- Home

- »

- Medical Devices

- »

-

Fluoroscopy Systems Market Size, Share And Report, 2030GVR Report cover

![Fluoroscopy Systems Market Size, Share & Trends Report]()

Fluoroscopy Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Orthopedic, Cardiovascular, Pain Management & Trauma, Neurology), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-923-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fluoroscopy Systems Market Size & Trends

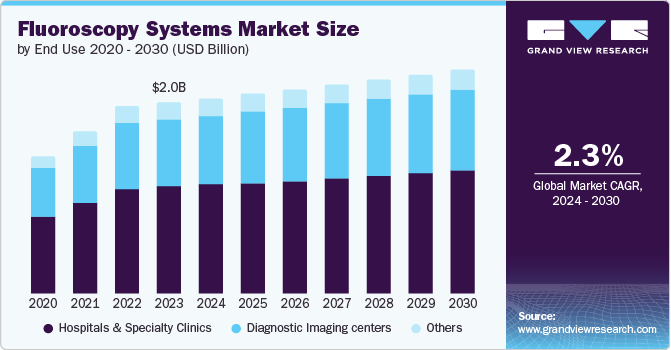

The global fluoroscopy systems market size was valued at USD 2.03 billion in 2023 and is projected to grow at a CAGR of 2.3% from 2024 to 2030. Growing geriatric population, chronic diseases and increasing adoption of fluoroscopy in pain management are key drivers fueling market. Advancements in fluoroscopy technology, including the shift to digital imaging, methods to reduce radiation dose, incorporation with other imaging techniques, and improved visualization aids, are further driving the market's expansion. These technological advancements enhance the quality of images, safety for patients, and efficiency in procedures, broadening the use of fluoroscopy in various medical settings.

The increasing frequency of long-term illnesses such as heart issues, stomach problems, and bone-related injuries require more sophisticated methods for diagnosis and treatment through imaging. Fluoroscopy is essential for diagnosing and treating these conditions, leading to a high demand for fluoroscopy equipment and services.

Due to the increasing number of elderly individuals around the globe, there is a growing need for diagnostic imaging tests to help heart diseases, arthritis, and cancer. The increasing utilization of fluoroscopy in minimally invasive interventional procedures across various medical fields, including cardiology, orthopedics, oncology, and urology, as well as the growing adoption of image-guided interventions like angiography, spinal surgeries, and tumor ablations, indicates significant opportunities for market expansion. Increasing healthcare costs, along with progress in medical technology and favorable payment policies, encourage the worldwide utilization of fluoroscopy equipment and services. The growing trend towards point-of-care imaging solutions, known for their portability, flexibility, and ease of use, is being supported by portable fluoroscopy systems, handheld devices, and mobile C-arm units to meet the evolving needs of healthcare providers, in particular in emergency departments, ambulatory surgery centers, and remote areas. The increasing use of minimally invasive surgical techniques, driven by advantages such as faster recovery times, shorter hospital stays, and lower complication rates, is fueling the rise in popularity of fluoroscopy-guided interventions. Fluoroscopy enables precise visualization and guidance during these procedures, thus driving market growth.

Product Insights

Fluoroscopy devices dominated the market and accounted for a share of 66.7% in 2023. Continual advancements in fluoroscopy machines, for instance moving to digital imaging, reducing doses, combining with other imaging methods, and improving visualization tools, are driving market growth. In addition, as the global population continues to age, there is an increasing need for diagnostic imaging for problems related to aging such as heart disease, joint inflammation, and tumors. The increasing utilization of fluoroscopy in minimally invasive interventional procedures across various medical fields like cardiology, orthopedics, oncology, and urology, paired with the growing popularity of image-guided interventions such as angiography, spinal surgeries, and tumor ablations, indicates significant opportunities for market expansion.

C-arms are expected to register the fastest CAGR in the coming years. Key drivers of market growth include growing elderly population, increasing chronic disease rates, improved maneuverability and imaging technology, and higher demand for imaging tech from emerging markets. Moreover mobile C-arms offer real-time guidance during procedures across a hospital, cutting the need for patient transfers, streamlining workflows, and potentially lowering costs. In addition to that manufacturers are creating compact, lightweight, user-friendly mobile C-arms with enhanced image quality which may create impact on growth of market.

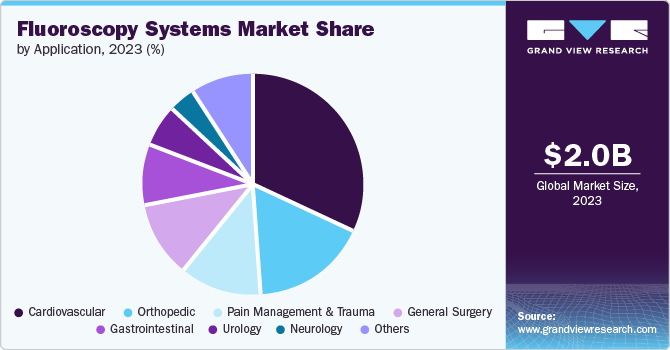

Application Insights

Cardiovascular accounted for the largest market revenue share in 2023. According to the World Health Organization, cardiovascular diseases (CVDs) are the primary reason for global mortality. The increased prevalence results in a higher demand for diagnostic and interventional procedures using fluoroscopy. Fluoroscopy is essential for various cardiovascular procedures such as coronary angiography, stenting, and electrophysiology studies. These procedures are less invasive than open surgery due to fluoroscopy guidance. In addition to that manufacturers are continuously enhancing fluoroscopy systems to cater to the specific requirements of cardiovascular procedures. Flat-panel detectors and improved image processing technologies have led to a substantial market presence for cardiovascular applications in the global fluoroscopy systems market.

Orthopedic is expected to register the fastest CAGR during the forecast period. Fluoroscopy is essential in minimally invasive orthopedic procedures such as arthroscopy, kyphoplasty, bone fracture reduction, and Joint replacement surgery. Minimally invasive techniques are being used more frequently in orthopedic procedures such as bone fracture reduction, joint replacements, and spine surgeries. Fluoroscopy is essential in these procedures as it offers immediate image guidance, enhancing accuracy and possibly reducing recovery times for patients. Additionally, the aging world population is resulting in a higher incidence of age-related orthopedic conditions such as arthritis and osteoporosis. This results in an increased need for orthopedic treatments that frequently require the use of fluoroscopy for both diagnosing and treating patients.

End Use Insights

Hospitals & specialty clinics dominated the market in 2023. In hospitals, a variety of medical conditions are carried out that requires the fluoroscopic guidance. This covers a range of procedures from less intrusive surgeries such as gallbladder removal or cardiac catheterization to injections for pain management and reducing fractures. Hospitals usually have the resources to acquire advanced fluoroscopy systems. These systems provide functions such as high-quality imaging, reduced radiation exposure, and robotic arms for better control. Specialized clinics frequently place importance on particular characteristics related to their area of specialty. In a cardiology clinic, having a fluoroscopy system with high-quality images to view blood vessels is a top priority. Health facilities regularly update technology to give optimal patient care, and fluoroscopy plays a crucial role in this effort.

Diagnostic Imaging centers are expected to register the fastest CAGR during the forecast period .The rapid growth is due to patient’s preference for outpatient imaging services over hospitals, driven by factors such as shorter wait times and flexible scheduling. Diagnostic imaging centers focus on meeting these needs by providing various types of imaging techniques, such as fluoroscopy. There is a growing trend of diagnostic imaging centers focusing on specific areas such as musculoskeletal imaging and women's health. Fluoroscopy is used in multiple procedures in these fields, making it worthwhile for these facilities to purchase specialized fluoroscopy systems.

Regional Insights

North America fluoroscopy systems market dominated the market in 2023 and the growth is primarily driven by established healthcare infrastructure, growing geriatric population, technological advancements, and rising use of fluoroscopy in pain management. According to research from the American Heart Association, the total cardiovascular-related deaths increased to 931,578 from the 928,741 deaths compared to previous year. In the previous year, there was an increase of over 54,000 deaths.

U.S. Fluoroscopy Systems Market Trends

The U.S. fluoroscopy systems market dominated the North America market with a share of 79.4% in 2023 due to rising incidence rate of trauma and injuries, including sprains, muscle sprains, supraspinatus tendinitis, and increasing. The National Safety Council (NSC) reports a 12% rise in sports and recreational injuries related to exercise equipment in 2022. Also in the 2022, emergency departments treated 3.6 million patients for sports and recreational equipment-related injuries. Exercise, cycling, and basketball are the most associated activities to injuries. This is expected to increase the demand for medical imaging, leading to a rise in market growth.

Europe Fluoroscopy Systems Market Trends

Europe fluoroscopy systems market was identified as a lucrative region in 2023 due to increasing need for less invasive procedures, expanding elderly demographic, and rising utilization of fluoroscopy in managing pain. Moreover, in Europe there is high prevalence of medical conditions that need fluoroscopy, such as cardiovascular diseases and gastrointestinal disorders, and there has been an increase in the adoption of advanced healthcare solutions and investments in innovative technologies.

The UK fluoroscopy systems market is expected to grow rapidly in the coming years, due to rise in technological advancements, greater affordability rates for treatments, and the annual growth in number of diagnostic procedures. Additionally, the increasing incidences of neurological conditions such as brain tumors is projected to drive market growth. For instance in 2023, approximately 79,340 adults aged 40 and older are expected to receive a diagnosis of a primary brain tumor in the U.S.

The Germany fluoroscopy systems market held a substantial market share in 2023 .Germany is a dominant player in European medical technology sector, with significant participation from major companies such as Siemens Healthineers. In addition healthcare system is strong and involves significant expenditure. This has the potential to increase investment rate in cutting-edge fluoroscopy technology. Moreover Germany is experiencing a fast-growing elderly population. This shift is expected to increase the need for fluoroscopy procedures in the realms of diagnosis and treatment.

Asia Pacific Fluoroscopy Systems Market Trends

Asia Pacific fluoroscopy systems market is anticipated to witness significant growth .Main factors fueling the fluoroscopy devices market include an increasing need for minimally-invasive surgeries, a growing elderly population, the high occurrence of chronic diseases, and a rise in the use of fluoroscopy for pain management.

The Japan fluoroscopy systems market is expected to grow rapidly in the coming years. As life expectancy increases, demand for medical procedures that involve fluoroscopy for diagnosis and treatment may increase. Japanese companies such as Shimadzu Corporation and Hitachi Medical Systems are leading in fluoroscopy technology in Japan. Technological Improvements such as flat-panel detectors that provide clearer images and reduce radiation exposure make these systems more appealing to healthcare professionals.

The China fluoroscopy systems market held a substantial market share in 2023. The rising incidence of sport injuries and orthopedic patients in China is a significant factor contributing to the growth of the fluoroscopy market.

Key Fluoroscopy Systems Company Insights

Some of the key companies in the fluoroscopy systems market include Canon Medical Systems Corporation; Hitachi Medical Systems; Siemens Healthineers; Koninklijke Philips NV; GE HealthCare; Ziehm Imaging GmbH; Shimadzu; Orthoscan Inc.; Hologic Inc.; and Carestream Health. Organizations are focusing on increasing customer base to gain a competitive edge in the industry.

-

Canon Medical Systems Corporation offers a range of fluoroscopy systems designed for diverse clinical needs. Its focus lies on high image quality with low radiation dose.

-

Siemens Healthineers offers a wide range of fluoroscopy systems. These systems are famous for being adaptable and can be used for various procedures, including cardiology, vascular interventions, and gastrointestinal examinations.

Key Fluoroscopy Systems Companies:

The following are the leading companies in the fluoroscopy systems market. These companies collectively hold the largest market share and dictate industry trends.

- Canon Medical Systems Corporation.

- Hitachi Medical Systems

- Siemens Healthineers

- Koninklijke Philips NV

- GE HealthCare

- Ziehm Imaging GmbH

- Shimadzu

- Orthoscan Inc.

- Hologic Inc

- Carestream Health.

Recent Developments

-

In July 2023, Canon Medical Systems launched a multipurpose fluoroscopic table with new functions, Zexira i9 digital X-ray RF system. It is a digital X-ray RF system which is equipped with all the essential features to meet clinical demands.

-

In October 2021, Siemens Healthineers announced the first U.S. installation of LUMINOS Lotus Max at Long Island Jewish Valley Stream (New York).

Fluoroscopy Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.07 billion

Revenue forecast in 2030

USD 2.37 billion

Growth Rate

CAGR of 2.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, KSA, UAE, and South Africa

Key companies profiled

Canon Medical Systems Corporation; Hitachi Medical Systems; Siemens Healthineers; Koninklijke Philips NV; GE HealthCare; Ziehm Imaging GmbH; Shimadzu; Orthoscan Inc.; Hologic Inc.; and Carestream Health.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fluoroscopy Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fluoroscopy systems market report based on product, application, end use, and region

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fluoroscopy Devices

-

C-arms

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Orthopedic

-

Cardiovascular

-

Pain Management & Trauma

-

Neurology

-

Gastrointestinal

-

Urology

-

General Surgery

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals & Specialty Clinics

-

Diagnostic Imaging centers

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.