- Home

- »

- Advanced Interior Materials

- »

-

Force And Torque Measurement Equipment Market, 2033GVR Report cover

![Force And Torque Measurement Equipment Market Size, Share & Trends Report]()

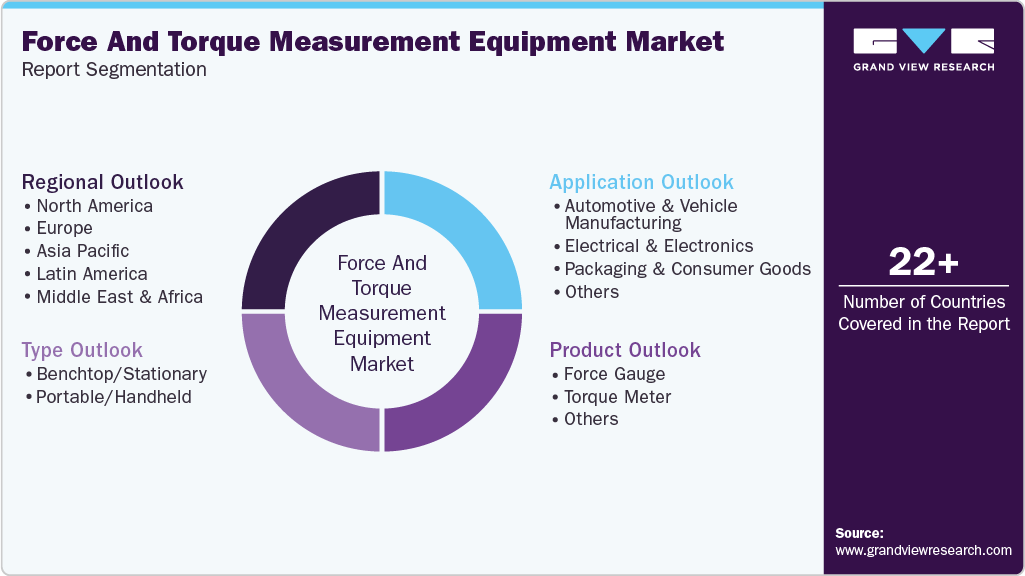

Force And Torque Measurement Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Force Gauge, Torque Meter), By Type (Benchtop/Stationary, Portable/Handheld), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-814-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Force And Torque Measurement Equipment Market Summary

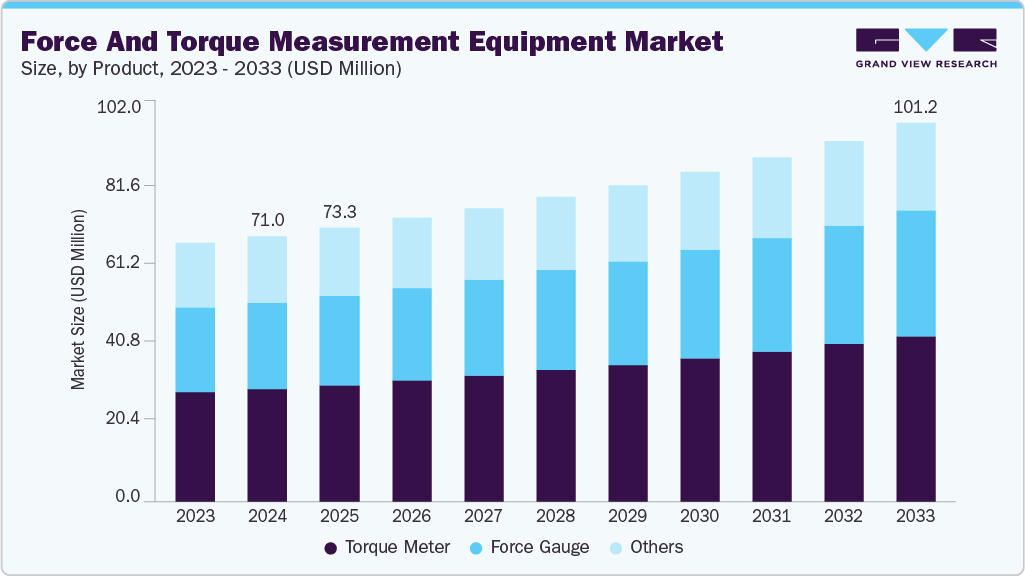

The global force and torque measurement equipment market size was estimated at USD 71.0 million in 2024 and is projected to reach USD 101.2 million by 2033, growing at a CAGR of 4.1% from 2025 to 2033. The industry is primarily driven by rising automation across the manufacturing, automotive, and packaging industries.

Key Market Trends & Insights

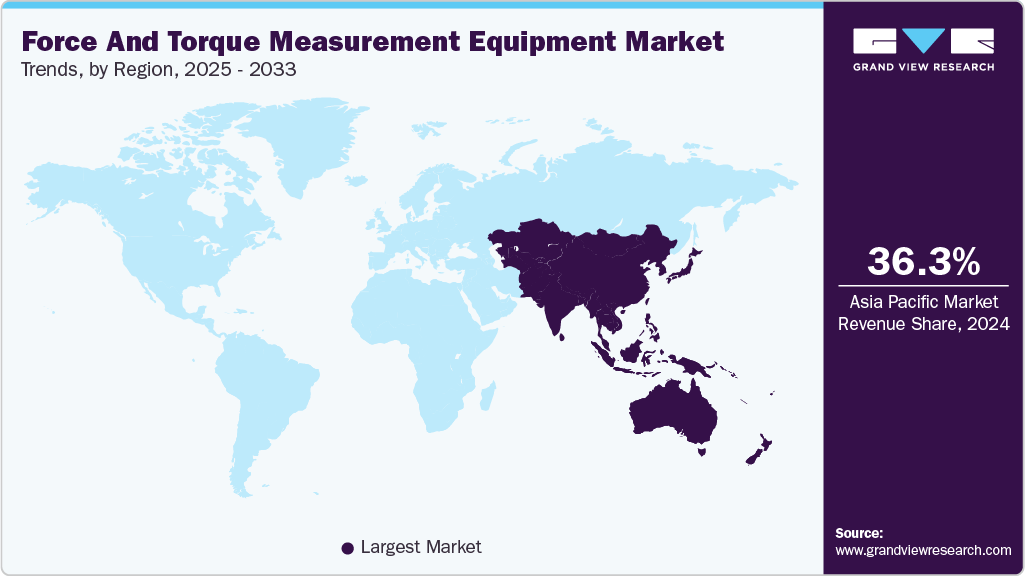

- Asia Pacific dominated the force and torque measurement equipment market with the largest revenue share of 36.3% in 2024.

- The force and torque measurement equipment market in the U.S. is expected to grow at a substantial CAGR of 4.4% from 2025 to 2033.

- By product, the torque meter segment is expected to grow at a considerable CAGR of 4.5% from 2025 to 2033 in terms of revenue.

- By type, the portable/handheld segment is expected to grow at a considerable CAGR of 4.3% from 2025 to 2033 in terms of revenue.

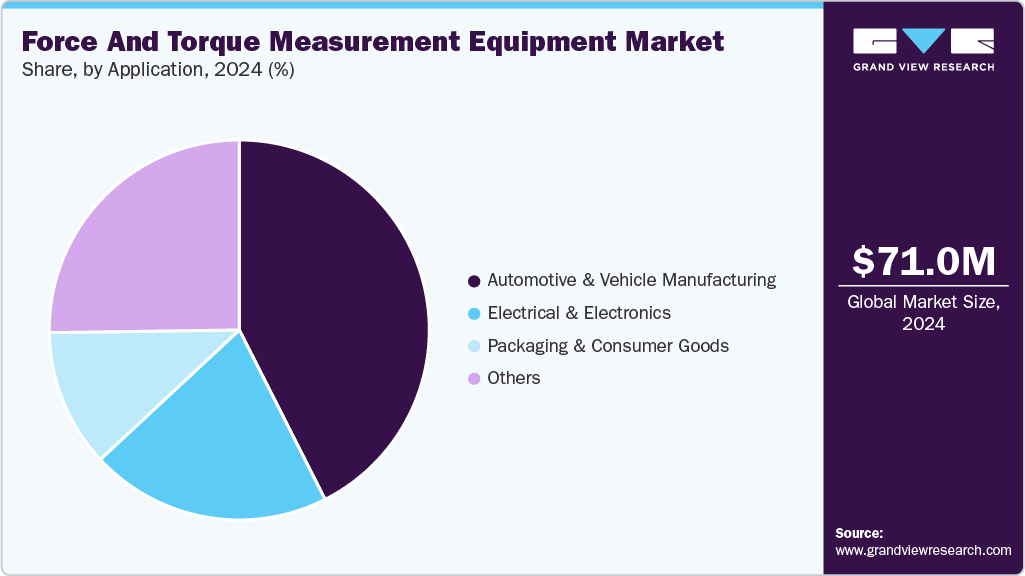

- By application, the automotive and vehicle manufacturing segment is expected to grow at a considerable CAGR of 4.6% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 71.0 Million

- 2033 Projected Market Size: USD 101.2 Million

- CAGR (2025-2033): 4.1%

- Asia Pacific: Largest market in 2024

- Asia Pacific: Fastest growing region

Industries are increasingly integrating precision measurement systems to ensure higher accuracy, improved product consistency, and reduced operational errors. The growing shift toward smart factories and digitalized quality-control processes further supports adoption.

Another key driver is the growing emphasis on safety compliance, product testing, and regulatory standards across critical sectors. Automotive crash testing, medical device validation, and industrial calibration requirements are becoming increasingly stringent, driving the deployment of high-accuracy measurement equipment. The rise of EV manufacturing, which requires precise torque control for motors and battery assembly, also fuels market expansion. Moreover, technological advancements such as miniaturized sensors and wireless torque tools continue to strengthen overall market growth.

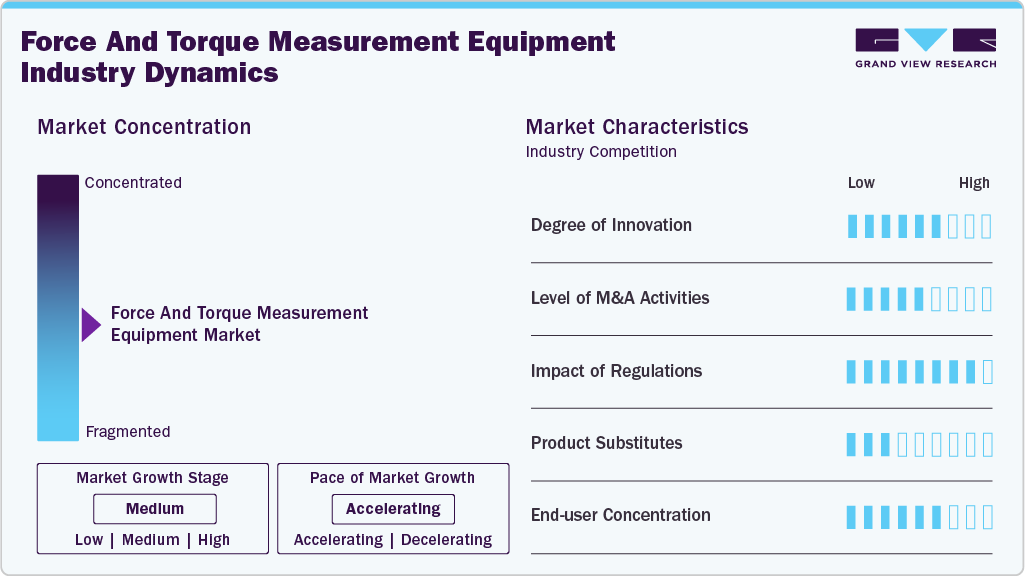

Market Concentration & Characteristics

The force and torque measurement equipment industry is moderately fragmented, with a mix of established international players and several specialized regional manufacturers. While leading companies hold strong technological capabilities and brand credibility, no single vendor dominates the entire landscape. Competitive intensity remains high as firms differentiate through sensor precision, digital integration, and customized testing solutions.

The industry is marked by continuous innovation, driven by the need for higher accuracy, faster response times, and integration with smart factory systems. Advancements in miniaturized sensors, wireless torque tools, and multi-axis force measurement are reshaping product capabilities. Manufacturers are also embedding analytics and IoT connectivity for real-time monitoring. This steady flow of technological upgrades keeps competition dynamic and pushes vendors to differentiate through performance and digital intelligence.

Regulatory standards in automotive testing, aerospace certification, medical device validation, and industrial safety strongly influence product development. Manufacturers must comply with strict calibration, traceability, and quality-assurance norms, which increases the emphasis on precision measurement. These regulations drive companies to invest in advanced metrology and robust testing frameworks. As compliance requirements tighten globally, demand for reliable force and torque measurement equipment continues to rise.

The customer base is diverse, spanning automotive, aerospace, manufacturing, robotics, and healthcare industries. However, high-volume demand is concentrated in the automotive and industrial automation sectors, where force and torque accuracy directly impact production output. These sectors frequently adopt advanced testing systems, creating stable long-term demand. While new applications are emerging, the market still relies heavily on these core end-user groups for recurring growth.

Drivers, Opportunities & Restraints

The growing automation in manufacturing, robotics, and automotive assembly is boosting the need for precise force and torque measurement systems. The shift toward electric vehicles and lightweight materials increases testing requirements across motors, fasteners, and structural components. Advancements in sensor accuracy, multi-axis capabilities, and wireless measurement tools further accelerate the adoption of these technologies. In addition, quality control mandates in aerospace, medical devices, and industrial safety continue to drive organizations toward high-performance metrology equipment.

Expanding Industry 4.0 adoption presents strong opportunities for smart, IoT-enabled sensing solutions that support predictive maintenance and real-time analytics. Emerging applications in collaborative robots, battery technology, and semiconductor manufacturing are opening new demand pockets for ultra-precise sensors. Growth in the Asia Pacific’s industrial base provides room for localized equipment suppliers to scale. The rising focus on automated testing labs and digital calibration services further enhances long-term market potential.

High equipment costs and complex calibration requirements limit adoption among small and mid-scale manufacturers. Sensor performance may also face challenges in extreme temperatures, vibration-heavy environments, or rapidly changing load conditions. Limited interoperability between legacy systems and modern digital platforms can slow integration. Moreover, economic uncertainty and delayed capital expenditures in industrial sectors may temporarily restrain investment in new measurement technologies.

Product Insights

Force gauge segment is expected to grow at a significant CAGR of 4.2% from 2025 to 2033 in terms of revenue. Torque meters continue to dominate the market as the segment accounted for a share of 42.4% in 2024. The dominance arises in the wake of industries placing stronger emphasis on fastening accuracy, motor efficiency, and drivetrain reliability. Their widespread use in automotive assembly, power tools, and industrial machinery consistently maintains high demand. The rise of EV manufacturing further strengthens their role, as electric motors and battery systems require precise torque validation. Besides, advanced digital and wireless torque meters are becoming standard in automated production lines, reinforcing their market leadership.

Force gauges are experiencing significant growth due to their increasing adoption in material testing, packaging validation, and quality inspection processes. Their versatility across tensile, compression, and push-pull measurements makes them a preferred choice in diverse lab and production environments. Compact digital force gauges are gaining traction in electronics, medical devices, and consumer goods, where precise measurements on a small scale are essential. Rising investments in R&D testing and portable measurement tools continue to accelerate the segment’s expansion.

Type Insights

Benchtop/Stationary segment is expected to grow at a moderate CAGR of 3.8% from 2025 to 2033 in terms of revenue. Portable and handheld measurement devices dominate the market, accounting for a 63.2% share in 2024, due to their flexibility, ease of use, and suitability for on-site inspections. Industries prefer these compact tools for quick diagnostics, assembly-line checks, and field testing where mobility is essential. Their lower cost and simple calibration requirements make them accessible for both large and small manufacturers. Growing demand for real-time, point-of-use measurement continues to strengthen their leadership in the market.

Benchtop and stationary systems are growing rapidly as sectors such as aerospace, medical devices, and materials research require higher precision and controlled testing environments. These systems support advanced load capacities, automated test setups, and detailed analytics, making them ideal for R&D labs and certification processes. The push for more repeatable and standardized testing methods is driving wider adoption. As product development cycles become more complex, demand for stable, high-accuracy benchtop equipment continues to accelerate.

Application Insights

Electrical & electronics segment is expected to grow at a significant CAGR of 4.4% from 2025 to 2033 in terms of revenue. The automotive and vehicle manufacturing sector dominates the market, accounting for a share of 42.5% in 2024, as force and torque measurement tools are essential for engine calibration, fastening verification, and component durability testing. The shift toward electric vehicles has further intensified demand for precise torque control in motors, batteries, and powertrain assemblies. Automated production lines in this sector rely heavily on high-accuracy torque meters and force sensors to maintain quality and safety standards. Continuous investments in advanced manufacturing strengthen this segment’s leading position.

The electrical and electronics segment is growing rapidly due to rising demand for precision testing in connectors, switches, micro-components, and assembly processes. Miniaturization trends require equipment capable of measuring very low forces with exceptional accuracy. Consumer electronics manufacturing increasingly depends on force gauges and micro-torque sensors to ensure reliability and product consistency. Expansion of semiconductor packaging, device testing, and small-form-factor assemblies continues to accelerate growth in this segment.

Regional Insights

The force and torque measurement equipment industry in North America is growing at a significant CAGR of 4.3% over the forecast period, driven by advanced automotive R&D, aerospace testing, and strong adoption of high-precision metrology systems. The push toward electrification and autonomous vehicles is increasing the need for accurate force and torque validation. The presence of leading technology developers also enhances innovation and product upgrades. Additionally, strict regulatory and safety standards continue to drive market demand.

U.S. Force and Torque Measurement Equipment Market Trends

The U.S. force and torque measurement equipment industry dominates the North American market due to its advanced manufacturing base, strong automotive R&D, and leadership in aerospace testing. High adoption of automated quality-control systems drives strong demand for precision force and torque equipment. The presence of major sensor and metrology companies further accelerates innovation and product deployment. Strict federal safety and calibration standards also reinforce steady market growth.

The force and torque measurement equipment industry in Mexico is growing rapidly as it expands its automotive and electronics manufacturing capabilities, attracting significant foreign investment. Increasing production of vehicles, components, and consumer electronics fuels demand for accurate measurement tools. The shift toward more automated assembly processes is boosting the adoption of torque meters and force gauges. As quality requirements become increasingly stringent, manufacturers in Mexico are upgrading to more advanced testing and calibration solutions.

Europe Force And Torque Measurement Equipment Market Trends

The force and torque measurement equipment industry in Europe is experiencing solid growth, driven by its strong engineering base, particularly in the automotive, aerospace, and industrial machinery sectors. The region’s emphasis on quality assurance and sustainability encourages the adoption of advanced testing and calibration tools. Germany, the UK, and Italy remain major contributors due to their high manufacturing intensity. Continuous investments in EV platforms and automation technologies further boost the market.

The Germany force and torque measurement equipment industry dominates the European market owing to its strong engineering heritage and high concentration of automotive and industrial machinery manufacturers. The country’s focus on precision engineering and rigorous quality standards fuels strong demand for advanced force and torque measurement systems. Leading OEMs and R&D centers rely heavily on high-accuracy testing equipment for product validation. Continuous investments in EV platforms and automation further reinforce Germany’s leadership position.

The force and torque measurement equipment industry in the UK is growing steadily as its manufacturing sector adopts more sophisticated testing and calibration technologies. Expansion in aerospace, automotive components, and advanced materials strengthens the need for precision measurement tools. The country’s increasing emphasis on digital manufacturing and automation supports the wider deployment of equipment. Rising investments in innovation hubs and engineering R&D continue to drive uptake of force and torque measurement solutions.

Asia Pacific Force And Torque Measurement Equipment Market Trends

The force and torque measurement equipment industry in the Asia Pacific is a dominant market, capturing 36.3% share in 2024, owing to its extensive manufacturing ecosystem spanning automotive, electronics, and industrial automation. The rapid expansion of smart factories in China, Japan, South Korea, and India boosts the adoption of precision measurement tools. The region benefits from high production volumes, lower equipment integration costs, and strong investments in quality control. The growing adoption of EV manufacturing and robotics further reinforces its leadership position.

The China force and torque measurement equipment industry dominates the Asia Pacific market due to its massive manufacturing capacity across the automotive, electronics, and industrial machinery sectors. The country’s rapid expansion of smart factories and robotics integration drives strong adoption of force and torque measurement equipment. High production volumes and continuous upgrades in quality-control systems further accelerate demand. Government support for EV development and advanced manufacturing also reinforces China’s dominant position.

The force and torque measurement equipment industry in India is growing quickly as its automotive, electronics, and industrial automation sectors expand and modernize. The increasing focus on quality assurance and tighter compliance requirements is prompting manufacturers to adopt more accurate testing tools. Rising investments in EV components, precision engineering, and R&D labs are boosting equipment demand. As the country accelerates its shift toward digitalized and automated production, the uptake of force and torque measurement systems continues to rise.

Middle East & Africa Force And Torque Measurement Equipment Market Trends

The force and torque measurement equipment industry in the Middle East & Africa region is experiencing emerging growth, driven by industrial diversification and rising investments in manufacturing and testing infrastructure. Government-led industrialization programs are fostering demand for modern quality-control tools. Although still developing, the region shows strong long-term potential as technology adoption accelerates.

The Saudi Arabia force and torque measurement equipment industry is experiencing strong growth as it accelerates industrial diversification under national development programs. Expanding manufacturing activities in sectors such as automotive parts, oilfield equipment, and industrial machinery are driving demand for precise force and torque measurement tools. Investments in quality-control infrastructure and advanced testing laboratories are becoming increasingly common in new industrial zones. As the country pushes toward higher production standards and technological modernization, the adoption of accurate measurement equipment continues to rise.

Latin America Force And Torque Measurement Equipment Market Trends

The force and torque measurement equipment industry in Latin America is gradually expanding as industries modernize production lines and adopt more reliable testing equipment. Automotive assembly in Brazil and Argentina plays a key role in driving demand for torque and force measurement tools. The increased focus on product quality and compliance is encouraging manufacturers to upgrade their metrology systems. Growth in electronics and consumer goods production also supports market development.

The Brazil force and torque measurement equipment industry is witnessing steady growth as its automotive, machinery, and consumer goods industries increase investments in quality assurance and modern testing technologies. Rising production volumes and the expansion of local manufacturing facilities are boosting demand for reliable force and torque measurement tools. The country’s shift toward greater automation and standardized testing practices supports wider adoption. As industrial modernization progresses, Brazil continues to strengthen its position as a key growth market in Latin America.

Key Force And Torque Measurement Equipment Company Insights

Some of the key players operating in the market include Hottinger Brüel & Kjær, Kistler Group, and Interface Inc.

-

Hottinger Brüel & Kjær specializes in precision measurement technologies that support complex test setups across automotive, aerospace, and industrial applications. The company is known for delivering high-accuracy force and torque solutions tailored for dynamic testing environments. Its systems often integrate seamlessly with advanced data acquisition platforms to streamline analysis. HBK focuses on improving measurement repeatability and operational efficiency in demanding R&D workflows. The brand is widely chosen for projects requiring dependable metrology under variable load conditions.

-

Kistler Group provides high-performance force, torque, and pressure measurement systems designed for applications that demand exceptional accuracy and stability. The company emphasizes sensor technologies that perform reliably under high-speed, multi-axis, or rapidly changing load scenarios. Its equipment is engineered to support advanced manufacturing optimization, crash testing, and industrial automation tasks. Kistler’s solutions often incorporate smart data capabilities for deeper process insight. The brand is recognized for enabling precise measurement control in mission-critical engineering environments.

Key Force And Torque Measurement Equipment Companies:

The following are the leading companies in the force and torque measurement equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Hottinger Brüel & Kjær

- Kistler Group

- Interface, Inc.

- MTS Systems

- FUTEK Advanced Sensor Technology, Inc.

- PCB Piezotronics, Inc.

- Novanta Inc.

- PPT Group

- IMADA Co., Ltd.

- NORBAR TORQUE TOOLS LTD.

- AMETEK. Inc.

- TE Connectivity

- Gefran S.p.A.

- Sushma Industries Pvt. Ltd.

- Flintec

Recent Developments

-

In September 2025, Kistler introduced an expanded ISO 17025-accredited torque calibration service capable of handling measurements up to 100,000 N·m. The service supports both Kistler and third-party devices, offering low measurement uncertainty for high-precision needs. This upgrade benefits sectors such as automotive, aerospace, and medical technology. Overall, it enhances access to reliable and traceable torque calibration capabilities.

Force And Torque Measurement Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 73.3 million

Revenue forecast in 2033

USD 101.2 million

Growth rate

CAGR of 4.1% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Hottinger Brüel & Kjær; Kistler Group; Interface Inc.; MTS Systems; FUTEK Advanced Sensor Technology Inc.; PCB Piezotronics Inc.; Novanta Inc.; PPT Group; IMADA Co. Ltd.; Norbar Torque Tools Ltd.; AMETEK Inc.; TE Connectivity; Gefran S.p.A.; Sushma Industries Pvt. Ltd.; Flintec.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Force And Torque Measurement Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global force and torque measurement equipment market report based on product, type, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Force Gauge

-

Torque Meter

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Benchtop/Stationary

-

Portable/Handheld

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive and Vehicle Manufacturing

-

Electrical & Electronics

-

Packaging & Consumer Goods

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global force and torque measurement equipment market size was estimated at USD 71.0 million in 2024 and is expected to be USD 73.3 million in 2025.

b. The global force and torque measurement equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2033 to reach USD 101.2 million by 2033.

b. Asia Pacific is a dominant market and accounted for the 36.3% share, owing to its extensive manufacturing ecosystem spanning automotive, electronics, and industrial automation. Rapid expansion of smart factories in China, Japan, South Korea, and India boosts the adoption of precision measurement tools.

b. Some of the key players operating in the global force and torque measurement equipment market include Hottinger Brüel & Kjær, Kistler Group, Interface Inc., MTS Systems, FUTEK Advanced Sensor Technology Inc., PCB Piezotronics Inc., Novanta Inc., PPT Group, IMADA Co. Ltd., Norbar Torque Tools Ltd., AMETEK Inc., TE Connectivity, Gefran S.p.A., Sushma Industries Pvt. Ltd., and Flintec.

b. The market is driven by rising automation in manufacturing, automotive, and robotics, which increases the need for precise measurement tools. Growing quality-control requirements and stricter safety standards across industries further boost adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.