- Home

- »

- Drilling & Extraction Equipments

- »

-

Froth Flotation Chemicals Market Size, Industry Report, 2033GVR Report cover

![Froth Flotation Chemicals Market Size, Share & Trends Report]()

Froth Flotation Chemicals Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Collectors, Frothers, Modifiers), By End Use (Mining, Pulp & Paper, Industrial Waste & Sewage Treatment), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-638-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Froth Flotation Chemicals Market Summary

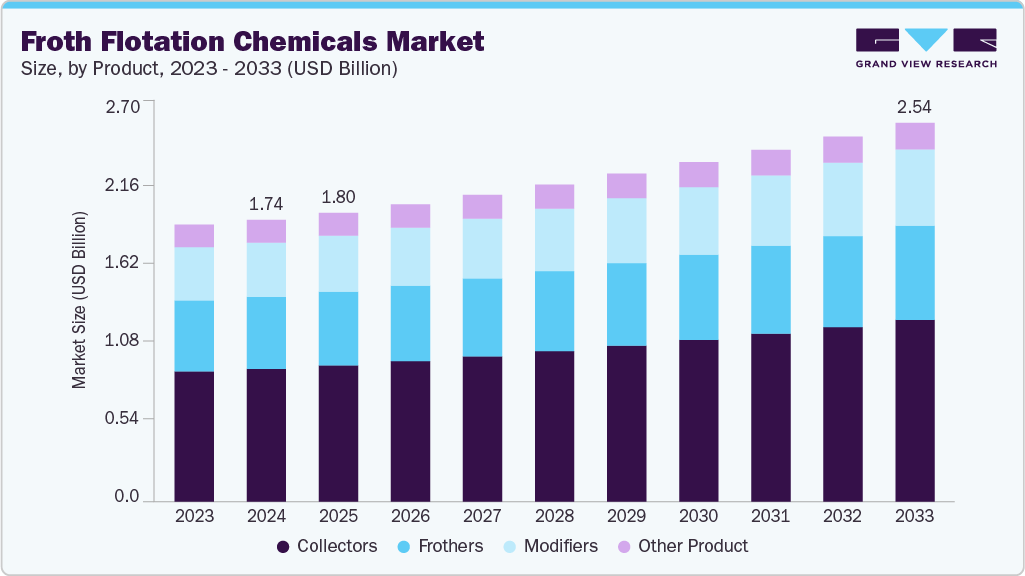

The global froth flotation chemicals market size was estimated at USD 1,742.6 million in 2024, and is projected to reach USD 2,541.6 million by 2033, growing at a CAGR of 4.4% from 2025 to 2033. The growth is attributed to the demand for mining chemicals, which is growing steadily due to increasing global mining activity and the need for more efficient extraction from low-grade and complex ores.

Key Market Trends & Insights

- Asia Pacific dominated the froth flotation chemicals market with the largest revenue share of 52.8% in 2024.

- China dominated the froth flotation chemicals market in the oil refining sector.

- By product, collectors-based chemicals dominated the froth flotation chemicals market, with a market share of 38.1%.

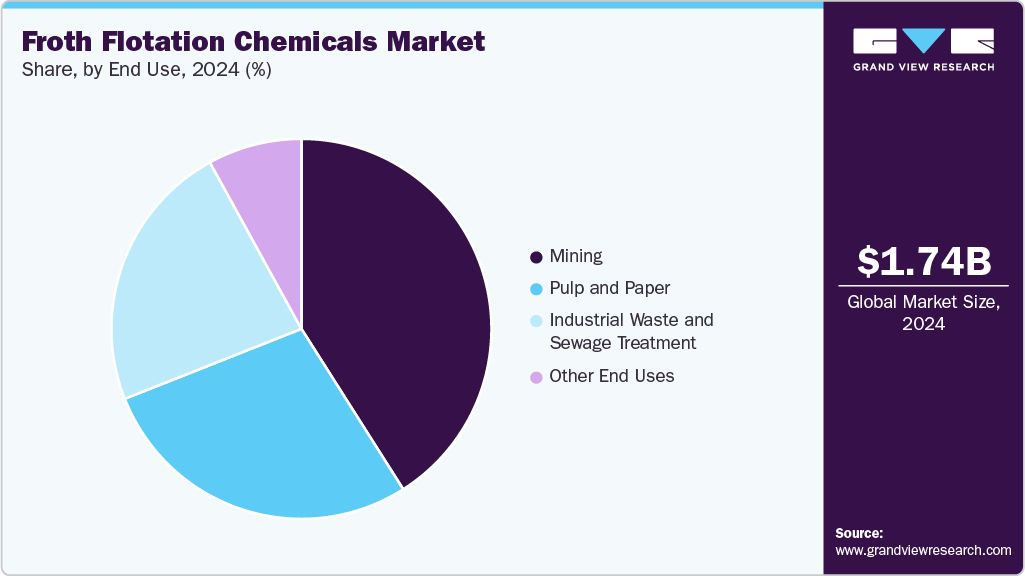

- By end-use, mining dominated the market with a revenue share of 40.8% in 2024.

Market Size & Forecasts

- 2024 Market Size: USD 1,742.6 Million

- 2033 Projected Market Size: USD 2,541.6 Million

- CAGR (2025-2033): 4.4%

- Asia Pacific: Largest market in 2024

- Middle East & Africa: Fastest growing market

These chemicals play a crucial role in flotation, separation, and ore beneficiation processes, helping improve recovery rates and reduce operational costs. The push for sustainability and optimized chemical use is driving the adoption of advanced, tailor-made formulations. Growing demand for critical minerals such as lithium and niobium also boosts chemical usage. This trend is expected to continue, supported by innovation, technical support, and global expansion of mining operations.The market demand for collectors in the froth flotation process is growing rapidly due to the increased extraction of industrial minerals like phosphate, barite, calcite, fluorite, lithium, and niobium, especially from low-grade and complex ores. Collectors tailored for selectivity, efficiency, and environmental safety are in high demand, particularly those compatible with fine particles and hard water conditions. Growth is driven by rising global demand for critical minerals (e.g., lithium and phosphate), advancements in collector formulations (anionic, cationic, non-ionic, amphoteric), and the need for sustainable, high-recovery processes across diverse ore types.

The market demand for frothers in the froth flotation process is growing steadily, driven by increasing global extraction of base and precious metals like copper, lead, zinc, gold, and nickel. Frothers enhance froth stability and recovery efficiency, making them essential in modern mineral processing. Advanced formulations, such as alcohol-based and glycol-based blends, are in demand due to their improved flotation kinetics, low persistence, and favorable environmental profiles. Growth is fueled by the shift toward lower-grade ores, increasing complexity in mineral processing, stricter EHS regulations, and the need for process-specific formulations that cater to diverse ore types and particle sizes.

The market demand for froth flotation chemicals to recover graphite from used lithium-ion batteries enables the separation of graphite and valuable metals like lithium and cobalt. This technique, widely used in the mining industry for particle sizes between 10 and 200 micrometers, is now being applied to battery recycling. Graphite, which makes up 15-25% of a battery’s weight, can now be efficiently recovered alongside metals. The process leverages existing, cost-effective mining technologies, making it attractive and practical for large-scale adoption.

The demand for modifier reagents in the froth flotation chemicals market is rising due to their critical role in enhancing selectivity and efficiency in complex ore processing. Modifiers, including activators and depressants, are widely used to control collector adsorption and tailor flotation conditions for diverse mineral systems. Their application is essential in multi-metal ores and finely disseminated deposits, especially for improving separation accuracy and reducing reagent consumption. Growth is supported by increasing global mining complexity and the need for customizable, ore-specific flotation strategies.

However, in the froth flotation chemicals market, the challenge of saturation and buoyancy limitations can reduce the effectiveness and reusability of reagents. These issues impact the selectivity and separation efficiency of the process, leading to lower recovery rates and increased processing complexity.

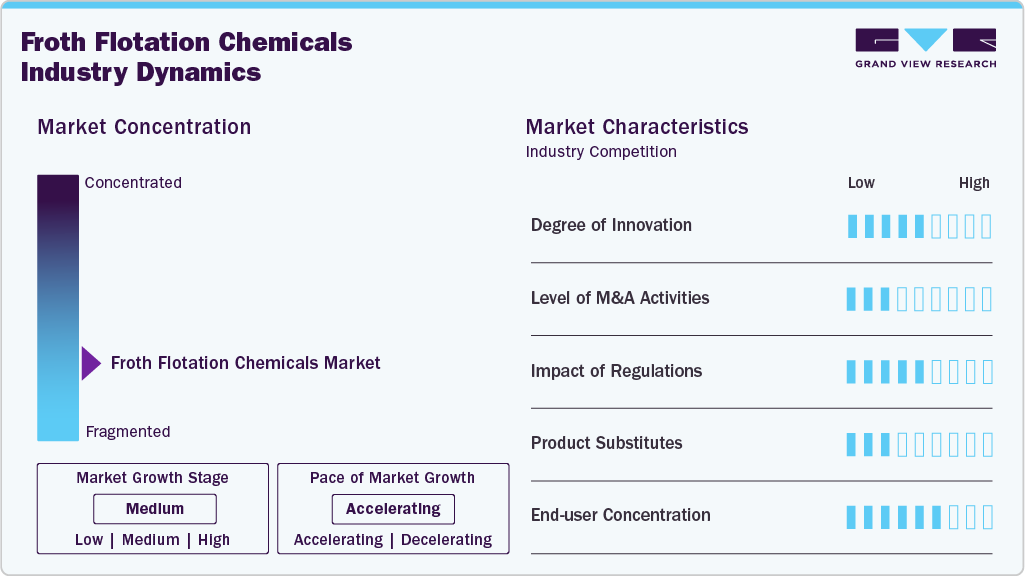

Market Concentration & Characteristics

The global froth flotation chemicals market is moderately fragmented with a mix of global players alongside numerous regional and specialized manufacturers. These companies serve a wide range of industries, with a primary focus on mining and mineral processing, while also supporting sectors like water treatment and industrial waste management. The market is characterized by intense competition, with increasing demand for tailor-made, high-efficiency reagents. There is a notable shift toward eco-friendly, biodegradable, and low-toxicity formulations, driven by growing environmental regulations and the need for sustainable mineral recovery solutions.

The threat of substitution for froth flotation is moderate, as alternative separation techniques like oil agglomeration, gravity separation, and magnetic separation exist. However, froth flotation remains dominant due to its cost-effectiveness and efficiency in processing fine particles across a wide range of ores and minerals.

Product Insights

Collectors-based chemicals dominated the froth flotation chemicals market, with a market share of 38.1% for their key role as reagents in froth flotation that selectively adsorb onto mineral particles, creating a hydrophobic surface to enhance bubble attachment and separation efficiency. They are classified as nonionic, anionic, or cationic, with heteropolar collectors containing polar and non-polar groups being the most effective. In the iron ore flotation process, fatty acids, resin acids, soaps, alkyl sulfates/sulfonates, and specially tailored amines collectors are used due to their ability to form water-repellent coatings, improving mineral recovery. Selecting the right collector is critical for optimizing flotation performance and market competitiveness.

Frothers' products are the fastest growing market with a CAGR of 4.7% for their high demand use in iron ore and coal flotation; frothers play a crucial role by stabilizing air bubbles to create a persistent froth layer, effectively separating valuable minerals. Commonly used frothers include MIBC, polypropylene glycols, and pine oils, with PO-based frothers offering higher recovery but lower selectivity. The effectiveness of frothers depends on particle size and reagent dosage, with finer particles benefiting more from alcohol-based frothers while coarser particles respond better to high-molecular-weight PO variants. Overdosing can reduce selectivity or destabilize the froth, making optimal dosing and frother blending essential for balancing recovery and grade.

End Use Insights

Mining end uses dominated the froth flotation chemicals market with a market share of 40.8%, driven by their critical role in enhancing mineral recovery efficiency and selectivity. Frothers ensure stable bubble formation, reduce coalescence, and tailor froth properties to specific ores, which are essential for extracting valuable minerals such as gold, copper, zinc, and coal. With rising global mineral consumption and the push for cost-effective, high-yield processing, flotation-based separation is increasingly vital. Consequently, the need for advanced frothing agents is growing, supporting greater operational efficiency and profitability in modern mining.

Pulp and paper end uses are the fastest growing fourth flotation chemicals market, with the CAGR of 4.7%, for the growing environmental need to reduce landfill waste, and sludge is driving demand for effective pulp and paper recycling technologies, with froth flotation chemicals playing a critical role in deinking processes. Despite challenges like fiber loss and frother-induced contamination, flotation remains vital for improving the brightness and cleanliness of recycled fibers. As the industry seeks higher-quality recycled paper and more efficient, eco-friendly processing, the demand for specialized frothers and surfactants tailored for flotation deinking is rising. This trend supports continued growth in the froth flotation chemicals market within the pulp and paper recycling sector.

Regional Insights

Asia Pacific dominated the froth flotation chemicals market due to its crucial role in coal beneficiation, particularly in countries such as China and India. Chemicals such as fuel oil-based collectors, frothers such as MIBC, and modifiers remove ash and sulfur from fine coal particles, improving fuel quality and reducing emissions. This process is essential for meeting energy demands while adhering to environmental standards. In iron ore processing, especially in India and China, froth flotation is used to upgrade low-grade ores by removing impurities such as silica and alumina. Collectors such as ether amines, frothers, and depressants such as starch are key to achieving high-purity iron concentrates. The growing demand for steel and infrastructure development in the region drives this sector's increased use of flotation chemicals.

China Froth Flotation Chemicals Market Trends

China dominated the froth flotation chemicals market in the oil refining sector, driven by large-scale mining of key minerals such as copper, lead, zinc, molybdenum, rare earth elements (REEs), and phosphate. China held over 44.0% revenue share of the Asia Pacific froth flotation chemicals market. Each ore type requires a tailored reagent suite to optimize recovery and selectivity. Xanthates, dithiophosphates, and alcohol-based frothers are widely used for base metals such as copper, lead, and zinc, while activators such as copper sulfate and depressants such as sodium cyanide enhance mineral separation. More specialized reagents such as thiophosphates and hydroxamic acids are used for molybdenum and REEs. In phosphate processing, fatty acid collectors and pH modifiers such as caustic soda are common. This diversity of applications underpins a robust and growing demand for flotation reagents across China's mining sector.

Europe Froth Flotation Chemicals Market Trends

In Europe, the demand for froth flotation chemicals is increasing for recycling lithium-ion batteries, supporting critical materials like graphite, lithium, and cobalt recovery. This method enhances separation efficiency and enables recyclers to meet strict EU recycling targets. As part of the region's push for a circular economy and resource sustainability, froth flotation offers a cost-effective, proven solution adapted from mining. The demand for specialized flotation reagents is growing as recyclers seek to optimize recovery rates while minimizing environmental impact.

North America Froth Flotation Chemicals Market Trends

In North America, the froth flotation chemicals market is primarily driven by the mining industry, where flotation is used to extract metals such as copper, zinc, lead, nickel, and molybdenum from low-grade sulfide ores using collectors (e.g., xanthates), frothers (e.g., MIBC), and modifiers (e.g., lime, depressants). In water and wastewater treatment, froth flotation helps remove suspended solids and oils in sectors such as oil & gas and food processing, using surfactants, coagulants, and pH modifiers. In addition, the pulp and paper industry employs flotation, especially in deinking recycled paper, where frothers and surfactants help separate ink particles. While mining dominates usage, growing environmental regulations and sustainability initiatives are accelerating the use of flotation chemicals in industrial and recycling applications.

Middle East & Africa Froth Flotation Chemicals Market Trends

In the Middle East & Africa region, froth flotation chemicals are vital for mineral beneficiation, particularly in phosphate, gold, and copper ore processing. In phosphate beneficiation, fatty acid collectors, pH modifiers such as caustic soda, and frothers such as MIBC selectively float or depress minerals, enhancing phosphorus pentoxide grade. In gold and copper sulfide flotation, xanthates and dithiophosphates serve as collectors, activators such as copper sulfate, and depressants such as sodium cyanide optimize metal recovery. Frothers ensure stable froth and improved concentrate quality, tailored to ore type and separation needs.

Latin America Froth Flotation Chemicals Market Trends

The Latin American froth flotation chemicals market is gradually expanding, primarily driven by the region's large-scale mining industry. Specific reagents are tailored to optimize recovery in froth flotation processes across various metals. In copper mining, collectors such as xanthates and dithiophosphates render copper sulfides hydrophobic, while frothers such as MIBC stabilize the froth, and modifiers such as lime and sodium cyanide aid in selectivity. For gold and silver recovery, collectors help float precious metals bound to sulfide ores, with frothers ensuring froth stability and modifiers such as copper sulfate enhancing flotation efficiency. In zinc processing, xanthates are used as collectors following activation by copper sulfate, while depressants such as sodium cyanide prevent interference from iron sulfides. Lead flotation uses collectors similar to depressants, such as zinc sulfate, to inhibit zinc flotation and frothers to support froth formation. In molybdenum recovery, selective collectors such as MBT are employed alongside frothers, and sodium hydrosulfide acts as a depressant to suppress copper during separation from copper-molybdenum concentrates. As mining operations expand to meet global metal demand, the need for efficient and tailored flotation chemicals continues to rise across the region.

Key Froth Flotation Chemicals Company Insights

Some of the key players operating in the froth flotation chemicals market include BASF and Solvay

-

BASF, a global chemical giant headquartered in Ludwigshafen, Germany, is a dominant and mature player in the froth flotation chemicals market, offering a comprehensive portfolio of collectors, frothers, and modifiers tailored for mineral processing. The company leverages its deep surfactant and formulation chemistry expertise to develop high-performance flotation reagents that enhance recovery rates, reduce environmental impact, and optimize operational efficiency. With a strong global R&D network, backward integration, and dedicated flotation competence centers, BASF continuously drives innovation in sustainable mining solutions. Through strategic collaborations and commitment to circular economy principles, BASF plays a critical role in advancing efficient and eco-friendly mineral extraction technologies across the globe.

Quadra Groups and NASACO are emerging market participants in the froth flotation chemicals market.

-

Quadra Group, headquartered in Canada, is an emerging player in the Froth Flotation Chemicals market, focusing on distributing high-performance reagents tailored for mining and mineral processing applications. Leveraging strategic partnerships and recent acquisitions, Quadra is expanding its footprint across North America, offering customized chemical solutions and technical support to meet the complex needs of flotation operations. The company emphasizes value-added services, sustainability, and supply chain reliability, positioning itself as a trusted partner for efficient and eco-conscious flotation processes. With a growing presence in the mining sector, Quadra is steadily becoming a key contributor to the next generation of flotation solutions.

Key Froth Flotation Chemicals Companies:

The following are the leading companies in the froth flotation chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Clariant

- Dow

- NASACO

- Nouryon

- Arkema

- Chevron Phillips Chemical Company LLC.

- Kemira

- Solvay

- Ecolab

- Quadra Groups.

Recent Developments

-

In October 2023, BASF launched two new flotation reagent brands, Luprofroth for frothers and Luproset for modifiers, to support the rapid growth of its mining solutions portfolio. These brands complement the existing Lupromin collector line, positioning BASF as a comprehensive solutions provider for the mining industry. The Luprofroth range offers sulfidic frothers designed to optimize bubble behavior, froth stability, and process efficiency while enhancing environmental safety. Meanwhile, the Luproset line includes advanced modifiers such as gold activators to improve mineral recovery and reduce reagent use. Backed by BASF's strong backward integration and global scale, this strategic move reflects the company's commitment to innovation and sustainable mining practices.

-

In April 2025, Quadra, a leading North American ingredient and chemical distributor, announced its acquisition of Bell Chem, a Florida-based supplier known for serving diverse industries, including water treatment. This strategic move enhances Quadra’s reach and capabilities in the water treatment and froth flotation chemicals market, areas critical to both environmental management and mineral processing. With Bell Chem’s strong logistics network, warehousing capacity, and specialized product lines, including sanitation solutions for the food and beverage sector, the acquisition supports Quadra’s continued growth and positions the combined entity to deliver more efficient, tailored solutions across local and international markets.

Froth Flotation Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,804.5 million

Revenue forecast in 2033

USD 2,541.6 million

Growth rate

CAGR of 4.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF; Clariant; Dow; NASACO; Nouryon; Arkema; Chevron Phillips Chemical Company LLC.; Kemira; Solvay; Ecolab; Quadra Groups.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Froth Flotation Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global froth flotation chemicals market report based on material, product, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Collectors

-

Frothers

-

Modifiers

-

Other Product

-

-

End Use Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Mining

-

Pulp and Paper

-

Industrial Waste and Sewage Treatment

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

France

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global froth flotation chemicals market size was estimated at USD 1,742.6 million in 2024 and is expected to reach USD 1,804.5 million in 2025.

b. The global froth flotation chemicals market is expected to grow at a compound annual growth rate of 4.4% from 2025 to 2033 to reach USD 2,541.6 million by 2033.

b. The mining segment led the market and accounted for the largest revenue share of 40.8% in 2024, driven by their critical role in enhancing mineral recovery efficiency and selectivity.

b. Some of the key players operating in the froth flotation chemicals market are BASF, Clariant, Dow, NASACO, Nouryon, Arkema, Chevron Phillips Chemical Company LLC., Kemira, Solvay, Ecolab, Quadra Groups.

b. The growth is attributed to froth flotation chemicals’s expanding role in mining chemicals, which is growing steadily due to increasing global mining activity and the need for more efficient extraction from low-grade and complex ores.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.