- Home

- »

- Medical Devices

- »

-

Foot And Ankle Trauma Market Size, Industry Report, 2033GVR Report cover

![Foot And Ankle Trauma Market Size, Share & Trends Report]()

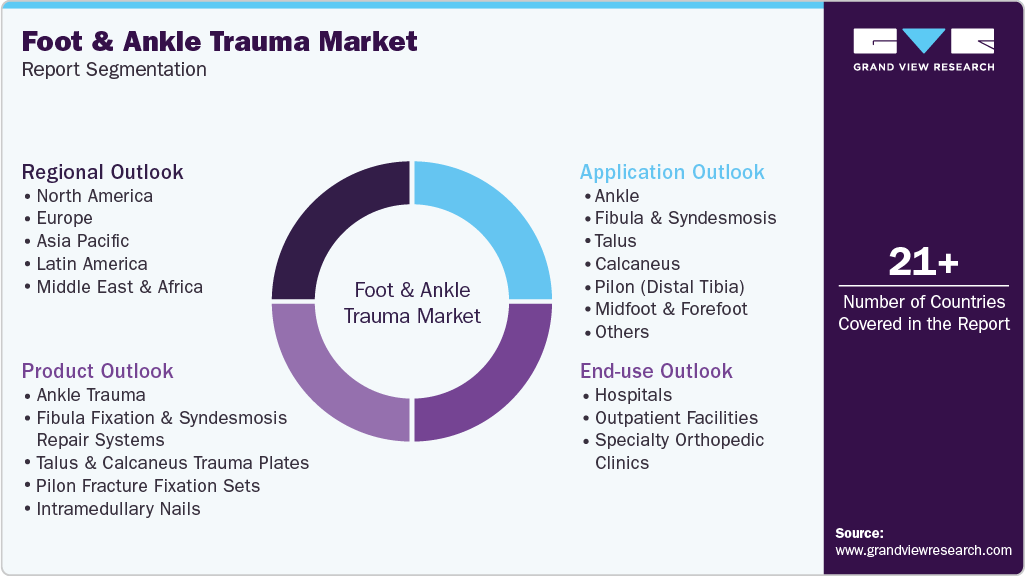

Foot And Ankle Trauma Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Talus & Calcaneus Trauma Plates, Ankle Trauma, Fibula Fixation & Syndesmosis Repair Systems), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-748-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Foot And Ankle Trauma Market Summary

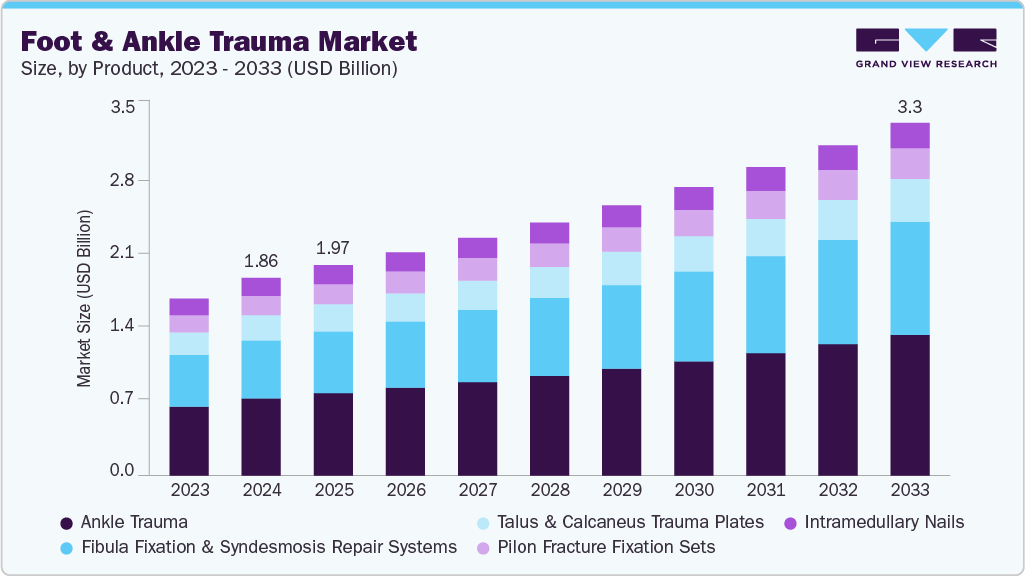

The global foot and ankle trauma market size was estimated at USD 1.86 billion in 2024 and is projected to reach USD 3.32 billion by 2033, growing at a CAGR of 6.71% from 2025 to 2033. The foot and ankle trauma industry is driven by the increasing fractures and sports-related injuries, improvements in minimally invasive surgical methods, and the expanding use of regenerative adjuncts and bio inductive scaffolds to promote healing.

Key Market Trends & Insights

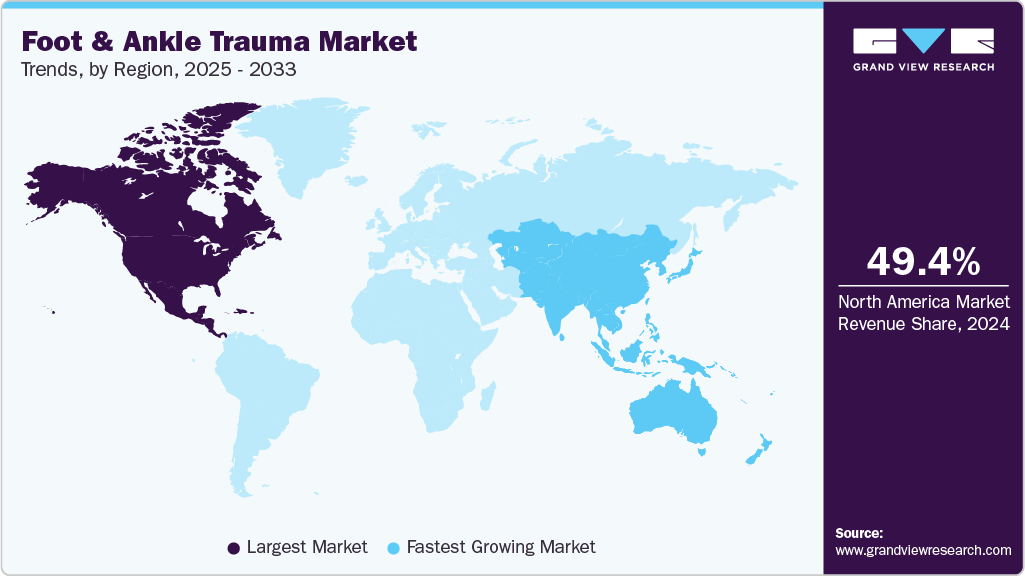

- North America dominated the foot and ankle trauma market with the largest revenue share of 49.35% in 2024.

- The foot and ankle trauma market in Canada is anticipated to register at the fastest CAGR during the forecast period.

- The ankle trauma segment accounted for the largest market revenue share in 2024.

- In terms of the application segment, the ankle segment accounted for the largest market revenue share in 2024.

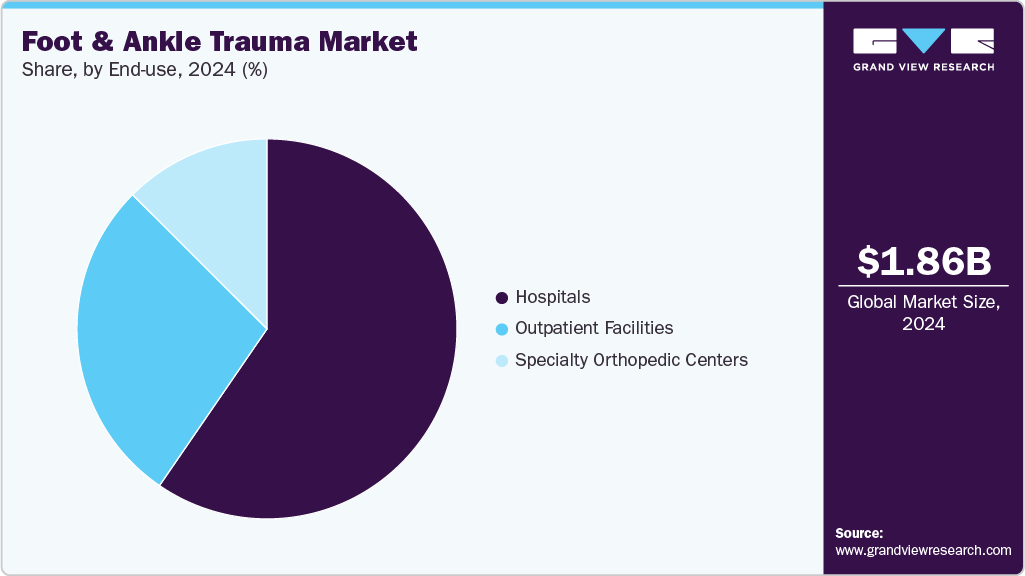

- In terms of end use segment, the hospitals segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.86 Billion

- 2033 Projected Market Size: USD 3.32 Billion

- CAGR (2025-2033): 6.71%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Growing investments in comprehensive postoperative care programs, digital surgical support, and surgeon training bolster the market. Greater accessibility and uptake of the latest trauma solutions are facilitated by expansion in developing nations and the steady improvement of healthcare infrastructure.In July 2024, OIC launched the Flex-Fix System, designed to treat ankle syndesmotic injuries with or without associated ankle fractures, offering micromotion support and minimizing the need for hardware removal.

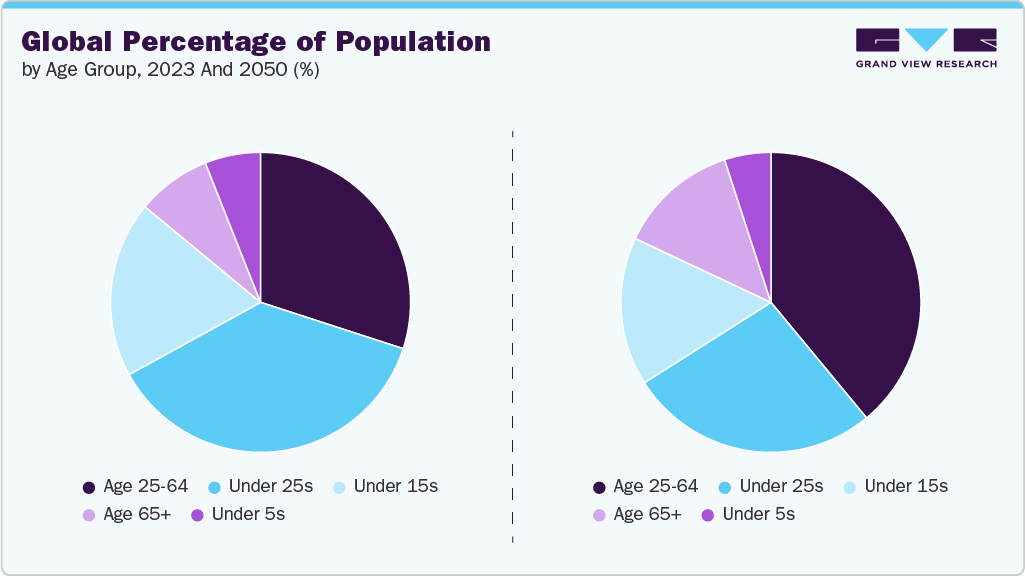

The rising incidence of fractures and sports-related injuries in all age groups is driving the market for lower extremity injuries. Rising awareness of early treatment and enhanced diagnostic capabilities is driving the need for efficient surgical procedures and specialized trauma implants. The need for trauma care is growing due to an aging population with higher fall risk and comorbidities, urbanization, and increased engagement in high-impact sports. These factors increase the need for prompt and efficient treatment solutions.In August 2025, according to CDC statistics, an estimated 1.19 million people die annually from road traffic crashes worldwide, making them the leading cause of death among individuals aged 5-29. These injuries cost the global economy about USD 3.6 trillion each year.

Sports Injuries, By Number of Injuries, 2022

Sport, activity, or equipment

Injuries

Number of injuries by age

Younger than 5

5 to 14

15 to 24

25 to 64

65 and older

Exercise, exercise equipment

4,45,642

6,662

36,769

91,013

2,29,640

81,558

Bicycles and accessories

4,05,411

13,297

91,089

50,863

1,95,030

55,132

Basketball

3,13,924

1,216

1,09,696

1,43,773

57,413

1,825

Football

2,65,747

581

1,45,499

1,00,760

18,527

381

ATV's, mopeds, minibikes, etc.

2,42,347

3,688

42,069

61,065

1,22,941

12,584

Skateboards, scooters, hoverboards

2,30,506

8,513

64,439

61,546

88,328

7,680

Source: National Safety Council analysis of U.S. Consumer Product Safety Commission NEISS data. National Safety Council. Injury Facts

Patient outcomes and surgical precision are improved by navigation technologies, improved imaging, and minimally invasive procedures. These developments promote broader use of the latest trauma devices by facilitating quicker recovery, lowering complications, and boosting surgeon confidence. Surgeons can treat complex fractures with better outcomes due to improvements in implant design and materials. In contrast, surgical workflows are being optimized by the combination of preoperative planning software and intraoperative digital tools.In April 2022, Medline Unite launched its Calcaneal Fracture plating system and IM Fibula implant in the U.S., expanding its titanium portfolio for foot and ankle trauma. The systems provide surgeons with comprehensive fixation options for fractures requiring ORIF.

Orthobiologics, bioinductive scaffolds, and other regenerative therapies are increasingly used to speed up recovery and promote healing. The incorporation of these solutions into surgical procedures is propelling market expansion and promoting wider clinical adoption of contemporary trauma care methodologies. Surgeons' endorsement is growing as part of new data on biologics and scaffold-based technologies. An analysis of the function of orthobiologics in traumatology and orthopedic surgery was published in The Archives of Bone and Joint Surgery in July 2022. Stronger clinical evidence is required to support the safe and effective use of PRP, BMAC, BMP-2, and stem cells in trauma care. It highlighted their applications in managing bone and soft-tissue lesions.

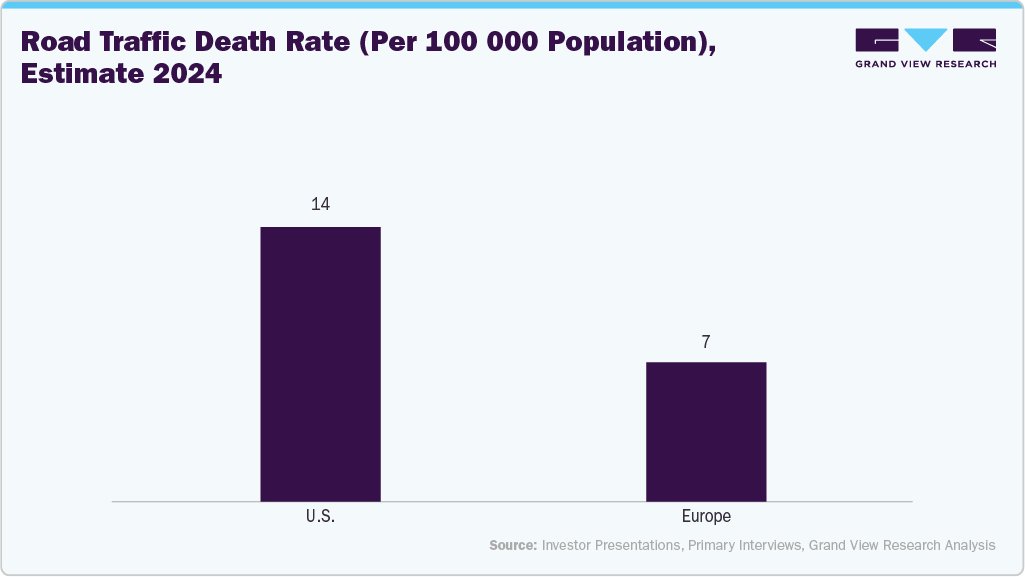

Globally, road traffic crashes remain a significant public health concern, fueling the market's growth. According to the WHO article published in May 2025, it causes approximately 1.19 million deaths annually and leaves 20-50 million individuals with non-fatal injuries. A substantial proportion of these fatalities involve vulnerable road users, including pedestrians, cyclists, and motorcyclists, who are particularly at risk of lower extremity injuries. Road traffic incidents are the leading cause of trauma among children and young adults aged 5-29, while two-thirds of fatalities occur among individuals of working age (18-59 years), representing a substantial socio-economic burden.

Aging Population and Trauma-Related Fractures

-

Fractures associated with osteoporosis: In patients over 60, osteoporosis accounts for about 25% of ankle and calcaneal fractures, frequently requiring specialized fixation plates and intramedullary nails.

-

Tendon degeneration: With an incidence of 5-10 per 100,000 per year, age-related tendon weakening raises the risk of traumatic Achilles ruptures, driving substantial demand for scaffolds and anchors for Achilles repair.

Industry Innovation in MIS Devices

Company

Key MIS Innovations in F&A

Regional Adoption Patterns

Arthrex

PROstep MIS platform, SpeedBridge, FiberTak

Widely used in Spain, Italy, UAE

Stryker

PROstep Lapidus, Prophecy 3D planning, Infinity TAR

Strong uptake in UK & Germany

Smith+Nephew

INVISIKNOT Syndesmosis Repair

Growing traction in France & Saudi Arabia

Procedure Updates

Procedure Type

MIS Adoption Trend

Example Devices

Achilles Repair (Traumatic Rupture)

High (PARS, SpeedBridge)

FiberTak, PARS Jig, MIS SpeedBridge

Syndesmosis Repair / Ankle Fractures

High

INVISIKNOT, FiberTak

Advancements in Foot and Ankle Care: Global Technology, Patient-Centric Models, and Research Innovation

-

Technological Advancements in Foot and Ankle Trauma

-

Robotics and Computer Navigation: Robotic-assisted surgery is gradually being adopted worldwide in lower extremity injuries, especially for complex fracture fixation and reconstructive procedures. By increasing accuracy in implant positioning, plate alignment, and pin placement, these systems lower human error and assist to produce more reliable post-operative results. Surgeons can minimize revision surgeries and modify fixation strategies with the aid of computer navigation tools, providing real-time intraoperative feedback.

-

-

Artificial Intelligence (AI): AI is increasingly applied to trauma care in three key areas:

-

Imaging Interpretation: Deep learning algorithms applied to CT and MRI scans detect subtle fractures, syndesmotic injuries, and complex trauma patterns with high accuracy, aiding timely and precise treatment.

-

Predictive Modeling: AI tools forecast rehabilitation timelines after fractures or ligament injuries, enabling personalized post-trauma care and optimized recovery.

-

Surgical Planning: AI-driven simulations help surgeons select fixation devices, determine screw trajectories, and predict construct stability in severe ankle and midfoot trauma cases.

-

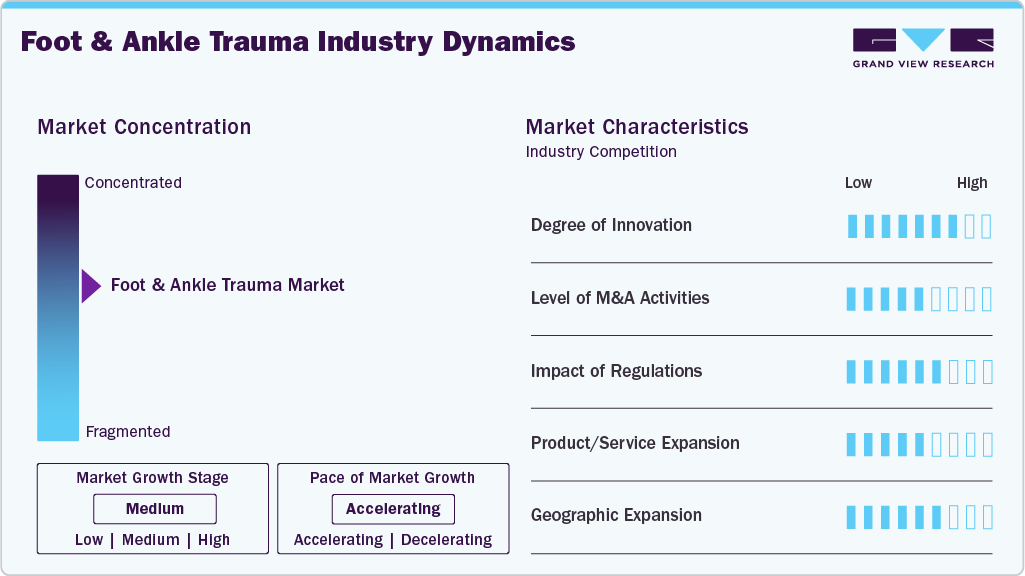

Market Concentration & Characteristics

Bioinductive scaffolds, less invasive implants, and enhanced imaging and navigation technologies are the primary fields of innovation in the foot and ankle trauma industry. These advancements aim to improve patient outcomes and increase surgical precision. Although there have been notable minor improvements, there haven't been many truly revolutionary discoveries. In October 2024, Paragon 28 launched the Phantom Fibula Nail System, providing a less invasive option for fibula fracture stabilization with instrumentation to facilitate anatomic reduction and optional syndesmotic fixation using R3FLEX or R3ACT systems.

Larger orthopedic firms buy smaller, specialized businesses to expand their product offerings and gain more rapid exposure to the latest innovations. These mergers and acquisitions are generally strategic and moderate in nature. Rather than being extensive, activity is selective, indicating a cautious approach to growth. These deals assist businesses in covering gaps in their biologics, trauma implant, and adjunctive therapy portfolios. In April 2025, Zimmer Biomet completed the acquisition of Paragon 28, a notable player in lower extremity orthopedic devices, making Paragon an officially owned subsidiary. This consolidates Zimmer Biomet’s presence in ankle trauma solutions and broadens its surgical portfolio globally.

Regulatory supervision is crucial for the creation and launch of new goods. Authorities including the FDA and CE Mark have strict evaluation and approval requirements for biologics and advanced implants. Launch schedules and adoption rates are strongly impacted by adherence to safety and efficacy standards. While novel regenerative and scaffold-based solutions are increasingly being examined, traditional trauma devices, such as traditional plates and screws, encounter relatively fewer obstacles.

Firms are expanding the range of their products to include postoperative rehabilitation programs, digital surgical support, and surgeon training. Enhancing adoption, expediting treatment pathways, and fostering stronger professional ties with surgeons are the goals of these initiatives. Although the integration of these services continues to proceed gradually, it is anticipated to grow as providers look for more comprehensive solutions. In September 2023, Orthofix Medical Inc. rolled out its Galaxy Fixation Gemini system across the U.S., offering ready-to-use sterile kits for managing fractures caused by trauma, with specific solutions for ankle and other limb injuries.

Increased expansion into emerging markets such as Asia-Pacific and Latin America, where rising injury rates and evolving healthcare systems are generating new demand, driving growth. These areas' adoption still trails more developed markets such as Western Europe and North America. Businesses are supporting regional growth through targeted infrastructure investments, training programs, and distributor relationships. As long as clinical education and facility capabilities continue to advance, it is expected that the use of advanced trauma solutions is expected to increase gradually.

Product Insights

The ankle trauma segment led the market with the largest revenue share of 39.12% in 2024.The segment’s dominance is attributed to the high prevalence of ankle fractures, increasing sports-related injuries, and the growing adoption of advanced fixation devices that improve patient outcomes and reduce recovery time.In January 2024, GLW Foot & Ankle launched the Apollo Ankle Fracture Plating System, featuring additive-manufactured TI-PEEK plates with a full portfolio of ankle fracture plates and screws, designed for improved visualization, anatomical fit, and reduced complications.

The fibula fixation and syndesmosis repair systems segment is anticipated to grow at the fastest CAGR over the forecast period. This rapid growth is driven by rising awareness of syndesmotic injuries, advancements in minimally invasive surgical techniques, and the development of novel fixation systems that offer enhanced stability and faster rehabilitation.This growth is further supported by increasing adoption of pre-contoured plates and suture-button devices, which improve surgical precision and patient outcomes in distal limb conditions.In September 2024, Paragon 28 launched the R3FLEX Stabilization System, designed to anatomically repair ankle syndesmotic injuries and restore stability after fractures or high ankle sprains.

Application Insights

The ankle segment led the market with the largest revenue share of 25.16% in 2024.The dominance of this segment is driven by the high incidence of ankle injuries, increasing participation in sports activities, and the widespread use of advanced surgical implants and fixation systems that improve recovery outcomes.In February 2025, Bioretec received CE mark approval for its RemeOs Trauma Screw product group, enabling treatment of ankle trauma in adults and children across Europe, supporting bone healing and eliminating the need for removal surgery.

The talus segment is anticipated to grow at the fastest CAGR over the forecast period,due to rising awareness of talus fractures, the complexity of surgical management, and the introduction of specialized implants designed to enhance stability and healing.In December 2023, PGI doctors treated misaligned ankle trauma involving talus fractures using computer-aided 3D modelling, mirroring the healthy foot to guide surgery. They corrected 8 cases and received a bronze medal at the AO Trauma Research Olympics in Davos.

End Use Insights

The hospitals segment led the market with the largest revenue share of 59.58% in 2024. This dominance is attributed to the availability of specialized orthopedic departments, advanced surgical facilities, and the presence of experienced surgeons capable of performing complex lower extremity procedures.In May 2024, with lateral ankle ligament reconstruction, Fortis Hospital Mohali successfully treated athletes with sports-related ankle trauma, including a 21-year-old kabaddi player who had continuing ankle instability. The procedure restored stability after repeated sprains, enabling the patient to resume athletic activities, highlighting the hospital’s expertise in corrective surgeries for ankle trauma.

Theoutpatient facilities segment is expected to grow at the fastest CAGR during the forecast period, due to increasing adoption of minimally invasive procedures, shorter recovery times, and the growing trend of day-care surgeries for lower extremity injuries.The rising preference for outpatient care is driven by improved patient convenience, reduced hospital stays, and enhanced efficiency in managing distal limb condition cases.In June 2025, HSS at NCH opened a new outpatient musculoskeletal surgery center in North Naples, FL, offering comprehensive orthopedic care, including foot, ankle, trauma surgery, and joint replacements in a modern facility.

Regional Insights

North America dominated the foot and ankle trauma market with the largest revenue share of 49.35% in 2024. It is driven by the high incidence of fractures and sports-related injuries, the early adoption of minimally invasive surgical techniques, and advanced healthcare infrastructure. Strong reimbursement programs, widespread access to the newest implants, and surgical support contributed to market leadership. The Mayo Clinic reported favorable outcomes and high patient satisfaction with the Bridle procedure for trauma-related foot drop in June 2024. A split posterior tibial tendon transfer is used in the procedure to help patients regain ankle dorsiflexion and lessen their need for braces. Patients with trauma-induced foot drop from knee or pelvis injuries due to accidents experienced improved gait and functional recovery.

U.S. Foot And Ankle Trauma Market Trends

The foot and ankle trauma market in the U.S. accounted for the largest market revenue share in 2024. The high adoption of the latest surgical techniques, complex orthopedic healthcare facilities, and a substantial patient base are contributing factors. The need for trauma interventions is growing as a result of an aging population and an increase in sports injuries. In February 2024, the American Orthopaedic Foot & Ankle Society (AOFAS) highlighted that lower extremity orthopaedic surgeons are underutilized in diabetic foot care and trauma management. The report highlighted their proficiency in both surgical and non-surgical treatment, the growing demand for high-quality care because diabetes is so common in the U.S., and the significance of education, multidisciplinary care, and early intervention to avoid complications, including ulcers, amputations, and injuries from trauma.

Europe Foot And Ankle Trauma Market Trends

The foot and ankle trauma market in Europe is expected to grow at a significant CAGR over the forecast period.It is driven by a rise in sports-related injuries, a greater understanding of the importance of early intervention, and the application of less invasive surgical methods. The development of healthcare infrastructure and the increasing availability of functional implants globally support growth. A December 2024 article in the Journal of Clinical Medicine states that traffic accidents, the workplace, and sports are the primary causes of trauma for a significant percentage of the population. It stated that a substantial number of patients require surgery for lower extremity injuries, which are a major cause of orthopedic emergency admissions.

The UK foot and ankle trauma market is expected to grow at a significant CAGR during the forecast period. The primary factors driving this market are fractures, sports injuries, and an aging population in need of trauma care. The effectiveness of treatment is being supported by the use of advanced surgical implants and regenerative adjuncts. An article about chronic lateral ankle instability (CLAI) was published in the Journal of Clinical Orthopaedics and Trauma in December 2023. According to the report, the prevalence of CLAI rises to 46% in patients who have previously suffered an ankle sprain, and it can occur in as many as 40% of patients with lateral ligament injuries. The burden in active populations such as the UK, where 5,600 acute ankle sprains are reported to emergency rooms every day, was brought to light in the article.

Asia Pacific Foot And Ankle Trauma Market Trends

The foot and ankle trauma market in the Asia Pacific is expected to register the at fastest CAGR over the forecast period.With the help of growing healthcare infrastructure, increased sports participation, and rising disposable income, the Asia Pacific lower extremity injury industry is anticipated to grow at the fastest rate during the forecast period. These significant variables are the increasing availability of minimally invasive procedures and the growing awareness of trauma care. In May 2023, Zimmer Biomet revealed its acquisition of OSSIS, a private company focused on medical devices that specializes in customized 3D-printed implants and intricate hip replacement procedures, including those involving revisions for bone tumors and trauma situations.

The China foot and ankle trauma market is anticipated to register at a considerable CAGR during the forecast period.Rapid urbanization, a rise in fractures, and an increase in the need for sophisticated surgical implants are the primary drivers. Adoption of digital surgical solutions and increased awareness of early intervention are two major growth drivers. In November 2024, an open-access review in Foot & Ankle Clinics highlighted chronic ankle instability (CAI) with emphasis on trauma-related ligament injuries. Anatomic repair or reconstruction of the anterior talofibular and, if necessary, calcaneofibular ligaments is the primary form of treatment. Proprioceptive training and rehabilitation constitute a part of the treatment, and arthroscopic procedures have been shown to improve functional outcomes, reduce stiffness, and lower the risk of secondary osteoarthritis.

Latin America Foot And Ankle Trauma Market Trends

The foot and ankle trauma market in Latin America is anticipated to witness at a considerable CAGR over the forecast period.It is driven by the growth of healthcare facilities, an increase in sports injuries, and an increase in orthopedic awareness. Growing investments in surgical facilities and training programs are supporting procedural efficiency. Economic development in key countries is improving patient access to advanced trauma care. According to a November 2023 article in Injury, the overall malreduction rate for ankle fractures in two Brazilian trauma centers was 22.2%. Patients over 60 years of age, open fractures, and fracture-dislocations were at higher risk, underscoring the difficulties in achieving the best anatomical reduction in lower extremity injuries.

The Argentina foot and ankle trauma market is anticipated to register at a considerable CAGR during the forecast period.This is owing to more people having access to contemporary surgical methods, and sports-related injuries and fractures are on the rise. The growth of orthopedic clinics and hospitals is supporting better treatment results. Minimally invasive techniques and regenerative solutions are growing in popularity. Government initiatives to improve healthcare services and infrastructure are expected to drive further market growth.

Middle East And Africa Foot And Ankle Trauma Market Trends

The foot and ankle trauma market in the Middle East and Africais anticipated to witness at a considerable CAGR over the forecast period.Growing orthopedic infrastructure, an increase in sports injuries, and rising healthcare spending all support it. Adoption of contemporary implants and awareness of advanced trauma care are steadily rising. Access to specialized trauma services is being improved by the region's growing medical tourism industry. The Journal of Orthopaedic Surgery and Research reported in December 2024 that lower extremity injury surgeries, primarily for fractures from traffic accidents, accounted for a significant amount of orthopaedic trauma costs in Saudi Arabia. Young males (less than 21 years old) accounted for the greatest number of cases and related costs.

The UAE foot and ankle trauma market is anticipated to register considerable growth during the forecast period. An increase in fractures, sports participation, and investments in medical facilities drives the market. Treatment effectiveness is supported by the availability of the latest surgical implants and minimally invasive procedures. The market is growing as a result of the expansion of orthopedic specialty centers and surgeon training programs. In January 2024, Auxein Medical showcased its advanced orthopaedic implants and innovative products specifically for lower extremity procedures at Arab Health, held in Dubai. The company emphasized its commitment to minimally invasive surgical techniques, presenting a new Trauma range that includes specialized implants for foot arthrodesis.

Key Foot And Ankle Trauma Company Insights:

Key participants in the foot and ankle trauma industry are focusing on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and expanding their business footprints.

Key Foot And Ankle Trauma Companies:

The following are the leading companies in the foot and ankle trauma market. These companies collectively hold the largest market share and dictate industry trends.

- Smith+Nephew

- Arthrex, Inc.

- DePuy Synthes (Johnson & Johnson)

- CONMED Corporation

- Stryker

- Globus Medical

- Atreon Orthopedics

- Zimmer Biomet

- Osteocare Medical Pvt Ltd.

- Auxein

Recent Developments

-

In October 2024, Globus Medical expanded its orthopedic trauma portfolio with several new systems, including the TENSOR Suture Button System. This system is compatible with ANTHEM Ankle and One-Third Tubular Plates, providing surgeons with a comprehensive ankle repair solution for syndesmotic injuries.

-

In August 2024, The TriLEAP Lower Extremity Anatomic Plating System was unveiled in the U.S. by DePuy Synthes, a division of Johnson & Johnson MedTech. This system includes streamlined titanium plates designed for specific trauma and foot and ankle restoration treatments.

-

In March 2022, Acumed launched its Ankle Syndesmosis Repair System with Acu-Sinch Knotless flexible fixation technology, designed with surgeons to address trauma-related syndesmotic disruptions of the tibiofibular joint. The system enables dynamic stabilization, integrates with Acumed and OsteoMed fibula fixation plates and nails, and expands the company’s foot and ankle trauma portfolio.

Foot And Ankle Trauma Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.97 billion

Revenue forecast in 2033

USD 3.32 billion

Growth rate

CAGR of 6.71% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Smith+Nephew; Arthrex, Inc.; DePuy Synthes (Johnson & Johnson); CONMED Corporation; Stryker; Globus Medical; Atreon Orthopedics; Zimmer Biomet; Osteocare Medical Pvt Ltd.; Auxein

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Foot And Ankle Trauma Market Report Segmentation

This report forecasts revenue growth and provides at the global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global foot and ankle trauma market report based on product, application, end use, and region:

-

Product Outlook (Revenue USD Million, 2021 - 2033)

-

Ankle Trauma

-

Fibula fixation and syndesmosis repair systems

-

Talus and calcaneus trauma plates

-

Pilon fracture fixation sets

-

Intramedullary nails

-

-

Application Outlook (Revenue USD Million, 2021 - 2033)

-

Ankle

-

Fibula & Syndesmosis

-

Talus

-

Calcaneus

-

Pilon (Distal Tibia)

-

Midfoot & Forefoot

-

Others

-

-

End Use Outlook (Revenue USD Million, 2021 - 2033)

-

Hospitals

-

Outpatient Facilities

-

Specialty Orthopedic Clinics

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.