- Home

- »

- Medical Devices

- »

-

Foot And Ankle Devices Market Size, Industry Report, 2033GVR Report cover

![Foot And Ankle Devices Market Size, Share & Trends Report]()

Foot And Ankle Devices Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Foot & Ankle (F&A) Trauma, Foot & Ankle (F&A) Reconstruction, Foot & Ankle (F&A) Orthobiologics, Foot & Ankle (F&A) Soft Tissue Repair), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-847-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Foot And Ankle Devices Market Summary

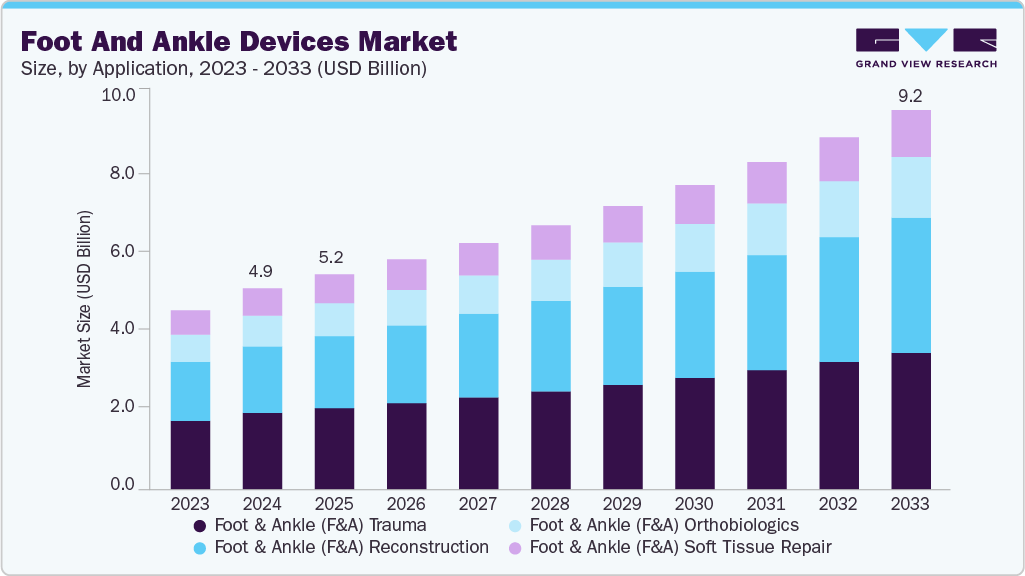

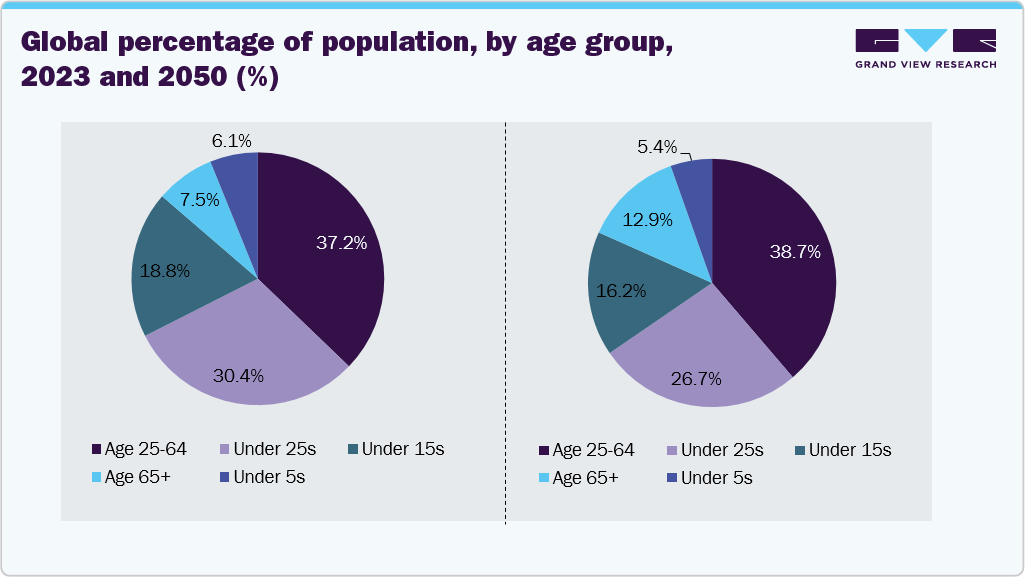

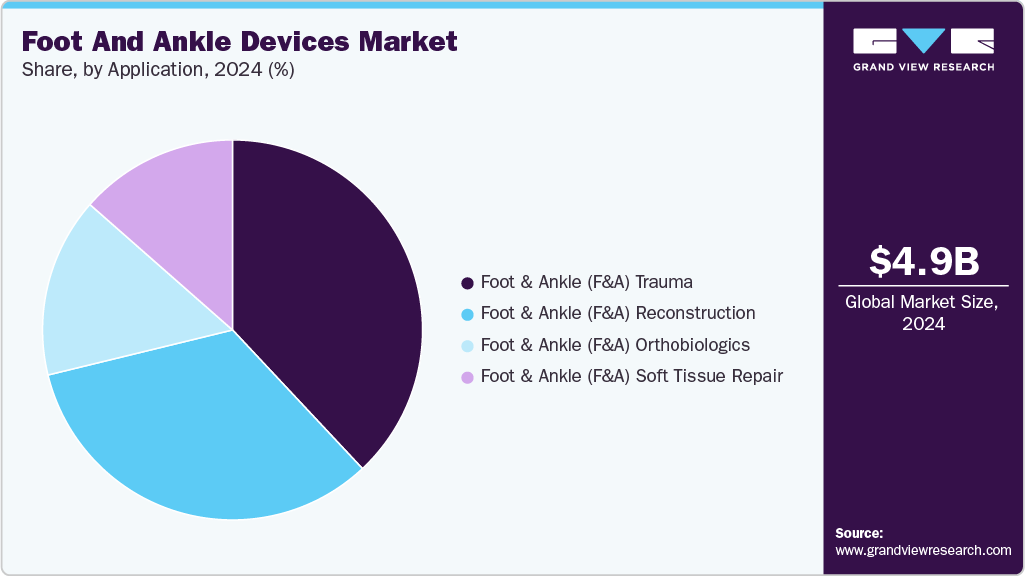

The global foot and ankle devices market size was estimated at USD 4.88 billion in 2024 and is projected to reach USD 9.21 billion by 2033, growing at a CAGR of 7.35% from 2025 to 2033. Factors such as the rising geriatric population, the urgent need for user-centric foot & ankle devices, the rising demand for minimally invasive surgical procedures, the increasing use of advanced technologies, such as AI & robotics, and the growing prevalence of target diseases, such as osteoporosis, fuel the market growth.

Key Market Trends & Insights

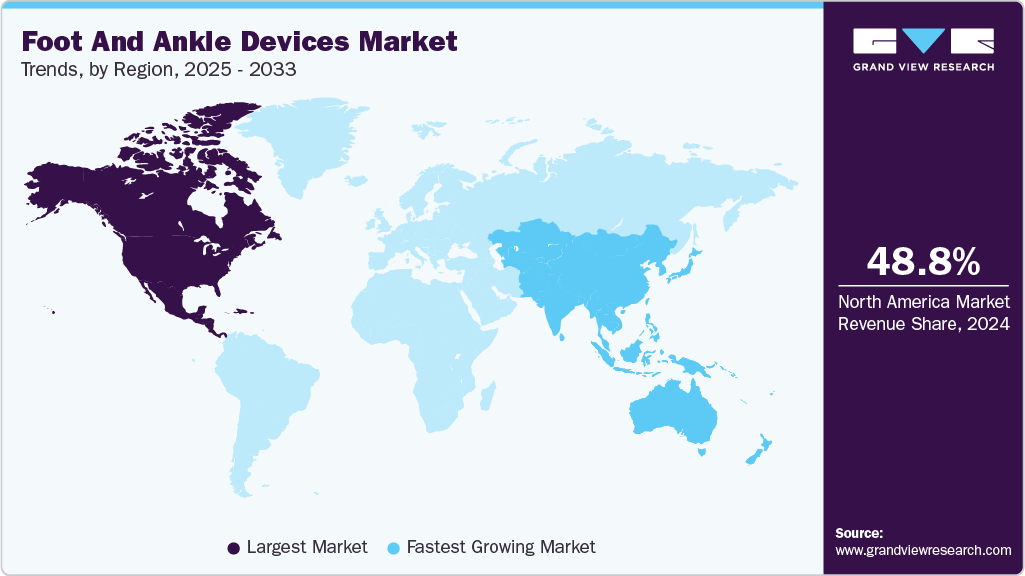

- The North America foot and ankle devices market accounted for the largest global revenue share of 48.80% in 2024.

- The U.S. foot and ankle devices industry is anticipated to register the fastest CAGR from 2025 to 2033.

- By product, the foot and ankle (F&A) Trauma segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.88 Billion

- 2030 Projected Market Size: USD 9.21 Billion

- CAGR (2025-2030): 7.35%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

According to Haleon HealthPartner, an ankle sprain is the most frequent injury globally. Around 628,000 sprains happen annually, and 40% of sprain and strain injuries are caused by playing football. The growing career opportunities in sports and the increasing popularity of athletic pursuits are contributing significantly to the growth of the foot and ankle devices industry. As more individuals, especially children and adolescents, engage in sports, the incidence of sports-related injuries is on the rise. According to a Safe Kids Worldwide survey, a young athlete visits a hospital emergency room for a sports-related injury every 25 seconds, with ankle injuries accounting for 15% and knee injuries for 9% of these cases. This alarming trend indicates a pressing need for effective treatment solutions, driving demand for orthopedic devices, particularly those focused on the foot and ankle.

The increasing adoption of minimally invasive treatments is a key market growth driver, as patients and healthcare providers recognize the advantages these techniques offer over traditional open surgeries. Minimally invasive foot and ankle surgeries involve smaller incisions, reduced pain, shorter hospital stays, faster wound healing, and lower risk of complications, making them a preferred option for patients and surgeons. Procedures such as arthroscopy and minimally invasive total joint replacement enable surgeons to perform complex repairs with minimal disruption to surrounding tissues. Such factors are expected to drive the market growth over the forecast period.

Moreover, key players are adopting various strategic initiatives, such as collaborations, signing new partnership agreements, mergers & acquisitions, and geographic expansions, to strengthen their services and gain a competitive advantage over other companies. For instance, in August 2024, DePuy Synthes, part of Johnson and Johnson MedTech, launched the TriLEAP Lower Extremity Anatomic Plating System. This innovative system features low-profile titanium plates specifically designed for foot & ankle surgeons. The plates are tailored for various trauma and reconstructive procedures in the forefoot and midfoot, applicable for both adults and adolescents. The TriLEAP System is intended to stabilize and fuse bones and bone fragments.

Aging Population and Degenerative Burden

-

Osteoporosis-related fractures: Around 25% of ankle fractures in patients >60 years are associated with osteoporosis, particularly ankle and calcaneal fractures. These often require dedicated fixation plates and intramedullary nails.

-

Degenerative ankle osteoarthritis (OA): Prevalence is estimated at ~3.4% of the global adult population, with post-traumatic cases showing higher rates. This fuels demand for fusion systems and total ankle replacement (TAR) implants as alternatives to long-term conservative care.

-

Tendon degeneration: Aging contributes to the weakening of tendons, raising the risk of Achilles tendon ruptures. Incidence is 5-10 per 100,000 annually, with higher risk in men aged 30-50 and in elderly populations with degenerative tendinopathy. This sustains demand for Achilles repair anchors and scaffolds.

Comorbidities and Economic Burden

- Bones & connecting tissues, such as tendons, ligaments, and cartilage, weaken with age, which increases the risk of injuries. The increase in the obese population is another important factor likely to boost the market. According to the Cigna Healthcare article published in February 2025, the U.S.'s economic burden of musculoskeletal conditions is staggering. Annual healthcare costs alone exceed USD 420 billion. Moreover, as per the Work Care article published in March 2025, individual musculoskeletal injury cases can accrue USD 15,000 to USD 85,000 in direct costs, not including much larger indirect costs such as lost productivity.

Industry Innovation in MIS Devices

Company

Key MIS Innovations in F&A

Regional Adoption Patterns

Arthrex

PROstep MIS platform, SpeedBridge, FiberTak

Widely used in Spain, Italy, UAE

Stryker

PROstep Lapidus, Prophecy 3D planning, Infinity TAR

Strong uptake in the UK & Germany

Smith+Nephew

ULTRABRIDGE Kit, INVISIKNOT Syndesmosis Repair

Growing traction in France & Saudi Arabia

Procedure Updates

Procedure Type

MIS Adoption Trend

Example Devices

Bunion Correction

High (Lapidus, Chevron)

PROstep, PROMO, Lapidus Cut Guide

Achilles Repair

High (PARS, SpeedBridge)

FiberTak, PARS Jig, MIS SpeedBridge

Plantar Plate Repair

Moderate, growing

InternalBrace, SutureTak

Total Ankle Replacement (TAR)

Increasing with 3D guides

STAR, Infinity, Cadence

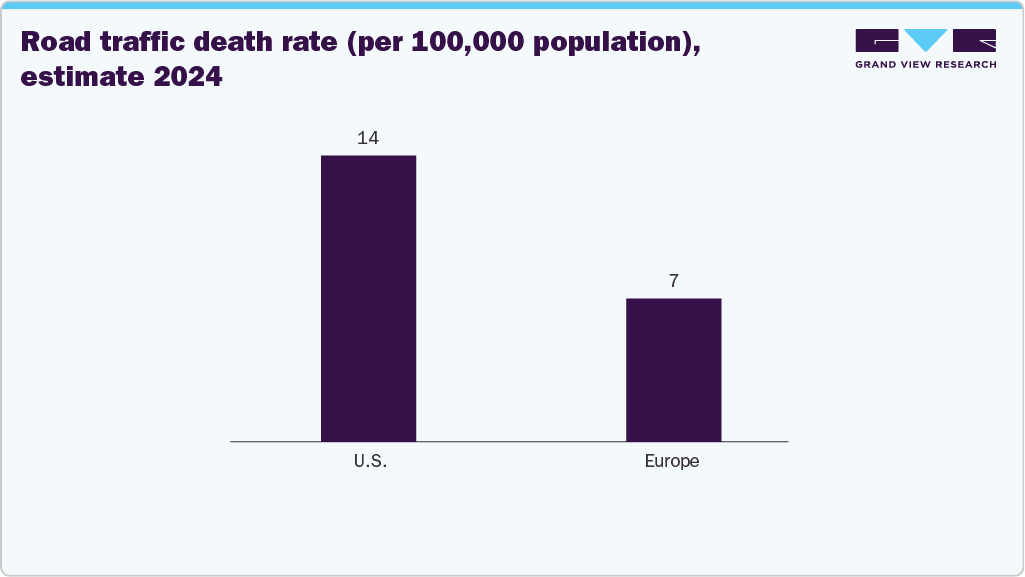

Globally, road traffic crashes remain a significant public health concern, fueling the market's growth. According to the WHO article published in May 2025, it causes approximately 1.19 million deaths annually and leaves 20-50 million individuals with non-fatal injuries. A substantial proportion of these fatalities involve vulnerable road users, including pedestrians, cyclists, and motorcyclists, who are particularly at risk of foot and ankle injuries. Road traffic incidents are the leading cause of trauma among children and young adults aged 5-29, while two-thirds of fatalities occur among individuals of working age (18-59 years), representing a substantial socio-economic burden.

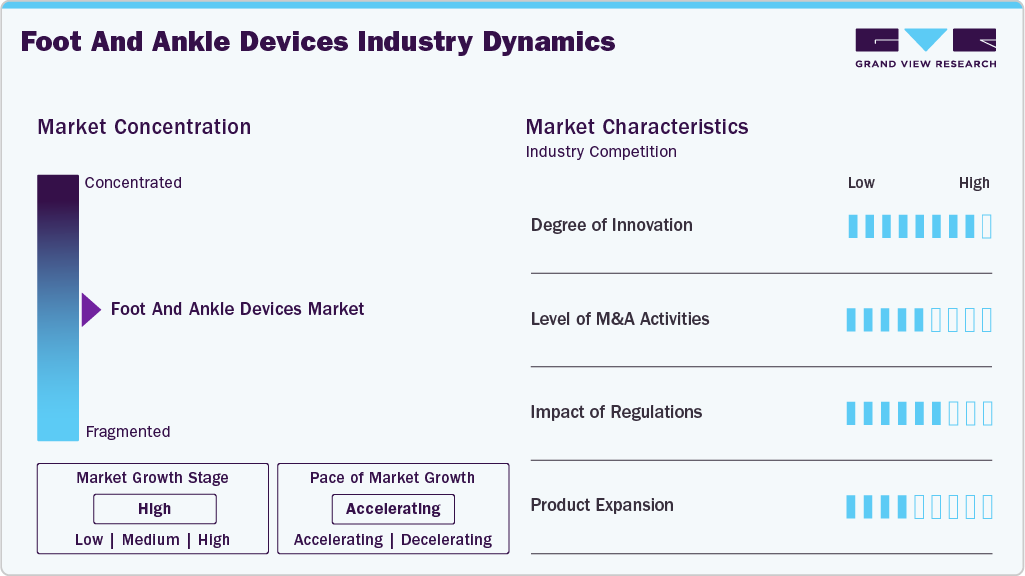

Market Concentration & Characteristics

The foot and ankle devices market is characterized by a high degree of innovation owing to the recent advancements in the field of orthopedic devices, including foot and ankle devices. For instance, in June 2022, Stryker Corporation launched its EasyFuse Dynamic Compression System, a foot and ankle staple system made from nitinol. This system aims to simplify surgical procedures, offer robust dynamic-compression implants, and minimize waste in the operating room.

The market has a medium level of merger and acquisition (M&A) activity, facilitating access to complementary technologies and distribution channels to maintain a competitive edge. For instance, in March 2024, Stryker Corporation acquired SERF SAS, a joint replacement company based in France. This strategic acquisition is expected to enhance Stryker Corporation's presence in the joint replacement sector across France, Europe, and other parts of the globe.

Regulatory organizations such as the U.S. FDA and the European CE mark authorize technologies that fulfill all requirements for clinical data and other safety standards. For instance, in December 2022, Enovis Corp. received U.S. FDA approval for STAR Patient Specific Instrumentation for use with the company’s STAR total ankle replacement device.

Several market players are expanding their business by launching new solutions in the foot and ankle devices industry to expand their product portfolio. For instance, in November 2023, Anika Therapeutics, Inc. launched the JAWS Great White Staple System, designed to enhance the strength and stability of osteotomy or fusion sites compared to traditional staple systems.

Application Insights

The foot and ankle (F&A) trauma segment dominated the foot and ankle devices market in 2024 with a revenue share of 38.02%.The development of customized implants, the rising demand for biocompatible implants with less toxic effects, and the robust demand for technologically advanced prosthetics from end users encourage manufacturers to introduce novel products. The rising incidence of road accidents and the growing preference for implants due to their numerous advantages are expected to drive segment growth over the forecast period. According to a WHO article published in May 2025, road traffic crashes account for nearly 1.19 million deaths globally each year and leave an additional 20 to 50 million people with non-fatal injuries, many of which involve the lower limbs.

The foot & ankle (F&A) reconstruction segment is anticipated to witness the fastest CAGR over the forecast period.Reconstruction (“Recon”) devices in foot and ankle surgery are specialized implants designed to restore anatomy and function in complex or end-stage conditions. They are most often used in cases of severe deformities, advanced degenerative diseases, failed primary surgeries, or limb salvage procedures in Charcot arthropathy and post-traumatic settings. Recon solutions include anatomically contoured plates, locking systems, fusion nails, total ankle replacement implants, and patient-specific cages.Furthermore, as per the article published in March 2024, in a mid-term retrospective study of 13 patients with Charcot arthropathy or end-stage arthritis treated using a patient-specific 3D-printed titanium cage with a dynamic hindfoot fusion nail, functional mobility improved notably.

Regional Insights

North America dominated the foot and ankle devices market with a revenue share of 48.80% in 2024. The market growth is driven by an increase in the use of orthopedic devices, a rise in the number of trauma and fracture cases, growth in the number of middle-aged & geriatric patients opting for foot and ankle devices, an increase in the prevalence of low bone density, introduction of biodegradable devices & internal fixation devices, and adoption of different strategies by market players. For instance, in February 2022, Johnson & Johnson subsidiary DePuy Synthes acquired CrossRoads Extremity Systems.

U.S. Foot and Ankle Devices Market Trends

The foot and ankle devices industry in the U.S. held the largest revenue share in 2024. The growth is driven by factors such as an increase in healthcare expenditure across the globe, the presence of a large number of key market players such as Acumed, LLC, Johnson & Johnson (De PuySynthes), Stryker Corporation, Zimmer Biomet Holdings, Inc., and an increase in the applications of 3D printing in the healthcare sector.

Europe Foot and Ankle Devices Market Trends

The Europe foot and ankle devices industry is anticipated to register the significant CAGR during the forecast period. The market growth is driven by demographic aging and a rising burden of chronic conditions such as diabetes and osteoporosis, which elevate risks of fractures and deformities. The market is increasingly shaped by the aging population, with rising incidence of ankle fractures, hallux valgus deformities, and osteoarthritis driving procedural volumes. In January 2024, France counted 14.7 million people aged over 65, representing 21.5% of the population, according to INSEE (the French National Institute for Statistics and Economic Studies).

Germany foot and ankle devices market is anticipated to register a considerable growth rate during the forecast period. Growing cases of osteoarthritis are escalating market growth. Musculoskeletal disorders lead to bone, ligament, and muscle damage. The increasing geriatric population at risk of disorders such as osteoarthritis creates a high demand for orthopedic surgeries. In May 2025, Thetis Medical reported that Germany recorded an average incidence of Achilles tendon ruptures at 7.77 cases per 100,000 person-years between 1991 and 2015, peaking at 11.33 per 100,000 in 2008.

The foot and ankle devices market in the UK is anticipated to register a considerable growth rate during the forecast period.Increasing product and accessories launches in the country are fostering market growth. In October 2024, Osteotec, headquartered in Newbury, UK, was appointed as the exclusive distributor for Novastep’s foot and ankle surgical solutions across the UK and Ireland, enhancing its portfolio and access to minimally invasive surgical technologies for foot and ankle pathologies.

Asia Pacific Foot and Ankle Devices Market Trends

The Asia Pacific foot and ankle devices industry is anticipated to register the fastest growth over the forecast period. The rapidly developing healthcare infrastructure in major countries, such as India, China, and Japan, and the rapidly expanding medical tourism industry, are propelling the demand for ankle & foot devices in the region. The number of foot & ankle implantations performed in the region is increasing due to improved diagnostic tools and the rising incidence of chronic orthopedic ailments. In May 2023 , Zimmer Biomet revealed its acquisition of OSSIS, a private company focused on medical devices that specializes in customized 3D-printed implants and intricate hip replacement procedures, including those involving revisions for bone tumors and trauma situations.

China foot and ankle devices market is anticipated to register a considerable growth rate during the forecast period.Medical tourism is booming, the healthcare infrastructure is constantly being improved, and patients are becoming more aware of the commercial availability of foot and ankle devices. All of these factors contribute to the country's market growth. In November 2024 , an open-access review in Foot & Ankle Clinics highlighted chronic ankle instability (CAI) with emphasis on trauma-related ligament injuries.

Latin America Foot and Ankle Devices Market Trends

Latin America is witnessing steady growth in the foot and ankle devices industry, owing to factors such as the growing aging population with a high risk of osteoporosis, technological advancements in foot and ankle devices, other musculoskeletal problems, and the rising incidence of osteoarthritis. Furthermore, modern fixation and prosthetic technologies have replaced traditional surgical techniques, which is expected to drive the region’s market growth.

Brazil foot and ankle devices market is anticipated to register considerable growth during the forecast period. In Brazil, foot and ankle devices have been benefiting from government programs and broader private insurance coverage. As a result, there has been a surge in the number of domestic device companies capitalizing on this trend, typically by offering cheaper but simpler products than their imported counterparts. According to a November 2023 article in Injury, the overall malreduction rate for ankle fractures in two Brazilian trauma centers was 22.2%.

Middle East and Africa Foot and Ankle Devices Market Trends

The Middle East and Africa foot and ankle devices industry is experiencing lucrative growth. Factors such as increasing awareness of implant surgeries among patients and healthcare professionals, rising prevalence of orthopedic conditions, product launches, and favorable reimbursement for orthopedic devices, including foot and ankle devices, propel the market growth. In December 2024, an article published in Johns Hopkins Aramco Healthcare’s news portal reported the first keyhole bunion correction surgery in the Eastern Province using a fourth-generation minimally invasive system.

South Africa foot and ankle devices market is anticipated to register a considerable CAGR during the forecast period. Factors such as healthcare spending in the country and the growing incidence of road accidents are expected to contribute to market growth over the forecast period. For instance, the State of Road Safety Report shows 2,818 recorded fatalities between January and March 2024 in South Africa, an increase from 2,498 in the same period in 2023.

Key Foot and Ankle Devices Company Insights

Key participants in the foot and ankle devices market are focusing on developing innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Foot and Ankle Devices Companies:

The following are the leading companies in the foot and ankle devices market. These companies collectively hold the largest market share and dictate industry trends.

- Stryker Corporation

- Johnson & Johnson (De PuySynthes)

- Zimmer Biomet

- Smith+Nephew

- Bioventus LLC

- Enovis Corp.

- Acumed LLC

- Arthrex, Inc.

- Anika Therapeutics, Inc

- Orthofix, Inc.

- Globus Medical

- CONMED Corporation

Recent Developments

-

In September 2024, Stryker Corporation expanded its Foot & Ankle portfolio by introducing two new products: the Ankle Truss System (ATS) and Osteotomy Truss System (OTS), recently acquired from 4WEB Medical.

-

In September 2024, Smith+Nephew launched its TOTAL ANKLE Patient-Matched Guides, offering surgeons a reliable and efficient solution for planning and executing total ankle replacement (TAR) procedures.

-

In January 2024, Anika Therapeutics, Inc, Inc. launched the Grappler Knotless Anchor System and Bridgeline Tape. It is a soft tissue anchoring system that includes implants for multiple foot and ankle conditions.

-

In September 2023, Stryker Corporation launched the PROstep MIS Lapidus, a novel internal fixation system designed to treat bunions.

Foot and Ankle Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.22 billion

Revenue forecast in 2033

USD 9.21 billion

Growth rate

CAGR of 7.35% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Stryker Corporation; Johnson & Johnson (De PuySynthes); Zimmer Biomet; Smith+Nephew; Bioventus LLC; Enovis Corp.; Acumed LLC; Arthrex, Inc.; Anika Therapeutics, Inc.; Orthofix, Inc.; Globus Medical; CONMED Corporation

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Foot And Ankle Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country level and provides an analysis of industry trends in each of the sub segments from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the foot and ankle devices market report based on application and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Foot and Ankle (F&A) Trauma

-

Ankle Trauma

-

Fibula fixation and syndesmosis repair systems

-

Talus and calcaneus trauma plates

-

Pilon fracture fixation sets

-

Intramedullary nails (specific to foot and ankle applications)

-

-

Foot & Ankle (F&A) Reconstruction

-

Hallux Valgus / Bunion Correction

-

Hammertoe Correction

-

Midfoot Reconstruction

-

Hindfoot & Ankle Recon

-

Total Ankle Replacement (TAR)

-

Toe Joint Replacement

-

-

Foot & Ankle (F&A) Orthobiologics

-

Biologics

-

Wedges

-

-

Foot & Ankle (F&A) Soft Tissue Repair

-

Lateral ligament reconstruction

-

Achilles tendon repairs

-

Spring ligament and deltoid repair

-

Plantar plate repair systems

-

Flexor/extensor tendon augmentation

-

Soft tissue augmentation scaffolds

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global foot and ankle devices market size was estimated at USD 4.88 billion in 2024 and is expected to reach USD 5.22 billion in 2025.

b. The global foot and ankle devices market is expected to grow at a compound annual growth rate of 7.35% from 2025 to 2033 to reach USD 9.21 billion by 2033.

b. North America dominated the foot and ankle devices market with a share of 48.8% in 2024. The main causes of this region's significant market share are its high incidence of sporting & physical activity induced injuries and its sizable geriatric population.

b. Some key players operating in the foot and ankle devices market include Stryker Corporation; Johnson & Johnson (De PuySynthes); Zimmer Biomet; Smith+Nephew; Bioventus LLC; Enovis Corp.; Acumed LLC; Arthrex, Inc.; Anika Therapeutics, Inc.; Orthofix, Inc.; Globus Medical; CONMED Corporation

b. Key factors that are driving the market growth include lucrative development opportunities, owing to the growing geriatric population, the emergency need for user-centric foot and ankle devices, the rising demand for minimally invasive surgical procedures, increasing use of advanced technologies such as AI and robotics, and the prevalence of target diseases such as osteoporosis.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.