- Home

- »

- Clothing, Footwear & Accessories

- »

-

Foot Orthotic Insoles Market Size And Share Report, 2030GVR Report cover

![Foot Orthotic Insoles Market Size, Share & Trends Report]()

Foot Orthotic Insoles Market (2023 - 2030) Size, Share & Trends Analysis Report By Material (Thermoplastic, Composite Carbon Fiber, Others), By Type (Pre-fabricated, Custom-made), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-321-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Foot Orthotic Insoles Market Summary

The global foot orthotic insoles market size was valued at USD 3.4 billion in 2022 and is projected to reach USD 5.78 billion by 2030, growing at a CAGR of 7.0% from 2023 to 2030. The rising geriatric population and a high incidence of diabetes and plantar fasciitis fuel the growth.

Key Market Trends & Insights

- North America accounted for around 44.1% of revenue share in 2022.

- U.S. healthcare system on quality of care and value-based services has led to a favorable environment for foot orthotics.

- By material, the thermoplastic segment accounted for a share of 56.0% in 2022.

- By type, the custom-made segment accounted for a share of 54.4% in 2022.

- By distribution channel, the hospitals and clinics segment held a share of 39.9% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 3.4 Billion

- 2030 Projected Market Size: USD 5.78 Billion

- CAGR (2023-2030): 7.0%

- North America: Largest market in 2022

According to the United Nations report, in 2019, the world population aged 65 and above reached 702.9 million and this number is expected to grow to 1,548.9 million by 2050. This is expected to create huge opportunities and demand for foot orthotic insoles.

Moreover, technological advancements due to high ongoing investments in R&D are expected to increase the growth potential of the market in the coming years. Moreover, online retailing is anticipated to facilitate consumer reach and product accessibility in the developing region, giving a boost to the industry’s growth over the forecast period.

The COVID-19 pandemic negatively impacted the industry. The pandemic and the associated restrictions and lockdowns affected overall sales of orthotics, including bracing and support products, which are largely driven by injuries, surgeries, and physician appointments. The COVID-19 outbreak impacted all the necessary activities for the sales of foot orthotic insoles. Over the forecast period, the market is expected to return and perform well with the increasing demand from the elderly population and patients.

Increasing demand for custom-made foot orthotics is fueling the growth. These materials are custom-made after a complete evaluation of the foot structure of the user. Tailor-made orthotics have clinically proven advantages over prefabricated ones in terms of better pain management and comfort. There is an increasing demand for 3D-printed orthotics among end-users.

These are thinner as compared to traditional ones, with increased gait efficiency and proprioception, which is boosting the market growth. Also, key players are continuously investing in R&D activities to produce more fit and comfortable insoles using 3D technologies. This is expected to offer increased opportunity in the global foot orthotic insoles market over the forecast period.

The increasing adoption of eco-friendly materials in manufacturing orthotic insoles is opening new avenues for growth. Favorable reimbursement policies in developed countries, growing investments by key industry players, and increased spending on research and development are expected to boost revenue in the coming years.

Many players are also keen on R&D in recycling thermoplastic materials to reduce the carbon footprint to adhere to the various norms and environmental policies. For instance, as published in November 2021, a team at Oxford University Hospital is focusing on significant sustainability improvements while making orthotic insoles and other products. The team has recycled more than 3.8 tons of thermoplastic since 2018.

The industry’s growth is restrained by the lower awareness about the product and treatment for foot pains, mostly in developing nations. In these nations, most of the people with pronation and supination of the foot arch are not aware of the treatment and have limited accessibility in the market. Prices of these foot orthotic insoles also tend to be at higher levels, further restraining the growth.

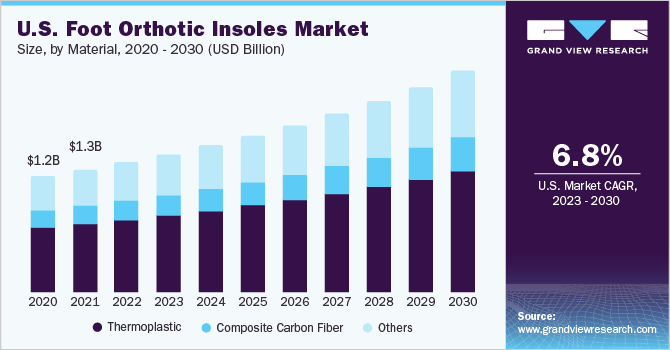

Material Insights

The thermoplastic segment accounted for a share of 56.0% in 2022 and is expected to witness a lucrative CAGR of 6.9% from 2023 to 2030. This is attributed to the associated benefits such as comfort and high durability provided by this material. Thermoplastic is a heat-molded form and is increasingly gaining popularity among people who take good care of their feet and those who need therapeutic support while walking. Rigid thermoplastics have limited use for geriatric patients with a high physiological reserve for patients with rigid feet. However, semi-rigid thermoplastic provides better pain tolerance to the geriatric population and is used for individuals suffering from biomechanical foot pain.

The composite carbon fibers segment is expected to grow at a significant CAGR of 7.4% over the forecast period. This is attributed to the increasing popularity of composite carbon fibers in the global market. Composite carbon fiber is known to exhibit high-performance and strong reinforcement polymer, which is a significant characteristic attributed to the increasing growth rate. Moreover, increasing company investment in R&D activities in composite carbon fiber is further expected to drive segmental growth over the forecast period.

Type Insights

The custom-made segment accounted for a share of 54.4% in 2022. The segment is expected to grow at a CAGR of 6.9% over the forecast period. High consumer preference for custom-made insoles is likely to account for the highest market share. These custom-made insoles provide maximum fit and comfort to patients with specific foot conditions.

The prefabricated segment is anticipated to witness a lucrative CAGR of 7.1% from 2023 to 2030. This is significantly attributed to the increasing consumer awareness about foot orthotic insoles among people with conditions such as plantar fasciitis, and foot arch problems. Increasing product placements and availability at the offline and online retail channels that offer the pre-fabricated foot orthotic insoles is also likely to give a boost and drive the growth of the segment.

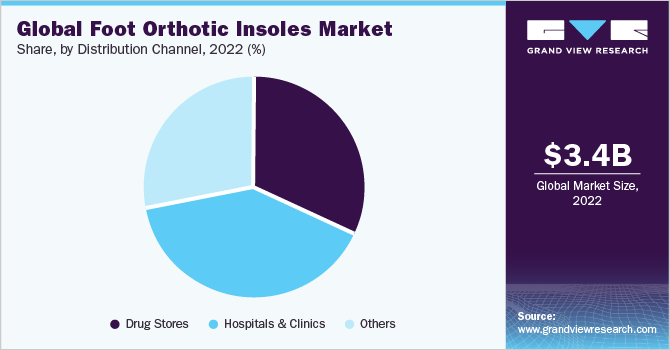

Distribution Channel Insights

The hospitals and clinics segment held a share of 39.9% in 2022. The segment is anticipated to grow at a CAGR of over 7.0% over the forecast period. This is significantly attributed to the fact that a significant share of the consumers is contributed by the patients and their preferences. These patients highly prefer hospitals and clinics for the purchase of foot orthotic insoles. Hospitals and clinics offer highly skilled and experienced personnel as well as proper infrastructure for the treatments and present trustworthy sales channels.

The drug stores segment is expected to exhibit a lucrative CAGR of 7.3% over the forecast period. The growth of the segment is significantly attributed to the expansion of medical and drug stores across the globe, mostly in developing regions. Also, various drug stores are increasingly offering foot orthotic insoles via this sales channel. Also, the second most trustworthy sales channel perceived by consumers tends to be drug stores. Consumer perception and increasing preference for the channel are likely to drive the growth of the segment.

Regional Insights

North America accounted for the largest revenue share in 2022 owing to the rising prevalence of diabetes in this region. In the global foot orthotic insoles, North America accounted for around 44.1% of revenue share in 2022. In addition, an increase in sports activities drives demand. Technological advancements due to high ongoing investments in R&D are expected to increase growth potential in the coming years.

The focus of the U.S. healthcare system on quality of care and value-based services has led to a favorable environment for foot orthotics. According to the Centers for Disease Control and Prevention, a total of 37.3 million people have diabetes, which accounts for the 11.3% of the U.S. population. Growing prevalence of conditions such as obesity, arthritis, and diabetes further support regional growth.

Asia Pacific is expected to witness a lucrative CAGR of 7.8% over the forecast period, attributed to the factors such as a high target population and technological advancements. In addition, improving health consciousness has benefitted the growth. The demand for prefabricated and custom insoles is significantly high in this region, due to the high incidence of chronic diseases such as musculoskeletal disorders and diabetes. Moreover, the adoption of the western sedentary lifestyle and eating habits are also expected to give rise to chronic diseases such as diabetes. This is likely to create the potential for regional growth.

Key Companies & Market Share Insights

The industry is marked by the presence of various small and large companies. The market is competitive in nature and is dominated by participants such as Superfeet Worldwide Inc.; Hanger; Bauerfeind AG; and Reckitt Benckiser Group PLC (Dr. Scholl’s). Key players are actively focused on R&D in the technique and material for optimum customer satisfaction and sustainability. For instance, 3D printing technology for orthotic insoles is being developed by various companies for various foot types and comfortable fitting.

-

In February 2022, Digital Orthotics Laboratories Australia Pty Ltd announced the launch of the iPhone scanning feature DOLA app that enables consumers to scan, counsel, and order orthotics.

-

In February 2022, Foot Solutions, a prominent retailer specializing in wellness footwear and custom orthotic insoles, has announced the acquisition of Happy Feet Plus, a Florida-based retailer.

Some of the key players operating in the market include:

-

Reckitt Benckiser Group PLC

-

Hanger Inc.

-

Ottobock SE & Co. KGaA

-

Össur hf

-

Algeo Limited

-

Bauerfeind AG

-

Groupe Gorge

-

Colfax Corporation

-

Superfeet Worldwide Inc

-

Materialise NV

-

Blatchford Group Limited

Foot Orthotic Insoles Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.58 billion

Revenue forecast in 2030

USD 5.78 billion

Growth Rate

CAGR of 7.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Malaysia; Australia; South Africa; Brazil

Key companies profiled

Reckitt Benckiser Group PLC; Hanger Inc.; Ottobock SE & Co. KGaA; Össur hf; Algeo Limited; Bauerfeind AG; Groupe Gorge; Colfax Corporation; Superfeet Worldwide Inc; Materialise NV; Blatchford Group Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Foot Orthotic Insoles Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the foot orthotic insoles market on the basis of material, type, distribution channel, and region.

-

Material Outlook (Revenue, USD Million; 2017 - 2030)

-

Thermoplastic

-

Composite Carbon Fiber

-

Others

-

-

Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Pre-fabricated

-

Custom-made

-

-

Distribution Channel Outlook (Revenue, USD Million; 2017 - 2030)

-

Drug Stores

-

Hospitals & Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Malaysia

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global foot orthotic insoles market size was estimated at USD 3.36 billion in 2022 and is expected to reach USD 3.58 billion in 2023.

b. The global foot orthotic insoles market is expected to grow at a compound annual growth rate of 7.0% from 2023 to 2030 to reach USD 5.78 billion by 2030.

b. North America dominated the foot orthotic insoles market with a share of 44.1% in 2022. This is attributable to rising consumer awareness regarding physical fitness.

b. Some key players operating in the foot orthotic insoles market include Dr. Scholl’s (Bayer), Acor Orthopedic, Inc., Aetrex Worldwide, Inc., Algeo Limited, Amfit Inc., Arden Orthotics Ltd., and Bauerfeind AG.

b. Key factors that are driving the market growth include the rising geriatric population and increasing demand for custom-made foot orthotics worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.