- Home

- »

- Consumer F&B

- »

-

Organic Food And Beverages Market Size Report, 2030GVR Report cover

![Organic Food And Beverages Market Size, Share & Trends Report]()

Organic Food And Beverages Market Size, Share & Trends Analysis Report By Product (Organic Food, Organic Beverages), By Distribution Channel (Convenience Stores, Specialty Stores), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-095-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Organic Food And Beverages Market Trends

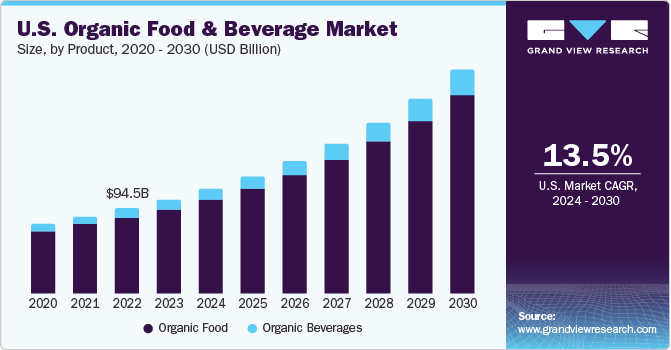

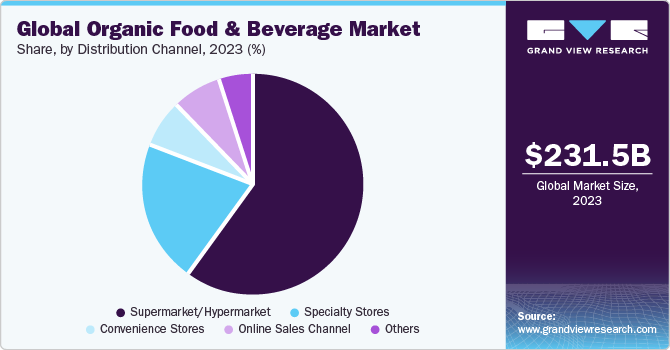

The global organic food and beverages market size was valued at USD 231.52 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 13.9% from 2024 to 2030. One of the primary factors driving market expansion is growing awareness about the health benefits associated with the consumption of organic products. Sales of organic food and beverages are projected to rise as a result of the change in purchasing behavior of consumers. In addition, the rising popularity of non-GMO products among consumers is driving market growth. The market has witnessed substantial growth due to the increased accessibility of organic foods and beverages. Organic products are no longer confined to niche stores or farmers' markets.

They have become readily available in mainstream supermarkets, online retailers, and even fast-food chains. This expanded distribution has made it convenient for consumers to include organic options in their regular shopping habits. In addition, there is a growing awareness and concern surrounding the environmental impact associated with conventional agricultural practices. These practices often contribute to issues, such as soil degradation, water pollution, and the loss of biodiversity. In contrast, organic farming methods prioritize sustainable practices aimed at promoting soil health, conserving water resources, and preserving wildlife habitats. This strong emphasis on environmental sustainability resonates with an increasing number of consumers who actively seek out products that align with their values of sustainability and ethical consumption.

The demand for organic ingredients has grown over the past few years owing to the desire for improved overall health among consumers and the awareness regarding the harmful effects of synthetic ingredients. Several health risks are associated with the use of conventional foods, owing to the presence of synthetic chemicals, such as pesticides and antibiotics, in animals and plants respectively. In addition, government participation in helping consumers to understand the difference between falsely labeled products and legitimate ones has also contributed toward overall market development. The government in some parts of the globe has also issued certain guidelines barring the use of chemicals, pesticides, growth hormones, and other synthetic chemicals to promote the cultivation of organic products.

Moreover, the government in India is encouraging organic farming by offering incentives to cultivators of organic food products under the National Horticulture Mission (NHM) at Rs. 10,000/- per hectare for a maximum area of four hectares per beneficiary and organic farming certification at Rs. 5.00 lakh for a group of farmers covering an area of 50 hectares in India. The negative impact of conventional farming practices has far exceeded its positive results. Water contamination in oceans is one of the after-effects of conventional farming in addition to pesticide-resistant pests, degrading soil fertility, rampant human diseases, expensive cleanups, and dead zones. Regulatory support for biological farming and supply trade regulations are expected to have a positive influence on market growth over the long term.

The intensification of the traditional farming system has generated a need for organic farming methods to maintain healthy soil in the long run. However, the high cost of production and operations and shorter shelf life are projected to constraint the market growth over the forecast years. Moreover, premium pricing of products limiting widespread customer acceptance and limited options to choose from the product assortments are hampering the market expansion. High packaging, logistics, and distribution costs to extend shelf life are also restricting market growth.

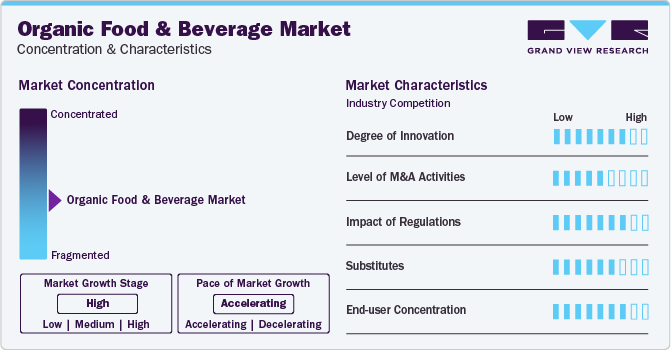

Market Concentration & Characteristics

The organic food and beverage market has witnessed a remarkable degree of innovation, with a surge in novel products incorporating sustainable practices, advanced production techniques, and diverse ingredients. From plant-based alternatives to eco-friendly packaging, the industry continues to evolve, meeting consumer demands for both health-conscious and environmentally friendly choices.

The market has experienced notable M&A activities, reflecting a dynamic industry landscape. Companies are strategically acquiring or merging to capitalize on the growing consumer demand for organic products, fostering innovation and market consolidation within the sector.

Stringent regulations in this market have significantly influenced industry dynamics, ensuring higher standards for production, labeling, and certification. These regulations enhance consumer trust, drive transparency, and encourage sustainable practices, ultimately fostering the growth of the organic sector while posing challenges for non-compliant businesses.

In the organic food and beverage market, the availability of substitutes is limited due to the unique characteristics of organic products, such as absence of synthetic pesticides and genetically modified organisms. While conventional alternatives exist, the distinct consumer preference for organic options and the stringent certification standards create a niche market with few direct substitutes.

The organic food and beverage market typically exhibits a dispersed end-user concentration, with a diverse consumer base seeking healthier and sustainable food options. This trend is driven by a growing awareness of environmental concerns, health consciousness, and a preference for organic and natural products among consumers from various demographic segments.

Product Insights

In the organic food segment, the fruits and vegetables segment emerged as the leading segment in 2023, having accounted for a share of 40.6% of the global revenues. The trend of organic vegetables was initiated in developed regions, including North America and Europe, and has extended to emerging economies, such as India and China. North America and Europe are the largest consumers of organic foods. The consumption of organic meat, fish & poultry products is expected to grow at the highest CAGR of 15.8% from 2024 to 2030. Increasing concerns regarding artificial preservatives and additives are anticipated to augment the product demand over the forecast years.

The organic beverages segment includes non-dairy beverages, coffee & tea, beer & wine, and others including juices and soft drinks. The organic beverages segment is poised to grow exponentially as consumers opt for natural drinks over carbonated beverages owing to various health benefits. Non-dairy beverages led the segment in 2023. Increasing adoption of vegan culture is also likely to boost segment growth. Coffee & tea sales are anticipated to grow at the highest CAGR of 17.1% from 2024 to 2030 due to the high consumption of flavored tea and coffee.

Distribution Channel Insights

The supermarket/hypermarket distribution channel segment accounted for the largest share of over 60.1% in 2023. These stores have a broad portfolio of branded as well as domestic products. Some of the brick-and-mortar stores provided by this distribution channel and its ability to stock popular brands have been supplementing the growth of this segment. The increasing number of supermarket & hypermarket chains and altering retail landscape, particularly in developing economies, are boosting product sales via this channel.

The online distribution channel segment is projected to grow at a CAGR of 15.2% from 2024 to 2030. Rising internet penetration and target marketing done by companies to reach all customer touchpoints are likely to fuel the growth of this segment. The trend of online sales and subscription boxes for organic produce has grown significantly in the last two years, which is expected to have a positive effect on market growth. Rapid penetration of online groceries and online food delivery platforms coupled with the surge in the adoption of smartphones further triggers segment growth.

Regional Insights

Availability of farmlands for organic farming in the U.S., Australia, and Argentina has forced the regulators to frame supportive policies to increase production output of organic foods. This factor in turn is projected to have a positive impact on organic food and beverages market demand over the forecast period. The North American organic food & beverages market made a larger contribution in the global market of 49.9% in 2023 owing to the unique advantages associated with the products, such as being eco-friendly, zero chemical and residue-free, and healthier compared to conventional food. Increasing consumer awareness regarding the benefits of non-genetically modified or engineered products intake is anticipated to fuel the North America market in the near future.

The Asia Pacific organic food & beverages market is expected to grow at a CAGR of 18.1% from 2024 to 2030, driven by the rising trend of ready-to-eat foods among the working-class people as well as high millennial population in countries, such as India. China, India, and Japan are the major markets, in terms of consumer spending on food. Moreover, a substantial rise in the demand for frozen food owing to less time for preparation and cooking is opening new avenues for the regional market for organic frozen food. The Europe organic food and beverages market is anticipated to grow at a CAGR of 12.7% from 2024 to 2030. The organic food and beverages market in Europe has witnessed a significant shift in consumer attitudes toward sustainability and ethical consumption.

Many consumers are now prioritizing products that are produced in an environmentally responsible manner, which includes organic farming practices. Organic agriculture promotes biodiversity, and soil health, and reduces the use of synthetic fertilizers and pesticides, aligning with the values of environmentally conscious consumers. According to a 2023 market report by the Soil Association Certification, the organic market in the UK has shown significant growth owing to the cost-of-living crisis, with sales increasing by 1.6% in 2022. This market growth was driven by strong performance in the food service sector, which witnessed sales increase by 152%.

However, sales of organic foods and drinks in supermarkets, independent retailers, and home delivery were mixed. Furthermore, as per the findings of the Meatless Farm Report, the organic market remains on an upward trajectory despite facing obstacles. Notably, there is a remarkable surge in the demand for sustainable shopping among consumers, indicating a robust interest in eco-friendly practices. Interestingly, the report highlights that customers are increasingly seeking organic goods that are reasonably priced and easily accessible. This implies a favorable outlook for the organic market, suggesting sustained growth in the foreseeable future.

South Africa organic food & beverages market

The organic food & beverages market in South Africa is poised for growth due to an increasing awareness of sustainable farming practices and a rising demand for ethically-sourced products. Factors unique to the country's trends include a growing emphasis on biodiversity preservation, ethical farming, and the promotion of local, organic agriculture.

Canada organic food & beverages market

The organic food & beverages market in Canada is driven by government initiatives promoting organic farming practices. In March 2022, the Minister of Agriculture and Agri-Food declared a financial commitment of up to USD 103,400 to support the Organic Federation of Canada, facilitating a novel collaboration aimed at advancing sustainability and fostering growth within Canada's organic industry.

Germany organic food & beverages market

The organic food & beverages market in Germany is projected to grow at CAGR of 13.8% from 2024 to 2030. Trade expos and exhibitions contribute by serving as platforms for showcasing organic products, fostering industry connections, and educating consumers.For example, Nuremberg, Germany hosts the annual BioFach worldwide trade show for organic food and agriculture. In 2023, the expo drew over 36,000 trade visitors from 135 countries.

India organic food & beverages market

The organic food & beverages market in India is projected to grow at CAGR of around 21% from 2024 to 2030. India exported 1,978,460.38 million tons (mt) of organic products worth USD 2,480.24 million between 2019-20 and 2021-2022. Of these exports, the U.S. received about 50% and the European Union (EU) received 37%.

Key Organic Food And Beverages Company Insights

The global organic and food beverages market is characterized by a plethora of players ranging from established organic brands to new entrants, reflecting the industry's dynamic nature. Some prominent players in this market are Hain Celestial, Dole Food Company, Inc., Danone, Nestlé, General Mills Inc., Gujarat Cooperative Milk Marketing Federation (Amul), and more. Key factors influencing competition include product innovation, certification standards, and strategic alliances to capture a share of the expanding market driven by increasing consumer demand for organic and sustainable choices.

Key Organic Food and Beverage Companies:

The following are the leading companies in the organic food and beverages market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these organic food and beverages companies are analyzed to map the supply network.

- Hain Celestial

- Whole Foods Market L.P.

- Dole Food Company, Inc.

- Dairy Farmers of America, Inc.

- General Mills Inc.

- Danone

- United Natural Foods, Inc.

- Gujarat Cooperative Milk Marketing Federation (Amul)

- The Hershey Company

- Amy’s Kitchen, Inc.

- Organic Valley

- Conagra Brands, Inc.

- Nestlé

- Eden Foods

- SunOpta

Recent Developments

-

In October 2023, Dole Food Company, Inc. unveiled the establishment of Dole Organics, a specialized division, and introduced its 'GO Organic!' consumer brands at Fruit Attraction 2023 in Madrid in October. Focused on revitalizing the organic fresh produce category, Dole Organics aims to foster cross-sector collaboration, streamline supply chains, and ensure the ongoing continuity and consistency of organic products.

-

In April 2023, So Delicious Dairy Free, a division of Danone North America, unveiled its inaugural entry into the oatmilk segment with the introduction of Organic Oatmilk. Crafted from organic oats and various ingredients, the product is available in two variants: Original and Extra Creamy.

-

In February 2022, Amul, a dairy company in India, entered the organic food market by launching organic rice, flour, honey, chocolates, and potato products. They also plan to set up a "green college" to educate young farmers about natural and organic farming and create "organic haats" to sell organic products

-

In May 2022, Organic India, a leading organic tea and wellness brand, launched two new varieties of tea and infusion: Tulsi Detox Kahwa and Peppermint Refresh. Both teas are certified organic and vegan, and they are available in loose-leaf and teabag formats. The launch of these new teas is part of Organic India's mission to offer consumers healthy and sustainable wellness products

Organic Food and Beverage Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 258.94 billion

Revenue forecast in 2030

USD 564.22 billion

Growth rate (Revenue)

CAGR of 13.9% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Distribution Channel, and Region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Hain Celestial; Whole Foods Market L.P.; Dole Food Company, Inc.; Dairy Farmers of America, Inc.; General Mills Inc.; Danone; United Natural Foods, Inc.; Gujarat Cooperative Milk Marketing Federation (Amul); The Hershey Company; Amy’s Kitchen, Inc.; Organic Valley; Conagra Brands, Inc.; Nestlé; Eden Foods; SunOpta

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Food And Beverages Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global organic food and beverage market report on the basis of product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic Food

-

Fruits & Vegetables

-

Meat, Fish & Poultry

-

Dairy Products

-

Frozen & Processed Food

-

Others

-

-

Organic Beverages

-

Non-dairy Beverages

-

Coffee & Tea

-

Beer & Wine

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket/Hypermarket

-

Specialty Stores

-

Convenience Stores

-

Online Sales Channel

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global organic food and beverages market size was estimated at USD 208.19 billion in 2022 and is expected to reach USD 231.52 billion in 2023.

b. The global organic food and beverages market is expected to grow at a compounded growth rate of 11.7% from 2023 to 2030 to reach USD 564.22 billion by 2030.

b. Fruits and vegetables dominated the global product organic food and beverages market with a share of 40.2% in 2022. Increasing concerns regarding artificial preservatives and additives is anticipated to augment the growth of product demand over the coming years.

b. Some key players operating in white spirits market include Hain Celestial; Whole Foods Market L.P..; Dole Food Company, Inc.; Dairy Farmers of America, Inc.; General Mills Inc.; Danone; United Natural Foods, Inc.; Gujarat Cooperative Milk Marketing Federation (Amul); THE HERSHEY COMPANY; Amy’s Kitchen, Inc.; Organic Valley; Conagra Brands, Inc.; Nestlé; Eden Foods; SunOpta.

b. Key factors that are driving the market growth include, desire for improved overall health among consumers and the awareness regarding the harmful effects of synthetic ingredients. Several health risks are associated with the use of conventional foods, owing to the presence of synthetic chemicals such as pesticides and antibiotics in animals and plants respectively.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."