- Home

- »

- Consumer F&B

- »

-

Healthy Snacks Market Size, Share & Trends Report, 2030GVR Report cover

![Healthy Snacks Market Size, Share & Trends Report]()

Healthy Snacks Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Frozen & Refrigerated, Fruit, Nuts & Seeds, Bakery, Savory, Bars & Confectionery, Dairy), By Claim, By Packaging, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-915-9

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthy Snacks Market Summary

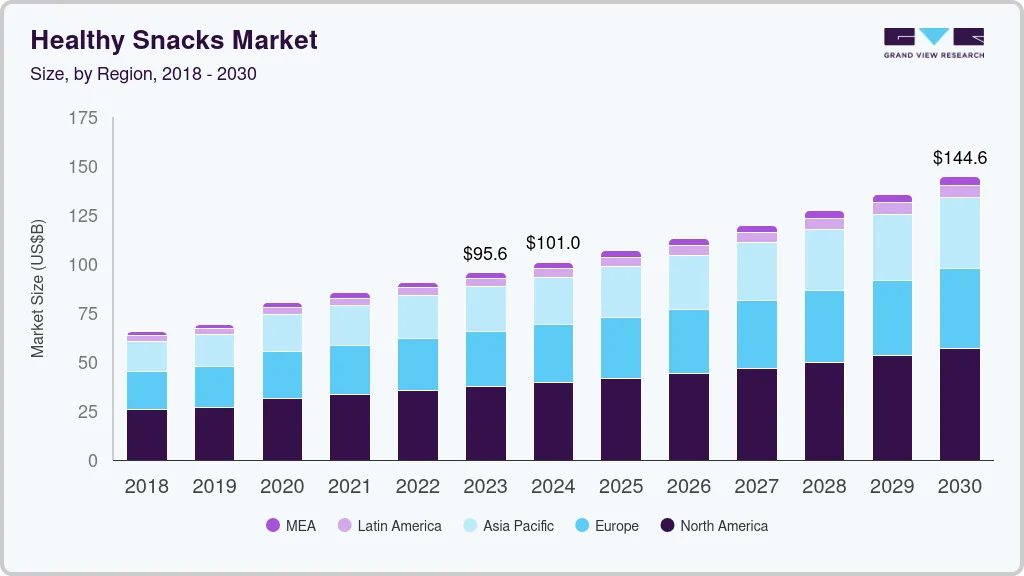

The global healthy snacks market size was estimated at USD 95.61 billion in 2023 and is projected to reach USD 144.64 billion by 2030, growing at a CAGR of 6.2% from 2024 to 2030. Busy lifestyles, increased urbanization, and changing dietary preferences are driving the demand for convenient, on-the-go snack options. Consumers are looking for snacks that are portable, easy to consume, and aligned with their dietary preferences.

Key Market Trends & Insights

- The North American healthy snacks market accounted for a share of 39.1% in 2023.

- The healthy snacks market in the U.S. is expected to grow at a CAGR of 6.0% from 2024 to 2030.

- By product, the fruit, the fruit, nuts and seeds segment held a share of 37.8% in 2023.

- By claim type, the low/ no sugar snacks segment held a share of 39.0% in 2023.

- By packaging, the bags and pouches segment accounted for a share of 42.3% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 95.61 Billion

- 2030 Projected Market Size: USD 144.64 Billion

- CAGR (2024-2030): 6.2%

- North American: Largest market in 2023

The rise in dietary restrictions and preferences for gluten-free, vegan, and organic diets have prompted manufacturers to innovate and diversify their product offerings to accommodate these needs. Concerns about obesity rates and the prevalence of chronic diseases such as diabetes, heart disease, and hypertension are prompting consumers to adopt healthier eating habits. According to data from the Centers for Disease Control and Prevention (CDC), obesity affects four out of ten Americans. Similarly, according to the Organization for Economic Co-operation and Development’s (OECD) 'Health at a Glance: Europe 2020: State of Health in the EU Cycle' report, one in six Europeans were obese, and over 50% of adults were overweight. Healthy snacks, which have lower calories, sugar, and fat content compared to traditional snacks, are seen to combat these health issues.

Growing awareness of the importance of health and wellness encourages consumers to seek healthier dietary options, including snacks. As people become more conscious of the link between diet and health, they actively seek snacks that offer nutritional benefits and support their overall well-being. A survey conducted by Whisps, renowned for its high-protein snacks made from 100% real cheese, unveiled shifting trends in American snacking habits.

The survey, including over 2,000 American adults in April 2023, reveals a significant trend of people substituting an average of four meals per week with snacks. As individuals increasingly munch throughout the day, a staggering 79% of adults express a desire to consume healthier snacks. This data underscores a growing preference for convenient and nutritious snack options among Americans, highlighting a shift toward more mindful eating habits and a demand for healthier snack alternatives.

People are becoming more conscious about the snacks they consume, focusing on ingredients, portion control, and variety. For instance, a survey conducted by Mondelēz India in October 2022 revealed a significant shift in consumer snacking habits and preferences in India. A large portion of respondents reported choosing snacks that cater to their body's needs and nutritional requirements, with 86% snacking to boost mood, find comfort, relax, and seek quiet moments.

Moreover, 95% of Indians expressed a likelihood of seeking snacks with special ingredients or health qualities soon, surpassing the global average of 87%. Urban households, driven by increased affluence, are transitioning to more packaged foods, and exploring diverse consumption options beyond traditional items like glucose cookies and salted chips. This trend was accelerated by the pandemic, as consumers spent more time at home.

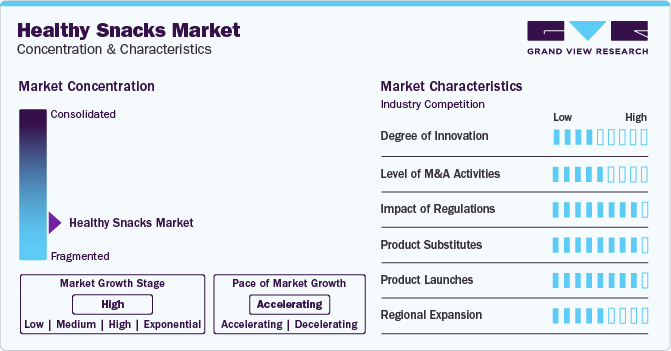

Market Concentration & Characteristics

In terms of innovation, there has been a significant focus on developing new and innovative healthy snack products to cater to changing consumer preferences. Companies are introducing snacks that are not only nutritious but also convenient, flavorful, and appealing to a wide range of tastes and dietary preferences.

Innovation in healthy snacks includes the incorporation of trendy ingredients such as ancient grains, superfoods, plant-based proteins, and functional ingredients like probiotics and adaptogens. In addition, there is a growing emphasis on snacks that are free from artificial additives, preservatives, and allergens, catering to consumers seeking clean-label and minimally processed options.

Larger food companies seek to expand their presence in the healthy snacks segment by acquiring smaller, innovative brands with unique product offerings and a strong customer base. These acquisitions allow larger companies to gain access to new markets, distribution channels, and consumer demographics, while providing smaller brands with resources and expertise to scale their businesses.

Product Insights

The fruit, nuts and seeds segment held a share of 37.8% in 2023. The trend of healthy snacks, including fruits, nuts, and seeds, is on the rise due to the increasing consumer demand for convenient, delicious, and nutritious snack options. According to a report published by FoodNavigator-USA in 2023, the healthy snack bar market is driven by the preference for whole nuts, seeds, fruits, and chocolate, as well as health and convenience factors. The market is also positively influenced by the growing awareness of maintaining a healthy lifestyle and the demand for snacks that offer nutritional benefits.

The market is also influenced by the increasing prevalence of dietary trends such as plant-based diets, veganism, and paleo diets. Fruits, nuts, and seeds align well with these dietary preferences, contributing to the sustained growth of this market segment. In addition, the perception of these snacks as wholesome, natural, and sustainable enhances their appeal among environmentally conscious consumers. The State of the Industry 2022 report also indicates that consumers are seeking healthy indulgences in their snack mixes and nuts, leading to continued innovation in this segment.

The healthy bakery snacks segment is expected to grow with a CAGR of 6.4% over the period of 2024 to 2030. The market reflects changing consumer trends, with an increasing inclination toward lifestyle diets, gluten- and grain-free alternatives, and a preference for plant-based foods, influencing the selection of grains utilized in bakery and snack items. Moreover, the popularity of artisanal and specialty bakery products and increased demand for offerings made from natural and organic ingredients play a pivotal role in driving the growth of the healthy bakery snacks market. According to an article posted on Snack Food & Wholesale Bakery, a noteworthy trend is the integration of "power ingredients" like grains, seeds, fruits, vegetables, nuts, and superfruits into bakery products, effectively meeting the convergence of wellness and indulgence in consumer choices.

Claim Insights

The low/ no sugar snacks segment held a share of 39.0% in 2023. The prevalence of health-related issues such as obesity and cardiovascular diseases has encouraged consumers to scrutinize nutritional labels more closely. Products with low or no-fat content are perceived as a better choice for cardiovascular health and weight management, contributing to their popularity in the market. Food manufacturers respond to this consumer trend by reformulating snacks to reduce or eliminate fat content while maintaining flavor, thereby meeting the demand for healthier alternatives.

Consumers prioritize protein intake in their diets; there is a natural inclination for snacks that offer a substantial protein content. Manufacturers often align with this preference by incorporating protein-rich ingredients into their snack formulations. According to a survey by Whisps, in 2023, 79% of Americans are trying to eat healthier snacks, and there is a growing preference for protein-rich snacks.

The gluten-free snacks segment is expected to grow at a CAGR of 7.5% from 2024 to 2030. The market for gluten-free claims in the healthy snacks market is primarily driven by the increasing awareness of gluten sensitivity and the growing demand for dietary alternatives among consumers. Gluten is a protein found in wheat, barley, and rye, and some individuals experience adverse reactions to it, such as celiac disease or non-celiac gluten sensitivity. As awareness of these conditions grows, a larger segment of the population is seeking gluten-free options to address their dietary needs and preferences.

Packaging Insights

The bags and pouches segment accounted for a share of 42.3% in 2023. Healthy snacks are predominantly packed in bags and pouches due to their convenience, ease of handling, and ability to maintain freshness and flavor. These packaging options are lightweight, often resealable, and provide efficient protection for the snacks inside, making them highly suitable for on-the-go consumption. Moreover, bags and pouches can be transparent or have windowed designs, which enhance product visibility and appeal, allowing consumers to make informed choices. Their cost-effectiveness, sustainability features, and versatility in accommodating various snack types further contribute to their widespread preference in the snack market.

The success of snack products in the competitive market heavily relies on eye-catching packaging and conveys the health benefits and quality of the contents. Consumers are looking for low- or no-sugar, gluten-free, and plant-based options that align with alternative diets like paleo, keto, and vegan. Moreover, custom packaging solutions, including various sizes, shapes, and types like straight bags, pillow-shaped bags, and roll stock packaging, are available to meet the specific needs of snack producers, ensuring that their products stand out on shelves and cater to consumer preferences for healthy, convenient snack options.

The canned segment is expected to grow at a CAGR of 6.4% from 2024 to 2030. Packing healthy snacks in cans is becoming increasingly popular since it caters to both manufacturers' needs and consumer preferences. For manufacturers, cans offer the advantage of extending the shelf life of snacks since they are airtight and lightproof, which preserves freshness and nutritional value without the need for added preservatives. The durability and protection afforded by cans also minimize spoilage and damage during transportation, ensuring the product's integrity upon reaching consumers. In August 2023, GoodPop, known for its health-conscious frozen treats, introduced its first beverage line, Mini Cans. These 7.5-ounce mini cans blend real fruit juice and sparkling water, made without added sugars, sweeteners, or flavors. Available in Fruit Punch, Orange, and Lemon Lime flavors, each can contains a mere 6 grams of sugar or less.

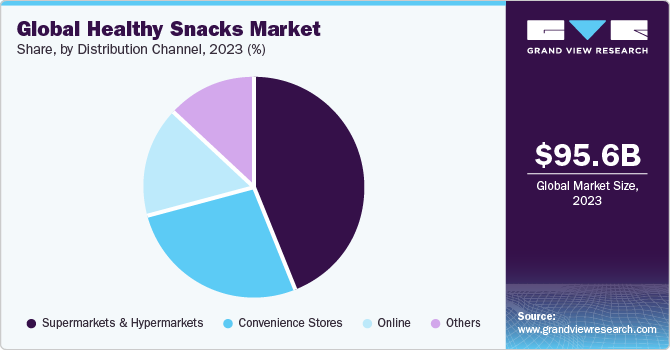

Distribution Channel Insights

In 2023, the distribution of healthy snacks through supermarkets & hypermarkets accounted for 43.9% of the total market. Consumers show a preference for supermarkets and hypermarkets while purchasing healthy snacks, and this inclination is attributed to several factors. These retail establishments present a diverse range of nutritious snack options, including roasted nuts, seeds, and fruits, effectively meeting the growing demand for convenient and healthy snack alternatives.

Moreover, the sheer volume of supermarkets and hypermarkets globally allows them to dominate the market in terms of distribution channels. For instance, 7-Eleven-one of the largest supermarket chains in the world-has more than 80,000 outlets in 16 countries. The rapid progress of retail infrastructure across developing economies is likely to drive the growth of this segment further.

Distribution of healthy snacks through online channels is gaining popularity. The ability to shop from home, access a vast array of products, and easily compare prices and reviews appeals to consumers. From the healthy snack manufacturers’ and brands’ perspective, the online channel provides a wider customer base, including those in remote or underserved areas. It eliminates geographical constraints, allowing brands to reach a wider audience and expand their customer base globally.

According to a survey commissioned by mobile app developer Bryj and conducted by Dynata, in 2024, 39% of shoppers prefer buying groceries through an app. Similarly, a Bank of America survey noted that 61% of respondents said they plan to shop for their groceries online in 2024. These findings suggest that a significant portion of consumers prefer buying snacks and groceries online.

Regional Insights

The North American healthy snacks market accounted for a share of 39.1% in 2023. In recent years, there has been a significant shift toward healthier eating habits across North America. People are becoming more conscious about what they put into their bodies and are opting for healthier alternatives, even when it comes to snacking. This trend has led to the rise in popularity of healthy snacks across the region.

Furthermore, the growing awareness of the importance of a balanced diet and the impact of food has driven the consumption of healthy snacks in North America. With the rise in chronic diseases such as obesity, diabetes, and heart disease, people are looking for ways to improve their diet and make healthier choices. This has led to a shift from traditional snacks, often high in calories, sugar, and unhealthy fats, to healthier options.

U.S. Healthy Snacks Market Trends

The healthy snacks market in the U.S. is expected to grow at a CAGR of 6.0% from 2024 to 2030. The popularity of healthy snacks in the U.S. can be attributed to the growing trend of convenience and on-the-go consumption. With busy lifestyles and hectic schedules, people are looking for snacks that they can grab on the way to work, school, or the gym. This has opened a market for healthy snacks that are not only nutritious but also convenient and portable.

In November 2023, Pokimane and cofounder Darcey Macken launched Myna, a healthy snack brand, in response to their previous health issues. Its first product, the Midnight Mini, is a collection of assorted cookies. These cookies are made with natural ingredients, without added preservatives, and serve as a gluten-free option for traditional cookies.

Asia Pacific Healthy Snacks Market Trends

The healthy snacks market in Asia Pacific is expected to grow at a CAGR of 6.8% from 2024 to 2030. In Asia, there is a growing awareness of the importance of foods that promote gut health and immunity, including prebiotics and probiotics. Incorporating functional ingredients like macronutrients and antioxidants into snacks has recently become a prevalent strategy among numerous manufacturers to develop healthier snack options.

Moreover, many companies are placing greater emphasis on clean labels and appealing product flavors to attract customers. These trends are anticipated to fuel the expansion of the Asia Pacific healthy snacks market in the foreseeable future. The food industry leaders are increasingly prioritizing the upcycling of food waste and introducing flavored snacks packed with both macro and micronutrients. These companies focus on repurposing by-products into nutritious chips through their manufacturing processes.

Key Healthy Snacks Company Insights

Established players have been actively investing in research and development to innovate and introduce healthier snack options. These companies leverage their extensive distribution networks and brand recognition to maintain a significant market share. Nestlé S.A.; Kellanova (The Kellogg Company); and Unilever are some of the key players in the healthy snacks market.

-

Nestlé offers healthy snack products under its Nestlé Fitness and La Laitière brands. The company manufactures, retails, and markets healthy crackers, yogurt, and cereals under these brands.

-

Kellanova is a producer of cereal, convenience food, and ready-to-eat foods. Its product portfolio includes cookies, crackers, savory snacks, fruit-flavored snacks, and veggie foods.

-

Unilever offers its products through family-owned shops, online stores, and brick-and-mortar stores. It has a presence in North America, Europe, Asia Pacific, Africa, and the Middle East.

Key Healthy Snacks Companies:

The following are the leading companies in the healthy snacks market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé S.A.

- Kellanova (The Kellogg Company)

- Unilever

- Danone

- PepsiCo

- Mondelēz International

- Hormel Foods Corporation

- Del Monte Foods, Inc.

- Select Harvest

- Monsoon Harvest

Recent Developments

-

In September 2023, Kellanova’s RXBAR brand partnered with podcaster Maria Menounos to launch a limited edition RXBAR ManifX bars with customizable wrappers. The RXBAR ManifX bars are available in Chocolate Sea Salt flavor, made with 12g of protein.

-

In September 2023, Danone UK&I announced a fresh lineup of high-protein dairy snacks under the brand name GetPRO, designed specifically for individuals aiming to optimize their workout regimes. The GetPRO range has between 15-25g of protein per serving across its eleven products, which include high-protein yogurts, mousses, puddings, and beverages. Notably, these offerings contain no added sugars and are either low-fat or 0% fat, catering to health-conscious consumers.

-

In June 2023, Unilever announced its acquisition deal with Yasso Holdings, Inc., a brand known for its premium frozen Greek yogurt in the U.S. This strategic move falls in line with Unilever's premiumization strategy within its Ice Cream Business Group, adding Yasso to a prominent portfolio alongside brands like Ben & Jerry's, Magnum, and Talenti. Yasso's product line perfectly caters to the increasing demand for convenient, healthier, and indulgent frozen snacks in North America.

Healthy Snacks Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 100.95 billion

Revenue forecast in 2030

USD 144.64 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, claim, packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; South Korea; Australia & New Zealand; India; Brazil; South Africa

Key companies profiled

Nestlé S.A.; Kellanova (The Kellogg Company); Unilever; Danone; PepsiCo; Mondelēz International; Hormel Foods Corporation; Del Monte Foods, Inc.; Select Harvest; Monsoon Harvest

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthy Snacks Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthy snacks market report based on product, claim, packaging, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Frozen & Refrigerated

-

Fruit, Nuts and Seeds

-

Bakery

-

Savory

-

Bars and Confectionery

-

Dairy

-

Others

-

-

Claim Outlook (Revenue, USD Million, 2018 - 2030)

-

Gluten-Free

-

Low/No Sugar

-

Low/No Fat

-

Others

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bag & Pouches

-

Boxes

-

Cans

-

Jars

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

Australia & New Zealand

-

South Korea

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global healthy snacks market size was estimated at USD 95.61 billion in 2023 and is expected to reach USD 100.95 billion in 2024.

b. The global healthy snacks market is expected to grow at a compounded growth rate of 6.2% from 2024 to 2030 to reach USD 144.64 billion by 2030.

b. The healthy snacks market in North America is expected to hold a share of 39.1% in 2023. In recent years, there has been a significant shift toward healthier eating habits across North America.

b. Some key players operating in the market include Nestlé S.A.; Kellanova (The Kellogg Company); Uniliver; Danone; PepsiCo; Mondelēz International; Hormel Foods Corporation; Del Monte Foods, Inc.; Select Harvest; Monsoon Harvest

b. Growing awareness of the importance of health and wellness is driving consumers to seek healthier dietary options, including snacks. As people become more conscious of the link between diet and health, they actively seek snacks that offer nutritional benefits and support their overall well-being.

b. The U.S. healthy snacks market dominated the North America market with a revenue share of 66.6% in 2022. Higher consumer spending power, and increasing health and wellness awareness, with more consumers seeking healthier food options, is consolidating market growth in the region. Furthermore, the U.S. has a vibrant and innovative food industry, with numerous companies dedicated to developing and marketing healthy snack products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.