- Home

- »

- Agrochemicals & Fertilizers

- »

-

Forage Seed Market Size, Share And Trends Report, 2030GVR Report cover

![Forage Seed Market Size, Share & Trends Report]()

Forage Seed Market (2024 - 2030) Size, Share & Trends Analysis Report, By Breeding Technology, (Hybrids, Open Pollinated Varieties & Hybrid Derivatives), By Crop (Alfalfa, Forage Sorghum), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-416-5

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Forage Seed Market Size & Trends

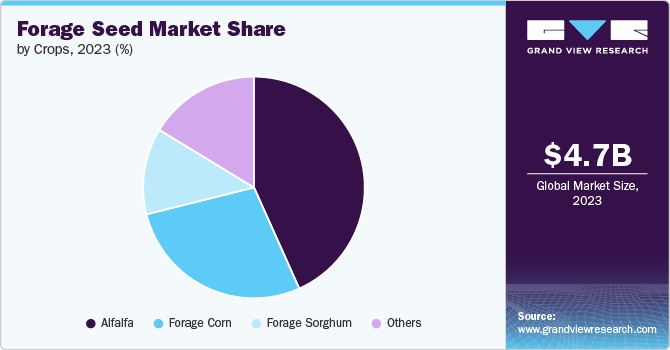

The global forage seed market size was estimated at USD 4.71 billion in 2023 and is projected to grow USD 6.19 billion by 2030, growing at a CAGR of 4.0% from 2024 to 2030. Owing to the demand for high-quality seeds used in livestock feed is experiencing significant growth, primarily driven by the increasing global livestock population. As the demand for meat and dairy products rises, farmers are seeking effective ways to enhance the nutritional value of animal feed.

Another key factor contributing to this demand is the growing emphasis on sustainable agricultural practices and soil health improvement. Farmers are increasingly recognizing the benefits of integrating these crops into their farming systems, as they not only provide essential nutrients for livestock but also enhance soil fertility and structure. This dual benefit is particularly important in regions facing challenges such as soil degradation and climate change. The rising awareness of the importance of sustainable farming practices is encouraging more farmers to invest in these crops, further driving market demand.

Additionally, socio-economic factors play a crucial role in shaping the market landscape. The shift in consumer preferences towards organic and natural animal products is influencing farmers to adopt high-quality seeds that align with these trends. As consumers become more health-conscious and environmentally aware, the demand for organic meat and dairy products is expected to rise. This shift is prompting livestock producers to seek out seeds that not only improve animal health but also contribute to the overall sustainability of their farming operations, thereby reinforcing the growth trajectory of the market.

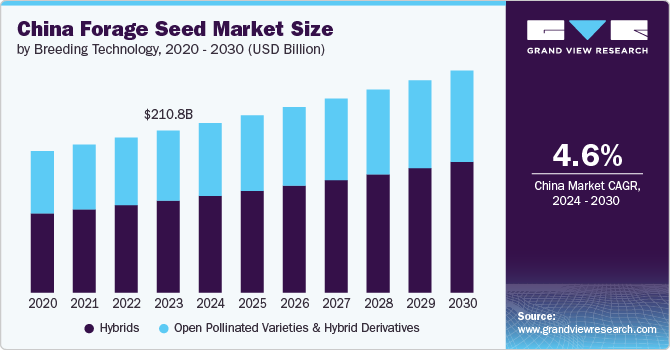

In China, the demand for high-quality seeds used for livestock feed is on the rise, driven by the country's growing livestock population and the increasing consumption of meat and dairy products. According to China's Development Plans for Adjustment of Crop Farming Structure, the area dedicated to these crops is projected to reach 6.3 million hectares, with a significant portion allocated to corn silage. This shift is essential as quality seeds are crucial for enhancing the nutritional value of animal feed, which directly impacts the yield of milk and meat production. However, domestic production of these seeds has not kept pace with demand, leading China to become the largest importer of such seeds in the Asia-Pacific region, primarily sourcing from the U.S.

Globally, the market for seeds used in livestock feed is expanding rapidly. This growth is fueled by the increasing demand for organic and high-nutritional animal feeds, as consumers become more health-conscious and environmentally aware. The rise in livestock numbers, coupled with a growing appetite for protein-rich meat products, is driving farmers to seek out superior seed varieties that can enhance feed quality and yield. Regions such as North America and Europe are leading the market, with North America accounting for a significant share due to its advanced agricultural practices and high livestock production

Breeding Technology Insights

Open pollinated varieties & hybrid derivatives technology dominated the market with a revenue share of 42.9% in 2023. The demand for open-pollinated varieties and hybrid derivatives in the seed market is driven by the need for genetic diversity and adaptability in changing agricultural conditions. Open-pollinated seeds are known for their ability to produce plants that are true to type, allowing farmers to save seeds for future planting without losing quality. This characteristic is particularly appealing to small-scale and organic farmers who prioritize sustainability and cost-effectiveness.

On the other hand, hybrid technology is experiencing significant growth due to its potential for higher yields and improved disease resistance. Hybrids dominate the market as they are engineered to maximize productivity and feed value, which is crucial for meeting the increasing global demand for livestock feed. The livestock population is expanding, necessitating the use of high-yielding varieties to ensure sufficient feed supply. This trend is particularly evident in regions like North America and Asia, where advancements in breeding technology are leading to the development of hybrids that can adapt to various environmental conditions and provide better returns on investment for farmers.

Crop Insights

Alfalfa crop dominated the market with a revenue share of 43.3% in 2023.The demand for alfalfa is increasing, particularly in regions where dairy farming is expanding. This growth is supported by the adoption of high-yielding varieties and government initiatives aimed at promoting forage cultivation. Alfalfa is highly sought after by dairy farmers due to its high protein content and nutritional quality. It can be harvested 10-12 times per season, making it a valuable crop for livestock feed.

Forage corn is currently the largest segment in the forage seed market, primarily due to its high digestibility and nutritional value for livestock. It is extensively used for producing corn fodder, hay, and silage. In the Asia Pacific region, forage corn has a significant market presence, driven by its role in meeting the nutritional needs of livestock and its adaptability to different farming systems.

The forage seed market in the Asia Pacific region is witnessing robust growth, with alfalfa, forage corn, and forage sorghum playing pivotal roles. Alfalfa leads in demand due to its nutritional benefits and adaptability, while forage corn remains the largest segment due to its digestibility and high yield. Forage sorghum is emerging as a strong contender, particularly in drought-prone areas, contributing to the diversification of forage options available to farmers.

Region Insights

North America Forage Seed Market Trends

The rising consumption of meat and dairy products is significantly boosting the demand for forage crops. As livestock farmers seek to enhance productivity, the need for high-quality forage seeds becomes critical.

Asia Pacific Forage Seed Market Trends

Asia Pacific dominated the market segment with a revenue share of 15.60% in 2023. The Asia Pacific forage seed market is poised for robust growth, driven by the increasing demand for high-quality animal feed and the dominance of hybrid seed varieties. As the region continues to expand its livestock production, the forage seed market will play a crucial role in meeting the nutritional needs of livestock while addressing challenges related to production and sustainability.

China forage seed market is poised for significant growth, driven by the increasing demand for quality forage in the livestock sector. With a focus on hybrid seed adoption and technological advancements, the market is likely to evolve, addressing both domestic needs and import dependencies.

Europe Forage Seed Market Trends

Forage corn is the largest crop in the European forage seed market, driven by increasing demand from dairy farmers and the growing production of biogas. Germany stands out as the leading producer of forage corn.

Key Forage Seed Company Insights

Some of the key players operating in the market include

-

Bayer AG is a prominent German multinational corporation headquartered in Leverkusen, Germany. Founded in 1863 by Friedrich Bayer and Johann Friedrich Weskott, the company has evolved into one of the largest pharmaceutical and biotechnology firms globally. Bayer operates primarily in the fields of healthcare and agriculture, with a diverse portfolio that includes pharmaceuticals, consumer health products, agricultural chemicals, seeds, and biotechnology products.

-

Ampac Seed Company is a prominent supplier of high-quality turf and forage seeds, based in Tangent, Oregon. Established over 20 years ago, the company has built a reputation for providing improved turfgrass genetics and a comprehensive range of seed products tailored for various applications, including residential lawns, sports fields, and wildlife habitats.

Key Forage Seed Companies:

The following are the leading companies in the forage seed market. These companies collectively hold the largest market share and dictate industry trends.

- Advanta Seeds – UPL

- Ampac Seed Company

- Bayer AG

- Corteva Agriscience

- DLF

- KWS SAAT SE & Co. KGaA

- Land O’Lakes Inc.

- RAGT Group

- Royal Barenbrug Group

- S&W Seed Co.

Recent Developments

-

In March 2023, PGG Wrightson Seeds is the development of the GT07 phalaris variety. This new variety is designed to exhibit market potential, especially in response to the challenges posed by Australia's changing climate. The development of GT07 was achieved through collaboration with the CSIRO's breeding program, highlighting the company's commitment to innovation and sustainability in agriculture.

-

In March 2023, In a strategic move to enhance its market presence in the UK, Barenbrug has entered into an agreement to acquire Watson Group, a well-established seed specialist in the UK. This acquisition is expected to bolster Barenbrug's growth in the grass-seed marketplace, particularly in Scotland, where Watson Group has a strong foothold.

Forage Seed Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.89 billion

Revenue forecast in 2030

USD 6.19 billion

Growth rate

CAGR of 4.0% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Breeding technology, crop, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan, South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Advanta Seeds - UPL; Ampac Seed Company; Bayer AG; Corteva Agriscience; DLF; KWS SAAT SE & Co. KGaA; Land O’Lakes Inc.; RAGT Group; Royal Barenbrug Group; S&W Seed Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

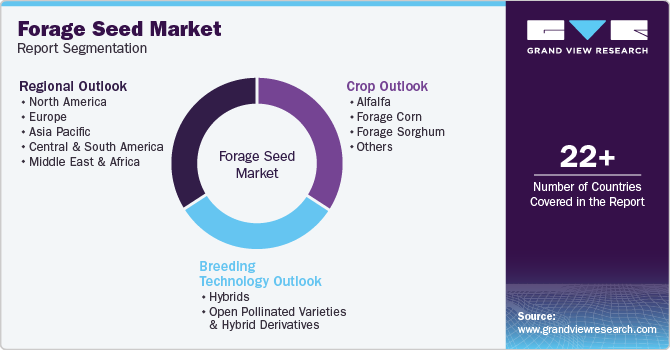

Global Forage Seed Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global forage seed market report based on breeding technology, crop, and region.

-

Breeding Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Hybrids

-

Open Pollinated Varieties & Hybrid Derivatives

-

-

Crop Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Alfalfa

-

Forage Corn

-

Forage Sorghum

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global forage seed market was valued at USD 4.71 billion in 2023 and is expected to reach USD 4.89 billion in 2024.

b. The global forage seed market was valued at USD 4.78 billion in 2023 and is projected to reach USD 6.19 billion by 2030, growing at a CAGR of 4.0% from 2024 to 2030

b. Asia Pacific dominated the market segment with a revenue share of 15.60% in 2023. The Asia Pacific forage seed market is poised for robust growth, driven by the increasing demand for high-quality animal feed and the dominance of hybrid seed varieties.

b. Some key players operating in the forage seed market include Advanta Seeds – UPL, Ampac Seed Company, Bayer AG, Corteva Agriscience, DLF, KWS SAAT SE & Co. KGaA, Land O’Lakes Inc., RAGT Group, Royal Barenbrug Group, S&W Seed Co

b. Key factors that are driving the market growth include the demand for high-quality seeds used in livestock feed is experiencing significant growth, primarily driven by the increasing global livestock population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.