- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Fortified Wine Market Size, Share & Growth Report, 2030GVR Report cover

![Fortified Wine Market Size, Share & Trends Report]()

Fortified Wine Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Port Wine, Vermouth, Sherry), By Distribution Channel (Pub, Bars & Restaurants, Internet Retailing, Liquor Stores, Supermarkets), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-929-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fortified Wine Market Size & Trends

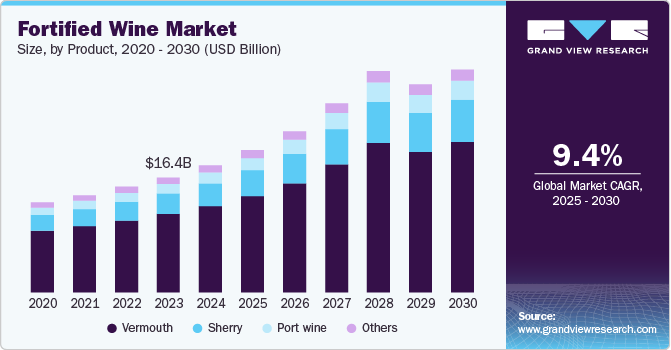

The global fortified wine market size was estimated at USD 18.11 billion in 2024 and is projected to grow at a CAGR of 9.4% from 2025 to 2030. This can be credited to the health benefits offered and the premiumization of wine products. Moreover, technological advancement and development in manufacturing and innovation in flavors are accelerating market growth over the forecaste period. The rising consumption and demand for alcoholic drinks in various special events are further supporting the industry's growth. The consumption of the product is considered social recognition, which in turn will drive industry growth during the forecast timeline. In addition, various health benefits are associated with the consumption of fortified wine. However, the increased taxation on wine in several nations and stringent government rules and regulations are hindering the growth of the market during the forecast period.

Moreover, the increasing investment in R&D by various manufacturers to produce innovative products of fortified wine across the globe is creating opportunities for the market over the upcoming years. However, government guidelines in countries such as the U.S., Germany, the UK, China, and India are expected to maintain the quality of fortified wine products. Recently, the Food Safety and Standards Authority of India (FSSAI) has framed and notified the alcoholic beverages standard regulations 2018 for the manufacturing and labeling of wine.

Product Insights

The port wine market accounted for 67.9% of the global revenue for 2024. The increasing use of vermouth wine as an antiseptic and medicinal drug to treat cold and viral diseases is expected to drive market growth. The rising demand for dessert wine from European countries like the UK, Germany, France, and Italy has projected market growth during the forecast period.

The sherry wine market is anticipated to grow at a CAGR of 10.2% from 2025 to 2030. The increasing popularity of sherry wine among western consumers as a drink during dinner to keep the body warm has led to an upsurge in this segment. Various health benefits of sherry wine, such as maintaining cholesterol and antioxidants, avoiding hypothermia, and many others, have projected the growth of this segment during the forecast period.

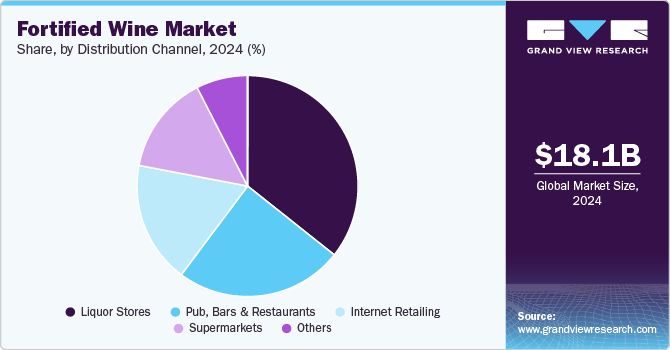

Distribution Channel Insights

Sales of fortified wine through liquor stores accounted for a share of 35.7% in 2024. The increasing number of liquor stores across the globe is driving the market. Various manufacturers are selling their products through offline channels, which is propelling the growth of the segment. In addition, easy access to diverse products through stores is likely to drive the segment growth. Liquor stores are expected to remain dominant in the forecast period due to improved distribution channel networks across the globe.

Sales of fortified wine through internet retailing are anticipated to grow with a CAGR of 10.0% over the forecast period. Owing to the internet penetration rate, the e-commerce sector's rising adoption among consumers has witnessed lucrative growth in recent years. Several manufacturers are offering alcoholic products on their websites and e-commerce platforms, which, in turn, will drive industry demand.

Regional Insights

The fortified wine market in North America accounted for a share of 25.2% of the global revenue in 2024. The market is driven by a growing interest in premium alcoholic beverages, especially among millennials and young professionals. The U.S. stands out as the largest market in the region, with increased demand for wines with higher alcohol content and flavor diversity. The growing number of specialty wine shops and a rise in at-home consumption due to lifestyle changes have also contributed to market expansion.

U.S. Fortified Wine Market Trends

The fortified wine market in the U.S. is projected to grow at a CAGR of 9.5% from 2025 to 2030. The market is experiencing steady growth due to increasing consumer preference for premium products and innovative wine offerings. While traditional fortified wines like sherry and port remain popular, there is a rising demand for new flavors and varieties. This trend is supported by the growing craft alcohol movement, along with an increase in wine-tasting events and a shift toward online alcohol purchases.

Europe Fortified Wine Market Trends

The fortified wine market in Europe is projected to grow at a CAGR of 9.5% from 2025 to 2030. Europe is one of the largest and most established markets for fortified wines, with countries like Spain, Portugal, and Italy being key producers. Fortified wine is deeply rooted in European culture, particularly in the Mediterranean regions. Despite market maturity, there is a resurgence in the popularity of these wines among younger generations, driven by a renewed appreciation for classic, high-quality products.

The fortified wine market in the UK accounted for a share of 13.6% of Europe's revenue in 2024. The UK has a strong tradition of consuming fortified wines, particularly port and sherry, which are often enjoyed during festive seasons. Recently, there has been a renewed interest in fortified wines, with consumers exploring a broader range of brands and flavors. The rise of premiumization and interest in heritage products is driving market growth, along with an increase in wine festivals and tastings.

Germany fortified wine market is projected to grow at a CAGR of 9.1% from 2025 to 2030. In Germany, fortified wine consumption is gradually rising, with a growing interest in sweet and dessert wines. The market is primarily driven by consumers seeking premium and imported wines, as well as those who appreciate high-alcohol-content beverages. While Germany is more focused on beer and white wine, fortified wines are gaining popularity, particularly in the urban and cosmopolitan areas.

Asia Pacific Fortified Wine Market Trends

The fortified wine market in Asia Pacific accounted for a share of 19.6% of the global revenue in 2024. The Asia Pacific region is an emerging market for fortified wine, with increasing demand driven by changing consumer preferences and rising disposable incomes. China and Japan are leading this growth, with consumers seeking premium and imported products. Western influence, along with a growing wine culture, is pushing demand for fortified wines, especially in upscale restaurants and bars.

The fortified wine market in China accounted for a share of 30.8% of the Asia Pacific market in 2024. China's fortified wine market is experiencing rapid growth due to the country’s expanding middle class and rising interest in premium wines. Imported fortified wines are particularly popular among urban consumers, and the market is seeing a rise in wine education programs that introduce consumers to international varieties. Fortified wines, such as port and sherry, are becoming increasingly accessible in China’s major cities.

Japan fortified wine market is projected to grow at a CAGR of 9.9% from 2025 to 2030. Japan has a growing fortified wine market, driven by the nation’s appreciation for premium alcoholic beverages. Fortified wines are gaining traction among Japanese consumers who enjoy rich, full-bodied flavors. Although the market is niche compared to sake and beer, fortified wine consumption is increasing in urban areas, especially among younger adults and those interested in international wines.

Latin America Fortified Wine Market Trends

The fortified wine market in Latin America is projected to grow at a CAGR of 9.7% from 2025 to 2030.The market is still developing, with Brazil and Argentina being key emerging markets. Local wine production in these countries is primarily focused on table wines, but there is a growing segment of consumers interested in fortified varieties, particularly among younger generations and expatriates. The market is expected to expand as consumers explore more diverse alcoholic options.

Middle East & Africa Fortified Wine Market

The fortified wine market in the Middle East & Africa is projected to grow at a CAGR of 1.6% from 2025 to 2030.The Middle East region remains niche due to cultural and religious restrictions on alcohol consumption in several countries. However, in markets like South Africa, fortified wines are gaining popularity, driven by the country’s wine-making tradition and increasing interest in premium and artisanal products. This trend is especially prominent in urban centers with higher expatriate populations and tourism activities.

Key Fortified Wine Company Insights

The market is becoming increasingly fragmented with the rise of boutique wineries and craft producers that are challenging the dominance of large players. These smaller brands often focus on offering unique fortified wine varieties, experimenting with flavors, and targeting niche consumer segments. The growing trend toward premiumization—with consumers seeking high-quality, artisanal products—has provided these boutique players with opportunities to carve out market share. At the same time, larger producers are responding by expanding their premium product lines and engaging in the acquisitions of smaller, innovative brands to diversify their portfolios.

Global players in the fortified wine market are also competing through distribution channels, with many focusing on expanding their online sales platforms to reach a broader audience. The rise of e-commerce in alcohol sales has allowed producers to engage directly with consumers, offering curated wine selections and subscription services. In addition, companies are increasingly investing in brand storytelling and heritage marketing to resonate with millennial consumers who value authenticity and tradition in their wine choices.

Key Fortified Wine Companies:

The following are the leading companies in the fortified wine market. These companies collectively hold the largest market share and dictate industry trends.

- E. & J. Gallo Winery

- Constellation Brands, Inc.

- Treasury Wine Estates

- Trinchero Family Estates

- Deutsch Family Wine & Spirits

- The Wine Group

- Liberty Wines Limited

- Precept Wine, LLC

- Michelle Wine Estate

- Backsberg

- Sogevinus Fine Wines SL (Kopke)

- Taylor's Port

- Albina & Hanna

Recent Developments

- In February 2024, Sokol Blosser Winery launched its first collection of fortified wines. The White Aperitif offers bright notes of tart lemon, tropical pineapple, and honeydew melon, accented with a hint of anise and the Red Aperitif presents with anise, dark cherry, pomegranate, and warm mulled wine and is closer to a bitter amaro-style aperitif than a sweet vermouth.

Fortified Wine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.26 billion

Revenue forecast in 2030

USD 31.80 billion

Growth rate

CAGR of 9.4% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea, Australia, Brazil; Argentina; South Africa

Key companies profiled

E. & J. Gallo Winery; Constellation Brands, Inc.; Treasury Wine Estates; Trinchero Family Estates; Deutsch Family Wine & Spirits; The Wine Group; Liberty Wines Limited; Precept Wine, LLC; Michelle Wine Estate; Backsberg; Sogevinus Fine Wines SL (Kopke); Taylor's Port; Albina & Hanna

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fortified Wine Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the fortified wine market based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Port wine

-

Vermouth

-

Sherry

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Pub, Bars & Restaurants

-

Internet Retailing

-

Liquor Stores

-

Supermarkets

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fortified wine market size was estimated at USD 18.11 billion in 2024 and is expected to reach USD 20.26 billion in 2025.

b. The global fortified wine market is expected to grow at a compound annual growth rate of 9.4% from 2025 to 2030 to reach USD 31.80 billion by 2030.

b. Europe dominated the fortified wine market, with a share of 46.4% in 2024. This is attributable to rising awareness about the health benefits of fortified wine consumption and growing demand for flavored wine.

b. Some key players operating in the fortified wine market include E. & J. Gallo Winery; Constellation Brands, Inc.; Treasury Wine Estates; Trinchero Family Estates; Deutsch Family Wine & Spirits; The Wine Group; Liberty Wines Limited; Precept Wine, LLC; Michelle Wine Estate; Backsberg; Sogevinus Fine Wines SL (Kopke); Taylor's Port; and Albina & Hanna.

b. Key factors that are driving the fortified wine market growth include rising consumption and demand for alcoholic drinks in various special events along with technological advancement and development in the manufacturing and innovation in flavors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.