- Home

- »

- Automotive & Transportation

- »

-

Fuel Cell Powertrain Market Size, Industry Report, 2033GVR Report cover

![Fuel Cell Powertrain Market Size, Share & Trends Report]()

Fuel Cell Powertrain Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Fuel Cell Module (Stack + BoP), Hydrogen Storage System), By Product, By Application, By End User, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-734-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fuel Cell Powertrain Market Summary

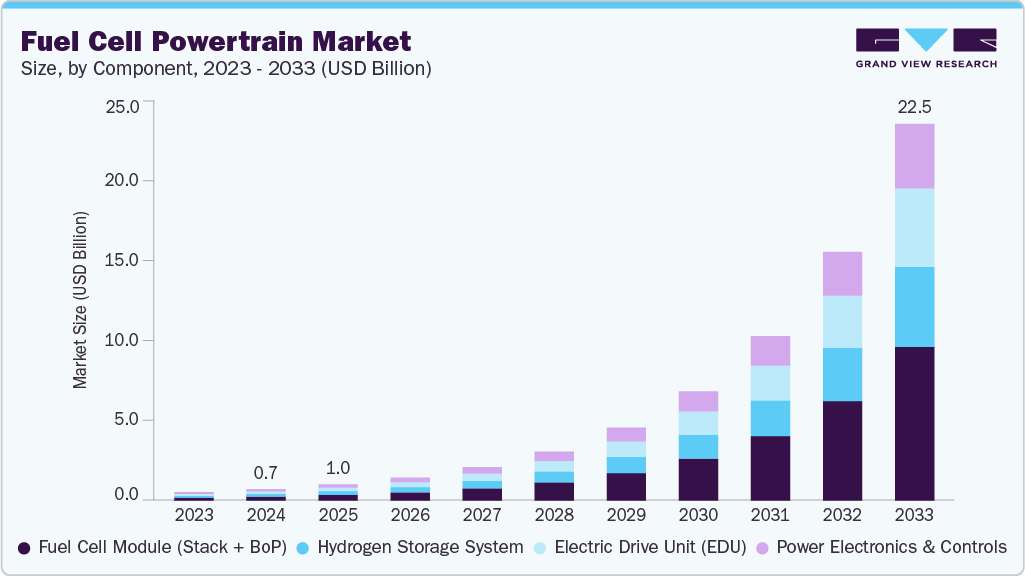

The global fuel cell powertrain market size was estimated at USD 685.3 million in 2024, and is projected to reach USD 22,498.1 million by 2033, growing at a CAGR of 48.3% from 2025 to 2033. The market is gaining momentum, driven by growing government incentives for zero-emission vehicles and the rising demand for fuel cell-powered trucks and buses across logistics and public transport sectors.

Key Market Trends & Insights

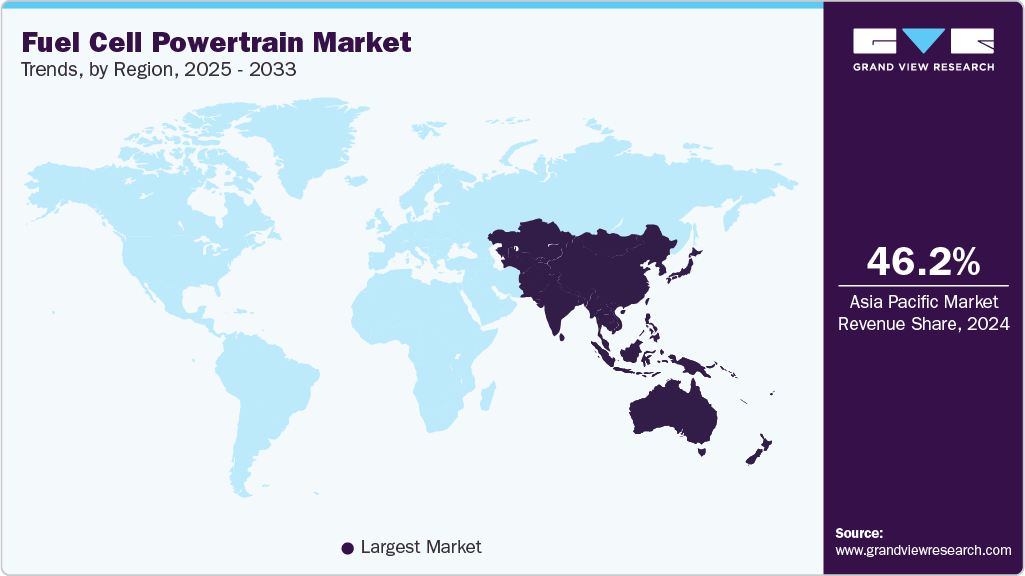

- The Asia Pacific fuel cell powertrain market accounted for a revenue share of 46.2% in 2024.

- By component, the fuel cell module segment held the largest market share in 2024.

- By product, the fuel cell electric powertrain segment accounted for the largest share of 37.9% in 2024.

- By application, the commercial trucks & buses segment held the largest market share in 2024.

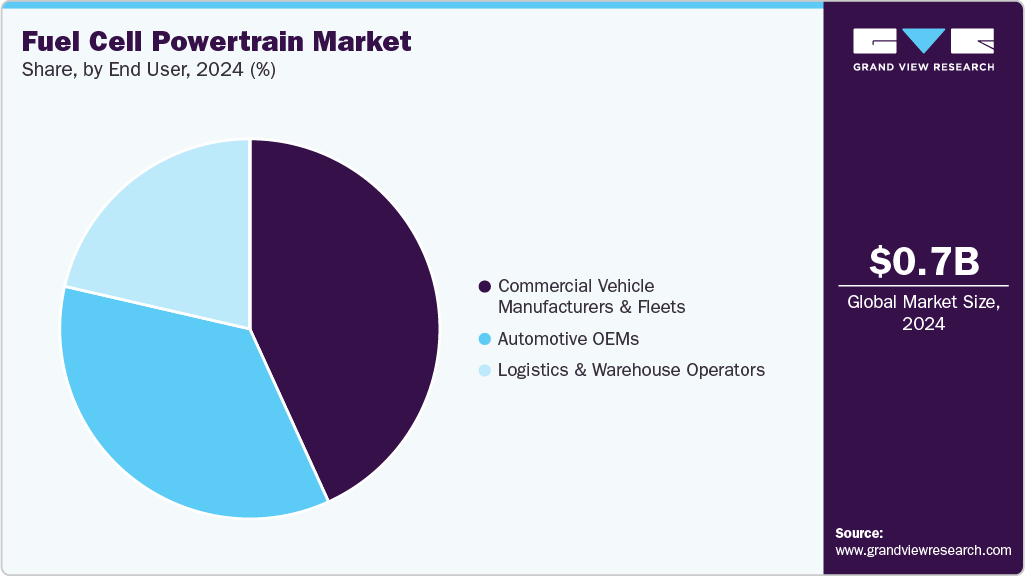

- By end user, the commercial vehicle manufacturers & fleets segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 685.3 Million

- 2033 Projected Market Size: USD 22,498.1 Million

- CAGR (2025-2033): 48.3%

- Asia Pacific: Largest market in 2024

- North America: Fastest Growing Market

Continuous cost reductions in fuel cell systems and hydrogen storage technologies are also supporting broader adoption, alongside the steady expansion of green hydrogen production infrastructure worldwide. Emerging markets in the Middle East & Africa and Latin America are creating new opportunities for deploying fuel cell-based heavy-duty fleets, particularly in regions seeking alternatives to diesel engines. However, high upfront costs of fuel cell systems compared to battery-electric alternatives remain a significant challenge, hindering faster commercialization across cost-sensitive segments.Government incentives have played a pivotal role in accelerating the deployment of fuel cell powertrains by reducing upfront costs and supporting infrastructure development. These policy measures are aimed at fostering the transition away from internal combustion engines and promoting the adoption of zero-emission mobility solutions across commercial and public sectors. Incentives typically include purchase subsidies, tax exemptions, research and development funding, and direct support for fleet retrofitting or replacement. These initiatives are particularly critical for high-cost segments like fuel cell-powered trucks and buses, where operating economics remain a barrier without government intervention.

For instance, in July 2025, Germany’s Federal Ministry for Transport launched a new funding round to promote the adoption of zero-emission bus fleets. The initiative covers battery-electric and hydrogen-powered buses, as well as the retrofitting of existing diesel vehicles, with the goal of expediting the decarbonization of public transport systems nationwide. In May 2023, the UK government, along with industry partners, announced USD 104.43 million (GBP 77 million) in funding for zero-emission vehicle initiatives. The program included support for the HYER POWER hydrogen fuel cell range extender designed for emergency service vehicles. These developments reinforce the strategic commitment by governments to scale hydrogen fuel cell mobility, which is expected to significantly drive the expansion of the fuel cell powertrain industry over the forecast period.

The growing need to decarbonize heavy-duty transportation is accelerating the adoption of fuel cell-powered trucks and buses, particularly in logistics and public transit sectors where long range, quick refueling, and high payload capacity are critical. Fleet operators are increasingly turning to hydrogen fuel cell vehicles as a viable alternative to diesel, especially for long-haul routes and intensive urban service cycles. Public transport agencies are also prioritizing low-emission solutions to meet national and regional climate targets, making fuel cell buses a strategic investment. For instance, in July 2025, Oman’s state-owned operator Mwasalat signed an agreement with Birba to deploy hydrogen-powered buses for the Green Hydrogen Summit in Muscat. Supported by Shell’s dedicated green hydrogen refueling station, the initiative illustrates Oman’s broader strategy to advance hydrogen mobility and reduce emissions in the transport sector. Such developments underscore the growing interest in fuel cell vehicles among logistics providers and public agencies, signaling a strong market shift toward zero-emission heavy-duty mobility platforms.

The rapid expansion of green hydrogen production infrastructure is becoming a critical driver for the fuel cell powertrain market, as it directly addresses the fuel supply challenges that have historically limited adoption. By scaling up renewable hydrogen generation and distribution networks, both governments and private sector players are laying the groundwork for widespread deployment of fuel cell vehicles, particularly in heavy-duty applications. This infrastructure growth enhances energy security, reduces lifecycle emissions, and enables cost parity with diesel over time.

For instance, in July 2025, Envision commissioned the world’s largest green hydrogen and ammonia plant in Chifeng, China, powered by an off-grid renewable energy system. Producing 320,000 tons of green ammonia annually, the project represents a significant breakthrough in enabling large-scale, clean hydrogen supply for transportation and industrial use. In addition, the California Air Resources Board (CARB) is targeting 176 public hydrogen refueling stations by 2026 to serve up to 250,000 FCEVs. Although current infrastructure focuses on light-duty vehicles, CARB identifies medium- and heavy-duty fuel cell vehicles as key to reducing emissions and improving air quality. Such developments demonstrate how the strategic buildout of hydrogen production and distribution infrastructure is accelerating the commercial viability of fuel cell powertrains across both industrial and mobility sectors.

In the Middle East & North Africa, countries such as Morocco, Egypt, and Tunisia are actively pursuing green hydrogen roadmaps and bilateral agreements to position themselves as regional export hubs. For instance, Egypt has signed memorandums of understanding (MoUs) worth USD 40 billion to develop hydrogen and ammonia projects in the Suez Canal Economic Zone. Meanwhile, Namibia is advancing a USD 9.4 billion project to become a leading green hydrogen exporter by 2028. In Latin America, Argentina, Chile, Brazil, and Colombia are formulating national hydrogen strategies to drive heavy-duty transport decarbonization. Chile’s National Green Hydrogen Strategy, launched in 2020, targets 5 GW of electrolysis capacity by 2025 for domestic use and export. Argentina is also developing a Hydrogen Promotion Act featuring tax incentives and local content mandates. Such regulatory moves and infrastructure investments are further creating strong growth potential for fuel cell truck and bus fleets, offering new opportunities for OEMs and fleet operators across these emerging regions.

The underdeveloped state of hydrogen refueling networks and upstream supply chains continues to hamper widespread fuel cell vehicle deployment, particularly for commercial applications. The scarcity of public refueling stations, high costs of infrastructure buildout, and logistical challenges in hydrogen production and distribution restrict adoption outside of pilot zones or highly supported markets. For instance, in July 2025, Stellantis announced a strategic retreat from its hydrogen fuel cell van program, explicitly citing inadequate infrastructure and limited policy incentives as key barriers. The automaker will instead focus on electric, hybrid, and plug-in hybrid models under its multi-energy strategy, while upgrading AC charging systems to better serve fleet operators’ evolving needs. This decision reflects broader industry hesitation around fuel cell commercialization, reinforcing the urgent need for coordinated infrastructure investments and regulatory support to unlock hydrogen’s full potential.

Component Insights

The fuel cell module (stack + BoP) segment led the fuel cell powertrain market with the largest share of 34.1% in 2024. These modules form the core of fuel cell powertrains, offering modular scalability, better power density, and system efficiency. Suppliers are accelerating R&D to improve membrane durability, reduce platinum group metal (PGM) usage, and lower overall cost per kilowatt. Factors such as the growing demand for compact, integrated systems, rising investments in high-efficiency fuel cell stacks, increased deployment in heavy-duty mobility platforms, and a sharp focus on performance optimization through thermal and water management systems are supporting the segment growth.

The electric drive unit (EDU) segment is expected to grow at the fastest CAGR from 2025 to 2033, driven by the rising integration of fuel cell systems with electric propulsion platforms, increasing demand for compact and modular e-axle solutions, growing focus on drivetrain efficiency, and supportive regulations promoting zero-emission heavy transport. EDUs combine electric motors, gearboxes, and power electronics into a single assembly, enabling seamless torque delivery, reduced mechanical complexity, and enhanced vehicle packaging. OEMs are increasingly shifting toward integrated EDU architectures to simplify design, reduce weight, and improve vehicle energy efficiency.

Product Insights

The fuel cell electric powertrain segment accounted for the largest share of the fuel cell powertrain industry in 2024, driven by the rising demand for integrated hydrogen propulsion solutions, increasing focus on modular vehicle architectures, growth in light commercial and off-highway fuel cell applications, and expanding efforts by startups and OEMs to accelerate time-to-market. These powertrains combine fuel cell stacks, energy management systems, and drive units into scalable platforms that reduce engineering complexity and lower development costs. For instance, in March 2024, Viritech launched the VPT60N, a ready-to-run 60kW fuel cell electric powertrain designed for road cars, light commercial vehicles, and off-highway applications. The modular system integrates the fuel cell, hydrogen storage, power electronics, and transmission, enabling rapid deployment of hydrogen vehicles across diverse segments. This reflects a broader trend toward complete, out-of-the-box powertrain solutions tailored for hydrogen mobility adoption.

The fuel cell stack segment is expected to grow at a significant CAGR during the forecast period. Fuel cell stacks are the heart of the energy conversion process, and improvements in durability, power density, and cost-effectiveness are making them increasingly viable for commercial applications. Strategic collaborations between OEMs and stack developers are accelerating innovations in bipolar plate design and catalyst layer architecture. Factors such as the increasing production of heavy-duty fuel cell vehicles, advancements in membrane electrode assemblies (MEA), rising investment in platinum group metal (PGM) reduction technologies, and growing localization of stack manufacturing in key automotive hubs are fueling the segment’s growth.

Application Insights

The commercial trucks & buses segment accounted for the largest share of the fuel cell powertrain market in 2024, driven by the rising demand for long-range, zero-emission heavy-duty vehicles, tightening emission regulations across major economies, increasing investments in hydrogen refueling infrastructure along freight corridors, and the operational advantages of fast refueling and high payload capacity. Public transport agencies and logistics providers are increasingly shifting toward fuel cell electric vehicles to meet sustainability goals while ensuring operational efficiency. For instance, in February 2025, Toyota unveiled its third-generation fuel cell system (3rd Gen FC System), optimized for heavy-duty commercial vehicles. Offering greater durability, improved fuel efficiency, and lower cost, the system will roll out post-2026 across Japan, Europe, North America, and China to support hydrogen-based decarbonization efforts.Companies are also prioritizing platform integration, extended range capability, and high-efficiency powertrains tailored for heavy-duty use cases. For instance, in May 2022, Ballard Power partnered with Wisdom Motor Company, Templewater, and Bravo Transport to deploy hydrogen-powered trucks, buses, and specialty vehicles in Hong Kong, using Ballard’s PEM fuel cell technology. The initiative supports regional zero-emission transport goals and highlights industry momentum toward scalable, fuel cell-based commercial fleets.

The passenger vehicles & buses segment is expected to register a notable CAGR from 2025 to 2033. Governments in key markets such as South Korea, Japan, and China are offering purchase incentives, infrastructure support, and fleet targets to promote fuel cell electric vehicles (FCEVs) in the passenger car segment. As consumer awareness and acceptance of hydrogen vehicles improve, the segment is expected to maintain its lead over the forecast period, supported by expanding model availability and improvements in driving range and refueling convenience. Factor including increasing demand for zero-emission mobility solutions, rising regulatory pressure to decarbonize urban transport, growing investment in hydrogen fuel cell cars by major OEMs, and advancements in lightweight and compact fuel cell systems supports the segment growth.

End User Insights

The commercial vehicle manufacturers & fleets segment accounted for the largest share of the fuel cell powertrain industry in 2024. Factors such as the increasing focus on decarbonizing logistics fleets, demand for longer-range zero-emission drivetrains, and incentives for hydrogen truck adoption are driving growth. Key industry players are actively investing in scalable fuel cell solutions to meet fleet-level emission reduction targets. In May 2023, PACCAR and Toyota expanded their collaboration to commercialize hydrogen fuel cell versions of Kenworth T680 and Peterbilt 579 trucks, powered by Toyota’s next-generation fuel cell modules. Initial customer deliveries are set for 2024, supporting zero-emission freight movement in heavy-duty transport and reinforcing fleet demand for fuel cell-powered vehicles.

The automotive OEMs segment is expected to register a notable CAGR from 2025 to 2033, owing to its strategic focus on diversifying powertrain portfolios, compliance with tightening global emissions regulations, and growing investments in hydrogen vehicle platforms. OEMs are increasingly prioritizing fuel cell R&D, component integration, and partnerships with hydrogen tech suppliers to secure long-term competitiveness in the evolving zero-emission vehicle market. Several leading automakers are shifting resources toward scalable fuel cell architecture, with pilot programs underway for both passenger and light commercial vehicle categories.

Regional Insights

The Asia Pacific fuel cell powertrain market accounted for 46.2% of the global share in 2024, driven by strong government support for hydrogen mobility, substantial investments in fuel cell infrastructure, early commercialization of hydrogen vehicles, and active participation from domestic OEMs. Countries such as South Korea, China, and Japan are leading national hydrogen strategies that include generous subsidies, fuel cell truck pilot deployments, and public-private R&D programs to scale hydrogen production and refueling networks. Companies in the region are also actively investing in fuel cell innovation, expanding FCEV lineups, and integrating hydrogen into broader decarbonization plans. For instance, in April 2025, Hyundai unveiled the second-generation NEXO FCEV at the Seoul Mobility Show, featuring a new design, over 700 km of targeted range, towing capability, and enhanced safety. The update reinforces Hyundai’s position in hydrogen mobility and expands its multi-path electrification strategy alongside BEVs and hybrids.

The India fuel cell powertrain market is expected to grow over the forecast period. India continues to promote localized clean mobility manufacturing as part of its broader decarbonization and "Make in India" initiatives. This focus is driving public-private partnerships to scale domestic production of hydrogen-based technologies. In August 2023, Cummins and Tata Motors, through their joint venture TCPL GES, signed an MoU with the Jharkhand Government to establish a manufacturing plant for hydrogen internal combustion engines, fuel cell systems, and battery electric powertrains, supporting India’s low-carbon mobility and clean energy transition.

The fuel cell powertrain market in China held a substantial market share in 2024. The market is experiencing rapid growth, driven by strong state-level subsidies, mandatory adoption quotas for fuel cell electric vehicles (FCEVs) in urban freight, increasing localization of fuel cell stacks and components, and the formation of hydrogen demonstration city clusters across regions such as the Yangtze River Delta and Jing-Jin-Ji. These policies aim to reduce the cost of hydrogen powertrains, scale up refueling infrastructure, and promote commercialization across medium- and heavy-duty transport sectors.

As part of efforts to accelerate national hydrogen infrastructure and reduce the delivered cost of green hydrogen, China is investing in long-distance transmission projects. In July 2025, China approved its first cross-provincial green hydrogen pipeline, a 400 km route linking Inner Mongolia to Beijing. Developed by Sinopec, the project will transport 100,000 tons of wind-powered hydrogen annually, supporting China’s decarbonization goals and fuel cell vehicle deployment strategies.

The Japan fuel cell powertrain market held a significant share in 2024. In Japan, market growth is influenced by the government's long-term strategy to establish a nationwide hydrogen ecosystem by 2040, with a focus on decarbonizing commercial transport. This includes investments in fuel cell vehicle R&D, infrastructure expansion, and public-private partnerships targeting logistics fleets and bus operators. To accelerate adoption in key logistics corridors, Japan is also offering region-specific deployment incentives. In May 2025, Japan’s Ministry of Economy, Trade and Industry announced major subsidies to accelerate hydrogen-powered commercial vehicle adoption, focusing on six high-demand regions. The incentives aim to lower hydrogen refueling costs by up to 75%, supporting the deployment of fuel cell trucks and buses for long-haul transportation.

Europe Fuel Cell Powertrain Market Trends

The Europe fuel cell powertrain industry was identified as a lucrative region in 2024. The regional market is undergoing a significant transformation, fueled by stringent EU carbon neutrality targets, the expansion of hydrogen refueling infrastructure, and increased public-private investments in clean mobility. Growing emphasis on decarbonizing heavy-duty transport and integrating hydrogen into long-haul logistics is shaping demand across the continent. For instance, to accelerate the deployment of hydrogen-powered commercial fleets, European governments are ramping up funding support through strategic programs. In November 2024, Daimler Truck secured approximately USD 264.52 million (€226 million) from Germany’s BMDV and the EU’s IPCEI Hydrogen initiative to develop and deploy 100 next-generation fuel cell trucks. Series production is set to begin by 2026, reinforcing the role of hydrogen in sustainable freight transportation.

Also, OEMs are leveraging multi-path electrification strategies by combining battery-electric and hydrogen powertrains to meet extended range requirements. For instance, in October 2024, Renault unveiled the Emblème concept at the Paris Auto Show, which integrates BEV and hydrogen FCEV technologies to achieve a range of up to 621 miles. The concept car emphasizes ultra-low life-cycle emissions through the use of recycled materials, aerodynamic efficiency, and renewable energy-powered production processes.

The Germany fuel cell powertrain market is being shaped by increasing emphasis on hydrogen innovation, industrial decarbonization, and the integration of clean energy solutions in commercial logistics. Government-backed programs and corporate investments are positioning Germany as a key hub for fuel cell deployment in both transport and infrastructure. For instance, in July 2025, Rolls-Royce and Duisport unveiled the world’s first 100% hydrogen-powered combined heat and power (CHP) units at the Duisburg Gateway Terminal. This CO2-neutral, self-sufficient energy system sets a new benchmark for sustainable power supply across logistics centers and industrial applications, reflecting Germany’s shift toward decentralized, zero-emission energy platforms.

Also, domestic manufacturing of fuel cell components is gaining momentum, supporting large-scale adoption across mobility sectors. For instance, in July 2023, Bosch commenced production of its fuel cell power modules for Nikola’s Class 8 hydrogen trucks at its Stuttgart-Feuerbach facility. The company plans to invest USD 2.6 billion in hydrogen technologies and anticipates robust uptake of fuel cell trucks by 2030, aligned with Germany’s broader climate neutrality goals.

The fuel cell powertrain market in the UK is gaining momentum, driven by strong government backing for hydrogen as part of its Net Zero Strategy, increasing investments in zero-emission aviation technologies, and the push to decarbonize urban transport fleets. The country’s Hydrogen Strategy and incentives under the Aerospace Technology Institute (ATI) program are accelerating innovation and adoption across both aviation and light commercial vehicle (LCV) segments. For instance, in July 2024, GKN Aerospace launched the H2FlyGHT project to develop a 2MW-class cryogenic hydrogen fuel cell propulsion system for aviation. Supported by the ATI, the project aims to fast-track flight testing and certification of hydrogen-powered aircraft, positioning the UK at the forefront of clean aviation innovation.

In the commercial vehicle segment, early fleet demonstrations and OEM collaborations are laying the groundwork for broader rollout. For instance, in May 2024, First Hydrogen signed a letter of intent to integrate its hydrogen fuel cell powertrain into electric vans supplied by a major German automaker. Successful trials in the UK showcased high performance and efficiency, drawing increased interest from fleet operators seeking low-emission alternatives for last-mile delivery and utility services.

North America Fuel Cell Powertrain Market Trends

The North America fuel cell powertrain industry was identified as a lucrative region in 2024. The fuel cell powertrain market in North America is being driven by a growing focus on zero-emission freight corridors, increasing investment in hydrogen infrastructure, and major OEM efforts to commercialize fuel cell-powered Class 8 trucks. Federal initiatives such as the U.S. Department of Energy’s Hydrogen Shot and state-level clean transportation mandates are reinforcing industry momentum. For instance, in April 2025, Savage and Symbio North America announced a strategic partnership at the ACT Expo to deploy hydrogen fuel cell drayage trucks. The system integrates Symbio’s 300 kW multi-stack fuel cell powertrain and FORVIA’s 34 kg hydrogen tanks, providing a lightweight, zero-emission solution optimized for short-haul freight without compromising payload.

Also, OEM collaborations in the region are accelerating fuel cell integration into heavy-duty platforms. For instance, in May 2024, Hexagon Purus announced it would supply hydrogen storage systems and high-voltage battery packs to Toyota North America for the serial production of heavy-duty fuel cell powertrain kits. This move supports the deployment of zero-emission Class 8 trucks and expands on their ongoing partnership in hydrogen mobility.

U.S. Fuel Cell Powertrain Market Trends

The U.S. fuel cell powertrain industry held a dominant position in 2024. The Fuel cell powertrain market in the U.S. is witnessing a significant transformation, driven by substantial federal investments in hydrogen infrastructure, a strong focus on decarbonizing heavy-duty transportation, and growing collaboration between public agencies and private manufacturers. The U.S. Hydrogen Energy Earthshot and Inflation Reduction Act have further catalyzed demand for domestically produced fuel cell systems. For instance, in March 2024, the U.S. Department of Energy announced USD 750 million in funding for 52 projects aimed at accelerating clean hydrogen production and fuel cell manufacturing. The initiative is expected to enable 14 GW of annual fuel cell capacity, supporting the transition to zero-emission technologies across heavy-duty transport and industrial sectors.

The Canada fuel cell powertrain market is gaining momentum due to the country’s clean energy transition goals, strong government backing for hydrogen infrastructure, and the push to decarbonize long-haul transportation. Canada’s Hydrogen Strategy and provincial programs in Alberta and British Columbia are encouraging public-private collaborations and accelerating deployments in freight and rail applications. For instance, in February 2024, Ballard Power received a follow-on order from CPKC Rail for 12 additional 200 kW fuel cell engines to expand its hydrogen-powered locomotive fleet in Alberta. The order supports regular freight service while advancing Canada’s emission reduction goals through the integration of cutting-edge hydrogen fuel cell technology.

Key Fuel Cell Powertrain Company Insights

Some of the key players operating in the market include Ballard Power Systems Inc., Plug Power Inc., Toyota Motor Corporation, and Hyundai Motor Company.

-

Founded in 1979 and headquartered in Burnaby, Canada, Ballard Power Systems Inc. is a prominent developer and manufacturer of proton exchange membrane (PEM) fuel cell systems. The company focuses on zero-emission fuel cell technology for heavy-duty applications, including buses, trucks, trains, and marine vessels. Ballard offers integrated fuel cell power modules and components such as FCmove, hydrogen fuel processors, and system controllers. It serves major OEMs and transit agencies globally, operating production and R&D facilities across North America, Europe, and China.

-

Founded in 1997 and headquartered in New York, U.S., Plug Power Inc. designs and manufactures hydrogen fuel cell systems and electrolyzers. The company specializes in turnkey hydrogen solutions, including PEM fuel cell engines, hydrogen storage systems, refueling infrastructure, and green hydrogen production. Plug Power serves sectors such as logistics, material handling, commercial vehicles, and stationary power. The company is actively building a global green hydrogen network to support the fuel cell-powered mobility market.

Key Fuel Cell Powertrain Companies:

The following are the leading companies in the fuel cell powertrain market. These companies collectively hold the largest market share and dictate industry trends.

- Ballard Power Systems Inc.

- Plug Power Inc.

- Toyota Motor Corporation

- Hyundai Motor Company

- Cummins Inc.

- Symbio (Faurecia & Michelin JV)

- Bosch Hydrogen Powertrain Systems (Bosch Group)

- AVL List GmbH

- Horizon Fuel Cell Technologies Pte. Ltd.

- Sinosynergy Hydrogen Energy Technology Co., Ltd.

Recent Developments

-

In July 2025, Rolls-Royce and Duisport launched the world’s first 100% hydrogen-powered combined heat and power (CHP) units at the Duisburg Gateway Terminal in Germany. The CO2-neutral, self-sufficient system sets a new benchmark for sustainable energy supply in logistics and industrial operations.

-

In June 2025, NTPC launched India’s first hydrogen fuel cell buses in Leh, operating at the world’s highest altitude of 11,562 feet. Powered by green hydrogen and solar energy, the project marks a major step in India’s clean mobility push and carbon-neutral goals for Ladakh.

-

In June 2025, Honda revised its plan to build a fuel cell module production plant in Moka City, Japan, citing shifts in the global hydrogen market. The company will reduce initial capacity and delay operations beyond FY2028, opting out of METI's GX subsidy program due to revised targets.

-

In March 2025, Germany allocated ~USD 180.2 million (EUR 154 million) to develop decentralized hydrogen innovation hubs in Chemnitz and northern Germany. The initiative aims to support SMEs and supply industries in advancing hydrogen technologies, fostering climate-neutral mobility, and accelerating market readiness of clean energy solutions.

-

In September 2024, BMW announced plans to launch its first-ever series production fuel cell electric vehicle (FCEV) in 2028, developed in collaboration with Toyota. The move reflects BMW’s commitment to offering hydrogen-powered, zero-emission mobility as part of its technology-open approach.

-

In August 2024, Toyota and BMW strengthened their partnership to advance hydrogen fuel cell powertrain development, with BMW aiming for mass production of its iX5 Hydrogen vehicle. The collaboration reflects growing interest in hydrogen as BEV sales slow and zero-emission mobility gains traction.

-

In August 2024, Nuvera Fuel Cells and Viritech signed an MoU to co-develop hydrogen fuel cell powertrains for on-road commercial vehicles, leveraging Nuvera’s E-Series engines and Viritech’s VPT60N system. The partnership also explores high-power density fuel cells for motorsport, aerospace, and automotive applications.

-

In May 2024, CamMotive opened a dedicated hydrogen fuel cell test facility in Cambridge, UK, to accelerate development of next-generation hydrogen powertrains for transportation and stationary applications. The lab supports system optimization and performance evaluation for fuel cells up to 200kW, enhancing clean energy innovation.

-

In May 2024, Symbio, in partnership with Michelin, unveiled its first hydrogen fuel cell Class 8 heavy-duty truck at ACT Expo 2024. Powered by Symbio’s 400kW StackPack system, the truck delivers over 450 miles per fueling, targeting zero-emission regional-haul operations with diesel-equivalent performance.

-

In March 2024, Viritech unveiled its VPT60N ready-to-run 60kW hydrogen fuel cell powertrain for cars, light commercial vehicles, and off-highway applications. Designed for rapid deployment, the system supports OEMs and Tier-1 suppliers in accelerating zero-emission vehicle production without compromising performance.

Fuel Cell Powertrain Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 961.6 million

Revenue forecast in 2033

USD 22,498.1 million

Growth rate

CAGR of 48.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, product, application, end user, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Ballard Power Systems Inc.; Plug Power Inc.; Toyota Motor Corporation; Hyundai Motor Company; Cummins Inc.; Symbio (Faurecia & Michelin JV); Bosch Hydrogen Powertrain Systems (Bosch Group); AVL List GmbH; Horizon Fuel Cell Technologies Pte. Ltd.; Sinosynergy Hydrogen Energy Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fuel Cell Powertrain Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global fuel cell powertrain market report based on component, product, application, end user, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Fuel Cell Module (Stack + BoP)

-

Hydrogen Storage System

-

Electric Drive Unit (EDU)

-

Power Electronics & Controls

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Fuel Cell Stack

-

Fuel Cell System

-

Fuel Cell Electric Powertrain

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Passenger Vehicles

-

Commercial Trucks & Buses

-

Material Handling

-

-

End User Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial Vehicle Manufacturers & Fleets

-

Automotive OEMs

-

Logistics & Warehouse Operators

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fuel cell powertrain market size was estimated at USD 685.3 million in 2024 and is expected to reach USD 961.6 million in 2025.

b. The global fuel cell powertrain market is expected to grow at a compound annual growth rate of 48.3% from 2025 to 2033 to reach USD 22,498.1 million by 2033.

b. The Asia Pacific fuel cell powertrain market accounted for 46.2% of the global share in 2024, driven by strong government support for hydrogen mobility, substantial investments in fuel cell infrastructure, early commercialization of hydrogen vehicles, and active participation from domestic OEMs. Countries such as South Korea, China, and Japan are leading national hydrogen strategies that include generous subsidies, fuel cell truck pilot deployments, and public-private R&D programs to scale hydrogen production and refueling networks.

b. Some key players operating in the fuel cell powertrain market include Ballard Power Systems Inc., Plug Power Inc., Toyota Motor Corporation, Hyundai Motor Company, Cummins Inc., Symbio (Faurecia & Michelin JV), Bosch Hydrogen Powertrain Systems (Bosch Group), AVL List GmbH, Horizon Fuel Cell Technologies Pte. Ltd., Sinosynergy Hydrogen Energy Technology Co., Ltd.

b. Key factors that are driving the market growth include growing government incentives for zero-emission vehicles and the rising demand for fuel cell-powered trucks and buses across logistics and public transport sectors. Continuous cost reductions in fuel cell systems and hydrogen storage technologies are also supporting broader adoption, alongside the steady expansion of green hydrogen production infrastructure worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.