- Home

- »

- Food Safety & Processing

- »

-

Food Sterilization Equipment Market Size, Share Report 2030GVR Report cover

![Food Sterilization Equipment Market Size, Share & Trends Report]()

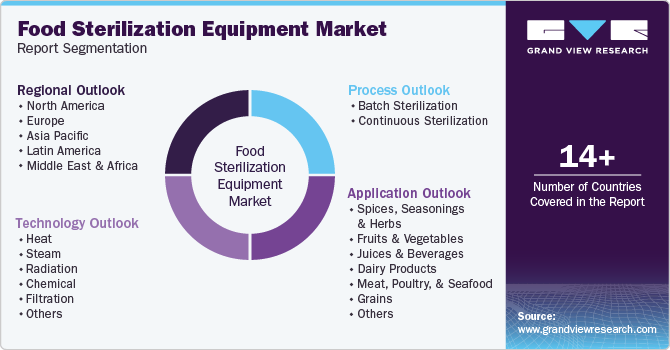

Food Sterilization Equipment Market Size, Share & Trends Analysis Report By Process (Batch Sterilization, Continuous Sterilization), By Technology (Heat, Radiation), By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-120-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Food Sterilization Equipment Market Trends

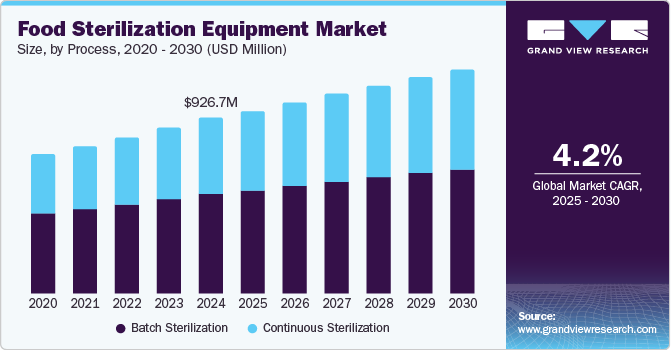

The global food sterilization equipment market size was estimated at USD 926.7 million in 2024 and is projected to grow at a CAGR of 4.2% from 2025 to 2030. Globally, heightened awareness of foodborne illnesses and stringent food safety regulations compel manufacturers to adopt effective sterilization solutions. Notably, according to the FDA, in the U.S., 73% of consumers prefer ordering from establishments that prioritize food safety and hygiene standards, underscoring the critical need for efficient sterilization methods. This demand is further amplified by the growing penetration of online food delivery services, which has heightened scrutiny of food safety practices and increased consumer expectations for safe, properly sterilized food products.

Technological advancements play a pivotal role in enhancing the efficiency and effectiveness of sterilization methods. Continuous innovations, such as steam, radiation, and chemical sterilization technologies, appeal to food manufacturers who seek to improve product safety and extend shelf life. The presence of major industry players in this sector fosters competition and drives further technological developments, ensuring the availability of cutting-edge sterilization solutions that meet evolving consumer demands.

The significant growth of processed foods also contributes to the increasing demand for sterilization equipment. In the Asia Pacific region, 62% of consumers report that their food purchasing decisions are influenced by health and well-being considerations, leading to a marked preference for convenience foods and ready-to-eat products. This surge in demand necessitates robust sterilization processes to ensure food safety and quality, thereby positioning sterilization equipment as essential for food manufacturers aiming to cater to this evolving consumer landscape.

Regulatory compliance is a crucial driver in the market, as governments worldwide enforce strict food safety standards. In Brazil, 55% of consumers are aware of health impacts when ordering food online, reflecting a growing trend towards healthier options. This regulatory environment pushes manufacturers to invest in advanced sterilization technologies to adhere to safety protocols, enhancing product quality and operational efficiency.

Process Insights

Batch sterilization led the market with a revenue share of 56.7% in 2024 as this method enables the comprehensive sterilization of substantial food quantities within a controlled environment, significantly reducing contamination risks. Batch sterilization is versatile for various food types, including canned and packaged goods, and is favored by manufacturers for its consistent quality and compliance with strict regulatory standards.

Continuous sterilization is expected to grow at the fastest CAGR of 4.7% over the forecast period. It utilizes steam or direct heat to decrease heating and cooling durations, reducing operational costs substantially. Continuous sterilization is especially beneficial for liquid foods, soups, and ready-to-eat meals, offering uniformity and consistent reproducibility, thus driving demand among food manufacturers for enhanced productivity and regulatory compliance.

Technology Insights

Heat sterilization dominated the market and accounted for a share of 38.2% in 2024. This prevalent method effectively eradicates microorganisms while preserving food quality and safety. Particularly suitable for high-moisture foods, it ensures long-term shelf stability without sacrificing nutritional value. Its lower capital investment enhances accessibility for manufacturers, driving demand amid increasing concerns for food safety and hygiene.

Chemical sterilization is expected to register the fastest CAGR of 5.3% over the forecast period. Chemical sterilization methods, including chlorine compounds and hydrogen peroxide, are beneficial for heat-sensitive foods that are unable to endure high temperatures. This technology ensures comprehensive disinfection while maintaining food quality and nutritional integrity. Growing consumer awareness of food safety and stringent regulations are driving demand for effective chemical sterilization solutions in the industry.

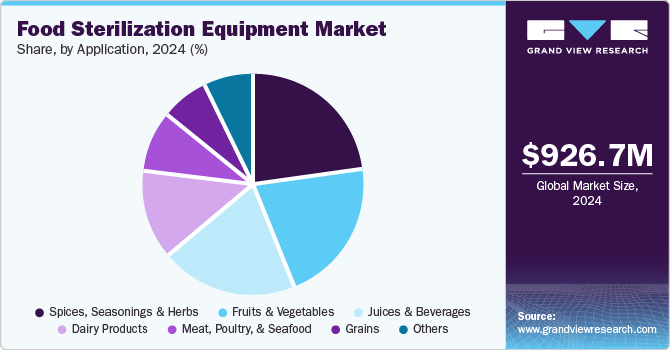

Application Insights

Spices, seasonings, and herbs held the largest market share of 23.4% in 2024. Effective sterilization of spices and herbs is crucial to prevent pathogen contamination and ensure safety and quality. The growing demand for organic and clean-label foods drives consumer interest in products free from harmful microorganisms. Moreover, the culinary industry’s expansion underscores the need for diverse, sterilized spice options that prioritize flavor and safety.

The meat, poultry, & seafood segment is projected to grow at the fastest CAGR of 5.7% over the forecast period. Meat and seafood are especially vulnerable to pathogens such as Salmonella and Listeria, making effective sterilization methods essential for consumer safety. The increasing demand for ready-to-eat and processed meat products compels manufacturers to implement advanced sterilization technologies that enhance shelf life while preserving product quality and safety.

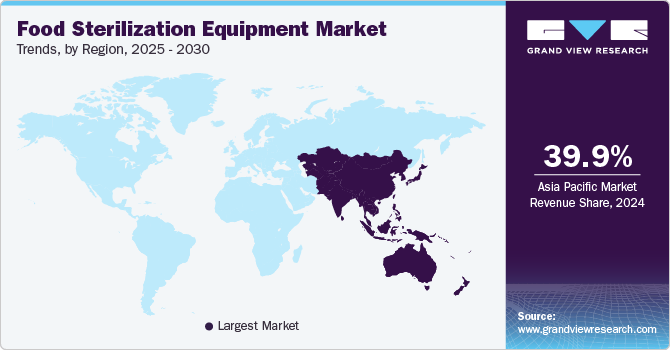

Regional Insights

North America food sterilization equipment market is expected to grow rapidly over the forecast period. The region’s emphasis on advanced manufacturing technologies and innovation fuels investments in efficient sterilization solutions. Growing consumer concerns about foodborne illnesses further accelerate the demand for effective sterilization methods across diverse applications. Moreover, the presence of major industry players enhances competitiveness and promotes technological advancements.

Asia Pacific Food Sterilization Equipment Market Trends

Asia Pacific food sterilization equipment market dominated the global market with a revenue share of 39.9% in 2024. The region is undergoing rapid industrialization, accompanied by stricter food safety regulations and heightened consumer awareness of hygiene. Growing food processing sectors in countries such as China and India are driving demand for advanced sterilization technologies essential for ensuring product safety and prolonging the shelf life of packaged foods.

The food sterilization equipment market in China dominated Asia Pacific with the largest revenue share in 2024. China’s strong food processing sector and strict government food safety regulations are driven by rapid urbanization and a growing middle class’s demand for packaged foods. Technological advancements in sterilization methods further enhance efficiency, positioning Chinese manufacturers as pivotal players in the market.

Latin America Food Sterilization Equipment Market Trends

Latin America food sterilization equipment market is expected to register the fastest CAGR of 5.6% in the forecast period. The region is experiencing heightened awareness of food safety standards alongside rising incidents of foodborne illnesses. Enhanced healthcare infrastructure and investment in advanced sterilization technologies are driving market growth, as the increasing demand for processed foods and beverages necessitates effective sterilization solutions to ensure product safety and quality.

Europe Food Sterilization Equipment Market Trends

Europe food sterilization equipment market held a substantial market share in 2024. European countries are progressively implementing advanced sterilization technologies to adhere to regulations and satisfy consumer demand for safe, high-quality food products. The established food processing industry bolsters market growth, with manufacturers investing in innovative solutions. Increasing consumer awareness of health and wellness further drives the demand for effective sterilization methods.

Key Food Sterilization Equipment Company Insights

Some key companies operating in the market include Allpax Products LLC, Cosmed Group, DE LAMA S.P.A., and HISAKA WORKS, LTD., among others. Companies are investing in advanced sterilization technologies, expanding product portfolios, and forming partnerships to enhance efficiency, comply with food safety regulations, and meet growing consumer demand.

-

Allpax Products LLC specializes in advanced food sterilization equipment, particularly retorts and aseptic processing systems. Their customizable technologies ensure the safety and quality of canned and packaged foods while enhancing operational efficiency and adherence to stringent food safety regulations.

-

JBT provides an extensive selection of solutions, including continuous rotary pressure sterilizers and batch retorts, enhancing food safety, extending shelf life, and improving production efficiency while prioritizing innovation, sustainability, and compliance with stringent regulatory standards in food processing.

Key Food Sterilization Equipment Companies:

The following are the leading companies in the food sterilization equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Allpax Products, LLC

- Cosmed Group

- DE LAMA S.P.A

- HISAKA WORKS, LTD.

- JBT Corporation

- Surdry S. L.

- Ventilex

- Systec

- Steriflow

- Raphanel System S.A.

Recent Developments

-

In September 2024, Allpax and STOCK America showcased their latest sterilization innovations at Pack Expo. These included the versatile Model 2402 and the ImmersaFlow process, which enhance product quality and operational efficiency.

-

In March 2024, JBT Corporation introduced the SeamTec 2 Evolute for powder products at Anuga FoodTech 2024, enhancing hygienic design, ergonomics, and operational efficiency while meeting market demands for infant formula packaging.

Food Sterilization Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 961.0 million

Revenue forecast in 2030

USD 1.18 billion

Growth rate

CAGR of 4.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Process, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; India; Australia; Japan; South Korea; Brazil; Argentina; South Africa; UAE

Key companies profiled

Allpax Products LLC; Cosmed Group; DE LAMA S.P.A.; HISAKA WORKS, LTD.; JBT; Surdry Food Sterilizers; Ventilex (HIPERBARIC); Systec GmbH & Co. KG; Steriflow; Raphanel System Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Sterilization Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global food sterilization equipment market report based on process, technology, application, and region:

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Batch Sterilization

-

Continuous Sterilization

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Heat

-

Steam

-

Radiation

-

Chemical

-

Filtration

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Spices, Seasonings & Herbs

-

Fruits & Vegetables

-

Juices & Beverages

-

Dairy Products

-

Meat, Poultry, & Seafood

-

Grains

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."