Accessories include catheters, bloodlines, suction canisters, video processors, camera heads, and video converters.

Fluid management and visualization systems include dialyzers, insufflators, suction/ evacuation and irrigation, fluid warming systems, and waste management systems. Frequent product launches and innovations may accelerate market growth. In August 2018, Hologic Inc. launched a Fluent fluid management system in the U.S. The system features innovations to provide simplified and effective fluid management for hysteroscopic procedures for operating room (OR) staff. Moreover, in September 2019, Nordson Corporation acquired LinkTech Quick Couplings, Inc. to further broaden its fluid management product portfolio offering for various healthcare applications.

End-use Insights

The hospital segment accounted for the largest revenue share of 39.1% in 2019 and is anticipated to maintain its lead over the forecast period. This can be attributed to the fact that they offer the first line of care to the patients. More than 80 percent of hospital patients receive IV fluid during their stay. Moreover, Practice Greenhealth, a non-profit organization, further stated that fluid management and visualization systems reduce the exposure of hospital staff to hazardous and infectious material and save US$ 51 million annually.

The ambulatory surgical centers segment is expected to witness the fastest growth over the forecast period as they offer same-day surgery, thus avoiding costs related to hospital stay. According to the Report to the Congress: Medicare Payment Policy, March 2017, the number of Medicare-certified ASCs increased at an average annual rate of 1.1 percent from 2010 to 2014, whereas the rate increased to 1.4 percent, accounting to 5,500 ASCs in 2015.

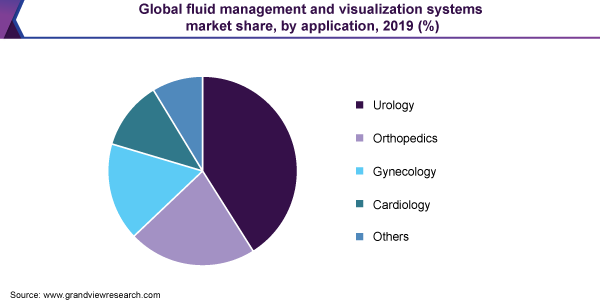

Application Insights

The urology segment accounted for the largest revenue share of 41.2% in 2019 and is anticipated to maintain its lead over the forecast period. Key players have developed novel mechanical fluid management and visualization systems to support the surgeons during urological endoscopic procedures. The developers also seek research partnerships with scientific partners within endoscopic urology surgery and development to improve technology in the field of endoscopic urology surgery.

In June 2019, Corinth MedTech raised US$ 12 million for a novel urology device named Veloxion System to treat bladder tumors and benign prostate. According to the company, about 400,000 patients require Transurethral Resection of Bladder Tumor (TURBT) and 300,000 men suffer from Benign Prostatic Hyperplasia (BPH) procedures annually. The Corinth technology also aids in treating women suffering from fibroids, intrauterine polyps, and abnormal uterine bleeding.

Regional Insights

North America accounted for the largest revenue share of 44.1% in 2019 and is expected to maintain its lead over the forecast period. North America has a well-established healthcare infrastructure and a large number of key pharmaceutical companies. It is a developed economy with high disposable income, which enables people to choose from various advanced treatment options. The majority of the population in this region is covered with health insurance and access to healthcare services. The region is expected to maintain its lead during the forecast period owing to continuous innovations and increasing gynecology procedures. For instance, on 6th May 2020, Baxter Inc. announced the results of the fluid evaluation in sepsis hypotension and shock (FRESH) study with its Starling fluid management system. The company published the results in CHEST Journal. According to the National’s Women’s Health Network, an estimated 600,000 hysterectomies are performed annually in the U.S. The data also stated that more than one-third of women have had a hysterectomy by the age of 60.

The Asia Pacific is likely to witness the fastest growth over the forecast period as the region consists of emerging economies, like Japan, China, and India. These countries have a large population base with a high incidence of chronic diseases, leading to an increasing number of surgical procedures. Moreover, the countries are technologically advanced and offer various advanced surgical procedures at low cost, thus promoting medical tourism.

Key Companies & Market Share Insights

Market players are adopting several strategies such as acquisitions to intensify the product portfolio and for geographical expansion, significant investment in research and development, and product launch and innovation to gain a significant share in the global market. For instance, in September 2019, Baxter International Inc. acquired Cheetah Medical to expand specialized patient monitoring portfolio. Baxter gained rights for non-invasive fluid management monitoring system - Starling, which provides an assessment of fluid responsiveness to the clinicians. Some prominent players in the global fluid management & visualization systems market are:

-

Medtronic plc

-

CONMED Corporation

-

Stryker Corporation

-

Smith & Nephew plc

-

Traubco LLC

-

Hologic, Inc.

-

Serres

-

Angiodynamics, Inc.

-

Ecolab, Inc.

Fluid Management & Visualization Systems Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 8.8 billion

Revenue forecast in 2027

USD 12.5 billion

Growth Rate

CAGR of 5.1% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Russia; Japan; China; Malaysia; India; South Korea; Thailand; Brazil; Mexico; Argentina; Columbia; South Africa; Saudi Arabia; UAE; Qatar

Key companies profiled

Medtronic plc; CONMED Corporation; Stryker Corporation; Smith & Nephew plc; Traubco LLC; Hologic, Inc.; Serres; Angiodynamics, Inc.; Ecolab, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels as well as provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. Grand View Research has segmented the global fluid management and visualization systems market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Instruments

-

Dialyzers

-

Fluid Waste Management System

-

Others

-

-

Accessories

-

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Urology

-

Orthopedics

-

Gynecology

-

Cardiology

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2027)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

Malaysia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Columbia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Qatar

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.