- Home

- »

- Medical Devices

- »

-

Sterilization Equipment Market Size, Industry Report, 2030GVR Report cover

![Sterilization Equipment Market Size, Share & Trends Report]()

Sterilization Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Heat Sterilizers, Low-temperature Sterilizers, Sterile Membrane Filters, Radiation Sterilizers), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-400-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sterilization Equipment Market Summary

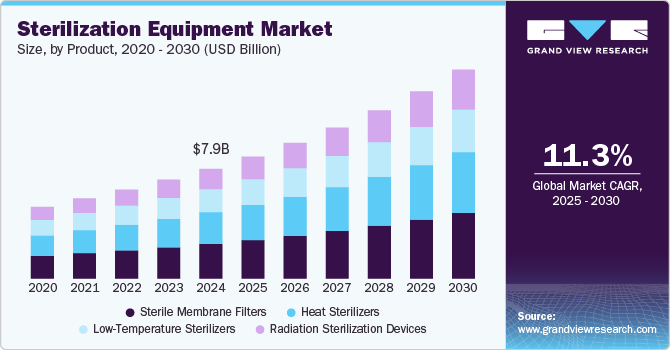

The global sterilization equipment market size was estimated at USD 7.9 billion in 2024 and is projected to reach USD 15.0 billion by 2030, growing at a CAGR of 11.3% from 2025 to 2030. The growing healthcare needs, driven by an aging population and rising chronic diseases, are increasing the demand for advanced sterilization equipment.

Key Market Trends & Insights

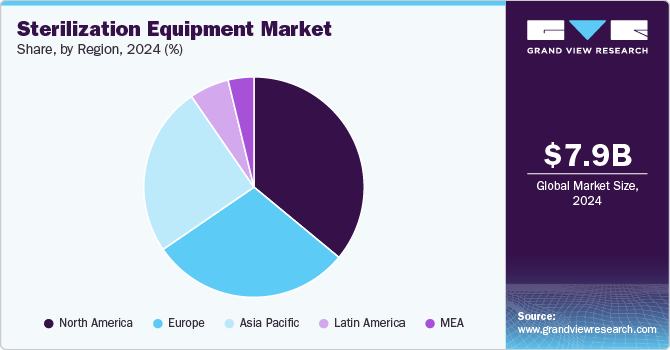

- North America sterilization equipment market secured the largest market share of 36% in 2024.

- Europe sterilization equipment market is set to expand at the fastest-growing CAGR of 11.2% from 2025 to 2030.

- By product, the sterile membrane filters segment dominated the market with the largest revenue share of 31.6% in 2024.

- Based on product, the heat sterilizers segment is anticipated to emerge as the fastest-growing segment and grow at a CAGR of 11.5% from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 7.9 Billion

- 2030 Projected Market Size: USD 15.0 Billion

- CAGR (2025-2030): 11.3%

- North America: Largest market in 2024

- Europe: Fastest growing market

With hospitals and healthcare facilities expanding, ensuring the safety of medical tools and environments has become paramount. Moreover, the heightened awareness of healthcare-associated infections (HAIs) has further emphasized the necessity for effective sterilization methods. This awareness drives healthcare providers to adopt stringent sterilization protocols to minimize infection risks, fueling the growth of the sterilization equipment market as it becomes an essential component of modern healthcare infrastructure.

The expansion of the pharmaceutical and biotech industries is driving the increasing adoption of disposable medical devices, as these sectors require efficient, safe, and cost-effective solutions. Disposable devices reduce the risk of cross-contamination, improve patient safety, and streamline production processes. As demand for these devices rises, sterilization equipment becomes more crucial to ensure their sterility and compliance with regulations. This growing trend is expected to significantly boost the sterilization equipment industry, with companies investing in advanced sterilization technologies to meet the surging healthcare demands.

Product Insights

The sterile membrane filters segment dominated the market with the largest revenue share of 31.6% in 2024 due to their efficiency, versatility, and widespread adoption across pharmaceuticals, biotechnology, and food & beverage industries. These filters effectively remove microorganisms, bacteria, and other contaminants from liquids and gases without altering the chemical composition or properties of the substance. Their burgeoning demand is driven by the need for high-quality, contamination-free products and the emphasis on stringent regulatory standards. Furthermore, their cost-effectiveness and ease of use contribute to their dominant position in the market.

The heat sterilizers segment is anticipated to emerge as the fastest-growing segment and grow at a CAGR of 11.5% from 2025 to 2030 owing to their effectiveness in eliminating microorganisms without using chemicals. With a rise in demand for safe, non-toxic sterilization methods in healthcare and pharmaceutical industries, heat sterilizers, such as autoclaves, are gaining popularity. They are highly efficient, cost-effective, and can sterilize various medical instruments. As infection control standards tighten and awareness about health risks rises, the adoption of heat sterilization technologies is projected to surge, driving market growth.

Regional Insights

North America sterilization equipment market secured the largest market share of 36% in 2024, attributed to the adoption of disposable medical devices and the expansion of healthcare infrastructure. Disposable medical devices, commonly used in surgeries and diagnostic procedures, require effective sterilization to prevent infections. As healthcare systems expand and modernize, particularly with the rising number of outpatient facilities and hospitals, the demand for sterilization equipment increases to maintain high safety standards. These trends are fueling the market growth, with healthcare facilities prioritizing advanced sterilization methods to meet stringent regulations and improve patient care.

U.S. Sterilization Equipment Market Trends

The increase in healthcare-associated infections (HAIs) and the growing geriatric population in the U.S. are accelerating the expansion of the sterilization equipment industry across the U.S. HAIs caused by unsanitary medical practices or contaminated instruments highlight the need for advanced sterilization technologies to ensure patient safety. In addition, the aging population is more susceptible to infections, further amplifying the demand for effective sterilization methods. As healthcare facilities prioritize infection control, the need for reliable sterilization equipment is expected to grow, significantly boosting the market size in the U.S.

Innovations in sterilization technologies, such as advanced low-temperature methods, automated sterilization systems, and environmentally friendly solutions, are projected to fuel the growth of the Canada sterilization equipment market. These innovations improve efficiency, reduce operational costs, and enhance patient safety. Moreover, the increasing number of surgical procedures, driven by a growing aging population and medical advancements, is creating a higher demand for sterilization equipment to ensure infection control in healthcare settings. Technological advancements and increased surgical procedures are anticipated to propel market expansion across Canada significantly.

Europe Sterilization Equipment Market Trends

Europe sterilization equipment market is set to expand at the fastest-growing CAGR of 11.2% from 2025 to 2030 due to rising healthcare and food safety regulatory standards. Stringent regulations aimed at preventing contamination and ensuring safety across various industries, particularly healthcare and food & beverage, are pushing the demand for effective sterilization solutions. In particular, the food & beverage industry is increasingly adopting sterilization technologies to maintain hygiene, extend shelf life, and prevent microbial contamination in products. As regulatory compliance intensifies and consumer demand for safe products grows, adoption of sterilization equipment is expected to continue to rise across Europe.

The growing demand for disposable medical devices and the increasing interest in sustainable, environmentally friendly sterilization methods are expected to propel the market expansion across the UK. Effective sterilization is essential to prevent infections as disposable devices become more common in medical settings. Besides, there is a rising shift toward eco-friendly sterilization technologies, such as hydrogen peroxide and ozone-based systems, to reduce environmental impact. These trends are pushing healthcare providers to adopt advanced, sustainable sterilization solutions, contributing to market growth as regulatory and environmental concerns gain more focus.

Ongoing investments in healthcare infrastructure and technological innovation are set to accelerate the growth of Germany sterilization equipment industry. The increasing focus of the country on modernizing healthcare facilities, including hospitals and clinics, is fueling the demand for advanced sterilization solutions. Technological innovations, such as developing more efficient, eco-friendly, and automated sterilization systems, further enhance the market. These advancements improve operational efficiency and help meet stringent hygiene standards, positioning the market for continued growth in the coming years.

Asia Pacific Sterilization Equipment Market Trends

The growth of the biopharmaceutical sector in the Asia Pacific region is driving demand for sterilization equipment to ensure the safety and quality of bioproducts. Furthermore, increasing awareness of foodborne illnesses and a growing focus on food safety are further fueling the need for sterilization solutions in food processing industries. Stringent hygiene and sterilization standards are being adopted to prevent contamination and improve public health. Together, the expansion of the biopharmaceutical industry and heightened food safety awareness are projected to fuel the growth of the sterilization equipment industry in Asia Pacific.

Japan is expected to grow at a commendable CAGR over the forecast period, owing to the adoption of nitrogen dioxide (NO₂) sterilization and the integration of robotic automation and IoT. NO₂ sterilization offers a highly effective, low-temperature solution for sensitive medical devices, aligning with a focus of Japan on innovation and quality in healthcare. Also, robotic automation and IoT integration enhance sterilization efficiency, accuracy, and monitoring, minimizing human error and improving operational workflows. These advancements align with Japan's commitment to technological excellence and efficient healthcare, significantly contributing to market expansion.

China is anticipated to achieve a noteworthy share during the forecast period, spurred by the growing incidence of hospital-acquired infections (HAIs) and the increasing number of surgical procedures in China. As HAIs remain a significant healthcare challenge, there is a heightened need for effective sterilization solutions to ensure patient safety and prevent cross-contamination. Besides, the rising volume of surgeries further intensifies the demand for reliable sterilization technologies. With healthcare standards tightening and the emphasis on infection control, these factors are set to propel the growth of China sterilization equipment industry in the near future.

Key Sterilization Equipment Company Insights

Some of the key companies in the sterilization equipment market include ASP (Fortive Corporation), Getinge; STERIS, Steelco S.p.A.; Shinva Medical Instrument Co., Ltd., MATACHANA; 3M, MMM Group; Stryker; Andersen Sterilizers; SOLSTEO; HUMAN MEDITEK CO., LTD.; Scitek Global Co., Ltd.; Renosem; Labtron Equipment Ltd; Labotronics Scientific; Genist Technocracy Pvt. Ltd.; DE LAMA S.P.A.; Bionics Scientific (a Unit of Kartal Projects Pvt Ltd.); TDK Corporation; Tuttnauer; and Biobase Biodusty(Shandong), Co., Ltd.

-

3M offers innovative products and solutions for multiple industries, particularly healthcare, safety, electronics, and consumer goods. Its portfolio features adhesives, coatings, medical supplies, and advanced technologies designed to enhance efficiency and performance.

-

TDK Corporation provides various electronic components, including capacitors, inductors, sensors, magnetic materials, and power supplies. Its products cater to the automotive, healthcare, industrial, and consumer electronics industries.

Key Sterilization Equipment Companies:

The following are the leading companies in the sterilization equipment market. These companies collectively hold the largest market share and dictate industry trends.

- ASP (Fortive Corporation)

- Getinge

- STERIS

- Steelco S.p.A.

- Shinva Medical Instrument Co., Ltd.

- MATACHANA

- 3M

- MMM Group

- Stryker

- Andersen Sterilizers

- HUMAN MEDITEK CO., LTD.

- SOLSTEO

- Scitek Global Co., Ltd.

- Renosem

- Labtron Equipment Ltd

- Labotronics Scientific

- Genist Technocracy Pvt. Ltd.

- DE LAMA S.P.A.

- Bionics Scientific (a Unit of Kartal Projects Pvt Ltd.)

- TDK Corporation

- Tuttnauer

- Biobase Biodusty(Shandong), Co., Ltd.

Recent Developments

-

In January 2024, Advanced Sterilization Products (ASP), a Fortive company, expanded its Sterilization Monitoring (SM) portfolio with new steam monitoring products. These additions enhance sterility assurance and improve efficiency, helping sterile processing departments achieve greater confidence in sterilization results.

-

In June 2024, Getinge launched the Poladus 150, an innovative low-temperature sterilization solution for heat-sensitive surgical instruments. Equipped with cutting-edge cross-contamination barrier technology, the Poladus 150 is crucial in preventing healthcare-associated infections (HCAIs) and enhancing patient safety and care quality.

Sterilization Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.8 billion

Revenue forecast in 2030

USD 15.0 billion

Growth rate

CAGR of 11.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Report updated

February 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product and region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

ASP (Fortive Corporation); Getinge; STERIS; Steelco S.p.A.; Shinva Medical Instrument Co., Ltd.; MATACHANA; 3M; MMM Group; Stryker; Andersen Sterilizers; SOLSTEO; HUMAN MEDITEK CO., LTD.; Scitek Global Co., Ltd.; Renosem; Labtron Equipment Ltd; Labotronics Scientific; Genist Technocracy Pvt. Ltd.; DE LAMA S.P.A.; Bionics Scientific (a Unit of Kartal Projects Pvt Ltd.); TDK Corporation; Tuttnauer; and Biobase Biodusty(Shandong), Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sterilization Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global sterilization equipment market report on the basis of product and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Heat Sterilizers

-

Depyrogenation Oven

-

Steam Autoclaves

-

-

Low-Temperature Sterilizers

-

Ethylene Oxide Sterilizers

-

Hydrogen Peroxide Sterilizers

-

Others

-

-

Sterile Membrane Filters

-

Radiation Sterilization Devices

-

Electron Beams

-

Gamma Rays

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global sterilization equipment market size was estimated at USD 8.45 billion in 2024 and is expected to reach USD 9.31 billionin 2025.

b. The global sterilization equipment market is expected to grow at a compound annual growth rate of 10.75% from 2025 to 2030 to reach USD 15.6 billion by 2030.

b. North America dominated the sterilization equipment market with a share of 35.43% in 2024. This is attributable to increasing prevalence of HAIs, and chronic diseases, rising surgical procedures, relatively advanced healthcare infrastructure, and higher adoption of technologically advanced sterilization equipments.

b. Some players operating in the market are ASP (Fortive Corporation), Getinge, STERIS, Steelco S.p.A., Shinva Medical Instrument Co., Ltd., MATACHANA, 3M, MMM Group, Stryker, Andersen Sterilizers, HUMAN MEDITEK CO., LTD., SOLSTEO, Scitek Global Co., Ltd., Renosem, Labtron Equipment Ltd, Labotronics Scientific, Genist Technocracy Pvt. Ltd., DE LAMA S.P.A., Bionics Scientific (a Unit of Kartal Projects Pvt Ltd.), TDK Corporation, Tuttnauer, and Biobase Biodusty(Shandong), Co., Ltd.

b. Key factors that are driving the sterilization equipment market growth include the increasing prevalence of hospital-acquired infections and the rising number of surgical procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.