- Home

- »

- Homecare & Decor

- »

-

Folding Furniture Market Size & Share, Industry Report, 2030GVR Report cover

![Folding Furniture Market Size, Share & Trends Report]()

Folding Furniture Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Tables & Chair, Sofa, Beds, Others), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-707-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Folding Furniture Market Summary

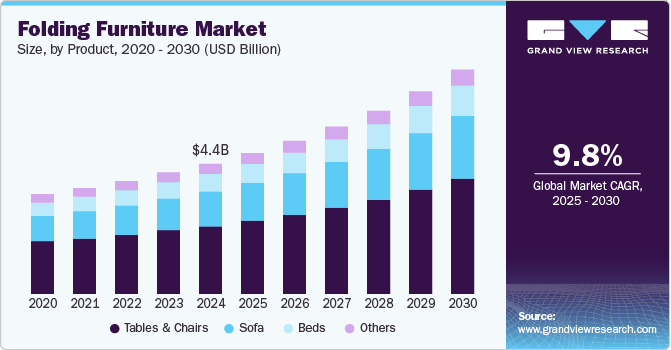

The global folding furniture market was estimated at USD 4.42 billion in 2024 and is projected to reach USD 7.61 billion by 2030, growing at a CAGR of 9.8% from 2025 to 2030. Rising urbanization & smaller living spaces, demand for space-saving multifunctional furniture, and a growing trend of minimalistic living are the major driving factors promoting the demand for folding furniture.

Key Market Trends & Insights

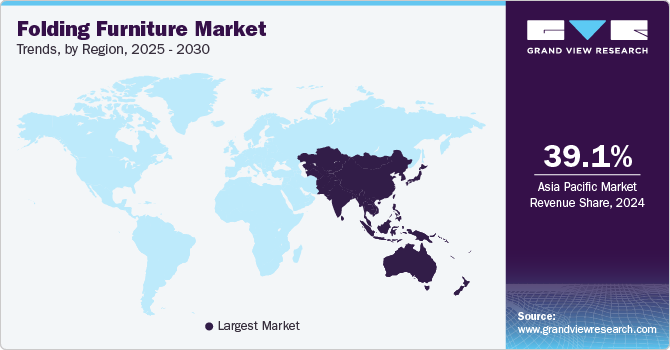

- Asia Pacific region dominated the global market in 2024 with a 39.1% revenue share.

- North America folding furniture market is projected to experience the fastest CAGR from 2025 to 2030.

- By product, the tables and chairs segment dominated the market in 2024 with a 51.9% revenue share.

- By distribution channel, the online segment is projected to witness the fastest CAGR over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4.42 billion

- 2030 Projected Market Size: USD 7.61 billion

- CAGR (2025-2030): 9.8%

- Asia Pacific: Largest market in 2024

Furnishing companies are continuously involved in developing new furniture designs that are functional, aesthetic, and made of lasting materials. Folding furniture made from ethically sourced materials and sustainability in manufacturing such furniture are also key factors governing the growth of the folding furniture industry.

Companies are introducing folding chairs and tables made of wood and metal to replicate the aesthetic appeal of traditional furniture. Rising demand for compact furniture has allowed the companies to introduce more products such as study tables, racks, and storage boxes with foldable features. For instance, in February 2019, Inter IKEA Systems B.V. launched space-saving shelving units with foldable tables, which can be easily used as a desk as well as a dining table.

Growing land pressure is leading to denser urban living and the development of smaller housing units. Concepts like studio apartments, micro-apartments, and loft apartments are becoming increasingly prevalent in densely populated urban areas. Soaring living costs in modern cities and high mortgage rates are compelling consumers to downsize their living spaces. This has promoted the concept of maximizing space utilization and furnishing concepts like folding furniture. Furthermore, the decline in traditional family structures is on the rise. For instance, in 2022, 29% of U.S. families did not have children. Additionally, 13.2% of men and 15.7% of women in the U.S. lived alone. Such family structures further endorse the concept of smaller apartments. Dwindling living spaces in cities worldwide are a major factor encouraging consumers to purchase folding furniture.

Sustainability is another key factor driving consumer preference for folding furniture. Rising prices of traditional wooden furniture and growing environmental concerns associated with its production are encouraging a shift towards more eco-friendly furnishings. Consumers are increasingly opting for folding furniture made from bamboo, reclaimed wood, composite materials, and metal, which saves space, promotes durability, and reduces waste. Sustainable furniture options often offer a more affordable alternative to traditional wooden furniture. Additionally, the furniture industry is embracing minimalist design principles, focusing on functionality and space-saving solutions, which align well with the growing demand for folding furniture.

Innovative designs enhance the aesthetic appeal of folding furniture. Renowned designers are leading the folding furniture industry to create novel designs that appeal to consumers. For instance, Dutch designer Renate Nederpel designed an origami-inspired Pop-Up Linen wardrobe made of cotton fabric and wooden panels. Similarly, German designer Nils Federking created a series of folding tables and chairs that elevate the aesthetic appeal of traditional folding furniture. Professionals from other fields are also contributing to the folding furniture industry by proposing innovative designs. For instance, Brian Ignaut, a leading solar array expert and former SpaceX design team member, launched a folding furniture company with the aim of promoting affordable and sustainable furniture.

Product Insights

Based on product, the tables and chairs segment dominated the global folding furniture market, with a revenue share of 51.9% in 2024. Folding tables and chairs offer unparalleled versatility and space-saving capabilities for small households. They are also preferred options for customers with limited outdoor space, such as small porches, terraces, gardens, and balconies. Recognizing the significance of folding tables and chairs, companies continue to introduce innovative designs made from sustainable materials. For instance, U.S.-based Flash Furniture offers bamboo folding chairs suitable for both indoor and outdoor use. Similarly, Folditure, a U.S.-based folding furniture company, has designed an origami-inspired, comfortable, and functional aluminum dining chair for indoor and outdoor use

The sofa segment is expected to experience a significant CAGR from 2025 to 2030. Shrinking living spaces and the need for versatile seating furniture that can also convert into beds for guests are driving consumers' demand for folding sofas. Sofa beds are considered a practical and stylish solution for confined spaces such as studios and micro-apartments. Folding sofas and sofa beds are also popular among budget hotels and resorts offering family accommodation. For instance, AWA Hotel in New Zealand and Casablanca Hotel in New York offer suites with both traditional beds and sofa beds to their guests

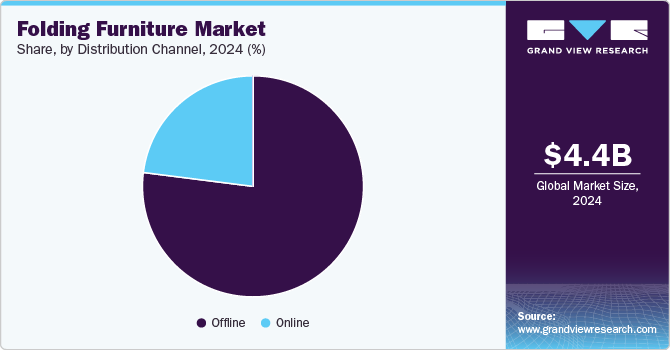

Distribution Channel Insights

The offline segment held the largest revenue share of the folding furniture market in 2024. The dominance of retail stores such as Inter IKEA Systems B.V., Urban Ladder, Pepperfry, and Raymour & Flanigan Furniture has intensified competition in the market. These stores offer a tangible experience that helps consumers visualize their homes and furniture within a real-world setting. Additionally, the availability of customizable furniture options tailored to consumer preferences and specific space requirements is a key factor driving these stores. Moreover, the availability of furniture in large retail stores, enabling consumers to shop for home furnishings alongside other household needs, has further stimulated demand for offline stores selling folding furniture.

The online segment is expected to experience the fastest CAGR during the forecast period. The surge in online shopping, driven by the increasing number of smartphone users, has fueled the growth of online furniture purchases. The availability of a wide variety of furniture at competitive prices from international brands further fuels the online segment. Online platforms and e-commerce websites may offer services such as free delivery, flexible payment options, free installations, and post-purchase support. For example, well-known online furniture retailers provide various furniture, including folding pieces, and post-purchase assistance. These additional services help build confidence among consumers to buy furniture online

Regional Insights

Asia Pacific folding furniture market dominated the global market with a revenue share of 39.1% in 2024. The region boasts a vast consumer base and is undergoing rapid urbanization. Countries are grappling with land constraints, and average apartment sizes in the region are among the smallest globally. For instance, the average housing size in Hong Kong is 484 square feet. Similarly, the average housing size in the populous nations of India and China is 504 and 646 square feet, respectively. Countries like Indonesia, Malaysia, and Singapore, also facing land constraints, have resulted in compact homes. Elaborate furniture often hinders efficient space utilization. This has led to a surge in demand for folding furniture in the region.

North America Folding Furniture Market Trends

North America folding furniture market is projected to experience the fastest CAGR from 2025 to 2030. Increasing preference for one-person or two-person households in American countries such as the U.S., Canada, and Mexico has urged consumers to invest in smaller living spaces.

The U.S. held the largest revenue share of the regional industry in 2024. According to quarterly residential vacancies and homeownership report published in 2024 by the U.S. government, 65.6% of the U.S. population owns a home. Additionally, first-time homebuyers increased to 32% in 2023 compared to 26% in 2022. Fueled by the ongoing growth in the real estate market, the demand for furniture, including folding furniture, is also rising. As furniture is perceived as a symbol of lifestyle in the country, consumers always look for innovative and functional designs. This has boosted the desire for folding furniture with features such as unique materials and aesthetic appearance.

Europe Folding Furniture Market Trends

The European folding furniture market is anticipated to experience significant growth during the forecast period. Approximately 70% of EU residents own homes, while the remaining 30% live in rented accommodation. According to data published by Euronews, the average number of rooms per person in the EU is 1.6. Many major European cities are overcrowded, forcing residents into confined living spaces. This has been a primary driver of the growing demand for folding furniture in Europe. The European furniture market is also highly integrated, with major chains and manufacturers offering innovative and practical designs. The region is home to some of the world's largest furniture retailers, such as IKEA, which provides a wide variety of functional furniture options.

Key Folding Furniture Company Insights

Some of the key companies operating in the global folding furniture market are Flexsteel Industries, Inc., Haworth, Inc., Meco Corporation, Dorel Industries, Inc among others. Major companies in the folding furniture industry are focusing on expanding their production capacity and adopting innovative technologies to meet consumer demand for folding furniture products. The market also comprises small to mid-sized players that offer a selected range of folding furniture and mostly serve regional customers.

-

Ashley Furniture Industries, a leading furniture retailer, is known for its diverse range of home furnishings, including a wide selection of folding furniture.

-

Ikea offers a wide range of sofa-cum-beds, folding chairs & tables, and wall-mounted storage units. The company offers signature flat-pack furniture that is designed for easy assembly, thus making it a popular choice for small homes.

Key Folding Furniture Companies:

The following are the leading companies in the folding furniture market. These companies collectively hold the largest market share and dictate industry trends.

- Flexsteel Industries, Inc.

- Haworth, Inc.

- Meco Corporation

- Dorel Industries, Inc.

- Murphy Wall Beds Hardware, Inc.

- Ashley Furniture Industries

- La-Z-Boy, Inc.

- Leggett & Platt, Inc.

- Resource Furniture

- Sauder Woodworking Company

- Inter IKEA Systems B.V.

Recent Developments

-

In September 2024, Ashley Furniture Industries, a leading home furnishing and furniture manufacturer, announced its plan to invest USD 80 million to expand its two manufacturing sites in Lee County, Mississippi.

-

In May 2023, Meco Corporation, one of the prominent companies in the folding furniture industry, announced a USD 27.8 million investment to expand its Greeneville headquarters.

Folding Furniture Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.77 billion

Revenue forecast in 2030

USD 7.61 billion

Growth rate

CAGR of 9.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, South Africa

Key companies profiled

Flexsteel Industries, Inc., Haworth, Inc., Meco Corporation, Dorel Industries, Inc., Murphy Wall Beds Hardware, Inc., Ashley Furniture Industries, La-Z-Boy, Inc., Leggett & Platt, Inc., Resource Furniture, Sauder Woodworking Company, and Inter IKEA Systems B.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Folding Furniture Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the folding furniture market report based on product, distribution channel, and region:

-

Product (Revenue, USD Billion, 2018 - 2030)

-

Tables & Chairs

-

Sofa

-

Beds

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.