Fumaric Acid Market Summary

The global fumaric acid market size was estimated at USD 561.5 million in 2023 and is projected to reach USD 748.4 million by 2030, growing at a CAGR of 4.2% from 2024 to 2030. This growth is attributed to the rising need for processed food and beverages, population growth, and dietary changes.

Key Market Trends & Insights

- Asia Pacific dominated the global fumaric acid market with the largest revenue share in 2023.

- By application, the rosin paper sizes segment is expected to grow at a significant CAGR from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 561.5 Million

- 2030 Projected Market Size: USD 748.4 Million

- CAGR (2024-2030): 4.2%

- Asia Pacific: Largest market in 2023

The increased need for fumaric acid in drug production in the pharmaceutical industry has also contributed to the upward market growth. Furthermore, the rise in the use of fumaric acid as a food additive to increase stability and shelf life has also resulted in the positive development of this market.

Fumaric acid is widely used to produce beverages, bakery items, desserts, wine, and more. It is added during the dry blending process of the dough. It is a non-toxic additive used as a flavoring agent and an agent to control the pH of the product. With the population's rise and increased processed food consumption, the demand for fumaric acid has increased significantly. Furthermore, the rise in the disposable income of the population has increased the consumption of ready-to-eat products and drinks, which has resulted in the market growth of fumaric acid.

Increased demand for fumaric acid in the automotive, construction, and chemical industries has also contributed to market growth. Fumaric acid produces unsaturated polyester resins for making roofs, pipes, and water tanks. In the automotive sector, fumaric acid produces various coatings and resins. Due to its affordability and weathering properties, fumaric acid has also increased in producing various synthetic paints and enamels. Therefore, these factors have resulted in the upward market growth of this industry.

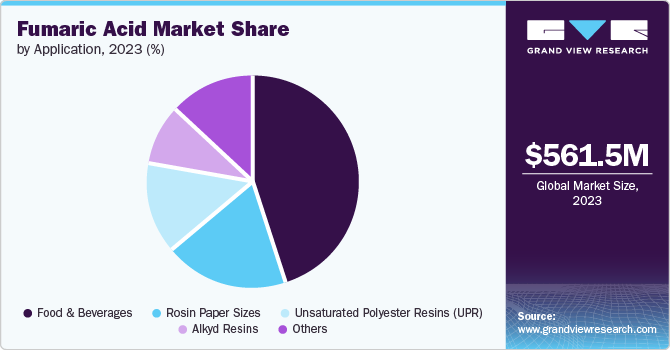

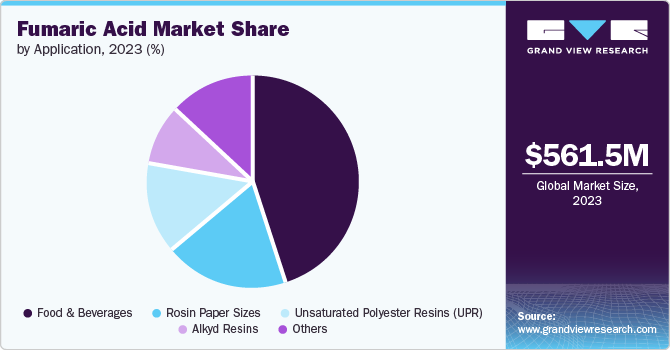

Application Insights

Food & beverages segment dominated the market and accounted for the largest revenue share of 44.8% in 2023 owing to the increased use of fumaric acid in convenience food production. Fumaric acid is used as a preservative to increase the shelf life and enhance the aroma and taste of the products. Furthermore, the rise in demand for drinks such as wine, energy, and juices has contributed to the expansion of the market. Fumaric acid is also used to produce jelly products and baked goods. The increase in population and lifestyle changes have led to a rise in demand for processed food, therefore resulting in the growth of this segment.

The rosin paper sizes segment is expected to grow at the fastest CAGR of 19.1% over the forecast years. This growth is attributed to the increased demand for rosin paper in the packaging industry. Rosin paper is widely used in the packaging industry due to its protective and durability properties. Increased use of rosin paper in the construction industry as an underlayment for flooring and surface protection has also contributed to the market growth of this segment.

Regional Insights

The North America fumaric acid market had a market share of 25.4% in 2023. Significant industries in the food and beverage, pharmaceuticals, and construction sectors drive this growth. The increased production of food products has resulted in an increased demand for fumaric acid, which adds preservative properties and flavor. Furthermore, the increased use of paints in the construction industry has increased the demand for fumaric acid in this region.

U.S. Fumaric Acid Market Trends

The fumaric acid market in the U.S. experienced significant growth in 2023 due to the presence of key manufacturers of food and beverage products. The U.S. uses fumaric acid extensively due to its high consumption of processed food and beverages. Furthermore, the increased use of fumaric acid to treat illnesses such as psoriasis and sclerosis has also resulted in the market growth of fumaric acid in this country.

Asia Pacific Fumaric Acid Market Trends

Asia Pacific fumaric acid market dominated the global market with a market share of 44.9% in 2023 due to the significant growth in the food & beverages industry and the rising demand for processed food. Rapid population growth, lifestyle changes, and increased reliance on ready-to-eat food products have also contributed to market growth, as increased disposable income has changed the preferences for food products. Furthermore, heavy investments by key market players in the food & beverages industry have also fuelled the market's growth in this region.

The fumaric acid market in China is expected to grow significantly due to the presence of key manufacturers and the country's increasing population. High investments by significant food and beverage companies have also increased demand for fumaric acid in China. Increasing preference for various juices, wine, and other beverages has also increased the demand for fumaric acid in China.

Europe Fumaric Acid Market Trends

Europe fumaric acid market is expected to grow at a CAGR of 4.1% over the forecast years. The market in the region was identified as a lucrative region in this industry as it had a market share of 28.8% in 2023 due to the upward market growth of the food & beverages industry. In addition, the increased use of fumaric acid in the construction, cosmetic, and pharmaceutical industries has also resulted in market growth as it is used in formulating various cosmetic products and pharmaceutical drugs. Furthermore, the market is growing due to the increased demand for paints and resins in the construction industry.

The fumaric acid market in the UK is expected to grow significantly due to rapid urbanization and industrialization, which has led to growth in the country's food, pharmaceutical, and construction sectors. Growing preference for food products made with natural ingredients has increased the demand for fumaric acid. Furthermore, an increase in disposable income and an increased rate of house renovation have led to a high demand for paints, resulting in the growth of the fumaric market in the country.

Key Fumaric Acid Company Insights

Some of the key participants in the global fumaric acid market are Anmol Chemicals Private Limited, Bartek Ingredients Inc., Changmao Biochem Engineering Company Limited, and ESIM Chemicals GmbH. Companies focus on integrating fumaric acid into food products to increase their shelf life. Due to its durability, companies also integrate fumaric acid to produce paints and resins.

Key Fumaric Acid Companies:

The following are the leading companies in the fumaric acid market. These companies collectively hold the largest market share and dictate industry trends.

- Anmol Chemicals Private Limited

- Bartek Ingredients Inc.

- Changmao Biochem Engineering Company Limited

- ESIM Chemicals GmbH

- Fuso Chemical Co. Ltd

- Merck KGaA

- Polynt

- Thirumalai Chemicals

- UPC Group of Companies

- Yongsan Chemicals Inc.

Recent Developments

-

In September 2023, Bartek Ingredients Inc. updated about the progress of the world's largest malic and fumaric acid manufacturing facility. The company CEO confirmed the delivery of products from the new facility by September 2024.

-

In May 2023, Polynt announced an expansion of resin production capacity to meet the increased paint and coating industry demand. The expansion will be helped by the opening of Polynt Coatings Canada Limited in Port Moody, BC.

Fumaric Acid Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 583.5 million

|

|

Revenue forecast in 2030

|

USD 748.4 million

|

|

Growth Rate

|

CAGR of 4.2% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 – 2022

|

|

Forecast period

|

2024 – 2030

|

|

Report updated

|

September 2024

|

|

Quantitative units

|

Volume in Kilotons, Revenue in Million, and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application and region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, China, India, Japan, South Korea, Thailand, Indonesia, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE

|

|

Key companies profiled

|

Anmol Chemicals Private Limited; Bartek Ingredients Inc.; Changmao Biochem Engineering Company Limited; ESIM Chemicals GmbH; Fuso Chemicals Co, Ltd; Merck KGaA; Polynt; Thirumalai Chemicals; UPC Group of Companies; Yongsan Chemcials Inc.

|

|

Customization scope

|

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Fumaric Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyses the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fumaric acid market report based on application and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)