- Home

- »

- Consumer F&B

- »

-

Frozen Fruit Bar Market Size, Share & Growth Report, 2030GVR Report cover

![Frozen Fruit Bar Market Size, Share & Trends Report]()

Frozen Fruit Bar Market Size, Share & Trends Analysis Report By Type (Original, Low Fat), By Flavor (Citrus, Pineapple, Grape, Apple, Mango, Coconut), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-094-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Frozen Fruit Bar Market Size & Trends

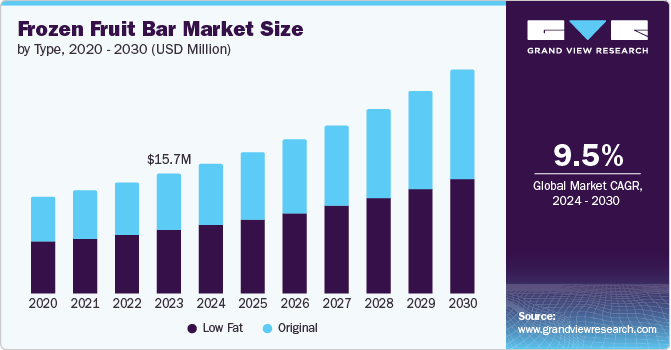

The global frozen fruit bar market size was valued at USD 15.7 million in 2023 and is projected to grow at a CAGR of 9.5% from 2024 to 2030. Market growth is driven by consumer demand for innovative flavors, with the introduction of new varieties such as kiwi, lime, and raspberry mix, and unique flavor combinations such as coconut water with banana. The trend towards exotic and seasonal flavors, as well as shifts in consumer preferences for frozen snacks, are key factors contributing to this market expansion.

Market growth worldwide is driven by several key factors, including the demand for innovative flavors, health and wellness trends, and the seasonality and perishability of fresh fruits. Consumers are seeking new and unique flavor combinations, such as coconut with banana, lime and raspberry, which has led to product innovation by manufacturers. Moreover, the growing health consciousness among consumers has increased demand for low-fat, organic, and fortified frozen fruit bar products, making them a popular alternative to traditional ice cream and popsicles.

The frozen fruit bar market is also benefiting from the rising disposable incomes and changing lifestyles of consumers. With increasing incomes, particularly in developing markets, consumers are able to spend more on premium and innovative frozen fruit bar products. Furthermore, changing lifestyles and on-the-go consumption patterns have boosted demand for convenient frozen snacks such as fruit bars. The expansion of distribution channels, including supermarkets, specialty stores, and online platforms, has also improved product accessibility and driven market growth.

Furthermore, sustainability and environmental consciousness are playing a significant role in driving the growth of the frozen fruit bar market. Consumers are seeking out eco-friendly and sustainable options, which has led manufacturers to develop products that meet these demands. The introduction of new flavors such as mangoes, passion fruit, guavas, and dragon fruit is also attracting a large customer base, particularly among young people who are eager to try new and innovative food products.

Type Insights

The low-fat segment dominated the market with a revenue share of 53.5% in 2023. The segment’s dominance in the frozen fruit bar market can be attributed to the growing demand for healthy, nutritious snack options. Lactose intolerant consumers and those with dietary restrictions opt for low-fat bars to avoid discomfort and disease. Moreover, health-conscious consumers seek tasty and nutritious products, while others prioritize low-fat content to maintain a healthy BMI, driving demand for low-fat frozen fruit bars.

The original segment in the frozen fruit bar market is expected to register the fastest CAGR of 10.1% in the forecast period. The original flavor segment’s success is driven by the rising demand for natural and organic products, innovative flavors, and widespread availability. Nostalgic appeal also plays a significant role, as familiar flavors evoke a sense of comfort and preference. Consumers tend to opt for tried-and-true options, sustaining the growth of the original segment and its large market share.

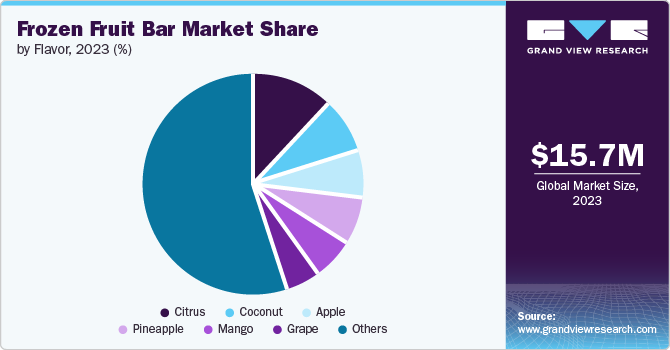

Flavor Insights

The citrus segment in flavors dominated the frozen fruit bar market with a revenue share of 11.9% in 2023. The citrus flavor segment is driven by its digestive benefits, stomach health, and high vitamin C content, positioning it as a healthier alternative to artificial flavors. The refreshing and tangy taste of citrus fruits such as lemons, oranges, and mandarins appeals to a broad consumer base, contributing to the growth of the citrus flavor frozen fruit bar market.

The mango flavor segment is expected to register the fastest CAGR of 11.8% in the forecast period. The mango flavor segment is experiencing rapid growth, driven by its widespread popularity, health benefits, and consumer preference. As one of the most widely consumed fruits globally, mango’s versatility allows for innovative flavor combinations, while its year-round availability through global trade networks fosters market growth and demand.

Regional Insights

North America frozen fruit bar market dominated the global frozen fruit bar market with a revenue share of 24.9% in 2023. Rising adoption of healthy and nutritious snacks in the diet, strong distribution channels, innovation in the fruit bars, maintaining quality standards, and effective marketing strategies driving the growth of the frozen fruit bar market in the region.

U.S. Frozen Fruit Bar Market Trends

The frozen fruit bar market in the U.S. occupies a substantial share of the North America frozen fruit bar market due to various factories of food & beverages are mainly located in the country. In addition, the continuous innovation in products and the huge consumer base for frozen products with the established distribution channel drive the market growth.

Europe Frozen Fruit Bar Market Trends

Europe frozen fruit bar market was identified as a lucrative region in 2023. The awareness of people in the region towards healthy living and hygienic food habits has accelerated the intake of frozen fruit bars as a healthy snack. European frozen fruit bar market offers consumers a wide variety of options in terms of the flavors of frozen fruit bars. The new and interesting flavors, as well as the ideas for combination, have become appealing to consumers in search of a new type of frozen dessert.

The frozen fruit bar market in the UK is expected to grow rapidly in the coming years due to the collaboration with retailers such as Walmart, and others. Moreover, Adherence to natural flavor and nutrient contents in fruits has made UK products superior. In addition, taste and nutritional value are primary factors for loyal consumers in the UK.

Germany frozen fruit bar market held a substantial market share in 2023 owing to health-aware consumers who prefer to consume healthy and natural products. They aim to deliver high-quality products produced from selected high-quality ingredients, delicious tastes, and attractive blends in product flavors, and high -technology used in the production processes.

Asia Pacific Frozen Fruit Bar Market Trends

The frozen fruit bar market in Asia Pacific is expected to register the fastest CAGR of 11.4% in the forecast period. The growth can be attributed to factors such as increasing awareness about health, availability of a new variety of fruits, research & innovation in production, increasing disposable income, and better promotional strategies. In addition, Asia Pacific countries have experienced growth in their economy and this has enhanced the standard of living. This has led to increased spending towards better and premium products such as frozen fruit bars.

Japan frozen fruit bar market is expected to grow rapidly in the coming years due to the growing tendencies among the Japanese people of healthy snack consumption. Consumers are now more conscious of the foods they eat thus, the demand for products that contain organic and less sugar is increasing that fit the frozen fruit bars.

Frozen fruit bar market in China held a substantial market share in 2023 owing to consumers looking for healthier snack products due to the growing healthy lifestyle concerns. Since they are derived from real fruits and commonly contain low-fat or organic fruit ingredients, this novelty food product is considered by society to be a healthier version of snacks.

Key Frozen Fruit Bar Company Insights

Some key companies in the Frozen Fruit Bar market include Natural Fruit Corporation; Outshine (Nestlé S.A.); Unilever; J&J Snack Foods Corp.; and others. Organizations are leveraging their strong brand recognition, extensive distribution networks, and continuous product development to maintain their market positions.

-

Natural Fruit Corporation is a leading manufacturer of premium, 100% natural frozen fruit bars featuring real fruit chunks. Catering to both kids and adults, the company offers a range of healthy and delicious treats made from natural ingredients. Its product line has been expanded to include frozen yogurt bars and drink mixes, maintaining a commitment to quality and purity.

-

J&J Snack Foods Corp is a leading manufacturer, marketer, and distributor of nutritious snack ingredients and beverages. The company operates through three primary segments: Food Service, Retail Supermarkets, and Frozen Beverages, providing a comprehensive range of products to meet diverse customer needs.

Key Frozen Fruit Bar Companies:

The following are the leading companies in the frozen fruit bar market. These companies collectively hold the largest market share and dictate industry trends.

- Natural Fruit Corporation

- Outshine (Nestlé S.A.)

- Unilever

- J&J Snack Foods Corp.

- Ice Pop Factory

- THE MODERN POP

- Happy & Healthy Products, Inc.

- Binggrae

- JonnyPops

Recent Developments

-

In June 2024, J&J Snack Foods Corp. partnered with Slick City to bring four popular brands - Dippin’ Dots, Hola Churros, ICEE, and SUPERPRETZEL - to Slick City locations nationwide, enhancing the park experience with tasty snacks and fun for guests.

-

In May 2024, JonnyPops introduced new organic, no-sugar-added fruit bars in 10-packs, which were vegan, dairy-free, gluten-free, and artificial dye-free. The bars were part of the pre-existing lineup with K12 organic pops.

Frozen Fruit Bar Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.0 million

Revenue forecast in 2030

USD 29.2 million

Growth Rate

CAGR of 9.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, flavor, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; South Africa

Key companies profiled

Natural Fruit Corporation; Outshine (Nestlé S.A.); Unilever; J&J Snack Foods Corp.; Ice Pop Factory; THE MODERN POP; Happy & Healthy Products, Inc.; Binggrae; JonnyPops

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Frozen Fruit Bar Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global frozen fruit bar market report based on type, flavor, and region:

-

Type Outlook (Revenue, USD Thousands, 2018 - 2030)

-

Original

-

Low Fat

-

-

Flavor Outlook (Revenue, USD Thousands, 2018 - 2030)

-

Citrus

-

Pineapple

-

Grape

-

Apple

-

Mango

-

Coconut

-

Others

-

-

Regional Outlook (Revenue, USD Thousands, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."