- Home

- »

- Advanced Interior Materials

- »

-

Food Service Disposable Market, Industry Report, 2033GVR Report cover

![Food Service Disposable Market Size, Share & Trends Report]()

Food Service Disposable Market (2025 - 2033) Size, Share & Trends Analysis Report By Packaging Type (Flexible, Rigid), By Material (Plastic, Polylactic Acid, Bagasse, Paper & Paperboard), By Application (Online, Food Service), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-917-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Food Service Disposable Market Summary

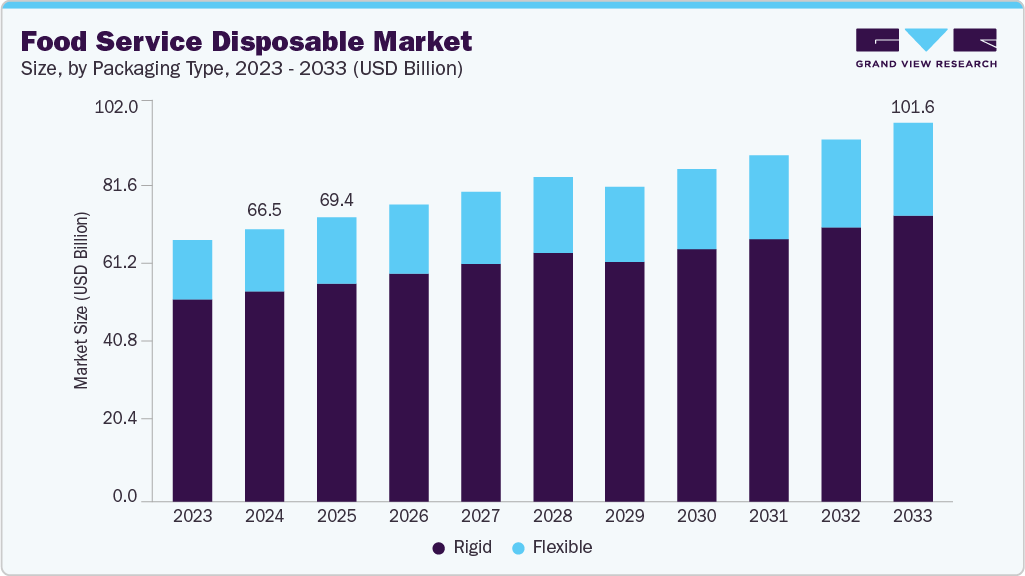

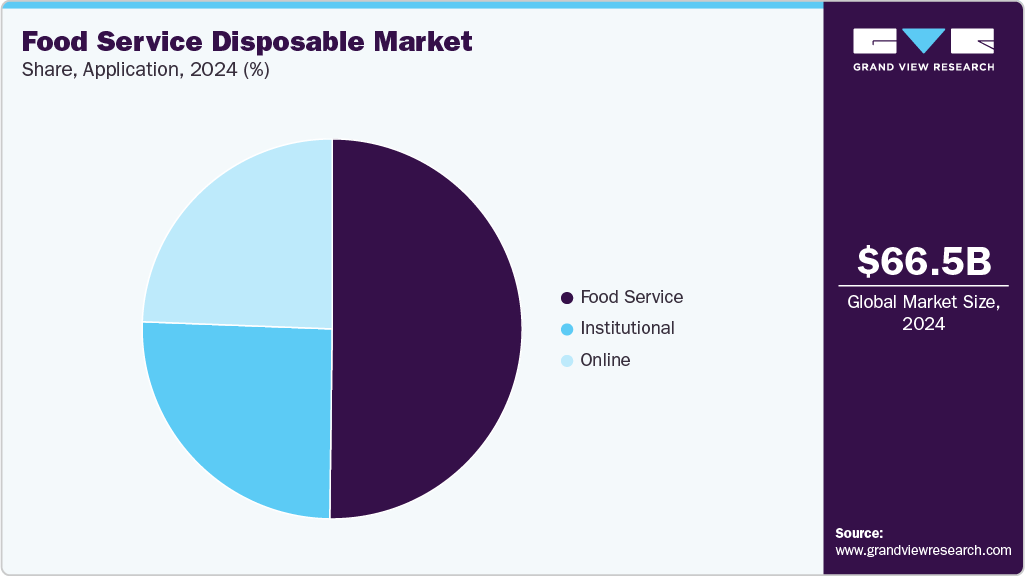

The global food service disposable market was estimated at USD 66.51 billion in 2024 and is projected to reach USD 101.56 billion, growing at a CAGR of 4.9% from 2025 to 2033. The growing penetration of online food delivery services is anticipated to drive the global market.

Key Market Trends & Insights

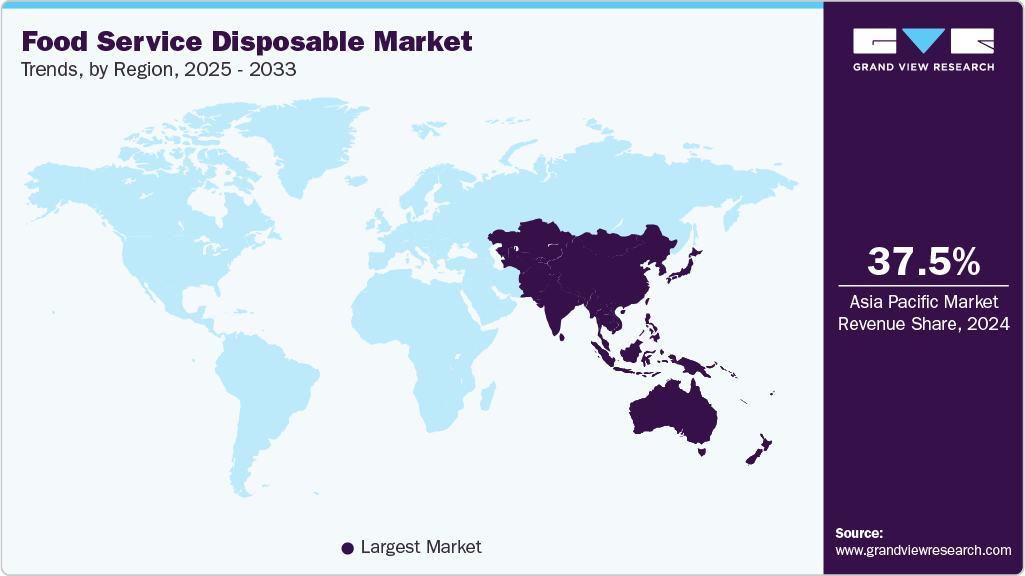

- Asia Pacific dominated the market in 2024, accounting for the largest revenue share of more than 37.5%.

- The rigid packaging type segment led the largest revenue share of more than 77.1% in 2024.

- The food service application segment led the market with a revenue share of more than 50.2% in 2024.

- China dominated the Asia Pacific regional market with a major revenue share of 47.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 66.51 Billion

- 2033 Projected Market Size: USD 101.56 Billion

- CAGR (2025-2033): 4.9%

- Asia Pacific: Largest Market in 2024

Moreover, the increasing popularity of Quick-Service Restaurants (QSRs), especially in the developing regions, such as Asia Pacific, owing to busy lifestyles and hectic work schedules is expected to favor the market growth over the forecast period. The high demand for online food delivery services amid the COVID-19 pandemic is also expected to boost the market growth. The surge in demand is aided by the lockdowns imposed across major cities that restrict hotels, restaurants, and cafes from providing dine-in services.One of the strongest drivers of the global food disposable service market is the rapid expansion of off-premise dining, fueled by food delivery platforms, takeaway models, and drive-through outlets. Consumers increasingly prefer convenience, often ordering meals to enjoy at home, in offices, or on the move. This shift makes disposables indispensable, as they ensure food remains fresh, safe, and visually appealing during transit. Packaging innovations such as vented lids for hot foods, grease-resistant containers for fried items, and stackable designs for bulk orders are now critical for restaurant operations. As delivery and takeaway become normalized eating habits worldwide, demand for disposable serviceware continues to grow across both developed and emerging markets.

The heightened focus on hygiene and food safety, particularly since the COVID-19 pandemic, has further accelerated reliance on disposable service products. Single-use cups, cutlery, and food boxes reduce contamination risks compared to reusable alternatives, especially in high-traffic foodservice environments. Beyond functionality, disposables also act as a form of consumer reassurance-sealed lids, tamper-evident bands, and individually wrapped utensils create a visible sense of safety and quality control. This “hygiene signaling” is now ingrained in consumer expectations, making disposables a standard component of the foodservice experience even as in-person dining recovers.

Shifting consumer lifestyles are also playing a pivotal role in driving the disposable service market. With rising urbanization, dual-income households, and a culture of eating on the go, consumers increasingly rely on foodservice outlets for quick, ready-to-eat meals. Disposable packaging supports this trend by offering portability, portion control, and reheating convenience-such as microwave-safe bowls, drinkable soup cups, and handheld sandwich wraps. For restaurants and retailers, disposables reduce preparation and cleaning time, enabling faster service turnover and lower labor requirements. This blend of consumer convenience and operational efficiency continues to anchor disposables as a necessary investment across the foodservice value chain.

Sustainability is reshaping the disposable service market, though it represents a material shift rather than a decline in overall demand. Governments worldwide are phasing out non-recyclable plastics and polystyrene foams, while consumers increasingly seek eco-friendly dining experiences. In response, manufacturers are innovating with compostable bioplastics, molded fiber containers, and recyclable paper-based formats. Foodservice operators, especially global QSR chains, are also making ESG commitments to reduce waste and increase the use of sustainable packaging. While these transitions involve higher costs and logistical challenges, they ultimately reinforce the importance of disposables by aligning them with long-term environmental and regulatory trends.

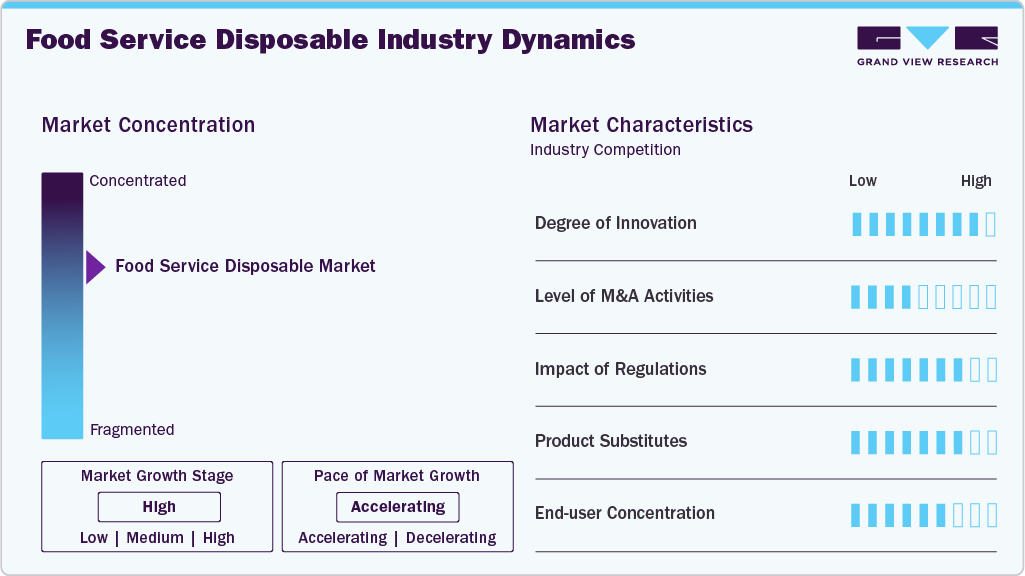

Market Concentration & Characteristics

The food disposable service market is characterized by a mix of global packaging conglomerates, regional mid-sized firms, and numerous local manufacturers catering to specific geographies. While fragmentation provides buyers with multiple sourcing options, the industry has seen increasing consolidation as large players acquire smaller firms to expand capacity, product portfolios, and regional reach. This trend is particularly evident in sustainable packaging, where innovation requires scale and R&D resources that only larger firms can afford. The dual presence of niche producers and dominant multinationals creates a competitive yet dynamic landscape.

Despite innovation in design and sustainability, the industry is fundamentally cost-sensitive. Foodservice operators-from global QSR chains to small street vendors-prioritize unit cost, reliability, and ease of procurement. Margins are often thin, and packaging is treated as a supporting rather than revenue-generating input. As a result, high-volume manufacturing with economies of scale is crucial for competitiveness. Even minor fluctuations in resin, pulp, or biopolymer prices directly affect profitability, making raw material costs a critical determinant of industry stability.

This industry is highly exposed to regulatory frameworks that restrict the use of certain plastics, mandate recycling quotas, or incentivize biodegradable materials. Regions such as the EU and North America are leading with single-use plastic bans and circular economy policies, pushing suppliers to innovate with compostable and recyclable solutions. While regulations create challenges for traditional players dependent on petroleum-based plastics, they also open opportunities for new entrants specializing in sustainable alternatives. This regulatory sensitivity means companies must remain agile and invest continuously in compliance and innovation.

Packaging Type Insights

The rigid packaging type segment led the largest revenue share of 77.1% in 2024. Rigid packaging is mainly used to protect food from spillage and for the convenience of consumers. Food service providers use variety of rigid packaging, which depends on the temperature, quantity, and material state of the food. The rigid packaging type includes plates & containers, bowls & tubs, mugs & saucers, lids, and other disposables. Plastic-made rigid products are anticipated to witness substantial growth.

The mugs, saucers, and containers used for beverages, such as hot & cold drinks and soups, are made from materials like metal and glass. These packaging products are mainly used when an insulated food packaging is required to decrease the chances of food spoilage due to inadequate temperature. These types of packaging products are also easy to recycle and reuse; due to these factors, they are proven to be more convenient and sustainable than their counterparts. The glass rigid packaging is deemed to be more premium than packaging made of other materials, such as plastic, which contributes to the high demand for glass products.

The flexible packaging type segment is estimated to record the fastest CAGR from 2025 to 2033. The high growth is attributed to the rising demand for flexible paper packaging as a result of government restrictions on single-use plastic products in many regions, such as Europe. The food service providers are now able to pack almost all kinds of foods in flexible packaging materials, such as pouches, wraps, and films, as they are unbreakable, lightweight, and more convenient than rigid products. These factors are expected to aid the segment over the forecast period.

Material Insights

The plastic material segment led the market accounting for 52.7% share of the global revenue in 2024. The segment will retain the dominant position throughout the forecast period as plastic is the most preferred choice of material in the packaging industry due to its low cost, ease of use, lightness, temperature resistance, etc. Plastics are used to manufacture various products, such as plates, bowls, cups, trays, cutlery, and food containers.

Plastic containers can be single-use or multi-use. Single-use plastic accounts for the high share of global plastic waste and is harmful to the environment. As a result, the consumption of single-use plastic is expected to decline at a significant rate in the coming years. However, the outbreak of COVID-19 has propelled its consumption and delayed its decline as consumers find it to be a safer option than reusable products.

Paper and paperboard packaging has grown rapidly over the past few years, especially replacing popular disposables, such as plastic cups. Paper & paperboard is used to make various other products including plates, trays, bowls, straws, egg cartons, and tray liners. Paper-based takeaway containers are an affordable and eco-friendly option in the market. Increasing consumption of takeaway foods & beverages, such as pizza and coffee, is expected to spur the demand for disposable products, driving the market growth.

Application Insights

The food service application segment led the market with a revenue share of 50.2% in 2024. The dynamics of the food service industry are changing rapidly, which is expected to aid in the growth of the food service disposables market. Moreover, increasing demand for takeaways and online food delivery services will boost the market growth.

Institutions, such as schools, colleges, universities, hospitals, correctional facilities, public & private cafeterias, nursing homes, and day-care centers, use such products on a daily basis. Unlike restaurants & hotels, where there is dedicated staff for serving food and cleaning tables & utensils, institutions often prefer third parties, such as catering services and non-governmental organizations, for meals. Therefore, the consumption of the institutional application segment is less prone to fluctuations and tends to stay consistent.

Region Insights

Asia Pacific food service disposable market dominated the global market and accounted for the largest revenue share of over 37.5% in 2024. The Asia-Pacific region is experiencing surging demand for food service disposables due to its fast-growing urban populations, rising middle-class incomes, and rapidly expanding quick-service and street food culture. With millions of small vendors, hawker centers, and informal eateries catering to on-the-go consumers each day, disposable products have become essential for both cost efficiency and convenience. In addition, the booming food delivery ecosystem, supported by super-apps and third-party logistics, requires vast volumes of secure and affordable packaging to maintain food integrity during transit. The sheer scale and diversity of consumption in this region make it the largest growth engine for disposables globally.

China food service disposables market is witness demand due to its digitally integrated food delivery ecosystem, dominated by platforms such as Meituan and Ele.me, which collectively process billions of annual orders. Rising consumer preference for app-based meal ordering, even in smaller cities, has created unprecedented demand for single-use containers, cutlery, and beverage cups designed for high-frequency usage. Moreover, the government’s ban on certain plastics and push toward biodegradable and paper-based alternatives has accelerated both volume growth and material transitions, making China a unique blend of high consumption and rapid regulatory-driven innovation.

Europe Food Service Disposable Market Trends

Europe’s demand for food service disposables is strongly shaped by the region’s stringent sustainability and circular economy regulations, which are phasing out single-use plastics and encouraging compostable, recyclable, and reusable solutions. High consumer environmental awareness adds further momentum, with diners often choosing outlets that visibly adopt eco-friendly disposables. The region’s vibrant café culture, growing takeaway preference, and integration of deposit-return schemes are driving innovation in design and materials. This combination of regulatory push and consumer pull makes Europe a leader in pioneering next-generation sustainable disposable packaging formats.

Food service disposable market in Germany presents a unique dynamic in the food service disposables market, driven by its robust regulatory environment and cultural shift toward environmentally responsible consumption. The government’s implementation of mandatory reusable options for takeout in 2023 has spurred demand for high-quality disposable alternatives that complement reusable systems while still ensuring convenience. At the same time, Germany’s strong bakery and café sector, coupled with high urban mobility, continues to sustain large-scale usage of disposable cups, trays, and wrappers. The interplay between regulatory strictness and a strong out-of-home dining culture defines Germany’s distinctive market demand profile.

North America Food Service Disposable Market Trends

In North America, the food service disposables market is underpinned by the deeply entrenched culture of convenience dining, where drive-throughs, takeout, and large-scale catering have long been integral to consumer lifestyles. Major quick-service restaurant chains, combined with widespread institutional foodservice in schools, hospitals, and workplaces, create a stable and recurring demand base. Furthermore, the region’s fragmented yet highly competitive food delivery landscape continues to add new layers of demand for innovative disposables, such as tamper-evident packaging and reheatable containers, to meet consumer expectations around safety, speed, and quality.

U.S. Food Service Disposable Market Trends

IntheU.S.,the rise of premium fast-casual dining and the explosive growth of meal delivery services are reshaping disposable packaging demand. Consumers increasingly expect packaging that not only maintains food freshness but also reflects sustainability commitments, prompting restaurants and delivery brands to experiment with compostable bioplastics, molded fiber trays, and branded paper-based containers. Additionally, U.S. state-level regulations-such as bans on polystyrene in California and New York-are accelerating a shift toward eco-friendly alternatives, ensuring that demand is not just growing in volume but also evolving in terms of material innovation and performance requirements.

Key Food Service Disposable Company Insights

The market players are adopting several business strategies to gain a competitive edge over others. For instance, Berry Global Inc. introduced pivot clear cups. As the consumption of niche beverages, such as frozen, blended, and mixed, is increasing so is the requirement for cost-effective, high-quality, single-use clear cups. These cups are made from an exclusive polypropylene blend that offers advantages over clear cups in the market.

-

In 2021, Amcor introduced AmFiber, based in Australia, a new platform for paper-based packaging solutions, marking a significant innovation in ethical packaging,

-

Placon, headquartered in the United States, acquired a former Sonoco packaging facility in North Carolina in October 2021, aiming to increase its manufacturing capacity.

-

In January 2020, Imperial Dade expanded its presence in Texas by acquiring Wagner Supply Company, enhancing its foodservice disposables and janitorial supplies portfolio based in the United States.

Key Food Service Disposable Companies:

The following are the leading companies in the food service disposable market. These companies collectively hold the largest market share and dictate industry trends.

- Huhtamaki Food Service

- Graphic Packaging International LLC

- Sonoco Products Company

- Sabert Corp.

- Genpak LLC

- Pactiv LLC

- Contital Srl

- Go Pak Group

- R+R Packaging Ltd.

- Interplast Group

Food Service Disposable Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 69.37 billion

Revenue forecast in 2033

USD 101.56 billion

Growth rate

CAGR of 4.9% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Packaging type, material, application, region

States scope

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

Key companies profiled

Huhtamaki Food Service; Graphic Packaging International LLC; Sonoco Products Company; Sabert Corporation; Genpak LLC; Pactiv LLC; Contital Srl; Go Pak Group; R+R Packaging Ltd.,Interplast Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Service Disposable Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global food service disposable market report based on packaging type, material, application, and region:

-

Packaging Type Outlook (Revenue, USD Million 2021 - 2033)

-

Rigid

-

Plates

-

Cups & Glasses

-

Trays & Containers

-

Bowls & Tubs

-

Mugs & Saucers

-

Lids

-

Others

-

-

Flexible

-

Wraps & Films

-

Others

-

-

-

Material Outlook (Revenue, USD Million 2021 - 2033)

-

Plastic

-

PP

-

PE

-

PS

-

PVC

-

Others

-

-

Paper & Paperboard

-

Bagasse

-

Polylactic Acid

-

Others

-

-

Application Technology Outlook (Revenue, USD Million 2021 - 2033)

-

Food Service

-

Full Service

-

Quick Service

-

Others

-

-

Online Delivery

-

Institutional

-

-

Region Outlook (Revenue, USD Million 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

Russia

-

Poland

-

The Netherlands

-

Portugal

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.