- Home

- »

- IT Services & Applications

- »

-

Function as a Service Market Size, Industry Report, 2030GVR Report cover

![Function as a Service Market Size, Share & Trends Report]()

Function as a Service Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Developer-Centric FaaS, Operator-Centric FaaS), By Deployment (Public Cloud, Private Cloud), By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-512-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Function as a Service Market Summary

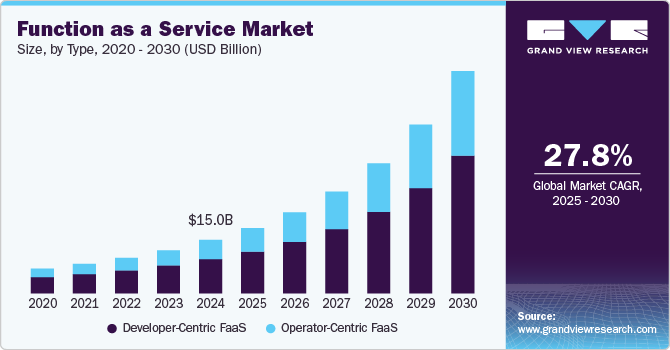

The global function as a service market size was estimated at USD 15.02 billion in 2024 and is projected to reach USD 62.52 billion by 2030, growing at a CAGR of 27.8% from 2025 to 2030. The shift from traditional DevOps to the more streamlined serverless computing model is a significant growth driver for the function as a service (FaaS) market.

Key Market Trends & Insights

- The North America function-as-a-service market held the largest share of over 37.0% in 2024.

- The Asia Pacific is growing significantly at a CAGR of 31.2% from 2025 to 2030.

- Based on type, the developer-centric FaaS segment dominated the market and accounted for a revenue share of over 64.0% in 2024.

- Based on enterprise size, the public cloud segment accounted for the largest revenue share of nearly 53.0% in 2024.

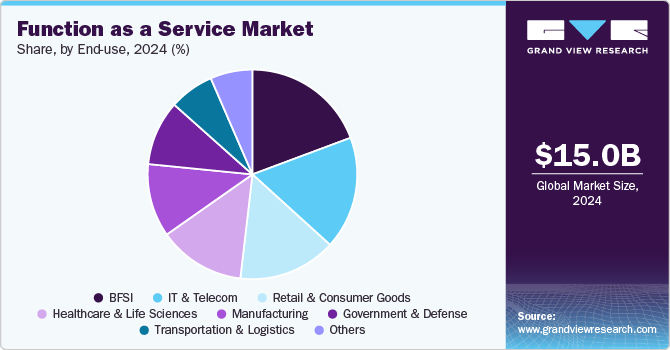

- Based on end-use, the BFSI segment accounted for the largest revenue share of over 19.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.02 Billion

- 2030 Projected Market USD 62.52 Billion

- CAGR (2025-2030): 27.8%

- North America: Largest market in 2024

Serverless computing eliminates the need for infrastructure management, allowing developers to focus solely on writing and deploying code. Moreover, advancements in AI and ML have created opportunities for FaaS to support serverless AI-driven end uses, streamlining complex computational processes without infrastructure concerns.

The widespread adoption of cloud computing is a critical driver of the function-as-a-service industry. Organizations increasingly seek scalable, cost-effective solutions that allow them to innovate without being burdened by infrastructure management. FaaS, as a cloud-native technology, provides a serverless model where businesses can deploy code on-demand, paying only for the resources consumed during execution. This pay-as-you-go model is particularly appealing for startups and SMEs, which can leverage FaaS to scale operations efficiently without significant capital investment. Enterprises also benefit from this model, using FaaS to manage seasonal or fluctuating workloads while maintaining optimal resource utilization.

The transition from monolithic end uses to microservices architecture has also been a significant growth driver for the FaaS market. Microservices enable businesses to break down large end uses into smaller, independent services that can be developed, deployed, and scaled individually. FaaS complements this approach by allowing developers to run individual functions as standalone units, improving end use flexibility and maintainability. This combination reduces interdependence and makes scaling specific end use parts more efficient, leading to faster development cycles and reduced time-to-market.

Industries such as e-commerce, banking, and entertainment increasingly adopt microservices for their ability to handle dynamic workloads and improve system reliability. FaaS plays a crucial role in this shift by supporting event-driven architectures, where specific functions execute in response to real-time triggers. This is particularly valuable for handling high-traffic events, such as online sales or media streaming, without impacting the overall system's performance. The synergy between microservices and FaaS is a key factor driving the adoption of serverless computing across enterprises aiming to modernize their software development practices.

Type Insights

The developer-centric FaaS segment dominated the market and accounted for a revenue share of over 64.0% in 2024, owing to the growing focus on serverless integration with other cloud-native services. With seamless integration with databases, messaging systems, storage services, and analytics platforms, developers create sophisticated, fully integrated applications without the complexity of managing these components themselves.

The operator-centric FaaS segment is expected to grow at a significant CAGR of 29.1% over the forecast period due to the increasing demand for managed and multi-cloud environments. As businesses adopt hybrid and multi-cloud strategies, cloud operators are seeking ways to provide seamless and efficient serverless offerings across different cloud environments. Operator-centric FaaS solutions enable these operators to offer serverless functions across public, private, and hybrid clouds, ensuring that their customers can leverage the benefits of FaaS while maintaining flexibility in where and how they deploy their applications.

Deployment Insights

The public cloud segment accounted for the largest revenue share of nearly 53.0% in 2024, driven by the increasing adoption of cloud-native technologies, scalability, and cost efficiency. Public cloud providers, including AWS, Azure, and Google Cloud, offer FaaS solutions that allow businesses to run serverless applications without the need to manage infrastructure. This democratizes access to powerful computing resources, enabling organizations of all sizes to leverage advanced technologies without incurring high upfront costs or managing complex infrastructure.

The private cloud segment is expected to grow at a significant CAGR over the forecast period due to the growing need for enhanced security and compliance. Organizations in highly regulated industries, such as finance, healthcare, and government, often prefer private clouds due to the ability to keep their data on-premises or within specific geographic regions. FaaS solutions running on private clouds allow these organizations to take advantage of serverless computing benefits, such as automatic scaling and cost efficiency, while meeting stringent regulatory requirements.

Enterprise Size Insights

The large enterprises segment accounted for the largest revenue share of over 56.0% in 2024. Large enterprises are increasingly adopting FaaS as part of their cloud strategies to drive digital transformation, optimize operational efficiency, and enhance scalability across diverse business units. With their complex IT environments and vast operational requirements, large organizations benefit greatly from the flexibility, cost-effectiveness, and rapid deployment capabilities that FaaS offers.

The SMEs segment is expected to grow at a significant CAGR over the forecast period, driven by the increasing need for cost-effective, scalable, and flexible solutions that empower businesses to innovate and compete in the digital economy. As SMEs embrace digital transformation to stay competitive, FaaS offers an ideal platform for enhancing agility, improving operational efficiency, and accelerating time-to-market for new products and services.

End-use Insights

The BFSI segment accounted for the largest revenue share of over 19.0% in 2024. The rise of Open Banking and API-driven ecosystems is a significant growth driver for FaaS in the BFSI sector. Open Banking regulations are pushing banks to share data with third-party providers, leading to the need for flexible, secure, and easily integrable serverless solutions. FaaS allows financial institutions to expose APIs for seamless data exchange while ensuring compliance and security across these integrations.

The retail & consumer goods segment is expected to register a significant CAGR over the forecast period due to the increasing focus on personalized customer experiences. Retailers are leveraging FaaS to deploy AI and machine learning models that power recommendation engines, predictive analytics, and targeted marketing campaigns. By using serverless computing, retailers can quickly scale their models as customer data grows, ensuring that they deliver tailored content and products to consumers in real time, which drives higher customer satisfaction and loyalty.

Regional Insights

North America function-as-a-service market held the largest share of over 37.0% in 2024, driven by the rapid adoption of cloud-native technologies, increased demand for scalable solutions, and the need for cost-efficient computing. The region’s businesses, spanning sectors such as technology, finance, healthcare, retail, and entertainment, are leveraging serverless computing to improve operational efficiency, reduce infrastructure overhead, and accelerate application development.

U.S. Function as a Service Market Trends

The function-as-a-service market in the U.S. is expected to grow significantly at a CAGR of 24.9% from 2025 to 2030. Companies in the U.S. are turning to serverless platforms for event-driven architectures that enable them to build and deploy applications faster, responding to rapidly changing market demands. The pay-as-you-go pricing model of FaaS aligns well with businesses seeking to optimize operational costs while scaling seamlessly to handle varying workloads.

Europe Function as a Service Industry Trends

The function-as-a-service market in Europe is anticipated to register considerable growth from 2025 to 2030. Europe’s robust commitment to data privacy and protection, particularly under the General Data Protection Regulation (GDPR), is influencing FaaS adoption. Companies are prioritizing secure, compliant cloud solutions that adhere to stringent regulatory standards. This has led to a demand for FaaS platforms that offer built-in encryption, secure data residency, and enhanced privacy features.

The UK function-as-a-service market is expected to grow rapidly in the coming years, driven by the rise of fintech and digital banking. U.K.-based financial institutions are utilizing FaaS to build real-time payment systems, fraud detection models, and personalized customer experiences. The scalability and event-driven nature of FaaS make it particularly well-suited to handle high transaction volumes while optimizing costs.

The function-as-a-service market in Germany held a substantial market share in 2024. As factories and production systems become more connected through IoT devices, FaaS solutions are being utilized to process real-time data at scale, improving efficiency and enabling predictive maintenance. The rise of edge computing further complements FaaS in Germany, as companies look for low-latency solutions to manage data closer to the source.

Asia Pacific Function as a Service Industry Trends

The function-as-a-service market in Asia Pacific is growing significantly at a CAGR of 31.2% from 2025 to 2030. The rapid digital transformation across industries like e-commerce, healthcare, and finance is boosting demand for FaaS platforms as businesses seek to enhance operational efficiency without managing server infrastructure.

Japan function-as-a-service market is expected to grow rapidly in the coming years. With Japan's emphasis on robotics and AI, FaaS is being utilized to support AI/ML workloads, automate processes, and power real-time applications, such as customer service chatbots and predictive maintenance systems.

The function-as-a-service market in China held a substantial share in 2024. With the rapid expansion of leading cloud providers like Alibaba Cloud, Tencent Cloud, and Huawei Cloud, FaaS adoption is increasing as businesses seek scalable, cost-efficient solutions to meet dynamic market demands. Moreover, China's leadership in 5G technology is boosting FaaS adoption for high-bandwidth, low-latency applications, including gaming, augmented reality, and live streaming.

Key Function as a Service Company Insights

Key players operating in the function-as-a-service industry are Amazon Web Services, Inc., Google, Oracle, IBM, and SAP SE. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In November 2024, Microsoft introduced new features to enhance serverless development for demanding workloads, including rapid cold starts, dynamic scaling, and improved security. The Flex Consumption Plan optimizes costs with automatic scaling to zero during inactivity while offering seamless integration with virtual networks at no extra cost. Developers can now use .NET 9 and C# 13 with the isolated worker model for improved performance across Windows and Linux platforms. AWS has also launched Redis extensions, allowing Redis to trigger serverless workflows, ideal for event-driven and data-heavy architecture. These updates deliver better scalability, performance, and security for serverless solutions.

-

In August 2024, Google rebranded Cloud Functions to Cloud Run functions, unifying its event-driven programming model within a single serverless platform. The updated Cloud Run functions now include GPU support, allowing Python developers to seamlessly run Hugging Face models without the need to manage infrastructure, GPU, containers or drivers. With features like scale-to-zero and rapid startup times, Cloud Run functions make it easier for developers to implement AI solutions using Hugging Face models with minimal code, providing a streamlined and scalable approach to serverless AI development.

Key Function as a Service Companies:

The following are the leading companies in the FaaS market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Oracle

- IBM

- Microsoft

- SAP SE

- Red Hat

- Dynatrace LLC.

- Infosys Limited

- Fiorano Software and Affiliates.

Function as a Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.37 billion

Revenue forecast in 2030

USD 62.52 billion

Growth Rate

CAGR of 27.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report services

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, enterprise size, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Kingdom of Saudi Arabia, South Africa

Key companies profiled

Amazon Web Services, Inc.,;Google; Oracle; IBM; Microsoft; SAP SE; Red Hat; Dynatrace LLC.; Infosys Limited; Fiorano Software and Affiliates.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Function as a Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global function-as-a-service market report based on type, deployment, enterprise size, end use, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Developer-Centric FaaS

-

Operator-Centric FaaS

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

IT & Telecom

-

BFSI

-

Retail & Consumer Goods

-

Healthcare & Life Sciences

-

Government & Defense

-

Transportation & Logistics

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global function as a service market size was estimated at USD 15.02 billion in 2024 and is expected to reach USD 18.37 billion in 2025.

b. The global function as a service market is expected to grow at a compound annual growth rate of 27.8% from 2025 to 2030 to reach USD 62.52 billion by 2030.

b. The function as a service market in North America held the largest share, over 37.0%, in 2024, driven by the rapid adoption of cloud-native technologies, increased demand for scalable solutions, and the need for cost-efficient computing.

b. Some key players operating in the function-as-a-service market include Amazon Web Services, Inc., Google, Oracle, IBM, Microsoft, SAP SE, Red Hat, Dynatrace LLC., Infosys Limited, Fiorano Software and Affiliates.

b. The shift from traditional DevOps to the more streamlined serverless computing model is a significant growth driver for the Function-as-a-Service (FaaS) market. Serverless computing eliminates the need for infrastructure management, allowing developers to focus solely on writing and deploying code.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.