- Home

- »

- Advanced Interior Materials

- »

-

Foil Insulation Market Size And Trends, Industry Report, 2030GVR Report cover

![Foil Insulation Market Size, Share & Trends Report]()

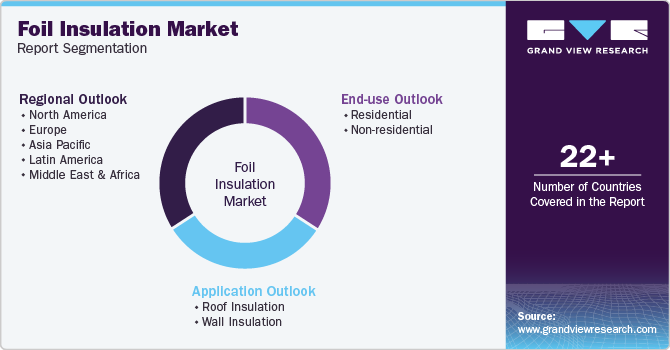

Foil Insulation Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Roof Insulation, Wall Insulation, Others), By End Use (Residential, Non-residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-570-8

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Foil Insulation Market Size & Trends

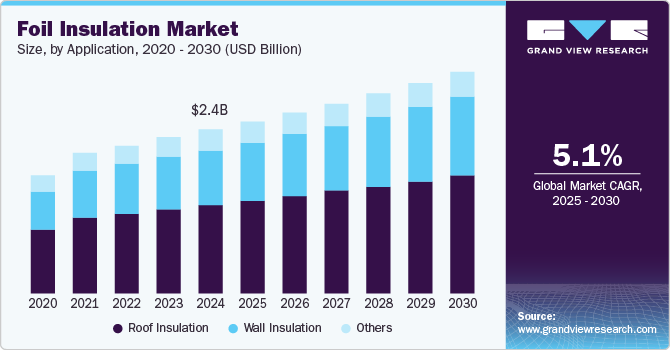

The global foil insulation market size was estimated at USD 2.40 billion in 2024 and is projected to grow at a CAGR of 5.1% from 2025 to 2030, driven by the growing demand for energy-efficient solutions across residential, commercial, and industrial sectors. As governments worldwide implement stricter energy efficiency standards and consumers increasingly seek ways to reduce energy consumption, foil insulation has become an attractive choice due to its ability to enhance thermal performance.

By reflecting radiant heat away from buildings, foil insulation helps to maintain more consistent indoor temperatures, reduce heating and cooling costs, and improve energy efficiency, driving its adoption across various applications.

Another significant driver of the foil insulation industry is the rising concern over environmental sustainability. As awareness of climate change and resource depletion increases, there is growing pressure on industries to adopt eco-friendly and energy-saving technologies. Foil insulation, made from materials such as aluminum, is not only effective in reducing energy consumption but is also lightweight, recyclable, and often composed of sustainable materials. This eco-conscious approach aligns with global efforts to reduce carbon footprints and promote green building practices, further boosting the demand for foil insulation in both new and retrofitted buildings.

The construction industry's expansion, particularly in developing regions, is also fueling the growth of the market. With rapid urbanization and infrastructure development, there is an increased need for cost-effective and efficient insulation solutions in residential, commercial, and industrial buildings. Foil insulation provides an affordable option that offers superior thermal resistance, ease of installation, and long-term energy savings. As construction activities intensify in regions such as Asia-Pacific, Latin America, and the Middle East, the demand for foil insulation applications is expected to rise significantly.

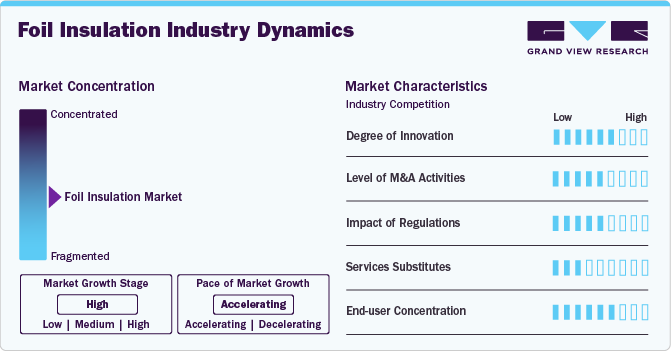

Market Concentration & Characteristics

The global foil insulation industry is characterized by moderate concentration, with a mix of established multinational companies and regional players competing for market share. Key manufacturers typically offer a wide range of foil-based insulation applications, including reflective foil, bubble foil, and metalized films, which are used across sectors such as construction, non-residential, and industrial applications. The degree of innovation within the market is relatively high, with companies focusing on improving the thermal performance, durability, and environmental impact of foil insulation materials. Innovations in eco-friendly and energy-efficient solutions are driving application development, as the demand for sustainable construction and energy-saving applications continues to grow. The competitive landscape is further shaped by the technological advancements in processes, which allow for the manufacture of high-quality foil insulation applications at lower costs.

Regulations play a significant role in the global foil insulation industry, particularly concerning energy efficiency standards and environmental impact. Governments across regions have introduced stricter building codes and regulations aimed at improving energy efficiency in construction, which positively influences the demand for foil insulation materials. However, the market is also facing pressure from substitutes such as foam insulation and spray-on coatings, which are increasingly being used for similar applications. End-user concentration remains somewhat diverse, with construction being the dominant sector, followed by non-residential and industrial applications. Despite the fragmentation in end use demand, construction-related applications, especially in residential and commercial buildings, are the primary drivers of market growth, spurred by the ongoing focus on energy-efficient and sustainable building practices.

Application Insights

The roof insulation segment led the market and accounted for the largest revenue share of 54.0% in 2024, driven by their excellent electrical insulating properties, flexibility, and durability. These tapes are widely used across residential, commercial, and industrial applications due to their ability to withstand high voltage, resist moisture and abrasion, and maintain adhesion over a wide temperature range. In addition, the growing non-residential and aerospace industries are major contributors to the rising consumption of roof insulation. Their flame-retardant and self-extinguishing properties make them ideal for ensuring safety in electrical circuits and non-residential wiring systems. Technological advancements in manufacturing have further enhanced the performance of roof insulation, such as the development of lead-free and low-VOC variants that align with environmental regulations.

The wall insulation segment is expected to grow at the fastest CAGR of 6.2% over the forecast period, driven by its enhanced performance in moisture- and weather-exposed environments. These tapes are commonly used in outdoor electrical installations, underground cabling, and harsh industrial settings where resistance to water, UV rays, and ozone is critical. Moreover, the increasing focus on renewable energy infrastructure and smart grid development globally is fueling demand for high-performance materials like wall insulation, which ensures long-lasting insulation and system reliability.

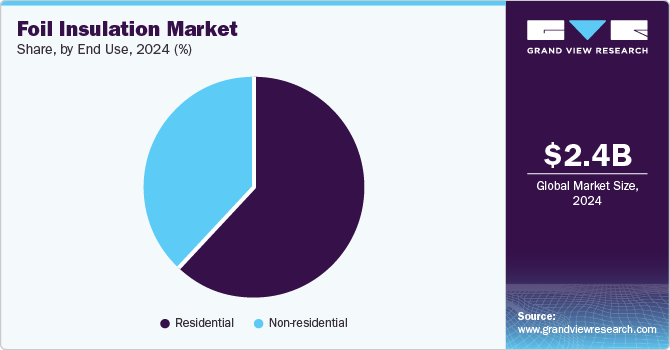

End Use Insights

The residential segment dominated the market and accounted for the largest revenue share of 61% in 2024, driven by rapid advancements in technology and the increasing complexity of electrical systems across various industries. As electronic devices become more compact and powerful, the demand for high-performance insulation materials has surged. Foil insulations are crucial in ensuring safety, preventing short circuits, and maintaining the efficiency of circuits and components.

The non-residential segment is expected to grow at the fastest CAGR of 5.4% over the forecast period, driven by the rising adoption of electric and hybrid vehicles, increasing vehicle electrification, and the growing complexity of non-residential electrical systems. As modern vehicles incorporate a higher number of electronic components for functions such as infotainment, safety, navigation, and powertrain control, the demand for reliable insulation materials has surged. Foil insulations are used extensively for wire harnessing, cable wrapping, and component shielding to ensure optimal performance, safety, and longevity of the vehicle’s electrical systems.

Regional Insights

The North American foil insulation industry is driven by the increasing focus on energy conservation, government regulations promoting energy-efficient buildings, and the growing demand for sustainable construction materials. In the United States, energy efficiency standards such as the International Energy Conservation Code (IECC) and Leadership in Energy and Environmental Design (LEED) certification are encouraging the use of foil insulation in both residential and commercial buildings. In addition, the ongoing trends in retrofitting older buildings with more energy-efficient materials further boost the market for foil insulation applications across North America.

U.S. Foil Insulation Market Trends

The foil insulation industry in the U.S. is primarily driven by the construction sector’s growing emphasis on energy efficiency and green building initiatives. Federal and state-level regulations and incentives for energy-efficient buildings have led to increased demand for foil insulation in residential and commercial projects. The increasing popularity of smart homes, which require high-performance insulation materials for optimal temperature control, also supports market growth. In addition, the U.S. non-residential sector, with its growing interest in lightweight, energy-efficient materials, is contributing to the demand for foil insulation in vehicles, further expanding the market growth.

Asia Pacific Foil Insulation Market Trends

Asia Pacific foil insulation industry dominated globally and accounted for the largest revenue share of about 46.4% in 2024. The Asia Pacific region is witnessing significant growth in the global market, driven primarily by the booming construction and infrastructure development in emerging economies such as India, China, and Southeast Asian countries. The rapid urbanization and increasing demand for energy-efficient building solutions have led to greater adoption of foil insulation materials. In addition, the growing focus on sustainability and green building certifications, such as LEED, has heightened the demand for eco-friendly insulation solutions. Government initiatives promoting energy efficiency and environmental regulations are also propelling market growth across the region.

China foil insulation industry is being driven by the country’s rapid urban expansion and the government’s commitment to sustainable development. As China continues to grow its infrastructure, including residential, commercial, and industrial buildings, there is a growing need for energy-efficient materials to meet building codes and reduce energy consumption. In addition, China’s focus on reducing carbon emissions through stricter environmental standards is encouraging the use of high-performance insulation materials like foil insulation in construction projects. The growing adoption of energy-efficient technologies in the manufacturing sector also contributes to market demand.

Europe Foil Insulation Market Trends

The foil insulation industry in Europe is primarily driven by the region's stringent regulations on energy efficiency and carbon emissions. The European Union's regulations, such as the Energy Performance of Buildings Directive (EPBD) and the push for a circular economy, are significantly influencing the demand for energy-efficient insulation materials. As the region continues to focus on reducing its carbon footprint, the construction and renovation sectors are increasingly adopting foil insulation solutions to improve energy efficiency. The growing trend towards passive house standards, where energy-efficient materials are essential, further propels the market growth.

Germany foil insulation industry is anticipated to grow over the forecast period. Germany, known as one of the leading countries in Europe for energy-efficient buildings, is driving the market with its commitment to sustainability and climate protection. The government’s strict energy efficiency regulations and subsidies for energy-efficient building practices are major contributors to the growing demand for foil insulation. In addition, Germany’s thriving construction industry, particularly in the residential and commercial sectors, continues to support the adoption of foil insulation applications. The country’s focus on reducing energy consumption and its leadership in renewable energy development also enhances the market for sustainable insulation materials.

Latin America Foil Insulation Market Trends

The Latin American foil insulation industry is growing due to increased construction activity and the rising demand for energy-efficient buildings across the region. Countries like Brazil and Mexico are investing heavily in infrastructure development, particularly in residential, commercial, and industrial projects, where foil insulation is increasingly being adopted to reduce energy consumption and enhance building performance. Moreover, the push towards sustainability in Latin America, driven by both governmental policies and public awareness, is fueling the demand for eco-friendly and energy-efficient solutions, including foil insulation.

Middle East & Africa Foil Insulation Market Trends

The foil insulation industry in the Middle East and Africa region is experiencing growing demand for foil insulation materials driven by the rapid expansion of urban infrastructure, particularly in countries such as the United Arab Emirates, Saudi Arabia, and South Africa. Extreme temperature conditions in the region have also spurred the need for effective insulation solutions that enhance energy efficiency in buildings and reduce cooling costs. The focus on sustainable construction practices and green building certifications, such as LEED, is further driving the adoption of foil insulation.

Key Foil Insulation Company Insights

Some of the key players operating in the market include Kingspan Group and Owens Corning.

-

Kingspan Group is a global player in high-performance insulation and building envelope solutions. The company focuses on creating sustainable and energy-efficient solutions, with a strong emphasis on reducing the environmental impact of buildings. Kingspan’s application offerings include foil-faced insulation boards, reflective insulation, and thermal insulation systems designed to improve the energy efficiency of residential, commercial, and industrial buildings.

-

Owens Corning is a prominent player in the insulation industry, specializing in materials that enhance energy efficiency and comfort in both residential and commercial settings. Their application portfolio includes a range of foil-based insulation materials, such as reflective insulation, foam boards, and fiberglass insulation systems. Owens Corning's foil insulation solutions are designed to reduce energy consumption and improve the thermal performance of buildings.

3M and Saint-Gobain are some of the emerging market participants in the foil insulation industry

-

3M is a diversified technology company that manufactures a broad array of insulation applications, including high-performance foil insulation materials. The company's application offerings include reflective foil insulation, thermal insulating films, and energy-saving solutions designed for use in a variety of applications, including construction, non-residential, and industrial sectors.

-

Saint-Gobain is a leading global manufacturer of innovative materials, offering a wide range of insulation applications that enhance energy efficiency and reduce environmental impact. Their application offerings include foil-based insulation solutions, such as reflective foils and composite insulating materials, used in the construction of residential, commercial, and industrial buildings.

Key Foil Insulation Companies:

The following are the leading companies in the foil insulation market. These companies collectively hold the largest market share and dictate industry trends.

- Kingspan Group

- Owens Corning

- 3M

- Saint-Gobain

- Armacell

- Rockwool International

- Johns Manville

- BASF

- Thermaflex

- Knauf Insulation

Recent Developments

-

In June 2024, ROCKWOOL launched its Fire Barrier EN, a new Application designed to enhance fire protection in building applications. The Fire Barrier EN is engineered to meet stringent fire safety standards, ensuring that buildings are better protected against fire hazards while maintaining optimal energy efficiency. By integrating this advanced application into its portfolio, ROCKWOOL is addressing the growing demand for safe, sustainable, and energy-efficient solutions in the construction industry, further strengthening its position in the foil insulation industry.

Foil Insulation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.52 billion

Revenue forecast in 2030

USD 3.23 billion

Growth rate

CAGR of 5.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

Kingspan Group; Owens Corning; 3M; Saint-Gobain; Armacell; Rockwool International; Johns Manville; BASF; Thermaflex; Knauf Insulation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Foil Insulation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global foil insulation market report based on application, end use, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Roof Insulation

-

Wall Insulation

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non-residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global foil insulation market size was estimated at USD 2.40 billion in 2024 and is expected to reach USD 2.52 billion in 2025.

b. The global foil insulation market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2030 to reach USD 3.23 billion by 2030.

b. The roof insulation segment led the market and accounted for the largest revenue share of 54.0% in 2024, driven by their excellent electrical insulating properties, flexibility, and durability.

b. Some key players operating in the foil insulation include tesa SE, Saint-Gobain, Nitto Denko Corporation, Avery Dennison Corporation, 3M, IPG, HellermannTyton, TERAOKA SEISAKUSHO CO., LTD., Shurtape Technologies, LLC, and Pidilite Industries Ltd.

b. The foil insulation market is driven by rising demand from the Non-residential and electronics sectors, growing infrastructure development, advancements in adhesive technologies, and increasing regulatory focus on electrical safety.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.