- Home

- »

- Organic Chemicals

- »

-

Fluorochemicals Market Size & Share, Industry Report, 2030GVR Report cover

![Fluorochemicals Market Size, Share & Trends Report]()

Fluorochemicals Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Fluorocarbons, Fluoropolymers), By Application (Refrigerants, Aluminum Production, Blowing Agents), By Region, And Segment Forecasts

- Report ID: 978-1-68038-096-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fluorochemicals Market Summary

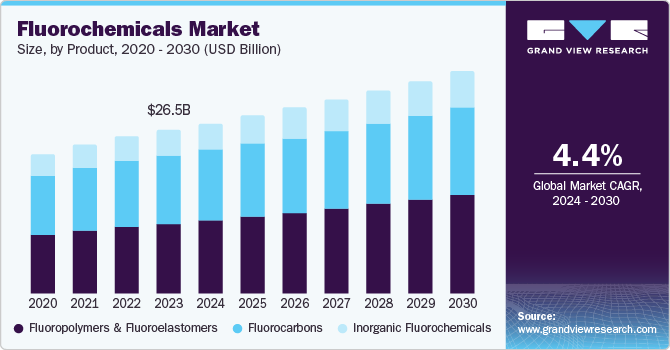

The global fluorochemicals market size was valued at USD 26.5 billion in 2023 and is projected to reach USD 36.0 billion by 2030, growing at a CAGR of 4.4% from 2024 to 2030. The increased use of fluorochemicals in the electronics and semiconductor industries has primarily driven the market.

Key Market Trends & Insights

- Asia Pacific fluorochemicals market secured the dominant share of 50.8% in 2023.

- The U.S. fluorochemicals market is driven by the growing electronic industry.

- By product, fluoropolymers & fluoroelastomers segment have held the dominant market share of 43.2% in 2023.

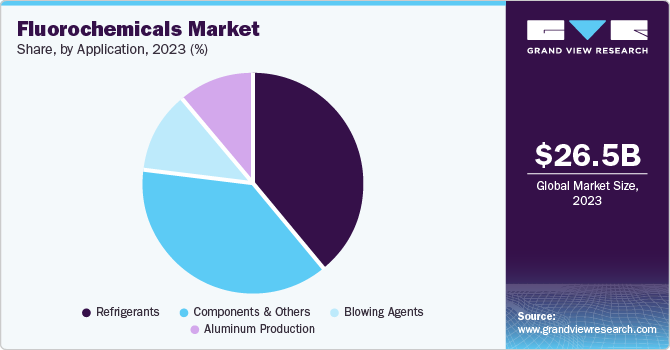

- By application, refrigerants segment accounted for the largest market revenue share of 38.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 26.5 Billion

- 2030 Projected Market Size: USD 36.0 Billion

- CAGR (2024-2030): 4.4%

- Asia Pacific: Largest market in 2023

- Europe: Fastest growing market

Fluorochemicals are essential in plasma etching processes that are used to manufacture semiconductors and light bulbs, enhancing their chemical and physical properties. This demand is further augmented by the rising production of flat display panels and advanced plastics including polytetrafluoroethylene (PTFE), which are crucial in electronics manufacturing. A significant factor is the expanding HVAC (heating, ventilation, and air conditioning) industry. The construction sector’s growth, particularly in developing regions, has led to a surge in the installation of HVAC systems, which rely heavily on fluorochemicals as refrigerants. This trend is prevalent in residential and commercial buildings, as the demand for efficient cooling systems is on the rise. Moreover, fluorochemicals align with environmental regulations as eco-friendlier alternatives to traditional chlorofluorocarbons and hydrochlorofluorocarbons, further driving the market growth.

In addition, the growth of the automotive industry has augmented the growth of the market. It is a major consumer of fluorochemicals, particularly in the production of aluminum, which is increasingly used to manufacture lightweight and fuel-efficient vehicles. The growing emphasis on reducing vehicle emissions and improving fuel efficiency has driven the demand for aluminum, thereby boosting the fluorochemicals market.

Product Insights

Fluoropolymers & fluoroelastomers have held the dominant market share of 43.2% in 2023 owing to their exceptional chemical resistance, high-temperature stability, and non-stick properties. The automotive sector is a significant driver, utilizing fluoropolymers in the production of lightweight, fuel-efficient vehicles. These materials are essential for manufacturing components including fuel hoses, gaskets, and seals that can withstand harsh chemical environments and extreme temperatures. Additionally, with the global shift towards sustainable energy sources, there is a rising demand for materials that can enhance the efficiency and longevity of solar panels, wind turbines, and lithium batteries. Fluoropolymers, with their durability and resistance to environmental degradation, have been increasingly used in these applications.

Inorganics are expected to register the fastest CAGR of 5.0% over the forecast period. Inorganic fluorochemicals, such as hydrogen fluoride, sodium fluoride, and aluminum fluoride, are essential in various industrial applications. One of the primary drivers is the aluminum production industry, where aluminum fluoride is crucial in the electrolytic process of aluminum smelting. The increasing demand for lightweight and fuel-efficient vehicles has boosted aluminum production, thereby driving the demand for aluminum fluoride. Furthermore, the water treatment sector has been a significant market contributor. Sodium fluoride has been widely used in water fluoridation processes to prevent dental cavities, especially in regions with inadequate natural fluoride levels in water.

Application Insights

Refrigerants accounted for the largest market revenue share of 38.8% in 2023 owing to the increasing demand for HVAC (heating, ventilation, and air conditioning) systems. The rapid urbanization and industrialization in the developing regions have led to a surge in the construction of residential, commercial, and industrial buildings, which require efficient HVAC systems. This trend is further supported by the growing emphasis on energy efficiency and the adoption of advanced HVAC technologies, which rely heavily on fluorochemical-based refrigerants.

Blowing agents are expected to emerge as the fastest-growing segment during the forecast period as these are crucial for polymer foams that are extensively used in industries such as construction, automotive, packaging, and appliances. Blowing agents are used to create insulation foams that enhance the thermal efficiency of buildings, reducing energy consumption, and costs. In the automotive sector, blowing agents help produce lightweight, durable foams that are used in various automotive components. Additionally, the packaging industry benefits from blowing agents as they are used to create protective packaging materials that are lightweight yet strong, ensuring the safe transport of goods.

Regional Insights

Asia Pacific fluorochemicals market secured the dominant share of 50.8% in 2023 owing to rapid industrialization and urbanization, particularly in countries such as China, India, and Japan. This has led to the rapid growth of the construction industry driven by infrastructure development and urban housing projects. The region is a leading producer of semiconductors, flat display panels, and other electronic components, which require fluorochemicals for their manufacturing processes. The growing demand for consumer electronics and advancements in technology have further propelled the market.

The Japan fluorochemicals market is expected to grow rapidly in the coming years due to its technological advancements and presence in high-tech industries. The country’s focus on innovation especially in electronics, and semi-conductor manufacturing has driven the market growth.

North America Fluorochemicals Market Trends

The fluorochemicals market in North America is likely to witness a significant growth rate owing to its well-established chemical industry and advanced manufacturing facilities. This infrastructure supports the production and application of fluorochemicals across various sectors. The automotive industry is a significant contributor, with the increasing production of vehicles incorporating advanced air conditioning systems that rely on fluorochemical-based refrigerants. Additionally, the shift towards electric vehicles (EVs) has further boosted the demand for fluorochemicals, as these vehicles require efficient thermal management systems

U.S. Fluorochemicals Market Trends

The U.S. fluorochemicals market is driven by the growing electronic industry. These chemicals are essential in the production of semiconductors, flat display panels, and other electronic components, which are critical for the region’s advanced technology sector. The healthcare industry in the country also contributed to the market’s growth, utilizing fluorochemicals in medical devices, implants, and pharmaceutical packaging due to their biocompatibility and resistance to sterilization processes.

Europe Fluorochemicals Market Trends

The Europe fluorochemicals market is expected to witness a fastest CAGR of 11.8% over the forecast period owing to the regulatory landscape in the region. The phase-out of ozone-depleting substances (ODS) and the transition to low-global-warming-potential (GWP) refrigerants have led to the development and adoption of new fluorochemical-based alternatives. These regulatory changes aim to reduce the environmental impact of fluorochemicals while maintaining their efficiency and performance.

Key Fluorochemicals Company Insights

The fluorochemical market is fairly fragmented featuring key companies such as 3M, DuPont, DAIKIN INDUSTRIES, Ltd, Asahi India Glass Limited, DONGYUE GROUP, and others. These companies have primarily focused on strategic partnerships, acquisitions, and mergers to continue with their dominant footprint.

-

Daikin Industries is a Japanese multinational conglomerate renowned for its innovative air conditioning and refrigeration solutions. The company is known for its commitment to sustainability and technological advancements, such as the development of energy-efficient inverter heat pumps and the use of low-global-warming potential refrigerants.

-

Asahi India Glass Limited (AIS) is India’s integrated glass solutions company. AIS specializes in manufacturing a wide range of glass products, including automotive safety glass, architectural processed glass, and float glass. The company serves various sectors such as automotive, building and construction, and consumer glass, offering innovative solutions combining aesthetics and functionality.

Key Fluorochemicals Companies:

The following are the leading companies in the fluorochemicals market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- DuPont

- DAIKIN INDUSTRIES, Ltd.

- Solvay

- Asahi India Glass Limited

- Arkema

- Honeywell International Inc.

- DONGYUE GROUP

- Pelchem SOC Ltd

- Air Products and Chemicals, Inc.

- Mitsui Chemicals India Pvt. Ltd.

- Halocarbon, LLC

- Koura

Recent Developments

-

In November 2023, Solvay introduced Tecnoflon SHP, a line of completely fluorinated synthetic rubbers (FFKM). The new products blend traditional FFKM performance with attributes designed for extreme environments.

-

In June 2023, Arkema, a global chemicals and advanced materials company, announced its acquisition of a controlling stake in Piam, a Brazilian company specializing in specialty adhesives and sealants. This strategic move is intended to strengthen Arkema’s position in the high-growth adhesives market and expand its footprint in Latin America. The acquisition aligns with Arkema's broader strategy to enhance its portfolio of sustainable and innovative solutions.

Fluorochemicals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 27.6 billion

Revenue forecast in 2030

USD 36.0 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

3M; DuPont; DAIKIN INDUSTRIES, Ltd.; Solvay; Asahi India Glass Limited; Arkema; Honeywell International Inc.; DONGYUE GROUP; Pelchem SOC Ltd.; Air Products and Chemicals, Inc.; Mitsui Chemicals India Pvt. Ltd; Halocarbon, LLC; Koura

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fluorochemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fluorochemicals market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030; Volume in Kilotons)

-

Fluorocarbons

-

HCFC

-

HFC and Others

-

-

Inorganic Fluorochemicals

-

Fluoropolymers & Fluoroelastomers

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030; Volume in Kilotons)

-

Refrigerants

-

Aluminum Production

-

Blowing Agents

-

Components & Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030; Volume in Kilotons)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.