- Home

- »

- Consumer F&B

- »

-

Avocado Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Avocado Market Size, Share & Trends Report]()

Avocado Market (2024 - 2030) Size, Share & Trends Analysis Report By Form (Fresh, Processed), By Distribution Channel (B2B, B2C), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-929-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Avocado Market Summary

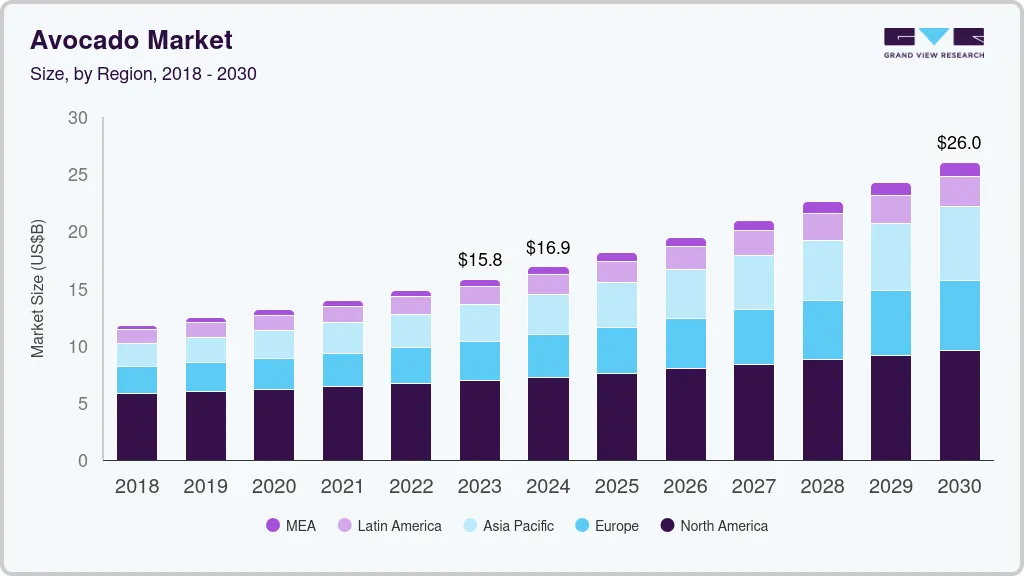

The global avocado market size was valued at USD 15.83 billion in 2023 and is projected to reach USD 26.04 billion by 2030, growing at a CAGR of 7.4% from 2024 to 2030. Increasing focus on a healthy lifestyle and a growing number of buyers for healthy food products are impelling market growth.

Key Market Trends & Insights

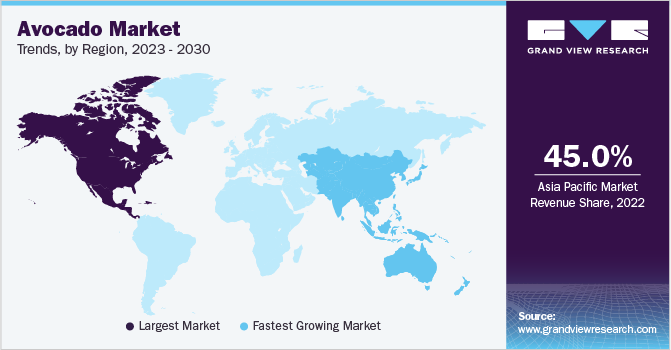

- North America dominated the market revenue share in 2022, accounting for 45.0% of the total revenue.

- Asia Pacific is forecast to grow with a significant CAGR of 10.4% from 2023 to 2030.

- By form, the fresh form accounted for the highest revenue share of 78.1% in 2022.

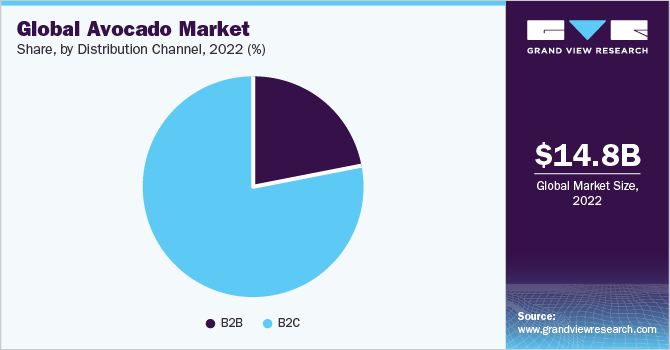

- By distribution channel, the B2B segment is anticipated to witness a prominent growth rate of 8.3% during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 15.83 Billion

- 2030 Projected Market Size: USD 26.04 Billion

- CAGR (2024-2030): 7.4%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Moreover, increasing awareness about nutritional values, a growing middle-class population, and rising import demand is expected to boost industry growth. Advanced markets for processed avocados are also estimated to drive industry growth. The COVID-19 pandemic has adversely affected the market in various regions.The market for avocados has been affected by the pandemic, majorly due to the closure of the hospitality industry consisting of hotels, restaurants, and cafes. However, staying at home due to various government guidelines and lockdown scenarios drew more awareness and attention from consumers toward healthy eating. In addition, consumers' preferences also shifted to homemade and self-prepared meals made from fresh fruits and vegetables. Since avocados are high in nutrients, consumers started excluding processed foods such as instant noodles and pizza and started incorporating healthy foods such as avocados. Initially, a huge loss of plants occurred in the nurseries due to the non-circulation of producers and farmers owing to quarantine.

The increased popularity of nutritious snacks among millennials due to the increased health consciousness is expected to bolster the demand in the upcoming years. According to an article published by Yahoo Finance in August 2019, about 80% of millennials bought avocados more than once in 2018, while 77% of non-millennials made repeat purchases. Furthermore, the year-round availability of avocados due to imports in the U.S. has increased its consumption, which is expected to support the positive outlook over the forecast period.

In recent years, consumers have been opting for snacks referred to as superfoods, including high levels of mono-saturated fat, potassium, fiber, folate, essential vitamins, and minerals. Hence, manufacturers are innovating existing avocado-based snacks to relaunch them in different flavors for consumers. For instance, in November 2020, Earnest Eats launched a new snacking line made with frozen slices of real avocado seasoned with sea salt and spices. The new line of avocado snacks is available in three flavors: Sea Salt, Sea Salt Lime, and Roasted Chipotle. Such innovations will provide consumers with options to choose from according to their tastes and preferences, which is expected to support market growth in the coming years.

The growing popularity of high-nutrients food has been boosting the adoption of avocados worldwide. According to a survey conducted by Tetra Pak in February 2021, consumers prefer avocado-based snacks with attributes such as healthy (56%), nutritious (51%), high in protein (40.8%), and calcium content (41.2%). The rising trend of snacking is also expected to boost the market globally in the coming years. In addition, rising urbanization, deployment of modern retail, and developments in the cold chain have increased product penetration.

The consumption of avocados varies considerably across the globe. Avocados are a primary source of protein for millennials who intentionally or not-skip their meals. Furthermore, countries with a large working population and time constraints are opting for avocado-based snacks. India, China, Brazil, Turkey, South Africa, Italy, Germany, the U.S., and Russia are among the leading consumers of such snacks.

Form Insights

The fresh form accounted for the highest revenue share of 78.1% in 2022. Global manufacturers are using new technologies in production as a result of the rising demand for raw fruit. The popularity of fresh avocados among consumers can be attributed to the growing consumption of fresh foods and easy product availability. The high fiber content of fresh form helps with digestion, prevents constipation, maintains the health of the gastrointestinal tract, and reduces the risk of colon cancer.

Although processed avocados are gaining popularity, avocados are mainly eaten in their fresh form. The rising disposable income levels and changing lifestyles are also among the major factors driving the growth of this segment. Consumers don’t have to worry about wastage or unusable fruit with processed products. Additionally, according to an April 2022 article in The Produce News, vegetarian salads account for 67.4% of the global packaged salad market, attributed to the desire for protein-enriched salads. Innovative new product launches and flavor possibilities in the category fuel the demand for processed fresh avocados.

Distribution Channel Insights

The B2B segment is anticipated to witness a prominent growth rate of 8.3% during the forecast period. The B2B segment includes the processing industry and foodservice industries. Avocado continues to gain popularity owing to its nutritional value. Due to rising health consciousness, particularly among the young population, consumers are increasingly opting for nutritious food in the form of sandwiches, salads, and healthy chips such as avocado chips at cafés and restaurants.

Additionally, several cafes are capitalizing on the work from café trend. An increasing number of working professionals are opting to work from cafes and restaurants. Since they most likely spend the majority of their day in the cafe, they would also order a significant amount of food throughout the day. This, coupled with the health and wellness trend, is expected to drive the demand for nutritional ingredients such as fresh avocadoes.

The B2C segment dominated the market in 2022 owing to the increased consumer demand for fresh avocados through these channels. The B2C channel can be categorized as e-commerce, supermarkets & hypermarkets, convenience stores, specialty stores, and other retail stores. Due to changing food preferences, consumers are willing to pay higher prices for a variety of high-quality items that are fresh, safe, and convenient. Retail stores have a strong influence on how fruits and vegetables are displayed and are diversifying their assortment of ready-to-eat fruits and fresh-cut products to increase sales.

Regional Insights

North America dominated the market revenue share in 2022, accounting for 45.0% of the total revenue. The demand for fresh avocados has been strong across North America. According to an article published by the University of California in November 2021, the per capita consumption of fresh avocados was pegged at 8.0 pounds in 2019. The increased demand for nutritious food will continue to drive the consumption of fresh avocados in the coming years.

Asia Pacific is forecast to grow with a significant CAGR of 10.4% from 2023 to 2030. The growth of the Asian-Pacific market is facilitated by the growing popularity of Western cuisine in major cities in China and other Asian countries. Moreover, the continued growth of the middle-class population of China and India is expected further to increase the demand for avocados in Asia Pacific. The growing demand from Asian consumers is creating a healthy environment for the manufacturers and suppliers of fresh fruits to extend their footprint in this region. This may propel the avocado market growth over the upcoming years.

Key Companies & Market Share Insights

The market is characterized by the presence of several well-established players and a few emerging players. New product launches, partnerships, and acquisitions are one of the key strategic initiatives in the industry. For instance:

-

In October 2022, Westfalia Fruit France announced the construction of a new facility in Graveson, in the Provence area of the south of France. The state-of-the-art facility will have avocado storage and ripening rooms, as well as packing capability to support Westfalia’s pan-Europe operations.

-

In May 2022, West Pak Avocado, Inc. announced the official launch of the Party Pak of avocados. This bag of jumbo fruit transitions with every season, featuring a new look and a reason to celebrate the goodness of avocados. Festive seasonal packing highlights recipes on the grab-and-go bag.

-

In September 2022, Mission Produce Inc. announced a state-of-the-art ripening, packing, and forward distribution center in Dartford, U.K. The location has direct access to major international ports and transportation networks.

Some of the key players operating in the market include: -

-

Calavo Growers, Inc.

-

West Pak Avocado, Inc.

-

Westfalia Fruit

-

Mission Produce, Inc.

-

EMPACADORA AVEHASS S.A. DE C.V.

-

Aguacates JBR

-

Propal

-

Duclos Farms

-

AustChilli Group

-

Simpson Farms

Avocado Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.92 billion

Revenue forecast in 2030

USD 26.04 billion

Growth rate

CAGR of 7.4% from 2023 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, distribution channel, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Calavo Growers, Inc.; West Pak Avocado, Inc.; Westfalia Fruit; Mission Produce, Inc.; EMPACADORA AVEHASS S.A. DE C.V.; Aguacates JBR; Propal; Duclos Farms; AustChilli Group; Simpson Farms

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Avocado Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the avocado market on the basis of form, distribution channel and region.

-

Form Outlook (Revenue, USD Million; 2018 - 2030)

-

Fresh

-

Processed

-

Pulp

-

Guacomole

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

B2B

-

Processing Industry

-

Food Service Industry

-

-

B2C

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global avocado market size was estimated at USD 14.85 billion in 2022 and is expected to reach USD 15.83 billion in 2023.

b. The global avocado market is expected to grow at a compound annual growth rate of 7.3% from 2023 to 2030 to reach USD 26.04 billion by 2030.

b. North America dominated the avocado market with a share of 45.0% in 2022. This is attributable to seasonal demand and increasing awareness of health benefits.

b. Some key players operating in the avocado market include Calavo Growers, Inc.; Del Rey Avocado Company, Inc.; West Pak Avocado Inc.; Westfaliafruit; Avehass; Mission Produce Inc; JBR Avocados; and Propal.

b. Key factors that are driving the fresh avocado market growth include improvement in living standards, increase in health expenditure, a surge in disposable income, and large-scale promotion of processed avocado.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.