- Home

- »

- Homecare & Decor

- »

-

Folding Bicycle Market Size & Share, Industry Report, 2030GVR Report cover

![Folding Bicycle Market Size, Share & Trends Report]()

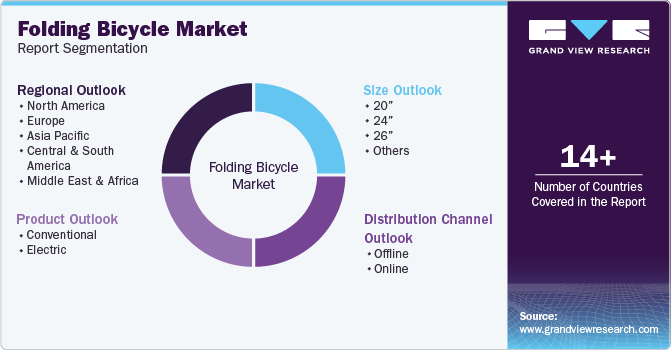

Folding Bicycle Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Conventional, Electric), By Size (20”, 24”, 26”, Others), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-634-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Folding Bicycle Market Summary

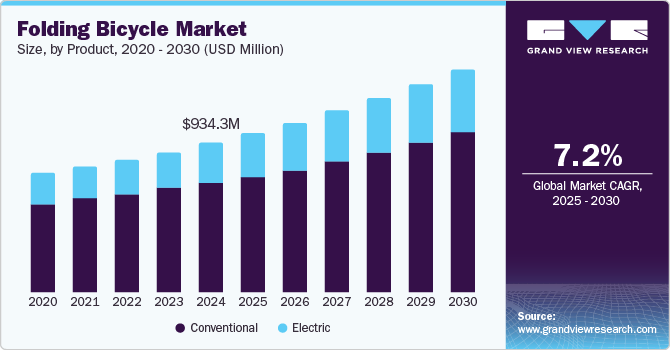

The global folding bicycle market size was valued at USD 934.3 million in 2024 and is projected to reach USD 1,410.3 million by 2030, growing at a CAGR of 7.2% from 2025 to 2030. Factors such as convenience, affordability, and reduced theft risk are key drivers of demand for foldable bicycles.

Key Market Trends & Insights

- North America folding bicycle industry dominated the global market with a revenue share of 40.4% in 2024.

- The Asia Pacific folding bicycle market is projected to experience the fastest CAGR from 2025 to 2030.

- The conventional bicycle segment dominated the global folding bicycle market based on product, with a revenue share of 73.1% in 2024.

- Based on Size, the 26” segment dominated the global folding bicycle market in 2024.

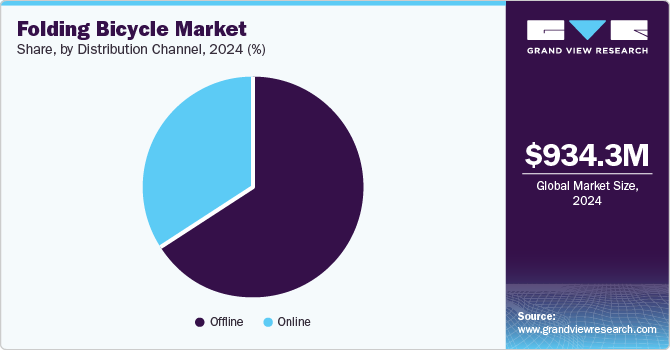

- Based on Distribution Channel, the offline segment held the largest revenue share of the folding bicycle market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 934.3 million

- 2030 Projected Market Size: USD 1,410.3 million

- CAGR (2025-2030): 7.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Additionally, increased spending on recreational activities among working professionals and the expansion of cycling infrastructure in developed economies, including the U.S., Germany, and the U.K., is expected to further boost the popularity of folding bicycles in the coming years. Moreover, Consumer awareness of environmental pollution, fitness, and personal health is expected to promote the utility of the foldable bicycle in the upcoming years. Folding bicycles can work as conventional bicycles, but they are lightweight, enhance flexibility and compactness, and have the additional merit of traveling through metros and subways. Consumers can keep these cycles inside their homes as they take up very little space.

Cities worldwide are expanding rapidly, forcing residents to commute longer distances. This encourages commuters to rely on public transportation, including buses, subways, and ferries. Bicycles offer a convenient and affordable way to reach transit stations and pick-up points. However, conventional bicycles can be cumbersome to carry on public transportation and are susceptible to theft and vandalism when left unattended. These factors are driving demand for folding bicycles among commuters. Folding bicycles are convenient to carry on public transportation and less susceptible to theft and vandalism. Additionally, folding bicycles require significantly less storage space compared to traditional bicycles, making them an ideal choice for people living in confined spaces.

Modern consumers are increasingly prioritizing fitness without sacrificing their daily routines. Bicycling offers an excellent alternative for commuters to maintain an active lifestyle without additional time or financial investment in other fitness activities. According to a health paper published by the National Library of Medicine, cycling to work reduced mortality rates among Danish men and women by 40%. Additionally, cycling can significantly reduce monthly fuel costs for commuters. These factors have highlighted the appeal of bicycles, including folding bicycles, among younger generations. Folding bicycles provide a faster and more affordable way to navigate heavy city traffic. Their compact size and comfortable design make them ideal for short- to medium-distance travel.

Governments and private organizations worldwide have been promoting cycling as a primary mode of transportation to reduce pollution. National authorities have been investing in dedicated cycling infrastructure and implementing safety regulations for cyclists. For instance, in May 2023, the French government announced an investment of over USD 2 billion to promote cycling and support the bicycle industry. In the U.S., state and local governments have collectively invested over USD 800 million in supporting biking initiatives, promoting safety, and enhancing recreational opportunities. These initiatives are making cycling safer, more enjoyable, and more affordable, thereby boosting the growth of the bicycle and folding bicycle industry.

Product Insights

The conventional bicycle segment dominated the global folding bicycle market based on product, with a revenue share of 73.1% in 2024. Conventional folding bicycles are preferred due to their easy availability and affordability. Fitness enthusiast riders often choose conventional folding bicycles pertaining to their fitness goals. Besides, conventional folding bikes are affordable with no riding cost. Major players operating in the folding bicycle industry are constantly developing new folding bicycles made from advanced materials, innovative designs, and advanced features. This improves ride quality and attracts more rides towards conventional folding bicycles.

The electric bicycle segment is expected to experience the fastest CAGR from 2025 to 2030. Electric folding bikes are fast and convenient for comparatively longer travel distances. Owing to this, office-going rides are more inclined towards electric folding bicycles. These are equipped with Lithium batteries and can reach a moderate speed of 50 to 60 km. Electric folding bicycles also offer convenience for charging, as consumers often find it difficult to change non-folding electric bikes outside any premises.

Size Insights

Based on size, the 26” segment dominated the global folding bicycle market in 2024. Such bicycles are suitable for riders with a 5.5 to 6 feet height. Consumers' growing preference to ride folding bicycles to their workplace and other city commutes is encouraging the demand for 26” bicycles. Additionally, people use folding bikes for recreational activities such as mountain biking and bike trekking. This has further boosted the demand for the 26” variant as these bicycles have bigger tires capable of handling different terrains.

The 20” segment is expected to experience the fastest CAGR from 2025 to 2030. These bicycles are convenient to carry and store in confined spaces such as elevators/escalators, office spaces, garages, and storage sheds. 20” folding bicycles are becoming popular among school-going students, as they are less susceptible to theft and vandalism. The folding bicycle industry is engaged in designing these size variants with better features, such as high-speed gears and disc braking, to attract students.

Distribution Channel Insights

The offline segment held the largest revenue share of the folding bicycle market in 2024. Consumers prefer offline buying as this channel allows riders to experience the feeling of the bicycle during test rides. Consumers can interact with retailers about their preferences. The retailers can also offer customized buying options to customers regarding hardware adjustments, accessories, customized designs, and colors. Moreover, the availability of different branded products in local supermarkets or other stores also results in impulse buying of consumers who get attracted by the designs, features, and promotional incentives offered by the retailers.

The online segment is expected to experience the fastest market growth during the forecast period. Online platforms allow potential buyers to compare a variety of options available in the market. Customers can read reviews and discuss the utility and features of different brands on online forums and in the community. This helps the consumers choose a better bicycle that suits their needs. Additionally, online portals and e-commerce platforms offer numerous benefits, such as flexible payment options, discounts, free deliveries, and post-sales support. This has increased sales through online channels and proved an opportunity for the folding bicycle industry to grow.

Regional Insights

North America folding bicycle industry dominated the global market with a revenue share of 40.4% in 2024. The total number of cyclists in the U.S., Canada, and Mexico has increased steadily over the past few decades. Growing emphasis on personal health, rising environmental concerns, and perpetual traffic congestion across big cities in the region are the major driving factors for bicycle riding. Besides, rising fuel prices is also a major driver promoting the use of folding bicycles among daily commuters.

U.S. Folding Bicycle Market Trends

A significant number of people in the U.S. choose to walk or cycle to work. According to data published by the U.S. Census Bureau, approximately 870,000 people commute by bicycle. The majority of these cyclists are young urban residents. Additionally, cycling as a recreational activity is also gaining popularity in the U.S. It is the third most popular outdoor activity, with over 51 million people cycling annually. This trend of cycling is steadily growing. The U.S. is also home to several leading players in the folding bicycle industry, providing consumers access to the latest innovative designs.

Asia Pacific Folding Bicycle Market Trends

The Asia Pacific folding bicycle market is projected to experience the fastest CAGR from 2025 to 2030. Bicycles are an integral part of Asian culture, and countries like China, India, Indonesia, Vietnam, Japan, and South Korea have significant cycling populations. The region boasts the world's largest consumer base, with a substantial number of people who prefer cycling for work and leisure. For instance, in 2022, 67% of urban Indians reported cycling at least once a week, the highest percentage globally. Similarly, Japan has over 100 million cyclists nationwide. Despite the widespread ownership of conventional bicycles, folding bicycles' growing popularity and benefits offer significant market potential in the region.

China held the largest revenue share of the regional industry in 2024. Bicycles have been a popular mode of transport across the country. However, bicycles are becoming popular among middle-class urban families for outdoor activities and sports. According to the Chinese Cycling Association, approximately 20 million people participated in a Qiyi Beijing Cycling Club riding event. This has boosted the demand for innovative bicycle designs, such as folding bicycles. Additionally, the country has over 350 million electric bicycles and is one of the largest manufacturers and consumers of electric bicycles. This will further provide considerable opportunity

Europe Folding Bicycle Market Trends

The European folding bicycle market is anticipated to experience significant growth during the forecast period. A considerable proportion of the European population prefers using a bicycle as a daily transportation medium. People in economies such as the U.K., Germany, Italy, and France prefer to use foldable products since they take up less space. Furthermore, favorable government initiatives on using environmentally friendly vehicles in nations such as France and the Netherlands are projected to open new avenues for the market over the next few years.

Key Folding Bicycle Company Insights

Some of the key companies operating in the global folding bicycle market are Dahon, A-bike, Giant Bicycles, Helix, Bike Friday, Montague Bike, Brompton Bicycle, GOGOBIKE, Birdy Bike, and FOREVER Bicycle, among others. Companies are increasing their spending on new product development to expand their brand reach. Furthermore, industry participants are expected to use e-commerce portals as a selling forum for the millennials who are increasing their spending on cycling as a recreational activity to improve their body fitness.

-

Dahon is a U.S.-based folding bicycle company founded by a famous American aerospace expert and physicist, Dr. Dewei Han. The company offers 15 different product series with more than 300 models, including mountain bikes, road tour vehicles, urban commuter vehicles, baby carriages, recreational sports vehicles, and electric vehicles, among others

-

Brompton Bicycles is a world-renowned company and a leader in the folding bicycle industry. The company manufactures handmade, high-quality, and durable folding bicycles. The design of folding bikes is lightweight and practical, and the company offers customizable designs that suit the riders' needs.

Key Folding Bicycle Companies:

The following are the leading companies in the folding bicycle market. These companies collectively hold the largest market share and dictate industry trends.

- Dahon

- A-bike

- Giant Bicycles

- Helix

- Bike Friday

- Montague Bike

- Brompton Bicycle

- GOGOBIKE

- Birdy Bike

- FOREVER Bicycle

Recent Developments

-

In February 2024, Gocycle, the British e-bike company, launched a new line of innovative electric cargo bikes for families. The new CX series of longtail electric bicycles are foldable. The new foldable electric bicycle weighs 23kg and can support 220kg

-

In October 2023, Bastille, a new French company, introduced a new design of folding bicycles. The design of the folding bike includes a tire size of 27.5”, which is one of the biggest in the folding bicycle industry. The bicycle has minimum electronic parts and is easier and cheaper to maintain than other folding bikes.

Folding Bicycle Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 994.6 million

Revenue forecast in 2030

USD 1,410.3 million

Growth Rate

CAGR of 7.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, size, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Saudi Arabia

Key companies profiled

Dahon; A-bike; Giant Bicycles; Helix; Bike Friday; Montague Bike; Brompton Bicycle; GOGOBIKE; Birdy Bike; FOREVER Bicycle

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Folding Bicycle Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the folding bicycle market report based on product, size, distribution channel, and region.

-

Product (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Electric

-

-

Size (Revenue, USD Million, 2018 - 2030)

-

20”

-

24”

-

26”

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.