- Home

- »

- Consumer F&B

- »

-

Food & Grocery Retail Market Size & Share Report, 2030GVR Report cover

![Food & Grocery Retail Market Size, Share & Trend Report]()

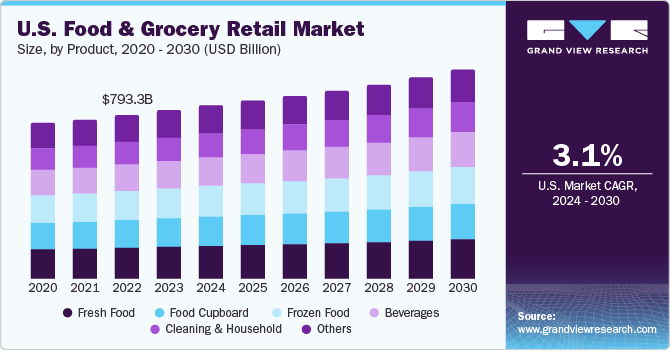

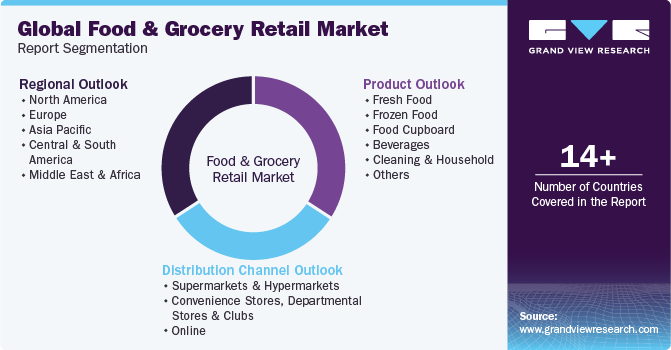

Food & Grocery Retail Market Size, Share & Trend Analysis Report By Product (Fresh Food, Frozen Food, Food Cupboard, Beverages, Cleaning & Household), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-418-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

Food & Grocery Retail Market Size & Trends

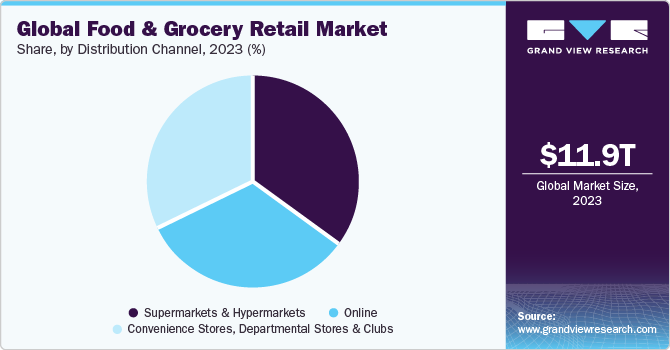

The global food & grocery retail market size was valued at USD 11,932.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 3.2% from 2024 to 2030. The growth can be primarily attributed to COVID-19 lockdown-induced higher spending on groceries, increased online-grocery sales volume, and consumer polarization. The pandemic resulted in the emergence of consumer polarization where some consumers scaled up to purchase expensive products. Furthermore, the pandemic-induced increased cooking at home has been a major growth driver for the market growth. The COVID-19 pandemic has altered the food and grocery retail industry.

During the first wave of the pandemic, customers rushed to stock up on groceries, both in stores and online, while restaurants, businesses, and schools were largely closed in most nations. For instance, according to Public Health England’s report “Impact of COVID-19 Pandemic on Grocery Shopping Behaviours”, grocery sales surged by nearly 11.1% in the U.K. when the first shutdown began in March 2020 up to the week ending June 2020, compared to the same period in 2019. Because of the market volatility caused by the COVID-19 pandemic, grocery retailers were forced to restructure their supply chains, explore private-label goods, and expand their supplier networks to meet consumer demand.

The supermarket business has been driven to digitalization by omnichannel mass merchandisers. The seamless omnichannel strategies have led to revolutionary trends in the global market. This trend was expedited by Amazon’s strategy of acquiring brick-and-mortar establishments to merge e-commerce and physical storefronts. Amazon’s acquisition of Whole Foods cemented its position as a major player in the supermarket market. Amazon was able to connect Amazon.com and Whole Foods as a result of this acquisition, providing a variety of delivery options as well as other advantages of online food shopping. The emergence of new delivery models has also propelled market growth.

Consumers are driving the development and acceptance of new grocery delivery models to match their retail and service consumption patterns. New delivery methods like Buy Online Pickup In-Store (BOPIS), curbside pickup, and direct-to-door are becoming more popular, indicating a shift in customer behavior. One- to two-day delivery is becoming more widespread, and it has the propensity to elevate delivery expectations. Inaccurate delivery estimates have a detrimental influence on customer loyalty and retention. Therefore, grocers are redesigning brick and mortar stores to optimize their real estate investments to accommodate these new consumption models, as subscription services and direct-to-consumer models grow in popularity.

There is an emerging trend wherein individuals are resorting to cooking international cuisines at home, to recreate the experience of traveling and vacationing. This has driven the demand for the food cupboard segment. Food cupboard staples like curry pastes and spice mixes offer amateur home cooks a shortcut to flavor-filled meals. Hence, food cupboard products have become an important and lucrative sector for specialty shops to pursue, as the home cooking trend grows and along with it the demand for ingredients that will add something unique to a normal dish. Furthermore, innovations in delivery models have propelled the segment growth. For instance, in China, Alibaba’s 232 Freshippo (Hema) stores were built with delivery as a top emphasis.

In the stores, often known as Hema, pickers who frequently outnumber shoppers, walk between reduced aisles to gather food and send them to an in-store packing station on conveyor belts. Scooter couriers then deliver the orders, frequently in under 30 minutes. Personalized customer experience is another significant factor driving the growth of the global market. Consumer preference is still heavily influenced by the shopping experience. According to Oracle’s Grocery Retail survey, carried out in 2020, 71% of customers exhibited speedy checkout as a top priority, followed by informed staff (57%).

To enhance customer experience, many leading retailers in the U.S., such as Hannaford, are using technology to manage and sync their retail operations from the back-end, which include supply chain, employee scheduling, and stock replenishment, to the front-end tasks, such as tracking purchases and providing real-time personalized product recommendations while the customer is shopping. The technology facilitates e-commerce while simultaneously driving the in-store experience for the consumers.

Market Concentration & Characteristics

In the Food & Grocery Retail market, innovation is evident through the integration of advanced technologies such as online platforms, AI-driven personalized shopping experiences, and smart supply chain management. Retailers are also focusing on sustainable practices, introducing eco-friendly packaging, and offering a diverse range of healthier and specialized products to cater to changing consumer preferences. Additionally, the implementation of data analytics and automation further enhances operational efficiency and customer engagement in this dynamic sector.

Strategic acquisitions are anticipated to propel growth in the Food & Grocery Retail Market by enhancing market presence, expanding product portfolios, and leveraging operational synergies. These endeavors enable companies to tap into new customer bases, streamline supply chains, and strengthen their competitive position in the dynamic retail landscape.

Regulations play a crucial role in shaping the Food & Grocery Retail market, influencing various aspects of the industry. Health and safety regulations, for instance, impact food handling, storage, and labeling, ensuring consumer protection. Moreover, environmental regulations drive sustainability initiatives, affecting packaging practices and waste management. I

End-user distribution channel can vary based on factors such as geographical location, store formats, and consumer preferences. Large supermarket chains may have a significant share of the market in certain regions, while smaller local stores may dominate in others. The rise of e-commerce has also introduced new dynamics, with online platforms capturing a growing share of end-user attention.

Product Insights

The food cupboard segment held the largest market share of over 18% in 2023. According to the COVID-19 Consumer Tracker commissioned by the U.K. Food Standards Agency, approximately 39% of the U.K. consumers cooked food from the scratch due to the pandemic-induced lockdowns, which resulted in the temporary closure of bars, restaurants, and cafes. The surge in cooking and baking activities, predominantly noticed among Generation Z consumers has led to an increased demand for the food cupboard segment in recent years. Nutrition and provenance have become increasingly important in the fine food industry in recent years, but the demand for high-quality, long-lasting food cupboard ingredients is expected to increase over the coming years, as more customers shop locally and less frequently.

The beverages segment is projected to register the fastest growth rate of 3.5% from 2024 to 2030. The off-trade purchases of beer, wine, and non-alcoholic beverages shot up due to the closure of restaurants, bars, pubs, and cafes during the pandemic. The altered consumer habits of consumption of beverages at home are expected to drive the segment growth during the forecast period. The beverage sector has undergone significant changes in recent years, as new trends force manufacturers to discover new ways to increase sales. The beverage business, like many others, has recently experienced an increase in health and wellness products. While standard beverage sales continue to drop, alternative goods, such as natural and organic beverages, continue to gain popularity.

Distribution Channel Insights

The supermarkets & hypermarkets segment led the market in 2023, having accounted for the largest revenue share of 34.9%. The high number of supermarkets and hypermarkets across the globe is the primary factor for its large market share. The convenient shopping experience of having a plethora of food and beverage items in a single place is one of the key factors that drive consumers to visit their nearby supermarkets and hypermarkets. Furthermore, to ensure the in-store buying habits of customers are maintained, storeowners are coming up with innovative marketing and promotional activities.

The growth of the online delivery channel can be attributed to the emergence of shopping trends brought about by the pandemic. More safety restrictions expanded the market for both online and (particularly in areas of stricter lockdowns) local shopping, while the closure of cafes and restaurants, coupled with a surge in remote working, diverted consumers’ food consumption from food service to grocery retail. Customers are becoming more exposed to the advantages of digitalization in other retail environments and are demanding them in grocery stores as well.

Savvy merchants are flourishing by leveraging technology to improve the shopping experience and satisfy shifting customer demands. The maturity of digital natives, or customers who grew up with digital technologies, has contributed to the expansion of online food and grocery sales (the Millennials and Generation Z). These customers are incredibly enthusiastic about and comfortable with technology, and internet purchasing is a deeply-rooted habit.

Regional Insights

The Asia Pacific food & grocery retail market accounted for the largest share of 36.6% of the global revenues in 2023. The proliferation of supermarkets in developing countries in this region is the main factor leading to the dominance of this region. This rise of supermarkets in Asia Pacific has been brought about by factors, which include urbanization and rising disposable incomes on the demand side, Foreign Direct Investment (FDI), format diversification, domestic investments, and modernization of procurement systems to reduce costs on the supply side. Increases in mobile usage and broadband penetration, particularly in developing countries, have also aided in the growth of online food purchases.

Asia Pacific routinely outperforms the global average in terms of online retailing adoption. Online ordering for home delivery is the most popular flexible retailing option in the region, with China being the biggest adopter of online food and grocery retailing. This has propelled the market in this region and is expected to drive the demand during the forecast period. Retailers in this region are harnessing the power of technology to enhance the customer experience as well as supply chain management.

With breakthroughs in blockchain technologies, many Asian retailers are leading the way in food safety. For instance, Walmart China’s traceability system employs cutting-edge blockchain and Artificial Intelligence (AI) to track the movement of more than half of all packaged fresh meat, 40% of packaged vegetables, and 12.5% of seafood at every stage of the supply chain. Customers are becoming more aware of where their food originates from, and hence retailers are investing in technologies that promote health and safety to increase customer trust and brand loyalty.

India Food & Grocery Retail Market

The food & grocery retail market in India was valued at USD 719.44 billion in 2023 and is expected to grow at a CAGR of 4.0% from 2024 to 2030. The growth of both store-based and e-commerce retailing remains robust as urban households embrace modern lifestyles, leading to a preference for convenient modern retail outlets. According to data from IBEF, the online penetration of the retail sector is projected to increase to 10.7% by 2024, showing significant growth compared to the 4.7% recorded in 2019. Notably, supermarkets and hypermarkets like FoodHall and Star Bazaar are catering to this trend by offering their customers the option to shop online through dedicated mobile apps and providing complimentary home delivery services.

The North America food & grocery retail market was valued at USD 1,872.4 billion in 2023 and is expected to grow at a CAGR of 2.4% from 2024 to 2030. The market is mainly driven due to significant growth in the food retail in the U.S. and Canada. In 2023, the U.S. food & grocery retail market accounted for a revenue share of over 40.0% in the North American region. According to the Census Bureau, food and beverage store sales for the entire year of 2022 witnessed a year-over-year increase of 7.6%, amounting to $947.57 billion (unadjusted). Within this, grocery stores experienced a growth of 8.3% to reach $848.52 billion over the course of 12 months.

The valuation of the Europe food and grocery retail market reached USD 3,005.9 billion in 2023 and is expected to grow at a CAGR of 2.8% over the coming years owing to the rising online grocery retail in the region. Consumers are increasingly adopting online shopping due to convenience, wider product selection, and home delivery options.

UK Food & Grocery Retail Market

The food & grocery retail market in the UK is expected to grow at a CAGR of 3.4% from 2024 to 2030. The market is growing due to rising online food and grocery retailing in the country.

Germany Food & Grocery Retail Market

The food & grocery retail market in Germany accounted for the largest share of 22.3% of the European market revenues in 2023. Germany boasts a well-developed retail infrastructure, with a wide network of supermarkets, hypermarkets, discount stores, and convenience stores. This infrastructure provides consumers with easy access to a diverse range of food and grocery options.

Key Companies & Market Share Insights

The market is fragmented with the presence of many global and regional players. These players are engaging in major acquisition and promotional activities to increase their customer base and brand loyalty. Furthermore, these players are harnessing new technologies, such as blockchain and AI, to enhance customer experience and streamline their supply chain activities. For instance, in 2021, U.K. grocer, Sainsbury’s, teamed up with Amazon to test a “just walk out” store, where it is possible to buy groceries without having to scan items or wait in the check-out lanes.

In December 2021, Discount grocery retailer, Netto, part of the Edeka Group, opened its first-ever Trigo’s hybrid, checkout-free solution-powered store in Munich, Germany. The 250 square meter store underwent a retrofit to become a Pick & Go hybrid autonomous offering. In January 2020, Walmart unveiled a new technology, called Alphabot, for its grocery business. The platform will enable to pick, pack, and deliver shoppers’ online grocery orders faster as the company tries to strengthen its foothold as America’s largest grocer.

Key Food & Grocery Retail Companies:

The following are the leading companies in the food & grocery retail market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these food & grocery retail companies are analyzed to map the supply network.

- Walmart

- Costco Wholesale Corp.

- 7-ELEVEN, Inc.

- Amazon.com Inc

- The Kroger Co.

- Target Brands, Inc.

- ALDI

- AEON Co Ltd

- Carrefour CA

- Schwarz Gruppe

Recent Developments

-

In September 2023, Kroger Co. and Albertsons Companies Inc. have officially entered into a binding agreement with C&S Wholesale Grocers, LLC for the sale of specific stores, banners, distribution centers, offices, and private label brands. This transaction is part of their planned merger, which was initially disclosed on October 14, 2022.

-

In September 2023, C&S Wholesale Grocers, LLC (C&S), a prominent player in wholesale grocery supply and supply chain solutions within the United States, has formally committed to acquiring 413 stores, eight distribution centers, and two offices. These assets became available as a result of the planned merger between The Kroger Co. and Albertsons Companies Inc.

Food & Grocery Retail Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12,266.7 billion

Revenue forecast in 2030

USD 14,781.1 billion

Growth rate

CAGR of 3.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue, USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Italy; France; Germany; Spain; China; India; Japan; South Korea; Australia; Argentina; Brazil; South Africa; Saudi Arabia

Key companies profiled

Walmart; Costco Wholesale Corporation; 7-ELEVEN, Inc.; Amazon.com Inc; The Kroger Co.; Target Brands, Inc.; ALDI; AEON Co Ltd; Carrefour CA; Schwarz Gruppe

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food & Grocery Retail Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global food & grocery retail market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fresh Food

-

Frozen Food

-

Food Cupboard

-

Beverages

-

Cleaning & Household

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores, Departmental Stores & Clubs

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global food & grocery retail market is expected to grow at a compounded annual growth rate of 3.0% from 2022 to 2030 to reach USD 14.78 trillion by 2030.

b. The Asia Pacific dominated the food & grocery retail market with a share of 36.3% in 2021. This is attributable to the proliferation of supermarkets in developing countries such as India.

b. Some key players operating in the food & grocery retail market include Walmart; Costco Wholesale Corporation; 7-ELEVEN, Inc.; Amazon.com Inc; The Kroger Co.; Target Brands, Inc.; ALDI; AEON Co Ltd; Carrefour CA; Schwarz Gruppe

b. Key factors driving the food & grocery retail market growth include the burgeoning prominence of online grocery retail channels and the increasing presence of supermarkets & hypermarkets in the developing countries of the Asia Pacific and Middle East & Africa

b. The global food and grocery retail market size was estimated at USD 11,324.4 billion in 2021 and is expected to reach USD 11,618.8 billion in 2022.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."