- Home

- »

- Next Generation Technologies

- »

-

Fuel Card Market Size, Share & Trends, Industry Report 2033GVR Report cover

![Fuel Card Market Size, Share & Trends Report]()

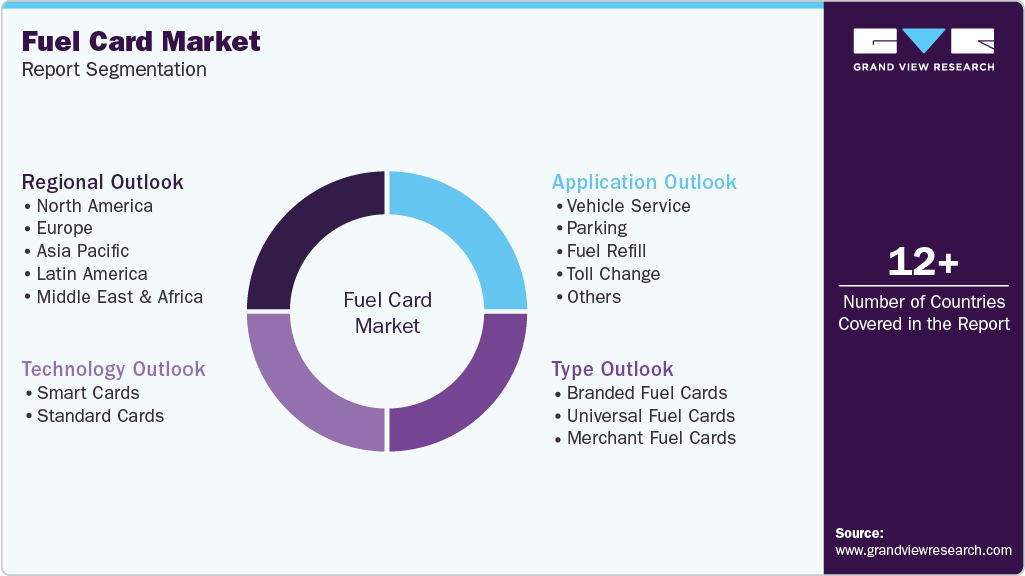

Fuel Card Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Branded Fuel Cards, Universal Fuel Cards), By Technology (Smart Cards, Standard Cards), By Application (Vehicle Service, Parking, Fuel Refill, Toll Change), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-173-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fuel Card Market Summary

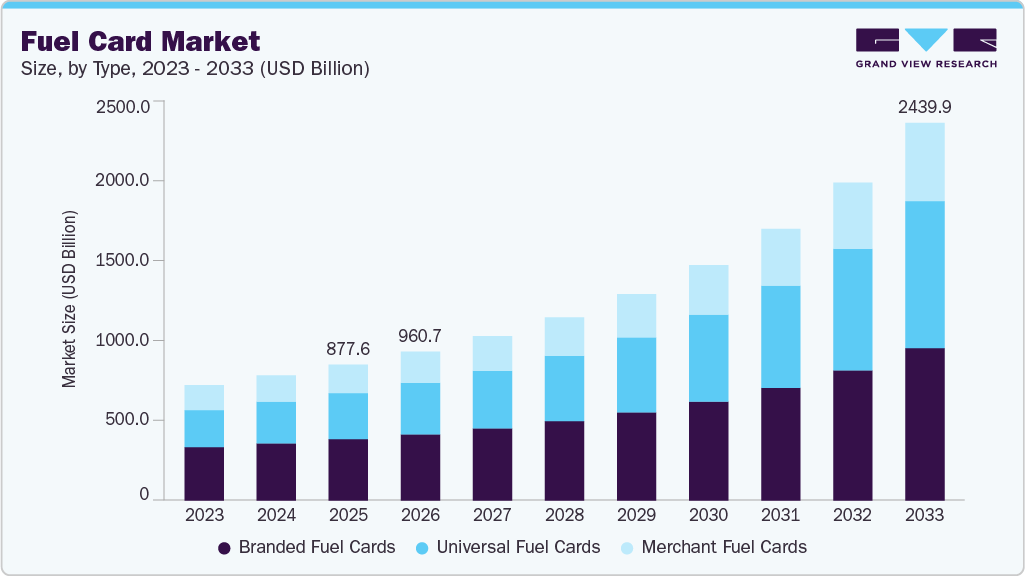

The global fuel card market size was estimated at USD 877.63 billion in 2025 and is projected to reach USD 2,439.88 billion by 2033, growing at a CAGR of 14.2% from 2026 to 2033. The fuel card market is gaining momentum as fleet operators increasingly move away from cash- and receipt-based fuel payments toward controlled, digital transaction systems.

Key Market Trends & Insights

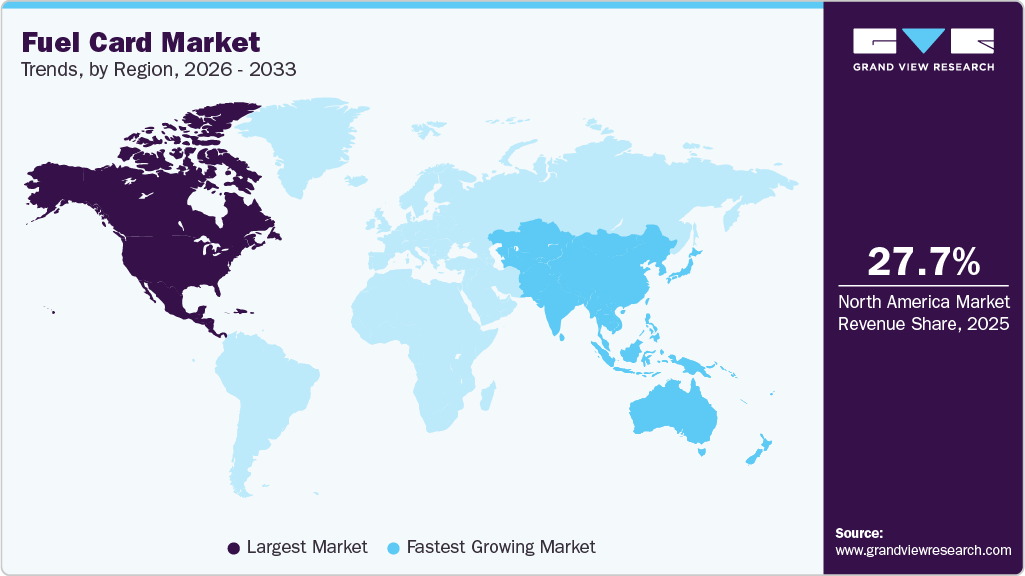

- North America fuel card market accounted for a 27.7% share of the overall market in 2025.

- The fuel card market in the U.S. is expected to witness strong growth from 2026 to 2033.

- By type, the branded fuel cards segment accounted for the largest share of 45.1% in 2025.

- By technology, the smart cards segment held the largest market share in 2025.

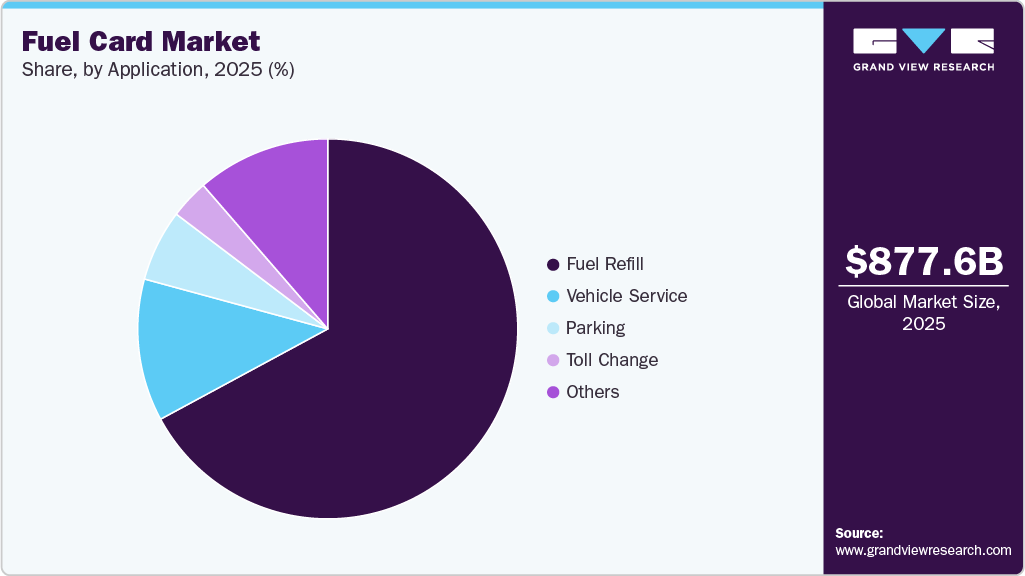

- By application, the fuel refill segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 877.63 Billion

- 2033 Projected Market Size: USD 2,439.88 Billion

- CAGR (2026-2033): 14.2%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Fuel cards help organizations reduce pilferage, improve expense visibility, and streamline reimbursement processes, making them particularly attractive for large commercial fleets. Volatility in global fuel prices has emerged as a critical driver accelerating fuel card adoption among fleet operators. Frequent price fluctuations create uncertainty in operating budgets, prompting businesses to seek greater control over fuel consumption and spending patterns. Fuel cards allow fleet managers to set predefined spending limits, monitor fuel usage in real time, and identify inefficiencies linked to driver behavior. This level of insight helps organizations optimize refueling schedules and avoid purchases during peak price periods. Additionally, consolidated transaction data strengthens negotiation power with fuel suppliers. By enabling proactive cost management, fuel cards act as a buffer against unpredictable energy expenses. As a result, they are increasingly being perceived as financial risk-mitigation tools rather than simple payment mechanisms.Technological integration is significantly reshaping the competitive landscape of the fuel card market. Modern fuel card solutions are increasingly integrated with telematics systems, GPS tracking, and advanced data analytics platforms. This integration allows fleet operators to link fuel consumption directly with vehicle performance, route efficiency, and driving patterns. Such insights support data-driven decisions on route optimization and fuel-efficiency improvements. Additionally, combining payment data with operational metrics enables predictive maintenance planning, reducing vehicle downtime. These connected capabilities enhance overall fleet productivity and asset utilization. As fleets become more digitized, the functional value of fuel cards continues to expand well beyond fuel payment alone.

Regulatory and compliance requirements are driving fuel card adoption, particularly in regions with strict tax and reporting regulations. Fuel cards simplify compliance by automatically generating transaction records, fuel invoices, and tax-ready documentation. This automation reduces manual paperwork and minimizes the risk of reporting errors. For enterprises operating large or geographically dispersed fleets, such compliance support significantly lowers administrative burden. Multi-country fuel cards further benefit cross-border fleets by offering consolidated billing and standardized reporting formats. These features help organizations manage complex regulatory environments more efficiently. As compliance expectations intensify, fuel cards are becoming indispensable tools for regulated fleet operations.

The fuel card market is also being shaped by the transformation of fuel cards into comprehensive mobility payment solutions. Providers are expanding card functionalities to include toll payments, vehicle maintenance services, parking fees, and roadside assistance. Many fuel cards are now also compatible with electric vehicle charging infrastructure, supporting fleets with mixed-energy vehicle portfolios. This diversification reflects the broader shift toward integrated mobility management. By consolidating multiple fleet expenses into a single platform, fuel cards improve operational convenience and cost tracking. These solutions help fleet managers gain a holistic view of total mobility spend.

Type Insights

The branded fuel cards segment dominated the market in 2025 and accounted for a 45.1% share of the global revenue. Branded fuel cards continue to dominate the fuel card market due to their strong association with established oil marketing companies and extensive proprietary fuel station networks. Fleet operators prefer these cards for assured fuel quality, consistent pricing, and greater acceptance in brand-owned outlets. Providers are strengthening their dominance by enhancing card features such as digital spend controls, automated invoicing, and loyalty or volume-based discounts. Branded fuel cards also benefit from long-standing relationships with large commercial and government fleets. Their seamless integration with fuel supply agreements and centralized billing systems improves operational reliability.

The universal fuel cards segment is projected to witness the fastest growth from 2026 to 2033. Universal fuel cards are emerging as a fast-growing segment, driven by the need for flexibility across multi-brand fuel networks. Fleet operators with wide geographic coverage increasingly favor universal cards to avoid dependency on a single fuel provider. These cards allow refueling decisions based on price competitiveness, route convenience, and station availability. Growth in logistics, e-commerce delivery, and intercity transportation is further accelerating demand for brand-agnostic fueling solutions. Universal fuel cards are also gaining traction due to improved digital platforms, real-time analytics, and broader acceptance partnerships.

Technology Insights

The smart cards segment dominated the market in 2025. Smart fuel cards dominate the market due to their advanced security, data processing, and real-time transaction control capabilities. These cards leverage chip-based technology and digital authentication to reduce fuel fraud, unauthorized usage, and data manipulation. Fleet operators increasingly prefer smart cards for features such as PIN protection, driver–vehicle mapping, geo-fencing, and instant transaction alerts. Integration with fleet management software, telematics, and analytics platforms further enhances their value proposition. Smart cards also support compliance through automated reporting and audit-ready transaction records.

The standard cards segment is projected to grow significantly from 2026 to 2033. Standard fuel cards remain a significant segment, particularly among small fleets and cost-sensitive operators seeking simple and reliable fuel payment solutions. Their ease of use, lower issuance costs, and widespread acceptance make them suitable for basic fueling requirements. Standard cards are commonly adopted in regions with lower digital infrastructure penetration or among fleets with limited technology integration needs. These cards offer straightforward transaction tracking without complex system dependencies. Additionally, they serve as an entry point for organizations transitioning from cash-based fuel payments.

Application Insights

The fuel refill segment dominated the market in 2025. The fuel-refill segment continues to dominate the fuel card market, driven by the core need for efficient, controlled fuel purchasing across commercial and corporate fleets. Fuel cards are widely used to replace cash-based refueling, helping operators reduce pilferage and improve visibility into fuel consumption. The high frequency of refueling transactions, especially in logistics, transportation, and public mobility services, reinforces the dominance of this segment. Fuel cards also enable fleet managers to enforce spending limits and select preferred fueling locations.

The vehicle service segment is projected to witness significant growth from 2026 to 2033. The vehicle service segment is emerging as fuel card providers expand their offerings beyond fuel payments to cover maintenance, repairs, and ancillary vehicle services. Fleet operators are increasingly seeking consolidated payment solutions to manage servicing costs alongside fuel expenses. Fuel cards are being integrated with authorized service centers, workshops, and roadside assistance networks to simplify expense tracking. This trend is particularly strong among large fleets aiming to reduce administrative complexity and downtime.

Regional Insights

The North America regiondominated the fuel card market with 27.7% market share in 2025. The fuel card market in North America is driven by the region’s large commercial vehicle base and the strong presence of organized fleet operators across logistics, transportation, and construction sectors. High fuel consumption and rising operating costs are prompting fleets to adopt fuel cards to improve expense control and prevent fraud. The widespread adoption of digital payments and advanced fleet management technologies supports seamless integration of fuel cards with telematics, GPS, and accounting systems. Strict regulatory and tax reporting requirements are further pushing companies toward automated, card-based fuel payment solutions. Additionally, the rapid growth of e-commerce and last-mile delivery services is driving demand for scalable, flexible fuel card programs.

U.S. Fuel Card Market Trends

The fuel card market in the U.S. is expected to witness strong growth from 2026 to 2033, supported by the country’s large commercial fleet base and rapid digitization of fleet operations. Increasing adoption of cashless and controlled fuel payment systems among logistics, transportation, and last-mile delivery fleets is driving market expansion.

The fuel card market in Canada is expected to grow at a notable pace during the forecast period, driven by increasing fleet digitization and government-led sustainability initiatives. Programs supporting zero-emission commercial vehicles are indirectly boosting demand for fuel cards that can manage both conventional fuel and EV charging expenses.

Asia Pacific Fuel Card Market Trends

The Asia Pacific regionis expected to grow at a fastest CAGR from 2026 to 2033. G Countries such as China, India, Japan, and South Korea are witnessing increasing adoption of fuel cards to replace cash-based refueling and improve fleet cost control. Government-led digitization initiatives and expanding digital payment infrastructure are strengthening fuel card acceptance across the region. Additionally, rising fuel price sensitivity among fleet operators is encouraging the use of fuel cards for spend monitoring and fraud prevention.

The fuel card market in China is expected to register steady growth from 2026 to 2033, driven by the country’s massive logistics, construction, and industrial vehicle base. Fleet operators are increasingly adopting fuel cards to comply with stricter emission regulations and improve fuel consumption monitoring.

The fuel card market in India is anticipated to grow at a significant rate during the forecast period, supported by rising commercial vehicle activity and formalization of fleet operations. Government initiatives promoting digital payments and GST-compliant invoicing are accelerating the shift from cash-based fueling to fuel card.

The fuel card market in Japan is expected to grow steadily from 2026 to 2033, driven by the country’s strong emphasis on efficiency, automation, and sustainability. Fleet operators are increasingly adopting fuel cards to align with eco-friendly transportation practices and reduce administrative overhead.

Europe Fuel Card Market Trends

The heavy-duty electric truck market in Europe is expected to grow at a moderate CAGR from 2026 to 2033. The Fleet operators are adopting fuel cards to manage fuel, tolls, and vehicle-related expenses in a centralized manner. The presence of large multinational logistics companies is driving demand for cross-border and multi-country fuel card solutions. Increasing electrification of commercial fleets is also prompting fuel card providers to integrate EV charging networks. These developments are reinforcing the role of fuel cards as integrated mobility payment platforms across Europe.

UK fuel card market is expected to grow at a notable CAGR from 2026 to 2033. Fleet operators are increasingly adopting fuel cards to improve compliance, reduce fuel fraud, and manage operating costs. The growing rollout of electric commercial vehicles is supporting demand for fuel cards that cover both fuel and charging payments. Additionally, rising fuel costs are pushing fleets to seek better spending control and data visibility. These factors are collectively driving fuel card adoption in the UK

The fuel card market in Germany is expected to grow at the highest CAGR from 2026 to 2033. Stringent emission norms and sustainability targets are encouraging fleet operators to adopt fuel cards for transparent fuel tracking and reporting.

Middle East & Africa Fuel Card Market Trends

The fuel card market in MEA is anticipated to grow at a steady CAGR of from 2026 to 2033. Governments and private enterprises are increasingly adopting fuel cards to improve fuel expense monitoring and reduce misuse. The gradual introduction of electric commercial vehicles in select Middle Eastern countries is encouraging fuel card providers to enhance digital payment capabilities. Additionally, large fleet operations in construction, oil & gas, and transportation are driving demand for centralized fuel payment solutions. These factors support sustained market growth across the region.

The fuel card market in KSA is expected to witness highest growth rate from 2026 to 2033. Large-scale infrastructure projects and logistics expansion are increasing fuel consumption across commercial fleets. Fleet operators are adopting fuel cards to improve cost control, reduce fuel pilferage, and streamline expense reporting.

Key Fuel Card Company Insights

Some of the key companies operating in the market include Corpay, Inc., WEX Inc., Shell plc, and BP plc.

-

Corpay, Inc. is one of the global leader in commercial payment solutions, with fuel cards forming a core part of its business. The company offers both branded and universal fuel card programs that cater to a wide range of fleet sizes, from small businesses to large multinational enterprises. Corpay’s strength lies in its extensive acceptance network, advanced spend controls, and strong analytics capabilities that help fleets manage fuel expenses and reduce fraud

-

WEX Inc. is one of the major providers of fleet and mobility payment solutions, widely recognized for its strong presence in the North American fuel card market. The company offers fuel cards designed to support corporate, government, and commercial fleet operators, with features focused on cost control, compliance, and operational efficiency. WEX fuel cards are commonly integrated with fleet management and telematics platforms, enabling detailed tracking of fuel usage and driver behavior.

Key Fuel Card Companies:

The following key companies have been profiled for this study on the fuel card market.

- Corpay, Inc.

- WEX Inc.

- Shell plc

- BP plc

- Exxon Mobil Corporation

- Chevron Corporation

- TotalEnergies SE

- DKV Mobility

- UTA Edenred

- Repsol

Recent Developments

-

In July 2025, BP partnered with WEX to launch the earnify fleet fuel card program in the U.S. in 2025, providing fleet drivers with fuel savings and access to vehicle-related purchases at merchants accepting WEX and Mastercard. The card could be used at over 8,000 stations across BP, Amoco, TravelCenters of America, TA Express, and Petro, and supported payments for parts, tolls, car washes, parking, and roadside assistance. Business owners and fleet operators were able to set spending controls by product type, amount, or time, and the cards featured EMV chip technology for security. Earnify fleet drivers could also join the rewards program to earn loyalty points when fueling for work at participating locations.

-

In April 2025, WEX launched WEX EV Depot, a solution enabling secure and seamless electric vehicle charging payments across depot, public, and at-home sites using the WEX Fleet Card. The platform integrated with WEX’s existing public ‘En Route’ and ‘At-Home’ charging solutions, allowing fleet operators to consolidate data across different chargers for operational efficiency. Key features included RFID-enabled secure payments, a mobile app for touch-free charger activation, and a mapping tool to guide drivers to preferred charging locations. The solution helped fleets manage EV and internal combustion vehicle payments on a single credit line while reducing downtime through overnight charging scheduling

Fuel Card Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 960.69 billion

Revenue forecast in 2033

USD 2,439.88 billion

Growth rate

CAGR of 14.2% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Transaction value in USD billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Corpay, Inc.; WEX Inc.; Shell plc; BP plc; Exxon Mobil Corporation; Chevron Corporation; TotalEnergies SE; DKV Mobility; UTA Edenred, Repsol

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fuel Card Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the fuel card market based on type, technology, application, and region:

-

Type Outlook (Transaction Value, USD Billion; 2021 - 2033)

-

Branded Fuel Cards

-

Universal Fuel Cards

-

Merchant Fuel Cards

-

-

Technology Outlook (Transaction Value, USD Billion; 2021 - 2033)

-

Smart Cards

-

Standard Cards

-

-

Application Outlook (Transaction Value, USD Billion; 2021 - 2033)

-

Vehicle Service

-

Parking

-

Fuel Refill

-

Toll Change

-

Others

-

-

Regional Outlook (Transaction Value, USD Billion; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fuel card market size was estimated at USD 877.63 billion in 2025 and is expected to reach USD 960.69 billion in 2026.

b. The global fuel card market is expected to grow at a compound annual growth rate of 14.2% from 2026 to 2033 to reach USD 2,439.88 billion by 2033.

b. North America dominated the fuel card industry, accounting for a 27.7% share in 2025. This is attributable to the key factors, such as 5G integration, smart city initiatives, and AI-based fleet optimization.

b. Some key players operating in the fuel card market include Corpay, Inc.; WEX Inc. ; Shell plc; BP plc; Exxon Mobil Corporation; Chevron Corporation; TotalEnergies SE; DKV Mobility; UTA Edenred; Repsol.

b. The growth of the fuel card market can be attributed to the increasing adoption of digital payment solutions and real-time telematics integration, which are enhancing operational efficiency, enabling better expense management, and supporting fleet electrification strategies across commercial transport, thereby reshaping fuel procurement and fleet management practices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.