- Home

- »

- Next Generation Technologies

- »

-

Free Ad-supported Streaming TV Market Size Report, 2033GVR Report cover

![Free Ad-supported Streaming TV Market Size, Share & Trends Report]()

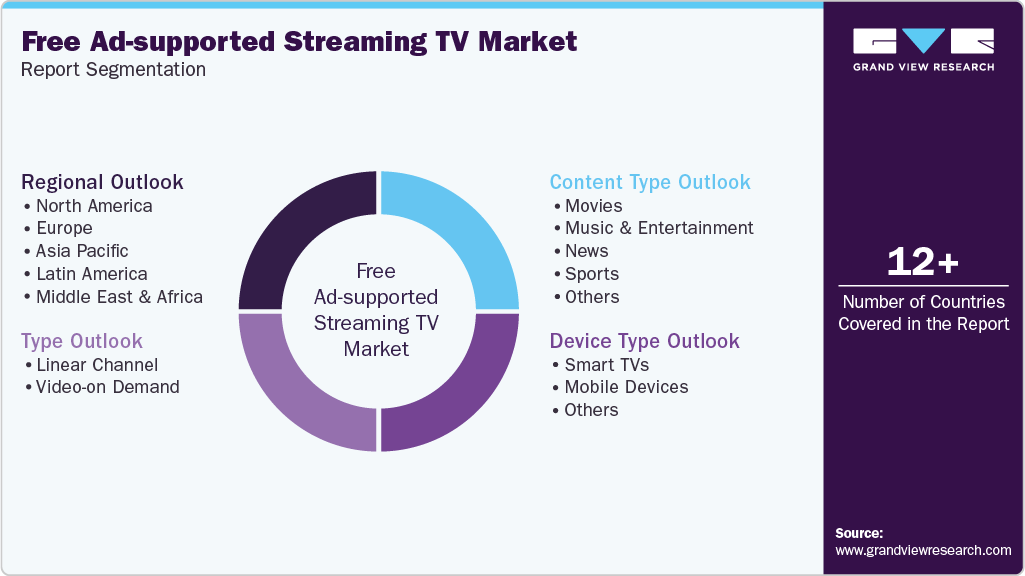

Free Ad-supported Streaming TV Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Linear Channel, Video-on-demand), By Device Type (Smart TVs, Mobile Devices), By Content Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-420-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Free Ad-supported Streaming TV Market Summary

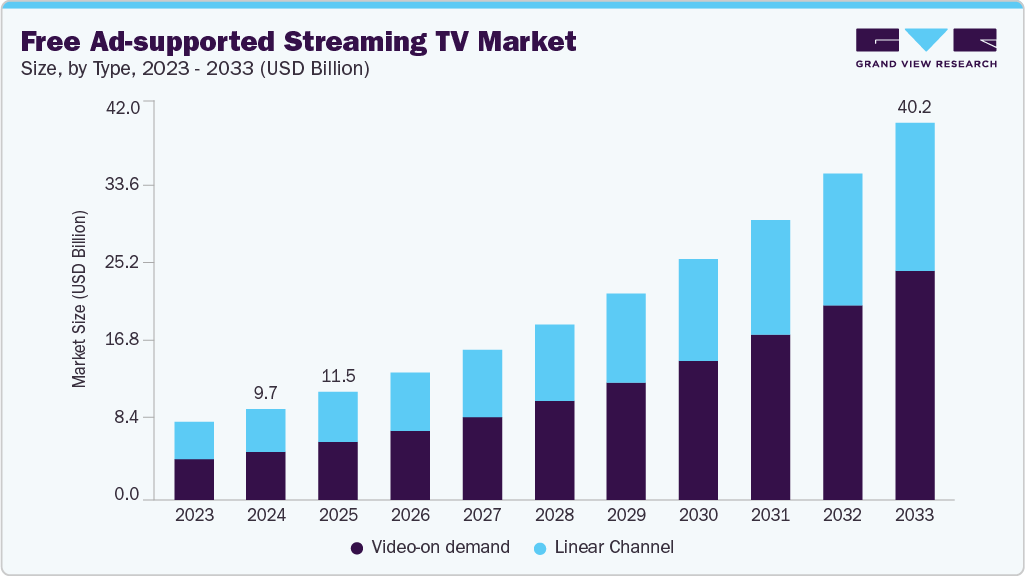

The global free Ad-supported streaming TV market size was estimated at USD 9.73 billion in 2024 and is projected to reach USD 40.20 billion by 2033, growing at a CAGR of 16.9% from 2025 to 2033. This growth is driven by increasing consumer demand for cost-effective entertainment, rising adoption of smart TVs and connected devices, expansion of digital advertising expenditure, and the entry of major streaming platforms offering ad-supported tiers.

Key Market Trends & Insights

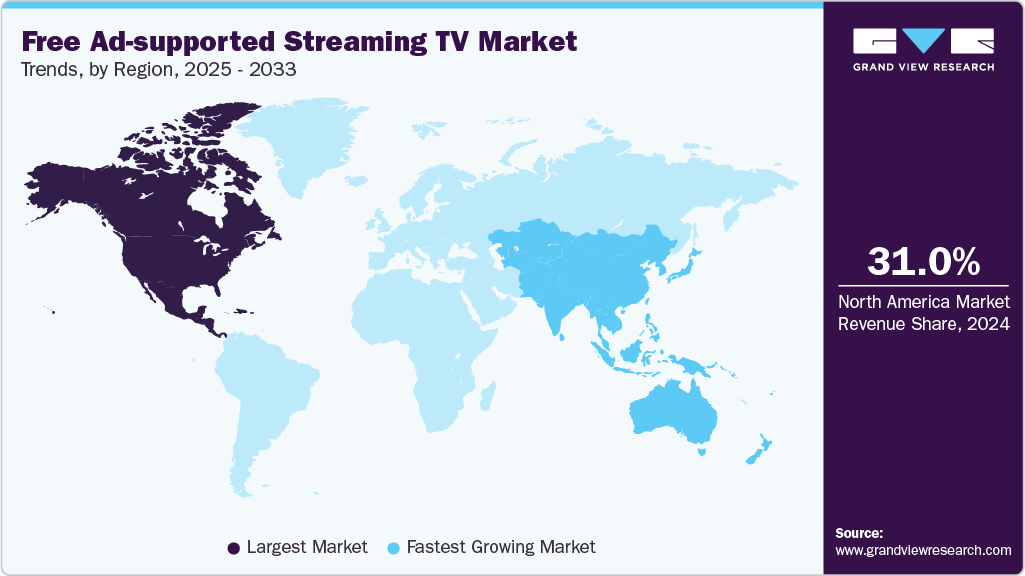

- North America dominated the global free Ad-supported streaming TV market with the largest revenue share of over 31% in 2024.

- The free Ad-supported streaming TV market in the U.S. led the North America market and held the largest revenue share in 2024.

- By type, the video-on-demand segment is expected to grow at the fastest CAGR during the forecast period.

- By device type, the smart TV segment is expected to grow at the highest CAGR over the forecast period.

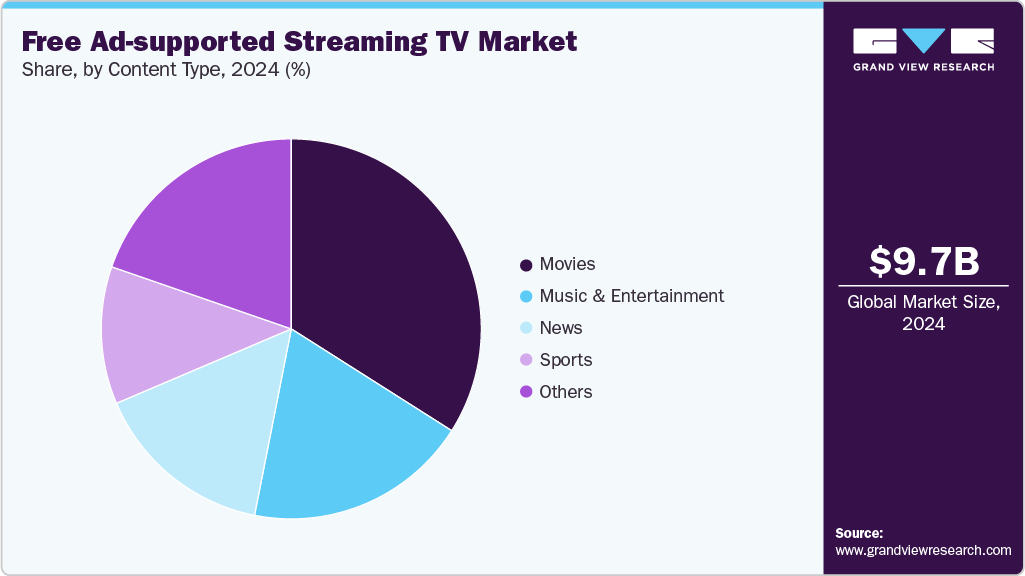

- By content type, the sports segment is expected to grow at the highest CAGR over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 9.73 Billion

- 2033 Projected Market Size: USD 40.20 Billion

- CAGR (2025-2033): 16.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Consumers are increasingly seeking affordable alternatives to traditional cable and subscription-based streaming services. Rising living costs and economic uncertainty are accelerating the adoption of free, ad-supported platforms. These services offer access to a wide range of content without monthly fees, making them particularly appealing to price-sensitive audiences. Advertisers benefit from larger, engaged viewership as consumers shift to free streaming channels. This trend positions FAST platforms as a sustainable growth segment in the digital entertainment ecosystem.FAST platforms are increasingly investing in a broad range of content, including live TV, movies, series, and niche programming. Curated channels and genre-specific offerings attract targeted demographics, enhancing viewer retention. Partnerships with independent studios and international content providers enrich the content library, appealing to multicultural audiences. Data-driven insights allow platforms to optimize programming based on engagement metrics. Diversification of content ensures both higher viewer engagement and better monetization opportunities for advertisers.

The demand for advertisers is rapidly shifting toward digital video and streaming platforms, driven by the need for measurable ROI and precise audience targeting capabilities. Free ad-supported streaming TV (FAST) services offer premium ad inventory at a lower cost than traditional television, appealing to both major brands and small to medium-sized enterprises. The integration of programmatic advertising enables real-time bidding and personalized ad placements, enhancing overall monetization opportunities. Rising advertising investments are also stimulating innovation in content creation and platform functionality. As a result, FAST platforms are emerging as strategic and influential channels within the modern advertising landscape.

Type Insights

The linear channel segment significantly contributed to market growth in 2024, accounting for over 46% of global revenue, driven by growing consumer preference for a traditional, lean-back viewing experience within digital streaming environments. The format’s curated, scheduled programming reduces content selection fatigue and encourages longer viewing sessions, resulting in higher engagement levels. This structured model also offers advertisers consistent ad inventory and predictable placement opportunities, maximizing visibility and return on investment. Major FAST providers, such as Pluto TV, Samsung TV Plus, and Xumo, have expanded their channel portfolios across various genres, including news, sports, and entertainment, to attract a broader audience. As a result, the linear channel segment continues to serve as a key driver of user retention and advertising revenue within the evolving FAST market.

The video-on-demand segment is expected to grow at the fastest CAGR during the forecast period, propelled by the success of platforms such as Tubi, Pluto TV, and The Roku Channel, which provide extensive movies, series, and original programming at no cost to viewers. As consumers experience subscription fatigue, the attractiveness of free, ad-supported content continues to rise. Tubi, for example, has effectively combined linear streaming with on-demand viewing, enabling users to switch seamlessly between continuous programming and specific content selections. Furthermore, the VOD segment within FAST platforms is gaining momentum through advancements in targeted advertising, significantly enhancing revenue opportunities for content providers. By leveraging audience data and behavioral insights, advertisers can deliver more relevant and personalized ads, driving higher engagement and improved monetization outcomes.

Device Type Insights

The mobile devices segment accounted for a significant market revenue share in 2024, driven by the increasing consumption of on-the-go entertainment and the widespread availability of high-speed mobile internet. Smartphones and tablets have become primary access points for streaming, particularly among younger demographics who seek flexibility and convenience. FAST platforms are optimizing their mobile applications with adaptive streaming, personalized recommendations, and interactive ad formats to enhance the viewing experience. The rise in 5G connectivity further supports high-quality, low-latency video delivery, encouraging longer watch times and higher engagement. Consequently, the mobile devices segment is emerging as a key growth driver, expanding audience reach and creating new monetization avenues for advertisers and content providers within the FAST ecosystem.

Smart TV is expected to grow at the highest CAGR over the forecast period, driven by the seamless integration of streaming capabilities directly into television hardware. The widespread adoption of smart TVs has eliminated the need for external devices, making it easier for consumers to access FAST channels and on-demand content. Manufacturers such as Samsung, LG, and Vizio are enhancing user interfaces and partnering with FAST service providers to deliver pre-installed apps and personalized content recommendations. This integration has improved accessibility, increased viewership, and expanded advertising reach. As a result, the smart TVs segment continues to be a major growth driver, fueling audience expansion and strengthening monetization opportunities across the FAST ecosystem.

Content Type Insights

The movies segment accounted for the largest market revenue share in 2024, fueled by increasing partnerships between streaming platforms and major studios to secure exclusive film libraries. Platforms are leveraging data analytics to curate personalized movie recommendations, enhancing viewer engagement and retention. High-quality, genre-diverse content attracts both mass and niche audiences, making the segment a key magnet for advertising revenue. As a result, the movies segment remains a primary growth driver, expanding monetization opportunities and solidifying the strategic value of FAST platforms in the digital entertainment ecosystem.

The sports segment is expected to grow at the highest CAGR over the forecast period, owing to increasing consumer demand for live and on-demand sports content across digital platforms. The rise in FAST services, which offer exclusive sports channels and event coverage, is attracting highly engaged audiences. Advertisers are capitalizing on this trend by placing targeted campaigns during high-viewership events, enhancing monetization potential. Moreover, partnerships between streaming platforms and sports leagues are expanding content availability, making the sports segment a key driver of audience growth and revenue in the FAST market.

Regional Insights

The North America free Ad-supported streaming TV market is anticipated with a revenue share of over 31.0% in 2024, driven by high digital adoption and the presence of major industry players such as Pluto TV, Tubi, and The Roku Channel. The region’s mature advertising ecosystem and widespread smart TV penetration continue to support audience expansion. Consumers are increasingly shifting from paid subscriptions to free, ad-supported options, enhancing advertiser reach and platform monetization. As a result, North America remains the dominant and most established market for FAST services worldwide.

U.S. Free Ad-supported Streaming TV Market Trends

The free Ad-supported streaming TV market in the U.S. is expected to grow significantly in 2024, fueled by increasing demand for cost-effective entertainment amid subscription fatigue. Major media companies and tech platforms are launching dedicated FAST channels to capitalize on growing viewership. Advancements in targeted and programmatic advertising are further strengthening monetization potential for both advertisers and content owners. Consequently, the U.S. continues to lead the global FAST landscape in terms of innovation, ad revenue generation, and content diversity.

Europe Free Ad-supported Streaming TV Market Trends

The free Ad-supported streaming TV market in Europe is expected to grow significantly over the forecast period, supported by rising adoption of connected TVs and increasing availability of localized FAST channels. Broadcasters and media companies are forming partnerships with streaming platforms to extend content distribution and ad-based monetization. Markets such as the UK, Germany, and France are at the forefront, benefiting from established digital advertising ecosystems. This regional expansion is driving stronger audience engagement and providing new revenue opportunities for advertisers targeting European consumers.

Asia Pacific Free Ad-supported Streaming TV Market Trends

The free Ad-supported streaming TV market in the Asia Pacific is anticipated to register the highest CAGR of over 19% during the forecast period, driven by rapid internet penetration, growing smartphone usage, and increasing preference for free digital content. Regional players are expanding localized FAST offerings to cater to diverse linguistic and cultural audiences. The rise of 5G networks and affordable smart devices is further enhancing streaming accessibility across emerging economies such as India, Indonesia, and the Philippines. With strong audience growth potential, the Asia Pacific is poised to become the fastest-growing region in the global FAST market.

Key Free Ad-supported Streaming TV Company Insights

Some key companies in the Free Ad-supported Streaming TV industry are Pluto TV, Tubi TV, The Roku Channel, Peacock TV, and Sling TV.

-

Pluto TV, owned by Paramount Global, is one of the leading Free Ad-Supported Streaming TV (FAST) platforms, offering a wide selection of live and on-demand channels across various genres, including news, sports, entertainment, and lifestyle. The service provides curated linear channels and a growing library of movies and series, available without subscription fees. Its monetization model is primarily ad-driven, leveraging advanced targeting tools to enhance advertiser returns. Pluto TV’s strong global expansion strategy and partnerships with major content providers have solidified its position as a pioneer in the FAST market.

-

The Roku Channel, operated by Roku, Inc., is a leading FAST platform integrated into Roku’s streaming devices and smart TV ecosystem. It offers a mix of live linear channels, on-demand movies, and exclusive Roku Originals, all supported by advertising revenue. Roku’s platform advantage allows seamless integration of content, distribution, and ad inventory across millions of connected devices. With strong advertiser relationships and user analytics, The Roku Channel remains a key driver of engagement and ad monetization in the FAST market.

Key Free Ad-supported Streaming TV Companies:

The following are the leading companies in the free Ad-supported streaming TV market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon.com, Inc.

- Crackle

- Peacock TV LLC

- Plex

- Pluto TV

- Roku, Inc.

- Sling TV

- Tubi TV

- Vudu

- Xumo, Inc.

Recent Developments

-

In August 2025, Hisense launched Hisense Channels, a Free Ad-Supported Streaming TV (FAST) service featuring over 200 premium channels, powered by Xumo Enterprise. The service is now available on Hisense Google TVs and will expand to additional smart TVs soon. Xumo Enterprise, the B2B arm of Xumo, provides the infrastructure and monetization capabilities for the platform. Hisense Channels offers content from leading publishers, including Scripps, Radial Entertainment, and Stingray, aiming to enhance the streaming experience for viewers.

-

In July 2025, Zee5 announced a strategic partnership with Amagi Media Labs to launch its Free Ad-Supported Streaming Television (FAST) service in India. Scheduled for an August debut, the service aims to offer a traditional TV-like viewing experience with a variety of content genres, including comedy, drama, and horror, available for free with advertisements. This move is designed to strengthen Zee5's presence in the rapidly growing connected TV market, which is projected to expand at an annual rate of 12.67% from 2025 to 2030. By entering the FAST sector, Zee5 aims to diversify its revenue streams and enhance its competitiveness against established players such as The Roku Channel and Plex.

-

In February 2025, Samsung TV Plus India expanded its Free Ad-Supported Streaming TV (FAST) offerings by launching five exclusive channels in collaboration with Warner Bros. Television. These channels, House of Crime, Foodie Hub, Wild Flix, Wheel World, and XXtreme Jobs, are designed to engage both regional and urban audiences, with a strong focus on Hindi-language programming. The partnership addresses the growing demand for high-quality, free entertainment accessible via Samsung Smart TVs and mobile devices. This strategic initiative reinforces Samsung TV Plus’s commitment to enhancing viewer choice and delivering value to advertisers within the competitive FAST market.

Free Ad-supported Streaming TV Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.50 billion

Revenue forecast in 2033

USD 40.20 billion

Growth rate

CAGR of 16.9% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, device type, content type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Amazon.com,Inc.; Crackle; Peacock TV LLC; Plex; Pluto TV; Roku, Inc.; Sling TV; Tubi TV; Vudu; Xumo, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Free Ad-supported Streaming TV Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global free Ad-supported streaming TV market report based on type, device type, content type, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Linear Channel

-

Video-on Demand

-

-

Device Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Smart TVs

-

Mobile Devices

-

Others

-

-

Content Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Movies

-

Music & Entertainment

-

News

-

Sports

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global free ad-supported streaming TV market size was estimated at USD 9.73 billion in 2024 and is expected to reach USD 11.50 billion in 2025.

b. The global free ad-supported streaming TV market is expected to grow at a compound annual growth rate (CAGR) of 16.9% from 2025 to 2033, reaching USD 40.20 billion by 2033.

b. North America dominated the FAST market, accounting for over 31% share in 2024. This is attributable to the fact that consumers are increasingly seeking free entertainment options due to rising living costs and subscription fatigue, making FAST services an attractive alternative to traditional cable and paid streaming platforms in this region.

b. Some key players operating in the free ad-supported streaming TV (FAST) market include: Amazon.com,Inc., Crackle, Peacock TV LLC, Plex, Pluto TV, Roku, Inc., Sling TV, Tubi TV, Vudu, Xumo, Inc.

b. Key factors that are driving the market growth include rising consumer preference for free content, increasing adoption of connected TVs and smart devices, expanding advertiser interest in targeted ad formats, and the growing availability of diverse, on-demand content libraries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.