- Home

- »

- Consumer F&B

- »

-

Frozen Meat Market Size, Share And Growth Report, 2030GVR Report cover

![Frozen Meat Market Size, Share & Trends Report]()

Frozen Meat Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Beef, Chicken, Pork), By Distribution Channel (Convenience Stores, Supermarkets & Hypermarkets, Online), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-890-9

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Frozen Meat Market Summary

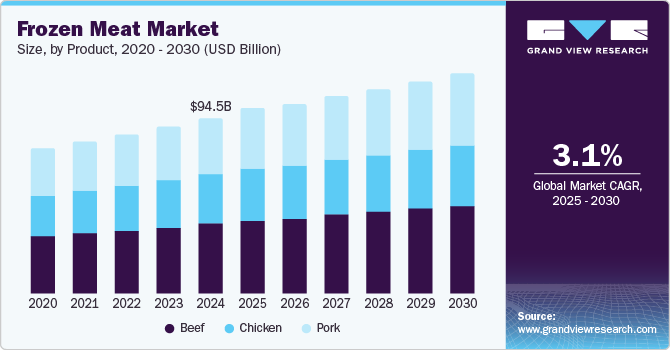

The global frozen meat market size was estimated at USD 94.5 billion in 2024 and is projected to reach USD 115.76 billion by 2030, growing at a CAGR of 3.1% from 2025 to 2030. The market growth can be attributed to the rising consumer demand for convenience and extended shelf life.

Key Market Trends & Insights

- The Asia Pacific (APAC) frozen meat market accounted for the dominant share of 34.6% in 2024.

- The U.S. frozen meat market is expected to be driven by busy lifestyles and the need for quick meal solutions over the forecast period.

- By product, beef dominated the market with 33.0% share in 2024.

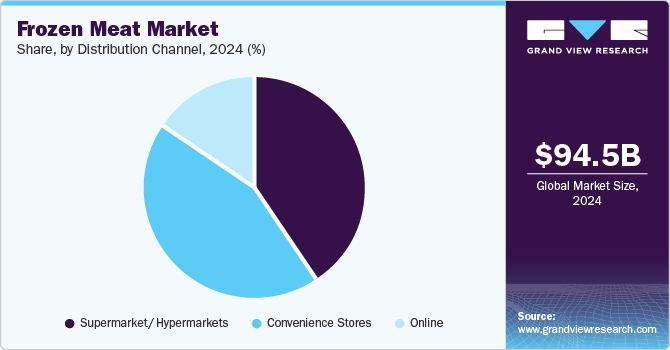

- By distribution channel , supermarkets and hypermarkets dominated the global market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 94.5 Billion

- 2030 Projected Market Size: USD 115.76 Billion

- CAGR (2025-2030): 3.1%

- Asia Pacific: Largest market in 2024

Busy lifestyles and the desire for longer-lasting meat options have led consumers to turn to frozen meats as a reliable solution. This trend is particularly strong in developed countries, where the demand for ready-to-eat and easy-to-prepare meals is on the rise. In addition, the market was significantly driven by the growing awareness of food safety and preservation. Freezing meat effectively inhibits the growth of harmful bacteria, ensuring that the product remains safe for consumption over an extended period. This has made frozen meat a popular choice for consumers who prioritize food safety and want to avoid frequent trips to the grocery store.

Moreover, technological advancements in freezing and packaging methods have contributed to the market's expansion. Improvements in freezing technology, such as quick freezing and blast freezing, help preserve the quality, texture, and flavor of frozen meat. These advancements allow manufacturers to offer higher-quality frozen meat products that can compete with fresh meat, attracting more consumers. Additionally, advancements in supply chain management have made it easier for manufacturers to maintain the freshness and nutritional value of frozen meat throughout the distribution process.

Product Insights

Beef dominated the market with 33.0% share in 2024. Beef remains one of the most popular meat products worldwide, and rising consumption, particularly in emerging economies, and has driven the market dominance. With increasing disposable incomes in countries including China, India, and Brazil, more consumers have incorporated beef into their diets, contributing to the growth of the frozen beef market. Moreover, the market witnessed a growing consumer preference for premium beef cuts, such as ribeye, tenderloin, and sirloin, in developed markets such as the U.S. and Europe. Frozen beef allows retailers and restaurants to maintain a consistent supply of premium cuts, making them accessible to a broader audience while ensuring long and quality shelf life.

The chicken segment is projected to grow over the forecast period. Chicken is one of the most widely consumed meats globally, and its popularity has continued to rise due to its affordability, versatility, and perceived health benefits. In addition, the rise in health-conscious eating habits, coupled with the popularity of high-protein diets, has boosted the demand for frozen chicken products, including breast fillets, thighs, and wings. Consumers have increasingly demanded convenience in meal preparation, leading to an increase in frozen chicken products that are easy to cook and ready to use, such as pre-marinated chicken, breaded chicken tenders, and nuggets. These products cater to busy lifestyles and offer quick meal solutions.

Distribution Channel Insights

Supermarkets and hypermarkets dominated the global market share in 2024. These retail channels offer a comprehensive selection of frozen meat products, including various types of meat such as beef, chicken, pork, lamb, and seafood, and processed options including nuggets, sausages, and ready-to-cook meals. This extensive variety has increasingly attracted consumers looking for a one-stop shopping experience. In addition, retailers often run promotions, discounts, and loyalty programs on frozen meat products, incentivizing customers to purchase more. These price reductions can significantly influence consumer buying behavior and drive sales through these channels.

Online distribution channels are anticipated to grow at a CAGR of 3.5% over the forecast period owing to the wide expansion of e-commerce platforms and online grocery services. Retailers have increasingly invested in their online presence and optimized their websites for a seamless shopping experience, making it easier for consumers to browse and order products. Additionally, online platforms often offer a wider variety of frozen meat products compared to physical stores, including specialty items, organic options, and international brands. This extensive selection allows consumers to find specific products as per their requirements and preferences.

Regional Insights

The North America frozen meat market held 21.1% share in 2024. With busy lifestyles becoming the norm, consumers in the region have increasingly sought convenient meal options. They have preferred frozen meat products, including pre-marinated, ready-to-cook, and processed items including frozen meatballs and nuggets. The market witnessed a growing shift towards health and nutrition among consumers. They perceive frozen meat as healthier alternatives such as lean cuts of chicken, turkey, grass-fed beef, as they seek to incorporate more protein into their diets.

U.S. Frozen Meat Market Trends

The U.S. frozen meat market is expected to be driven by busy lifestyles and the need for quick meal solutions over the forecast period. Frozen meat products, including ready-to-cook options including pre-seasoned chicken or frozen burgers, offer convenience for consumers looking for easy and fast meal solutions. Moreover, the growing demand for protein-heavy diets including keto, paleo, and high-protein meal plans is expected to accelerate the market. Chicken, beef, and pork have remained staples for consumers seeking to incorporate protein into their diets.

Asia Pacific Frozen Meat Market Trends

The Asia Pacific (APAC) frozen meat market accounted for the dominant share of 34.6% in 2024 owing to the rising disposable incomes and changing dietary preferences, leading to increased meat consumption across the region. Consumers have increasingly incorporated more protein-rich foods, including various types of frozen meat, into their diets.

Europe Frozen Meat Market Trends

The Europe frozen meat market held 29.3% of the global revenue share in 2024. European consumers have increasingly sought convenient meal solutions that fit their busy lifestyles. Frozen meat products, such as ready-to-cook and pre-marinated options, cater to this demand by offering quick and tasty meal solutions. In addition, manufacturers with innovations including freezing techniques have improved the quality and shelf life of frozen meat products. Methods such as flash freezing help maintain flavor, texture, and nutritional value, making frozen meat options more appealing to consumers.

Key Frozen Meat Company Insights

The global frozen meat market is intensely competitive. Key companies include Kerry Group plc, Margrif Group, Tyson Foods Inc., and others. These companies have increasingly invested in technological advancements to bring about innovation in preservatives to maintain the quality of meat and reduce prices.

-

Kerry Group plc is a leading food company that specializes in food ingredients, flavors, and nutritional solutions, catering to a wide range of industries including food, beverage, and pharmaceuticals.

-

BRF Global is a leading food processing company that is known for its strong brands such as Sadia, Perdigão, Qualy, Paty, Dánica, and Bocatti. The company produces and distributes a wide range of food products in over 150 countries. BRF entirely focuses on delivering delicious and nutritious food while promoting social development and environmental responsibility.

Key Frozen Meat Companies:

The following are the leading companies in the frozen meat market. These companies collectively hold the largest market share and dictate industry trends.

- Kerry Group plc

- BRF Global

- Associated British Foods plc

- Tyson Foods, Inc.

- Pilgrim’s

- VERDE FARMS

- Hewitt

Recent Developments

-

In July 2024, Manna Tree, a private equity firm announced the controlling stake in VERDE FARMS, a leading brand of organic and 100% grass-fed beef. This investment effort is aimed at accelerating Verde's growth in the expanding better-for-you (BFY) beef category.

-

In June 2024, Tyson launched Restaurant Style Crispy Wings and Honey Chicken Bites. These protein-packed, flavorful offerings are expected to cater to refined tastes with simplified mealtime.

Frozen Meat Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 99.20 billion

Revenue forecast in 2030

USD 115.76 billion

Growth rate

CAGR of 3.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Spain, Italy, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

Kerry Group plc; BRF Global; Associated British Foods plc; Tyson Foods, Inc.; Pilgrim’s; VERDE FARMS; Hewitt

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Frozen Meat Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global frozen meat market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Beef

-

Chicken

-

Pork

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarket/ Hypermarkets

-

Convenience Stores

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.