- Home

- »

- Homecare & Decor

- »

-

Fruit & Vegetable Wash Market Size & Share Report, 2030GVR Report cover

![Fruit & Vegetable Wash Market Size, Share & Trends Report]()

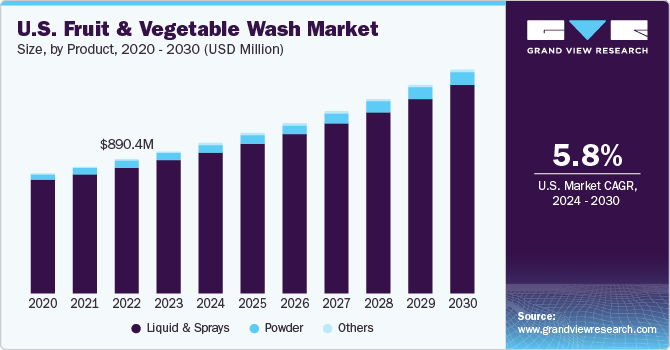

Fruit & Vegetable Wash Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Liquid & Sprays, Powder), By Type (Synthetic, Natural), By Distribution Channel, By End-user Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-168-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fruit & Vegetable Wash Market Summary

The global fruit & vegetable wash market size was estimated at USD 3,968.5 million in 2023 and is projected to reach USD 6,526.7 million by 2030, growing at a CAGR of 7.4% from 2024 to 2030. Factors favoring the use of fruit & vegetable wash include the growing consumer awareness pertaining to possible health risks associated with pesticide residues on fruits and vegetables and growing emphasis on healthy eating habits and high spending on sanitizers & hygiene products owing to the COVID-19 outbreak.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, South Africa is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, liquid & sprays accounted for a revenue of USD 3,748.8 million in 2023.

- Powder is the most lucrative grade segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 3,968.5 million

- 2030 Projected Market Size: USD 6,526.7 million

- CAGR (2024-2030): 7.4%

- North America: Largest market in 2023

According to a 2022 survey conducted by the FDA, 77% of domestically grown fruits, 60% of US vegetables, and 53% of US grains sampled showed pesticide residues.

Consumers are opting for organic and natural fruit & vegetable cleaners and washes due to concerns about potential health and environmental risks associated with synthetic chemicals.Manufacturers are now focusing on sustainable cleaners that are made from natural, biodegradable ingredients. In addition, consumers are showing a growing interest in organic food due to its potential advantages and lesser risks. BiOWiSH Fruit & Vegetable Wash has been approved for use in certified organic food production and handling and can supplement the banana wash process system types and management practices.

Due to the COVID-19 outbreak and increasing popularity of e-commerce, people are focusing more on hygiene, which has led to a surge in the purchase of fruits and vegetable cleaners. This is because these products offer convenience, wider range of selection, and access to reviews and recommendations. In 2020, Nykaa, an online retailer of cosmetics and beauty products, launched Nykaa Veggie Safe cleaner in response to concerns about food safety due to the pandemic. The product was made available on the Nykaa website and app, as well as in stores across India. Companies like ITC Ltd, Marico, and CavinKare have also launched fruit and vegetable washes through modern retail outlets and e-commerce channels during the COVID-19 pandemic.

The fruits and vegetable cleaning products industry has been influenced by the growing demand for sustainability and natural ingredients such as enzymes and plant extracts in cleaning products, leading to a shift towards the use of eco-friendly and organic formulations. As an example, in 2021, Amway India introduced a new product called Amway Home Fruit & Veggie Wash, which includes naturally-derived cleansing agents that leave no harmful residue. Consumers are increasingly aware of the importance of food safety and the risks associated with consuming contaminated produce. This growing awareness has led to an increased demand for safer food options. Consumers are increasingly busy and looking for convenient and easy-to-use products. Increasing consumer awareness regarding the importance of food safety and rising disposable incomes of consumers in developing countries and emerging markets has urged manufacturers to introduce new products and expansion into new markets. In 2020, Marico Limited launched a new brand Veggie Clean to enter vegetable and fruit hygiene category, owing to the increased consumer awareness and demand for hygiene products across the Indian market. Also, availability of product in liquid & spray, powder, wipes, and other forms will further boost the product adoption rate globally.

As more women enter the workforce and face longer hours and imbalanced work-life demands, the use of fruit & vegetable cleaners is anticipated to increase over the coming years. Moreover, ongoing investments in R&D are pivotal in the fruit & vegetable wash industry, fueling innovation, advanced formulation development, and improved product performance, thereby influencing market competitiveness and growth.In 2020, PeeSafe introduced RahoSafe fruit and vegetable wash in India due to increased consumer health consciousness and focus on cleaning and sanitization.

Product Insights

In terms of product, the liquid & sprays segment held the maximum share of 94.5% in 2023. Factors such as high versatility, effectiveness and convenience offered by liquid & spray products have led high prominence among consumers and manufacturers. Liquid and spray cleaners are often more effective at removing dirt, pesticides, and bacteria from fruits and vegetables compared to powdered cleaners. In 2020, ITC launched its first 100% natural action vegetable and fruit liquid wash available in two variants Nimwash 'Spray & Wash' and Nimwash 'Soak & Wash’ in packs of 450 ml, 500 ml, and 1 litre.Moreover, liquid and spray cleaners are more convenient to use than powdered cleaners, as they do not require mixing or measuring.

Powder products is anticipated to register a CAGR of 7%. Key benefits including cost effectiveness, environmental friendliness, and easy preparation methods have led to growing adoption of powder cleaners for washing fruits & vegetables. Powder cleaners often come in bio-degradable packaging and can be easily mixed with water during the cleaning of fresh produce. For instance, Grow Green Industries, Inc. have developed eatCleaner fruit and vegetable wash powder that are lab-proven all-natural wash capable of removing 99.99% of unwanted residue, including wax, germs, and pesticides.

Type Insights

Based on type, the synthetic segment dominated the market in 2023 with a revenue share of 72.08%. Synthetic cleaners are often perceived as highly effective at removing stubborn contaminants, such as bacteria and pesticides due to their stronger chemical formulations. They are a popular choice for budget-conscious consumers due to their longer shelf life and lower cost compared to natural cleaners. Manufacturers are currently investing in R&D to create new and innovative synthetic ingredients that can effectively clean and extend the shelf life of fruits and vegetables.

Demand of natural fruit & vegetable wash is set to expand at a CAGR of about 7.1%. The increasing awareness of the potential environmental impacts and residual effects of synthetic chemicals on produce is expected to drive demand for natural and bio-based products. In addition, natural fruit and vegetable cleaners are becoming more popular among consumers who seek eco-friendly and health-conscious options. In 2020, Hindustan Unilever announced the launch of its "Nature Protect" range of products, which includes fruit and vegetable cleaners .

End-user Industry Insights

The household segment dominated the market in 2023 with a revenue share of 76.97%. Household consumers nowadays are becoming more and more concerned about the safety of their food. They are looking for cleaners that can effectively remove pesticides, bacteria, and other contaminants from their produce. When it comes to selecting cleaners, consumers prioritize convenience and ease of use. They prefer products that are straightforward to apply and require minimal effort. Manufacturers are introducing products prepared from natural ingredients for catering to household end-users. In 2020, Wipro Consumer Care and Lighting announced to launch Giffy Fruit & Vegetable Wash with 100% naturally derived formulation .

Demand from commercial end-user industry is set to expand at a CAGR of about 7%. Commercial end-users, such as restaurants, hotels, cafes, and caterers, require cleaners that can effectively handle large volumes of produce while maintaining consistent performance. The stringent regulatory requirements towards food handling and storage are anticipated to drive the need for cleaners prepared from environmentally friendly ingredients. The FDA recommends cleaning and washing of fruits and vegetables, even if they are organic or bought at a farmer’s market.

Distribution Channel Insights

Supermarkets and hypermarkets dominated the market in 2023 with a revenue share of 48.70%. A wide range of cleaners from various brands are available at these stores, catering to diverse consumer needs and preferences. Consumers can physically inspect the products, assess their packaging, and build trust, which encourages repeat purchases. These channels will continue to dominate due to their established brand relationships and the trust consumers have in finding reputable fruit and vegetable cleaners, further solidifying their market presence.According to Ecommerce China, the retail volume of China's household cleaning and care market is expected to reach USD 2.5 billion by 2023.

The online channel is expected to witness strong demand for fruits and vegetable cleaners and is expected to witness a CAGR of 7.2% over the forecast period. Online platforms offer convenience and accessibility, especially for consumers who prefer to shop from home or have limited access to physical stores. They have enabled manufacturers to reach potential customers, improve communication, track finances, and boost brand awareness in a cost-effective manner. Major companies are expanding their distribution networks to potential and emerging economies. For instance, in July 2021, eatCleaner successfully launched its products in Japan through the Amazon.com platform under the Eatclean brand. The company developed a product with a completely different design to fit the Japanese market.

Regional Insights

North America dominated the global industry in 2023 with a share of 30.32%. The region is home to a large number of consumers who prioritize products made from natural ingredients due to concerns about the potential health and environmental hazards associated with synthetic chemicals. Consumers in the area are willing to pay a premium for products that are made using natural ingredients. According to the 2023 EWG Shopper's Guide to Pesticides in Produce, almost 75% of non-organic fresh produce sold in the U.S. contains residues of possibly harmful pesticides, which drives growth in the regional industry.

Asia Pacific market is set to grow at a CAGR of about 7%. This is due to its large and diverse consumer base, rapid urbanization, and increasing disposable income, which have all led to a surge in demand for products. To remain competitive and expand their market share, companies in the industry are increasing their presence in the region. In response to the COVID-19 outbreak, government officials have encouraged the public to clean their fruits and vegetables before consumption. As an example, in June 2021, the ITAP-NSTDA helped the Thai enterprise, Chiwadi Products Company Limited, to launch a line of fruit and vegetable wash products to support the safe food initiative in the country.

Key Companies & Market Share Insights

The industry is characterized by the presence of several established players and new entrants. Players in the market are diversifying and expanding their operations, adopting product launches, and other strategies to maintain market share.

Key Fruit & Vegetable Wash Companies:

- Procter & Gamble

- ITC

- Wipro

- Grow Green Industries, Inc.

- Marico Limited

- Unilever

- Diversey, Inc

- Maclin Group

- Hebei Baiyun Daily Chemical Co., Ltd.

- Dabur

Recent Developments

-

In May 2023, Grow Green Industries, Inc., announced that their eatCleaner Fruit and Veggie Wash products are now certified by the U.S. EPA Safer Choice program and have earned the Safer Choice label. This EPA program rigorously vets ingredients, claims, and product validity, creating high customer and vendor confidence

-

In June 2020, CavinKare introduced the 'SaaFoo' brand in India to meet the demand for fresh produce sanitization due to the pandemic.The product is available in sachet and liquid form and can be purchased at retail outlets or e-commerce platforms.

Fruit & Vegetable Wash Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.23 billion

Revenue forecast in 2030

USD 6.53 billion

Growth rate

CAGR of 6.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, type, distribution channel, end-user industry, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Procter & Gamble; ITC; Wipro; Grow Green Industries; Marico Limited; Unilever; Diversey Inc.; Maclin Group; Hebei Baiyun Daily Chemical Co., Ltd.; Dabur

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fruit & Vegetable Wash Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fruit & vegetable wash market report based on product, type, distribution channel, end-user industry, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid & Sprays

-

Powder

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Synthetic

-

Natural

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets and Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

End-user Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Commercial

-

Institutional

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the fruit & vegetable wash market include Procter & Gamble, ITC, Wipro, Grow Green Industries, Marico Limited, Unilever, Diversey, Inc., Maclin Group, Hebei Baiyun Daily Chemical Co., Ltd., Dabur

b. Key factors that are driving the fruit & vegetable wash market include the growing consumer awareness pertaining to possible health risks associated with pesticide residues on fruits and vegetables and growing emphasis on healthy eating habits and high spending on sanitizers & hygiene products owing to the COVID-19 outbreak.

b. The global fruit & vegetable wash market was estimated at USD 3.97 billion in 2023 and is expected to reach USD 4.23 billion in 2024.

b. The global fruit & vegetable wash market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030 to reach USD 6.53 billion by 2030.

b. North America dominated the fruit & vegetable wash market with a share of around 30.3% in 2023. The region is home to a large number of consumers who prioritize products made from natural ingredients due to concerns about the potential health and environmental hazards associated with synthetic chemicals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.