- Home

- »

- Medical Devices

- »

-

Foam Dressing Market Size & Share, Industry Report, 2033GVR Report cover

![Foam Dressing Market Size, Share & Trends Report]()

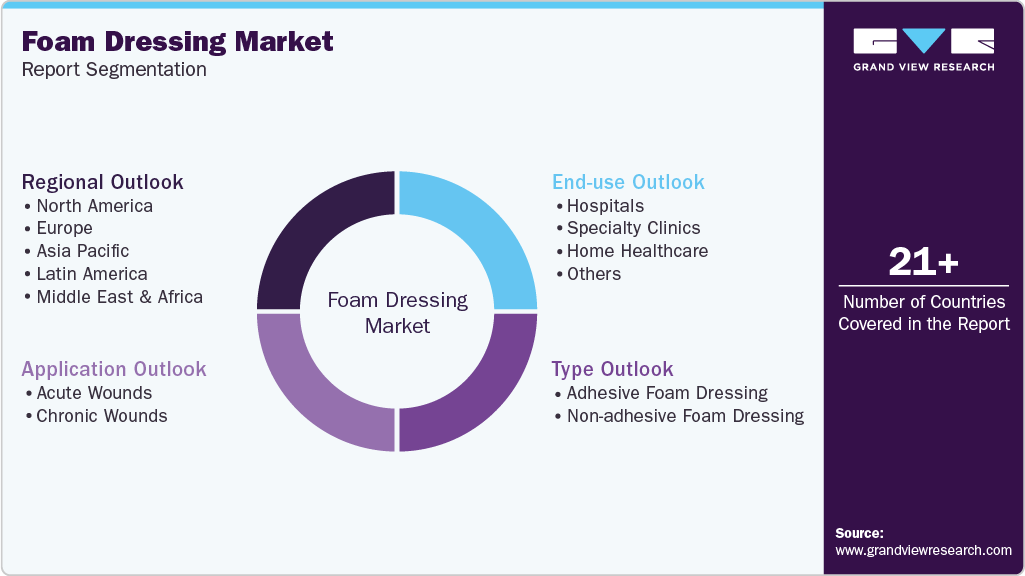

Foam Dressing Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Adhesive Foam Dressing, Non-adhesive Foam Dressing), By Application (Chronic Wounds, Acute Wounds), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-951-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Foam Dressing Market Summary

The global foam dressing market size was valued at USD 1.91 billion in 2024 and is projected to reach USD 2.89 billion by 2033, growing at a CAGR of 4.63% from 2025 to 2033. The growing demand for foam dressing items can be attributed to a rise in burn incidents, diverse types of ulcers, open wounds, and a surge in global surgical procedures.

Key Market Trends & Insights

- North America dominated the foam dressing market with the largest revenue share of 45.47% in 2024.

- The foam dressing market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By type, the adhesive foam dressing segment led the market with the largest revenue share in 2024.

- By application, the chronic wounds segment led the market with the largest revenue share in 2024.

- By end use, the hospital segment led the market with the largest revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.91 Billion

- 2033 Projected Market Size: USD 2.89 Billion

- CAGR (2025-2033): 4.63%

- North America: Largest market in 2024

In addition, diabetes is anticipated to be the main cause of these wounds. According to the International Diabetes Federation (IDF), there were 589 million adults (ages 20-79) living with diabetes worldwide in 2024, which is 1 in 9 adults. In addition, diabetes was responsible for 3.4 million deaths in 2024. The increasing prevalence of chronic wounds, such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, is a key driver of the foam dressing market. Chronic wounds require long-term management and advanced dressing solutions that promote faster healing and prevent infection. Foam dressings are highly effective in maintaining a moist wound environment, absorbing excess exudate, and reducing pain during dressing changes, making them a preferred choice for treating such conditions. The global rise in diabetes and obesity has led to a surge in chronic wounds, particularly among the elderly population, thereby fueling demand for advanced foam dressings. In addition, the growing emphasis on reducing hospital stays and healthcare costs has increased the adoption of foam dressings in hospital and home care settings. Continuous product innovations, such as antimicrobial and silicone foam variants, further enhance treatment outcomes, driving sustained growth in the foam dressing market.

According to a Multidisciplinary Digital Publishing Institute (MDPI) study, January 2022, in countries with affluence, 1-2% of people suffer from chronic severe wounds. Over 6.0 million Americans are estimated to have experienced at least one chronic wound in their lives. According to the American Diabetes Association’s report of December 2022, untreated diabetes over an extended period can frequently result in diabetic foot ulcers (DFU), which are extremely dangerous. Approximately 19% to 34% of the estimated 537 million diabetics worldwide are expected to experience a DFU at some point in their lives, which highly contributes to the demand of foam dressings.

Key Statistics on Diabetic Foot Ulcers (DFUs) in Saudi Arabia (2024)

Parameter

Statistic

Lifetime risk of developing DFU in diabetes patients

19-34%

Mortality within 12 months of DFU

~5%

Mortality within 5 years of DFU

~42%

Amputation risk

Higher in patients with diabetes compared to non-diabetics

Source: NCBI

The increasing number of road accidents and related injuries is a major driver of the foam dressing market. Road accidents often result in acute wounds, lacerations, burns, and traumatic injuries that require advanced wound care solutions for faster healing and infection prevention. Foam dressings are widely used in these cases due to their superior absorption capacity, moisture retention, and ability to maintain an optimal healing environment. As emergency departments and trauma care centers see a rise in accident-related cases, the demand for high-performance dressings such as polyurethane and silicone foam products continues to surge. Moreover, the growing emphasis on reducing hospital-acquired infections and improving patient recovery outcomes supports the adoption of advanced foam dressings. With governments and healthcare organizations investing heavily in trauma management infrastructure, the need for effective wound care products is expected to expand, fueling the growth of the global foam dressing market.

Australia Hospitalized Injury Rate per 100,000 Population by Age Group

Year

0-7 years

8-16 years

17-25 years

26-39 years

40-64 years

65-74 years

≥75 years

Total

2020

28.3

97.9

265.5

173.6

155.1

115.7

119.2

146.8

2021

28.3

98.6

278.8

178.1

162.6

122.6

129.1

152.3

2022

24.3

83.4

242.7

160.5

148.3

121.2

122.8

137.7

2023

29.2

92.6

282

189.7

168.5

128.8

149.7

159.2

2024

28.6

88.8

274

189.8

167.1

128.8

152.8

157.7

Source: Australian Institute of Health and Welfare, 2025

The advancements in additive manufacturing have led to creative solutions in several healthcare sectors. Foam dressings represent a breakthrough in the treatment of wounds. Despite advances in understanding of the cellular and molecular mechanisms underlying wound healing, the management of chronic wounds is still a challenge. For instance, in January 2023, ConvaTec introduced ConvaFoam to the U.S. market, a line of innovative foam dressings tailored to cater to healthcare providers and their patients' requirements. Being versatile in addressing various wound types at any stage of the healing process, ConvaFoam emerges as a convenient option for wound management and skin protection.

Market Concentration & Characteristics

The foam dressing market shows a high degree of innovation, driven by the growing demand for advanced wound care solutions that enhance healing efficiency, comfort, and patient quality of life. Companies are focusing on developing next-generation products with improved exudate management, antimicrobial properties, and extended wear time to meet the needs of patients with chronic and complex wounds such as venous leg ulcers and diabetic foot ulcers. Mölnlycke Health Care’s Mepilex Up, an advanced foam dressing designed for managing exuding wounds, is a key instance of this innovation. Introduced as a breakthrough in exudate management, Mepilex Up addresses the challenge of fluid leakage, significantly impacting patient comfort and quality of life. The dressing features a patented dimpled foam structure that enhances capillary action, allowing wound exudate to spread efficiently in all directions, even against gravity.

The level of mergers and acquisitions activity in the foam dressing industry indicates a moderate to high level of interest from companies seeking to expand their product portfolios, strengthen their market presence, or gain access to new technologies. As the demand for advanced wound care solutions grows, manufacturers and investors are keen to explore strategic partnerships and acquisitions to stay competitive in this dynamic market. For instance, in October 2023, Lion Street Medical, LLC, completed the acquisition of Pensar Medical, LLC, a medical device company with a strong focus on wound care. This strategic takeover has introduced new management to the esteemed Pensar Medical and WoundPro brands, further strengthening their presence in the medical industry.

Regulation in the foam dressing industry is significant for maintaining product safety, fostering fair competition, and promoting innovation. Governmental and regulatory bodies establish guidelines and standards for foam dressing manufacturing, testing, and marketing, which ensures patients receive high-quality and reliable products. These measures help create a level playing field for market participants, encourage innovation, and prevent market dominance by a few large companies. Regulatory approval is crucial for market access, and the process ensures that only safe and effective products are available for patients, building consumer trust.

Product expansion in the foam dressing industry can be considered moderate. While the market is growing due to increasing demand for advanced wound care solutions, it is not experiencing an extremely high rate of expansion. For instance, in June 2022, Medline launched an upgraded version of its Optifoam Gentle EX Foam Dressing, designed to effectively combat pressure injuries. The Optifoam Gentle EX dressing plays a vital role in Medline's Skin Health Solution Program, a comprehensive strategy encompassing people, processes, and products to deliver optimal skin and wound care outcomes. Factors contributing to this moderate growth include the continuous development of new foam dressing products, the increasing prevalence of chronic wounds, and the aging global population. In addition, regulatory frameworks play a crucial role in ensuring product safety and quality, which may slightly slow down the expansion rate.

The regional expansion of the foam dressing industry can be characterized as moderate, with various regions exhibiting differing levels of growth. North America and Europe have traditionally been the major contributors to the market's expansion due to the presence of well-established healthcare systems and a growing demand for advanced wound care solutions. These regions are expected to maintain a moderate growth rate, driven by factors such as an aging population, increasing prevalence of chronic diseases, and rising healthcare expenditures.

Type Insights

The adhesive foam dressing segment dominated the market in 2024 with the largest revenue share. In addition, the segment is expected to register the fastest CAGR over the forecast period. Adhesive foam dressings offer a high level of patient comfort, as they are designed to adhere securely to the skin while allowing for breathability and flexibility. This is particularly important for patients with sensitive skin or requiring long-term wound care, as it minimizes discomfort and promotes a conducive healing environment. Moreover, advancements in technology have led to the development of specialized adhesive foam dressings that cater to specific wound types and patient needs. This has expanded the market's appeal, as healthcare professionals can now choose from a wide range of products tailored to address various wound care challenges. For instance, hydrocolloid technology is known for its ability to create a moist wound healing environment by absorbing exudate and forming a secondary skin-like layer over the wound. This helps protect the wound from external contaminants and maintains a suitable environment for healing. By incorporating this technology into adhesive foam dressings, manufacturers have created a product that offers the best of both worlds - the security and comfort of adhesive foam dressings, combined with the moist wound healing benefits of hydrocolloids.

The non-adhesive foam dressing segment is expected to register a considerable CAGR over the forecast period. The growth of non-adhesive foam dressing can be linked to the increasing popularity of alternative wound care treatments, such as negative pressure wound therapy (NPWT) and hydrogels. These alternative treatments cater to specific wound care needs and may require the use of non-adhesive foam dressings as part of the treatment regimen.

Application Insights

The chronic wounds segment held the largest revenue share in 2024. The rise in the number of geriatric population and the increasing prevalence of venous leg ulcers, diabetic foot ulcers, pressure ulcers, and other chronic wounds are expected to drive the segment growth. For instance, according to the InDependent Diabetes Trust, 115,000 people in the UK may experience diabetic foot ulcer at any point in their lives. In comparison, over 275,000 people receive treatment for venous leg ulcers annually. In addition, Reapplix reports that approximately 60% of patients have a wound that does not heal, and 20% of these patients require an amputation. Similarly, it is anticipated that 1% of the population will have venous leg ulcers, a prevalence rate that may rise to 4% beyond 65 years age.

The acute wounds segment is expected to witness the fastest CAGR over the forecast period. As road accidents continue to be a significant global concern, resulting in a high number of injuries requiring wound care, the demand for effective wound management solutions has increased. Traumatic accidents, such as falls, sports injuries, and industrial accidents, also contribute to the growing need for efficient wound care products.

End Use Insights

The hospital segment held the largest revenue share of in 2024. Hospitals play a crucial role in providing comprehensive healthcare services, including wound care, to a large patient population. As hospitals expand and modernize their facilities and services, they increasingly incorporate advanced wound care technologies and products, such as foam dressings, into their offerings. According to the American Hospital Association, the U.S. has 6,093 hospitals operating across the country, providing essential healthcare services through a wide range of general, specialty, and community facilities. These hospitals recorded approximately 34.4 million total admissions, reflecting the significant demand for inpatient care and the extensive capacity of the U.S. healthcare system to manage diverse medical conditions, emergencies, and surgical procedures.

The home healthcare segment is anticipated to witness the fastest CAGR over the forecast period, which can be attributed to factors such as the increasing global aging population, convenience of receiving medical care in a familiar environment, and adoption of advanced wound care technologies. Home healthcare services provide patients with better access to wound management, which is cost-effective and promotes preventive care. The availability of user-friendly foam dressings and technological advancements in this field have also made it easier for home healthcare professionals to incorporate these products into their treatment plans, further driving the growth of this segment.

Regional Insights

North America foam dressing market held the largest revenue share in 2024. The market is driven by several key factors, including the region's advanced healthcare infrastructure and high healthcare spending, creating a beneficial environment for the adoption of innovative wound care solutions. The rising incidence of chronic wounds, such as diabetic ulcers, is spurring the demand for advanced wound care products.

U.S. Foam Dressing Market Trends

The foam dressing market in the U.S. held the largest market share in 2024. The local presence of key players is expected to enhance the growth significantly. Collaboration between these companies is a pivotal factor in driving the growth of the market. These collaborations often involve partnerships between medical device manufacturers, pharmaceutical companies, and research institutions to develop and commercialize innovative wound care solutions. For instance, in June 2023, in collaboration with ZeniMedical, Sunset launched an innovative, user-friendly, and cost-effective wound care product line to enhance patient care and minimize expenses. ZeniMedical provides a diverse assortment of foam, composite, hydrocolloid, alginate, and collagen dressings in various sizes, with or without borders, to cater to diverse wound management needs.

The growing prevalence of chronic and acute wounds is a key factor driving the U.S. foam dressing market. Chronic wounds, such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, require advanced wound care products that can manage exudate, maintain a moist healing environment, and reduce infection risks-functions that foam dressings effectively provide. Acute wounds resulting from surgeries, burns, or traumatic injuries demand quick and efficient healing solutions to minimize hospital stays and improve patient outcomes. The rising incidence of diabetes, an aging population prone to pressure ulcers, and an increase in surgical procedures have further amplified the demand for foam dressings, positioning them as a preferred choice for chronic and acute wound management across healthcare settings in the U.S.

-

In the U.S., approximately 1.6 million people develop a diabetic foot ulcer each year.

-

According to the American Burn Association’s Annual Burn Injury Summary Report 2024, 32,540 burn injury cases were treated at U.S. burn centers in 2023, with 156,073 cases reported over the five years (2019-2023). On average, approximately 1 in every 10,000 people in the U.S. requires inpatient hospitalization at a burn center each year, highlighting the persistent burden of burn injuries nationwide.

-

In 2023, 10,125 cases required intensive care, collectively utilizing over 110,000 ICU days, reflecting the resource-intensive nature of burn care.

Europe Foam Dressing Market Trends

The foam dressing market in Europe is experiencing steady growth, driven by the increasing prevalence of chronic wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, as well as a rising number of surgical and traumatic wounds. The region’s aging population, along with a growing burden of diabetes and obesity, has significantly increased the demand for advanced wound care products that promote faster healing and infection control. Moreover, adopting innovative foam dressings with enhanced absorbency, antimicrobial properties, and extended wear time-such as Mölnlycke’s Mepilex Up-has further fueled market expansion. Supportive government initiatives, improved healthcare infrastructure, and greater awareness among clinicians about the benefits of advanced wound care solutions continue to strengthen the foam dressing market across Europe.

The UK foam dressing market is anticipated to grow at a significant CAGR over the forecast period. The UK government has implemented several policies to support the use of foam dressing in the NHS. The National Institute for Health and Care Excellence (NICE) has issued guidance that recommends the use of foam dressing for the treatment of chronic wounds that have failed to respond to conventional treatment. In addition, NHS England has introduced several initiatives to promote the use of foam dressing, such as the Wound Care Innovation Programme and the Clinical Commissioning Group (CCG) Innovation Fund. These policies have made foam dressing more accessible to patients and have helped to drive the growth of the market.

The growing aging population and the rising incidence of burn cases are key factors driving the UK advanced wound care market. As the elderly population continues to expand, the prevalence of chronic wounds such as pressure ulcers, diabetic foot ulcers, and venous leg ulcers has significantly increased due to reduced skin elasticity, slower healing, and higher comorbidity rates. In addition, the number of burn cases, both minor and severe, has been rising, creating a greater need for effective wound management solutions.

-

According to the Centre for Ageing Better, in 2023, there were 11 million people aged over 65 in England. This number is projected to increase by 10% in the next five years and by 32% by 2043.

-

In the UK, 250,000 people suffer burn injuries each year, with 175,000 seeking accident and emergency care and 16,000 requiring hospital admission.

The foam dressing market in Germany is anticipated to witness significant CAGR over the forecast period, driven by the increasing prevalence of chronic wounds, rising geriatric population, and growing number of road accidents leading to traumatic injuries and burns. The country’s advanced healthcare infrastructure and high awareness of effective wound management solutions have accelerated the adoption of innovative foam dressings that provide superior absorption, moisture control, and patient comfort. Moreover, the increasing incidence of diabetic foot ulcers, pressure sores, and post-surgical wounds continues to fuel market growth. Government initiatives promoting advanced wound care practices and the presence of major players offering technologically advanced products further strengthen the German foam dressing market.

Road Traffic Accidents in Germany by Type and Location (2021-2024)

Road Traffic Accidents (Europe)

Unit

2024

2023

2022

2021

Total

Number

2,512,697

2,519,525

2,406,465

2,314,938

Of which:

Accidents involving material damage only

Number

2,221,996

2,227,635

2,116,793

2,055,951

Accidents involving personal injury

Number

290,701

291,890

289,672

258,987

Of which (Personal Injury Accidents):

Within built-up areas

Number

202,329

203,260

203,226

176,948

Outside built-up areas (excl. motorways)

Number

68,912

69,544

68,691

65,632

On motorways

Number

19,460

19,086

17,755

16,407

Source: Statistisches Bundesamt (Destatis) | 2025

Asia Pacific Foam Dressing Market Trends

The Asia Pacific foam dressing market is witnessing growth, driven by the rising prevalence of chronic wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, along with an increasing number of acute injuries from burns, trauma, and road accidents. The region’s expanding aging population, coupled with a growing diabetic demographic, has led to a higher demand for advanced wound management solutions like foam dressings that provide effective exudate control and promote faster healing. Moreover, the shift toward home-based care and outpatient treatment is boosting the adoption of foam dressings, as they offer longer wear time, ease of use, and comfort. Countries such as China and India are emerging as key markets due to the availability of low-cost manufacturing, increasing healthcare investments, and improving awareness of advanced wound care.

The foam dressing market in China is witnessing growth, driven by the increasing incidence of chronic wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, along with a rising number of acute injuries from burns and road accidents. The expanding elderly population and growing diabetes prevalence have further accelerated the demand for advanced wound care products that ensure effective exudate management and faster healing. Supportive regulatory reforms by the National Medical Products Administration (NMPA) have streamlined approval processes, encouraging domestic and international manufacturers to introduce innovative foam dressing solutions. Local companies focus on developing highly absorbent, antimicrobial, and silicone-based foam dressings that provide comfort and reduce infection risk.

The foam dressing market in India is anticipated to register a significant CAGR over the forecast period, driven by the rising prevalence of chronic wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, along with an increasing number of acute injuries caused by burns, trauma, and road accidents. The growing diabetic and aging population in the country has intensified the need for advanced wound care products that promote faster healing and reduce the risk of infection. In addition, improving healthcare infrastructure, increasing awareness among healthcare professionals, and expanding access to modern wound care in urban and rural settings fuel market growth. Local manufacturing initiatives and the availability of cost-effective foam dressings further support adoption, making India a rapidly emerging market within the Asia Pacific foam dressing industry. In 2024, India had an adult population of approximately 947 million, with a diabetes prevalence rate of 10.5% among adults. Nearly 89.8 million adults are living with diabetes across the country.

Latin America Foam Dressing Market Trends

The foam dressing market in Latin America is experiencing growth, driven by a rising incidence of chronic wounds, including those stemming from diabetes, coupled with increasing trauma and burn-related injuries. Countries like Brazil and Argentina lead the region, which is supported by improving healthcare infrastructure and greater investment in wound care solutions. Foam dressings stand out due to their effective fluid management and comfort features, making them the preferred choice for managing acute and chronic wounds. However, the market also faces challenges such as limited reimbursement coverage, cost sensitivity, and uneven access in rural areas, which manufacturers and distributors must navigate to tap this growth potential fully.

Key Foam Dressing Company Insights

Some of the leading players operating in the market include 3M, Coloplast Corp., Medline Industries, Smith & Nephew, and Cardinal Health. These players are heavily investing in technology and infrastructure, allowing them to process & analyze a large volume of samples efficiently. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

Some of the key companies are Derma Sciences Inc. (Integra LifeSciences), Ethicon (Johnson & Johnson), McKesson Corporation, and Molnlycke Health Care AB in the market. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key Foam Dressing Companies:

The following are the leading companies in the foam dressing market. These companies collectively hold the largest market share and dictate industry trends.

- Solventum (3M)

- Coloplast Corp

- Medline Industries, L.P.

- Smith+Nephew

- Cardinal Health

- Convatec Inc.

- Mölnlycke Health Care AB

- Essity

- DermaRite Industries, LLC

- B. Braun SE

- Tasami

- Mediq

- Datt Mediproducts Private Limited

- Changzhou Major Medical Products Co., Ltd.

- Ningbo Medelast Co., Ltd.

- Aero Healthcare AU Pty Ltd

- Zhejiang Kawamoto Health Care Products Co., Ltd.

Recent Developments

-

In March 2025, Convatec showcased its strongest-ever innovation pipeline in advanced wound care at the European Wound Management Association (EWMA) Conference in Barcelona, Spain. The company presented breakthrough solutions in exudate management, hard-to-heal wounds, and next-generation dressing technologies, including ConvaFoam, a multi-layered foam dressing for superior exudate control.

-

In January 2024, Coloplast Corporation, announced the launch of Biatain Silicone Fit in the U.S. This innovative silicone foam product is designed to cater to pressure injury prevention and wound management needs. By expanding its advanced wound care offerings, Coloplast aims to strengthen its presence within the foam dressings segment.

-

In January 2023, Convatec Inc. launched ConvaFoam, a versatile line of innovative foam dressings. Designed to cater to the diverse requirements of healthcare professionals and their patients, ConvaFoam offers a comprehensive solution suitable for a wide range of wound types across various stages of the healing process. This user-friendly dressing choice simplifies wound management and skin protection, making it an ideal option for healthcare providers.

-

In June 2022, Medline launched an upgraded version of its Optifoam Gentle EX Foam Dressing, designed to effectively combat pressure injuries. The Optifoam Gentle EX dressing plays a vital role in Medline's Skin Health Solution Program, a comprehensive strategy encompassing people, processes, and products to deliver optimal skin and wound care outcomes.

Foam Dressing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.00 billion

Revenue forecast in 2033

USD 2.89 billion

Growth rate

CAGR of 4.63% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billionand CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway: Japan; China; India; Australia; Thailand; South Korea; Brazil Argentina; Colombia; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Solventum (3M); Coloplast Corp; Medline Industries, L.P.; Smith+Nephew; Cardinal Health; Convatec Inc.; Mölnlycke Health Care AB; Essity; DermaRite Industries, LLC; B. Braun SE; Tasami; Mediq; Datt Mediproducts Private Limited; Changzhou Major Medical Products Co., Ltd.; Ningbo Medelast Co., Ltd.; Aero Healthcare AU Pty Ltd; Zhejiang Kawamoto Health Care Products Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Foam Dressing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global foam dressing market report based on type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Adhesive Foam Dressing

-

Non-adhesive Foam Dressing

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

-

End use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global foam dressing market size was estimated at USD 1.91 billion in 2024 and is expected to reach USD 2.00 billion in 2025.

b. The global foam dressing market is expected to grow at a compound annual growth rate of 4.63% from 2025 to 2033 to reach USD 2.89 billion by 2033.

b. The adhesive foam dressing segment dominated the foam dressing market in 2024 and is expected to witness the fastest growth over the forecast period due to a rise in high exudate wounds and product launches

b. Some key players operating in the foam dressing market include Solventum (3M), Coloplast Corp, Medline Industries, L.P., Smith+Nephew, Cardinal Health, Convatec Inc., Mölnlycke Health Care AB, Essity, DermaRite Industries, LLC, B. Braun SE, Tasami, Mediq, Datt Mediproducts Private Limited, Changzhou Major Medical Products Co., Ltd., Ningbo Medelast Co., Ltd., Aero Healthcare AU Pty Ltd, and Zhejiang Kawamoto Health Care Products Co., Ltd.

b. Key factors that are driving the foam dressing market growth include the increasing number of traumatic accidents , rise in a number of surgical procedures, and changing lifestyles are anticipated to drive the growth of the foam dressing market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.