- Home

- »

- Processed & Frozen Foods

- »

-

Fruit Concentrate Market Size, Share & Growth Report, 2030GVR Report cover

![Fruit Concentrate Market Size, Share & Trends Report]()

Fruit Concentrate Market (2023 - 2030) Size, Share & Trends Analysis Report By Source (Apple, Citrus Fruits), By Distribution Channel (B2B, B2C), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-103-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fruit Concentrate Market Summary

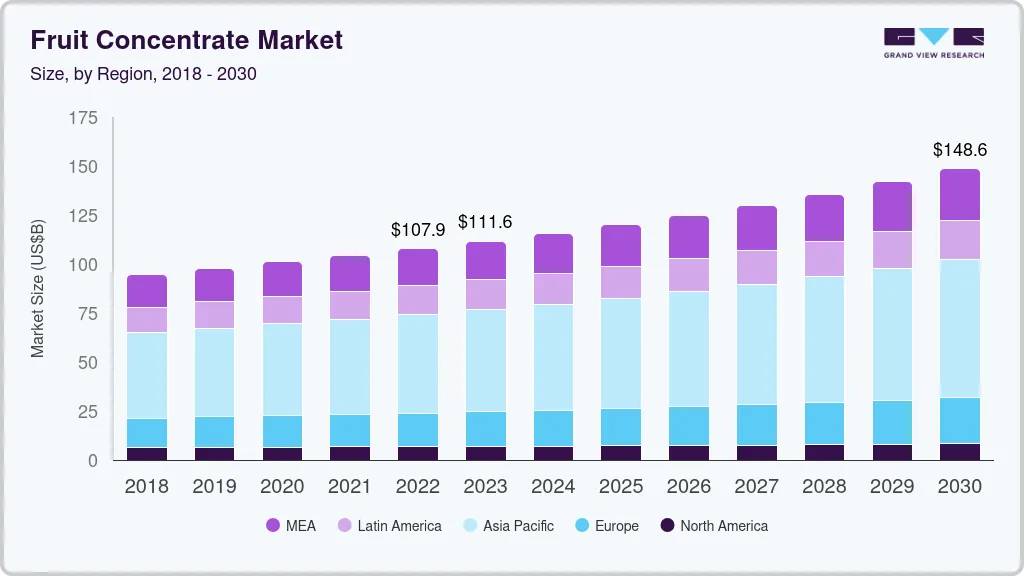

The global fruit concentrate market size was estimated at USD 107.8 billion in 2022 and is projected to reach USD 148.55 billion by 2030, growing at a CAGR of 4.1% from 2023 to 2030. The rising cases of chronic heart disease, diabetes, and obesity have increased the demand for healthier-food choices among consumers.

Key Market Trends & Insights

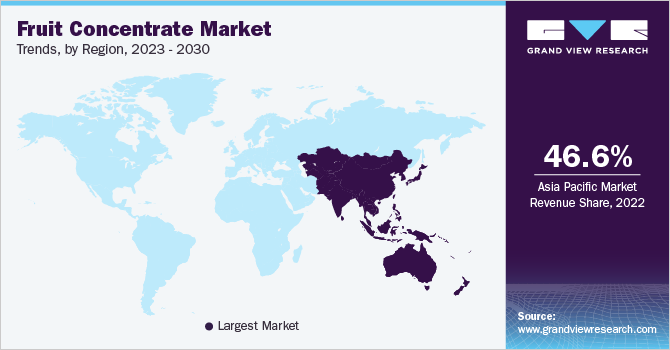

- The Asia Pacific region held a dominant revenue share of 46.6 % in 2022.

- The North America fruit concentrate industry is projected to grow at a CAGR of 2.3% from 2022 to 2030.

- In terms of source, the apple fruit extract segment held the largest share of 21.63%, in terms of revenue, in 2022.

- Based on application, the food and beverage segment held the largest revenue share of 34.01% in 2022.

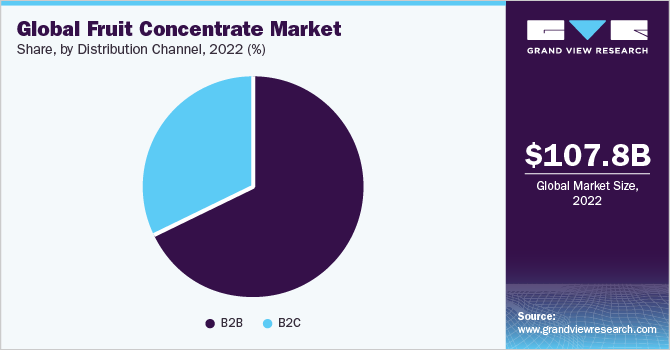

- Based on distribution channel, the B2B segment held the largest share of 68.07% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 107.8 Billion

- 2030 Projected Market Size: USD 148.55 Billion

- CAGR (2023-2030): 4.1%

- Asia Pacific: Largest market in 2022

The rise in the number of consumers consuming alternatives for sugar has propelled the demand for the replacement of natural fruit extracts in several food and beverage applications such as confectionery, snacks, juices, and chocolates. Moreover, the fructose present in fruits is a healthier alternative as it provides ideal sweetness and enhances moisture in food applications.In addition, there is a shifting consumption trend towards refined fruit puree concentrates instead of natural fruit juices. This trend is primarily driven by the unavailability of certain seasonal fruits throughout the year. Fruit concentrate puree offers a concentrated form of fruit that can be used as a substitute for fresh fruits or natural fruit juices throughout the year. The refining process removes water content while retaining the flavor, nutrients, and fiber present in the fruit. This makes fruit concentrate puree a versatile ingredient that can be used in various food and beverage applications, including smoothies, sauces, fillings, and baked goods.

Fruit concentrates are a convenient option for both manufacturers and consumers as they are easier to store, transport, and handle compared to fresh fruits. Concentrates have a longer shelf life as they undergo the process of water content removal, which helps in inhibiting microbial growth and preserving the product. This extended shelf life reduces the risk of spoilage, which makes fruit concentrates a practical choice for manufacturers, retailers, and consumers.

The food and beverage industry is a significant driver of the fruit concentrate market. Fruit concentrates are used as key ingredients in a wide range of products, including juices, smoothies, nectars, ice creams, yogurts, baked goods, sauces, and more. They serve multiple functions in food production, such as providing natural sweetening, enhancing flavors, adding color, and improving texture.

Source Insights

In terms of source, the apple fruit extract segment held the largest share of 21.63%, in terms of revenue, in 2022. Apple concentrate helps in enhancing the flavor of food and beverages. It provides a concentrated apple taste, adding a natural fruity flavor to the final product. In addition, it acts as a natural sweetener, eliminating the need for artificial sweeteners. The sweet and tangy profile of apple concentrate makes it a popular ingredient in various applications, such as sweetening beverages, sauces, and baked goods. For instance, in March 2019, Minute Maid, a subsidiary of Coca Cola announced the launch of an apple sparkle drink that includes apple concentrate from Kashmiri Apples sourced from India.

On the other hand, the berry concentrate segment showcased a significant CAGR of 4.3% during the forecast period. The growing usage of berries in supplements, gummies, and snacks to impart color and antioxidant properties is fueling the demand for the segment.Berries consumed in the form of supplements have shown significant improvements in fat breakdown, appetite suppression, and enhancement of the body's resting metabolism. With an increasing focus on health and fitness due to the rising prevalence of severe health conditions, there is a potential for regional demand for berry-flavored supplements. In June 2022, Symrise announced the launch of blueberry ingredients for usage in baby food.

Application Insights

The food and beverage segment held the largest revenue share of 34.01% in 2022. Fruit concentrates offer significant convenience to food and beverage manufacturers. They are easy to store, transport, and handle compared to fresh fruits. In addition, fruit concentrates can be used in smaller quantities to achieve the desired flavor and sweetness, making them cost-effective for large-scale production. In February 2023, Austria Juice showcased its collection of organic fruit juice concentrates in BioFach made from organic fruits and berries. Better Juice company is also actively investing in research and development (R&D) initiatives to reduce the amount of sugar in berries and fruits, to make them ideal for food and beverage manufacturers.

The pet food segment is expected to showcase a CAGR of 3.7% during the forecast period. Pet owners are increasingly seeking natural and healthy ingredients for their pets' food. Fruit concentrates are a healthier alternative to artificial additives or flavorings. Fruit concentrates are rich in vitamins, minerals, and antioxidants, which can be beneficial for pets' overall health and well-being. For instance, U.S.-based Tree Top Inc. offers pet food manufacturers a wide range of fruit ingredients in different forms.

Distribution Channel Insights

The distribution channel segment is bifurcated into B2B and B2C segment. The B2B segment held the largest share of 68.07% in 2022. Fruit concentrates can be used in a wide range of applications, such as ingredients in beverages, desserts, sauces, yogurts, and other food products, providing versatility to businesses. The ability to incorporate fruit flavors in various product categories expands the market demand for fruit concentrate. In addition, fruit concentrate has an extended shelf life compared to fresh fruits. This is beneficial for businesses that require longer storage times or have seasonal demand fluctuations.

The B2C segment is anticipated to grow at a CAGR of 3.7% during the forecast period.The increasing number of companies providing organic food and beverages, along with the expanded presence of newer brands in online channels and supermarkets, is driving the growth of the B2C segment. Manufacturers are adopting social media and various marketing strategies to attract consumer attention. In May 2023, Tropicana announced the launch of ambient fruit juices, which can be stored for a longer time. The juices are available in original orange, smooth orange, and pressed apple flavors.

Regional Insights

The Asia Pacific region held a dominant revenue share of 46.6 % in 2022. The demand for ready-to-drink (RTD) beverages is on the rise in the Asia Pacific region due to changing lifestyles and increasing urbanization. Fruit concentrates serve as key ingredients in the production of RTD fruit juices, flavored water, energy drinks, and other on-the-go beverages.

The convenience and flavor consistency offered by fruit concentrates makes them an indispensable ingredient in the RTD beverage segment. In June 2023, India-based Storia announced the launch of sugarcane juice, which is available in retail stores and online e-commerce stores such as blinkit, zepto, and Amazon.

Furthermore, India’s fruit concentrate industry showcased the fastest CAGR of 4.5% over the forecast period. Favorable initiatives by the government coupled with rising consumer demand for organic beverages is favoring the demand for fruit concentrate in the country.

The North America fruit concentrate industry is projected to grow at a CAGR of 2.3% from 2022 to 2030. With the growing concerns about the health impact of excessive sugar consumption, consumers are seeking healthier alternatives. Fruit concentrate offers a natural sweetness derived from fruits, making it an attractive option for manufacturers looking to reduce added sugars in their products in the region.

Europe is expected to witness a steady growth rate of 4.12% owing to the increasing demand for sustainably sourced products, which is driving the growth for the segment. In February 2023, Tropicana expanded its portfolio of pressed natural fruit juices in pineapple & pink guava and strawberry & banana flavors.

Key Companies & Market Share Insights

The global fruit concentrate industry is anticipated to witness intense competition as a result of numerous players operating within the industry. To stay ahead in the market and adapt to evolving consumer preferences, several companies are strategically diversifying their product portfolios to gain a competitive edge. Fruit concentrate manufacturers are continuously innovating their products and leveraging technological advancements to effectively cater to consumer demands. In March 2023, Dohler GmBH partnered with DKSH Performance Materials to market and distribute fruit powders, pectins, and fibers for Austria and Switzerland markets. Some prominent players in the global fruit concentrate market include:

-

Skypeople Fruit Juice Inc.

-

Royal Cosun

-

Kerr Concentrates, Inc.

-

Dohler GmBH

-

Archer Daniels Midland

-

Agrana Beteiligungs Ag

-

China Haiseng Juice Holdings Co., Ltd

-

Lemon Concentrate, S.L.

-

Rudolf Wild GmBH & Co. Kg

-

Sunopata Inc.

Fruit Concentrate Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 111.59 billion

Revenue forecast in 2030

USD 148.55 billion

Growth Rate (Revenue)

CAGR of 4.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million, Volume in Kilo Tons, and CAGR from 2023 to 2030

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa; UAE

Key companies profiled

Skypeople Fruit Juice Inc.; Royal Cosun; Kerr Concentrates, Inc.; Dohler GmBH; Archer Daniels Midland; Agrana Beteiligungs Ag; China Haiseng Juice Holdings Co., Ltd; Lemon Concentrate, S.L.; Rudolf Wild GmBH & Co. Kg; Sunopata Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

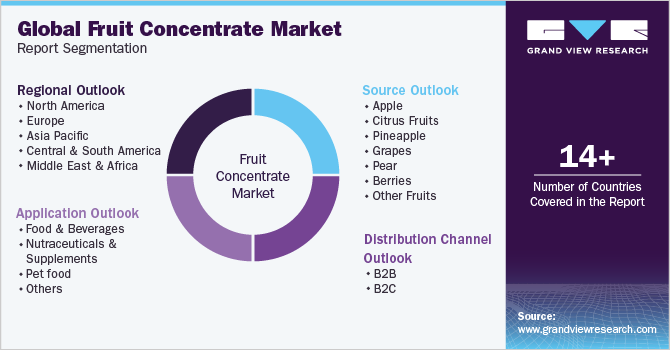

Global Fruit Concentrate Market Report Segmentation

This report forecasts volume and revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global fruit concentrate market report on source, application, distribution channel, and region:

-

Source Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

Apple

-

Citrus Fruits

-

Pineapple

-

Grapes

-

Pear

-

Berries

-

Other Fruits

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

Food & Beverages

-

Dairy Based Beverages

-

Non-Dairy Beverages

-

Confectionery

-

Bakery

-

Snacks

-

Desserts & Condiments

-

Others

-

-

Nutraceuticals & Supplements

-

Pet food

-

Others

-

-

Distribution Channel Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

B2B

-

B2C

-

Online Sales

-

Hypermarkets/Supermarkets

-

Wholesale Stores

-

Others

-

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global fruit concentrate market size was estimated at USD 107.8 billion in 2022 and is expected to reach USD 111.59 billion in 2023.

b. The global fruit concentrate market is expected to grow at a compound annual growth rate of 4.1% from 2023 to 2030 to reach USD 148.55 billion by 2030.

b. The Asia Pacific fruit concentrate market held a dominant revenue share of 46.6% in 2022 owing to the rise in the number of health-conscious consumers coupled with high demand for organic foods

b. Some of the major players in the fruit concentrate market include Skypeople Fruit Juice Inc., Royal Cosun, Kerr Concentrates, Inc., Dohler GmBH, Archer Daniels Midland, Agrana Beteiligungs Ag, China Haiseng Juice Holdings Co., Ltd, Lemon Concentrate, S.L., Rudolf Wild GmBH & Co. Kg, and Sunopata Inc.

b. Factors such as rising cases of chronic heart disease, diabetes, and obesity have increased the demand for healthier-food choices among consumers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.