- Home

- »

- Medical Devices

- »

-

Fundus Cameras Market Size, Share, Industry Report, 2030GVR Report cover

![Fundus Cameras Market Size, Share & Trends Report]()

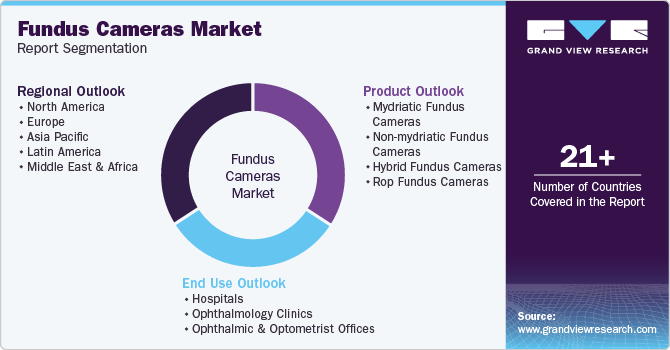

Fundus Cameras Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By End Use (Hospitals, Ophthalmology Clinics, Ophthalmic & Optometrist Offices), By Region (North America, Europe, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-1-68038-346-1

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fundus Cameras Market Summary

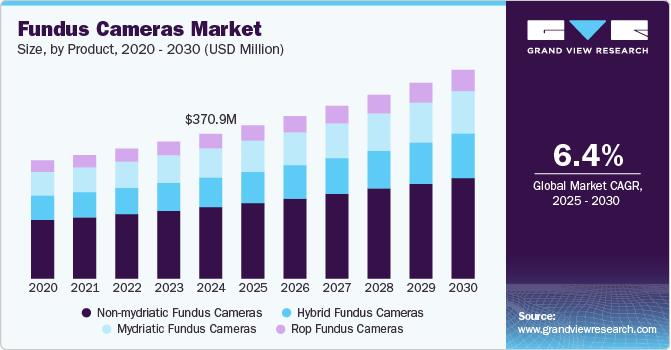

The global fundus cameras market size was estimated at USD 370.6 million in 2024 and is projected to reach USD 534.9 million by 2030, growing at a CAGR of 6.4% from 2025 to 2030. The increasing geriatric population and chronic disorders, such as diabetes and hypertension, are responsible for the growth in the incidence of retinal disorders.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, UK is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, non- mydriatic fundus cameras accounted for a revenue share of 49.4% in 2024.

- Hybrid fundus cameras is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 370.6 Million

- 2030 Projected Market Size: USD 534.9 Million

- CAGR (2025-2030): 6.4%

- North America: Largest market in 2024

Key retinal disorders include Diabetic Retinopathy (DR), Age-related Macular Degeneration (AMD), and Retinopathy of Prematurity (ROP). Furthermore, increasing awareness about eye disorders and commercializing several technologically advanced products are likely to propel the market during the forecast period.

Due to the rising incidence of chronic diseases like hypertension, diabetes, and geriatrics, retinal abnormalities are on the rise. Diabetic eye diseases consist of several eye conditions, including DR, diabetic macular edema, glaucoma, and cataracts. According to the National Eye Institute (NEI), in the U.S., diabetic retinopathy patients in America are expected to double from 7.7 million in 2010 to 14.6 million in 2050. In addition, advancements in the field are expected to drive the market during the forecast period.

The use of portable fundus photography cameras in hospital settings, as highlighted by the University of Colorado's ophthalmology department in February 2024, is transforming patient care and resident training. These compact, smartphone-sized devices enhance the ability of on-call residents to conduct comprehensive and efficient evaluations, crucial in fast-paced environments. The cameras, equipped with long lenses, enable real-time imaging and allow supervising physicians to view the images remotely, improving diagnosis and treatment plans. This innovation saves time, facilitates follow-up care, and reduces consultation delays.

As the fundus camera market grows, its potential to enhance clinical efficiency and patient outcomes is evident, especially in emergency and on-call situations. The trend suggests a broader adoption of such devices in both clinical and home settings, aligning with the increasing demand for more accessible, cost-effective, and mobile ophthalmic imaging solutions. This development is pivotal for the future of retina diagnostics and training.

The market is anticipated to expand due to rising awareness of eye problems and the launch of numerous cutting-edge products. The development of digital cameras, red-free fundus cameras, film-based fundus cameras, and other tools for clear and detailed fundus imaging are likely to lead to market growth throughout the projected period. Artificial intelligence, machine learning, and big data have enormous potential for improving healthcare. Diagnosing illnesses such as DR has proven to be quite accurate with the inclusion of AI in fundus cameras. It has been demonstrated that machine learning algorithms may detect eyes at risk for postoperative myopic regression following refractive surgery by using preoperative fundus photography in conjunction with other preoperative parameters, including anterior chamber depth, central corneal depth, age, and intended ablation thickness.

In addition, supportive government policies are anticipated to promote corporate expansion. According to the rules and regulations of medical device agencies in the U.S. and Japan, fundus imaging cameras must be updated every four years. By ensuring the quality of the equipment, this regulation improves diagnosis and treatment. The law is likely to maintain and increase the country's need for electronics.

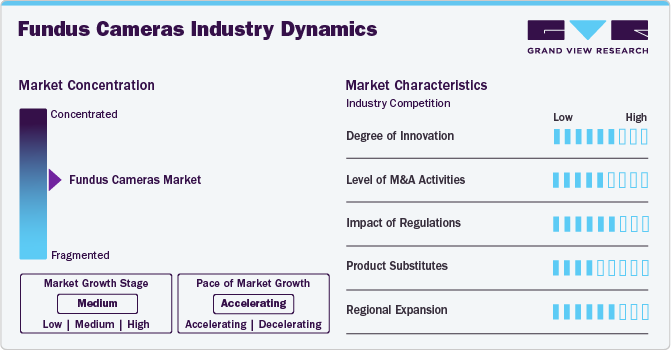

Market Concentration & Characteristics

The fundus camera industry is concentrated around a few key players, with companies like Canon, ZEISS, and Optovue dominating the industry. These companies focus on high-quality, advanced imaging technologies for retinal screening, including non-mydriatic and portable models. The industry is characterized by continuous innovation in AI integration for disease detection, portability, and telemedicine compatibility. Growing demand for early detection of ocular diseases like diabetic retinopathy and glaucoma is driving expansion in the industry. In addition, there is a shift towards more compact, user-friendly devices, enabling broader accessibility in both clinical and home care settings, improving patient outcomes.

The industry is experiencing a high degree of innovation, driven by advancements like the collaboration between Avant Technologies Inc. and Ainnova Tech Inc. In November 2024, their integration of Ainnova’s low-cost retinal camera with Vision AI software marks a major leap. This technology enables seamless retinal image capture and AI-powered analysis for early detection of ocular and systemic diseases. By combining affordable imaging with artificial intelligence, this innovation improves accessibility, enhances diagnostic accuracy, and supports proactive disease management. The integration of AI in retinal imaging promises to revolutionize routine healthcare screenings and expand detection capabilities worldwide.

Mergers and acquisitions (M&A) activity in the industry has increased. In March 2018, Optomed Oy acquired Commit Oy, a healthcare software solutions company, marking a significant M&A activity in the fundus camera industry. The merger combined Optomed’s hand-held fundus cameras with Commit’s screening software, creating a robust international provider of comprehensive disease screening solutions. This acquisition enhances customer service, drives innovation, and strengthens international growth. Optomed plans to leverage Commit’s expertise in diabetic retinopathy and other disease screenings, particularly with Finland's successful screening programs, for global expansion. The merger underscores the growing trend of integrating software and imaging technologies in the fundus camera market.

Regulations significantly influence the industry by ensuring product safety, efficacy, and quality. A prime example is Optomed USA’s launch of the Optomed Aurora AEYE in May 2024, the first FDA-cleared handheld AI fundus camera for detecting diabetic retinopathy beyond the mild stage. The approval highlights the critical role of regulatory standards in advancing medical technology. With FDA clearance, this device offers immediate, on-the-spot retinal screenings in primary care settings, enhancing early disease detection. Its clinical success, with diagnostic sensitivity of 92%-93%, illustrates how regulations ensure both safety and effectiveness, driving innovation in retinal health management.

In the industry, product substitutes include various imaging technologies like optical coherence tomography (OCT) and slit-lamp biomicroscopy. OCT provides detailed cross-sectional images of the retina, offering high-resolution views for detecting conditions like macular degeneration and glaucoma. Slit-lamp biomicroscopy, combined with a retinal lens, allows ophthalmologists to examine the fundus without a specialized camera. Additionally, smartphone-based retinal imaging systems are emerging as affordable, portable substitutes, providing basic retinal screenings. While these alternatives may not match the accuracy and comprehensive functionality of traditional fundus cameras, they offer convenient options for initial screenings and remote healthcare applications.

Regional expansion in the industry is driven by increasing healthcare access, rising awareness of eye health, and a growing demand for advanced eye care solutions. Topcon Healthcare’s launch of the NW500 robotic fundus camera in the U.S. in January 2023 highlights this trend. The NW500, with its innovative slit scan technology and high-quality imaging, allows for quicker, non-dilated retinal screenings, enhancing both workflow efficiency and patient experience. These advancements make it easier to incorporate advanced eye care into diverse healthcare settings, expanding Topcon's presence in global markets while meeting the rising demand for reliable, accessible retinal diagnostics.

Product Insights

The non-mydriatic cameras segment dominated the market and accounted for the largest revenue share of 49.4% in 2024. It improves the ability of a practitioner to view and observe detailed retinal anatomy, thereby improving the diagnosis and management of eye diseases. Furthermore, non-mydriatic cameras use fundus photography, eliminating the need for dilating drops and bright lights; hence, fundus photography is more patient friendly. This property also helps glaucoma patients for whom dilation is contraindicated. Advancements in non-mydriatic cameras, such as fluorescein imaging, portability, and live-action systems, are anticipated to drive the market during the forecast period.

The hybrid fundus cameras segment is estimated to register the fastest CAGR from 2025 to 2030. These cameras combine traditional fundus imaging with advanced technologies like optical coherence tomography (OCT) and fluorescein angiography, offering enhanced diagnostic capabilities. The growing demand for more comprehensive and accurate retinal imaging, coupled with the increasing prevalence of eye diseases such as diabetic retinopathy and glaucoma, is driving the growth of hybrid fundus cameras. Their ability to provide detailed, multi-modal imaging in a single device makes them increasingly popular in clinical settings.

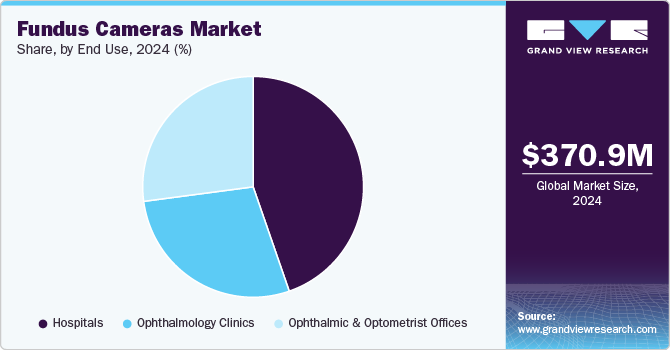

End Use Insights

The hospital segment accounted for the largest revenue share of 44.7% in 2024. Hospitals include secondary care, tertiary care, and advanced care. Hospitals are mostly preferred for paediatric eye care services and complicated procedures where one or more ophthalmologists and diagnostic and surgical support services are available. However, preference for specialty eye clinics, such as ophthalmologist and optometrist offices, may restrain the market's growth.

The ophthalmic & optometrist offices segment is estimated to register the fastest CAGR from 2025 to 2030 due to increasing optometrist practitioners, preference for primary eye care, and low-cost services by ophthalmic and optometrist offices compared to ophthalmologists. Furthermore, a stagnated supply of ophthalmologists allows optometric offices to dominate the market. For instance, the lack of ophthalmologists in low-income countries in the Asia Pacific, Latin America, and Africa increases the demand for optometrists in emerging regions.

Regional Insights

The North America fundus cameras market held the largest revenue share of 37.4% in 2024. Major factors contributing to the growth of this region include the increasing geriatric population and technical advances in the field. Furthermore, the approval and launch of fundus cameras in the U.S. and Canada and the high adoption of new technologies will likely boost the market share. The widening application of fundus cameras for early detection and screening for eye diseases and lifestyle-associated diseases is anticipated to propel the market during the forecast period.

U.S. Fundus Cameras Market Trends

The fundus cameras market in the U.S. accounted for the largest share of the North American market, highlighting its major influence on the region's overall landscape. According to the CDC data released in May 2024, around 12 million Americans aged 40 and older experience some form of vision impairment, including 1 million who are blind. Additionally, approximately 6.8% of children under 18 in the U.S. have a diagnosed eye or vision condition, with nearly 3% suffering from blindness or significant vision impairment, which persists even with corrective lenses.

Europe Fundus Cameras Market Trends

The European fundus cameras market is likely to witness a CAGR of 6.5% over the forecast period due to the local presence of major market players, technological developments in fundus cameras, such as easy-to-use, portability, and development of hybrid cameras, and adoption of newer products. For instance, key players such as Carl Zeiss Meditec Group, Optomed Oy (Ltd.), and CenterVue SpA are headquartered in Europe. In November 2022, Optomed announced the release of Aurora IQ, a handheld fundus camera with built-in artificial intelligence for quicker eye inspection. Furthermore, a rising number of diabetic retinopathy patients and the geriatric population is expected to boost the overall market during the forecast period.

The fundus cameras market in the UK is growing steadily, driven by an increasing demand for early detection of retinal diseases like diabetic retinopathy and age-related macular degeneration. In 2023, the market expanded by 6%, with a notable shift towards non-mydriatic and portable fundus cameras. The National Health Service (NHS) reported that over 2.5 million diabetic patients were screened for retinal conditions, boosting the adoption of fundus cameras in both clinical and remote settings.

France fundus cameras market is experiencing steady growth due to increasing awareness of eye health and advancements in diagnostic technology. The market is driven by the rising prevalence of diabetic retinopathy, macular degeneration, and other retinal diseases. In 2023, the French healthcare system saw a 5% increase in the adoption of fundus cameras, with non-mydriatic and portable models gaining traction in clinical and mobile healthcare settings. Additionally, the introduction of AI-driven fundus cameras is expected to boost market growth by 7% annually through 2025, enhancing early detection and enabling more efficient screenings across the country.

The fundus cameras market in Germany is expected to expand in the foreseeable future as people become more aware of potential issues linked to eye care, like infections or discomfort. This growing awareness has resulted in a stronger focus on ensuring the quality and dependability of vision correction products.

Asia Pacific Fundus Cameras Market Trends

The Asia Pacific fundus cameras market is expected to grow fastest from 2025 to 2030, driven by the rising prevalence of eye diseases like cataracts, glaucoma, and refractive errors, along with an aging population and workforce. Technological innovations and government efforts to enhance healthcare infrastructure also drive market expansion.

Countries like India and China, with large populations and increasing cataract surgery rates, are critical contributors to this growth. For instance, Samsung's initiative, announced on October 13, 2022, through its Galaxy Upcycling program, highlights the growing role of technology in expanding access to eye care. By repurposing old Galaxy devices into affordable EYELIKE Fundus Cameras, Samsung addresses the need for cost-effective retinal screening in underserved areas, particularly in low- and middle-income countries. This initiative significantly contributes to the fundus camera market by making retinal imaging accessible to both medical and non-medical professionals. It also showcases how innovative, sustainable solutions can increase screening capacities, helping to combat vision loss globally and improve early detection of conditions leading to blindness.

The fundus cameras market in China is steadily growing, with significant advancements in AI technology. In November 2018, Baidu launched an AI-powered tool to detect ocular fundus conditions that could cause blindness. The AI Fundus Camera screens for three eye diseases and generates reports from photos taken without a physician's assistance. Developed in collaboration with Chinese eye hospitals, the system focuses on diabetic retinopathy, macular degeneration, and glaucoma. Trained on labeled fundus images, the AI achieved 94% sensitivity and specificity in detecting these conditions, enhancing the efficiency and accessibility of eye disease screenings.

Japan fundus cameras market is primarily driven by the high volume of cataract surgeries, which commonly require ophthalmic sutures. Japan has one of the highest rates of cataract surgeries globally, contributing significantly to the demand for these products. Additionally, Japan invests heavily in healthcare, with the government allocating substantial funds toward advanced eye care services. In 2023, Japan’s healthcare expenditure reached over USD 400 billion, further supporting the growth of the fundus cameras market.

Latin America Fundus Cameras Market Trends

The fundus cameras market in Latin Americais experiencing steady growth. Improving healthcare infrastructure, along with greater access to advanced surgical technologies, is fueling the demand for fundus cameras in the region. In addition, rising awareness of eye care and government initiatives to reduce vision impairment are contributing to market expansion. The growing number of ophthalmic surgeries and investments in medical devices further support the market’s positive trajectory.

Middle East & Africa Fundus Cameras Market Trends

The Middle East and Africa fundus cameras marketis anticipated to witness robust growth over the forecast period, is driven by the increasing prevalence of eye diseases, especially in the aging population, and the government's focus on healthcare improvements. Moreover, the rise in disposable income and lifestyle changes, including increased screen time, contribute to heightened demand for vision care services and products.

Key Fundus Cameras Company Insights

The competitive scenario in the fundus cameras industry is highly competitive, with key players such as Carl Zeiss Meditec, Inc., NIDEK Co., Ltd. and others. The major companies are undertaking various organic and inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Fundus Cameras Companies:

The following are the leading companies in the fundus cameras market. These companies collectively hold the largest market share and dictate industry trends.

- Carl Zeiss Meditec, Inc.

- Kowa Company Ltd.

- Optomed Oy (Ltd.)

- Optovue, Incorporated

- CenterVue SpA

- NIDEK Co., Ltd.

- Topcon Medical Systems, Inc.

- Clarity Medical Systems, Inc.

- Canon, Inc.

Recent Developments

-

In October 2024, Visionix unveiled the VX 610, a nonmydriatic automated fundus camera, at Vision Expo West. It features auto alignment, focus, and capture, with a compact design and no need for pupil dilation thanks to cross-polarized light. The device is tablet-driven, telehealth-ready, and ideal for retinal screening, including diabetic retinopathy.

-

In May 2024, Remidio Inc. is set to deploy its 1000th FOP-NM handheld fundus camera in the U.S. this quarter. Since 2019, these portable, non-mydriatic devices have transformed diabetic retinopathy screening by eliminating dilation and offering high-quality images. Their ease of use has gained widespread acceptance, enhancing access to retinal care.

-

In March 2024, the University of Colorado Ophthalmology residents began using portable fundus photography cameras to enhance on-call evaluations. These smartphone-sized cameras allow for efficient, comprehensive imaging, improving patient assessments and follow-up care. The technology facilitates real-time supervision by physicians, ensuring accurate diagnoses and treatment plans in hospital settings.

-

In November 2023, Tohoku University has developed a new fundus camera using oblique illumination, which improves imaging of the retina and optic nerve. This technology enhances image contrast and allows for quasi-3D views, potentially enabling patients to capture their own retinal images at home. The approach is cost-effective, simple, and real-time.

Fundus Cameras Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 392.5 million

Revenue forecast in 2030

USD 535.0 million

Growth rate

CAGR of 6.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Carl Zeiss Meditec, Inc.; Kowa Company Ltd.; Optomed Oy (Ltd.); Optovue, Incorporated; CenterVue SpA; NIDEK Co.Ltd.; Topcon Medical Systems, Inc.; Clarity Medical Systems, Inc.; Canon, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fundus Cameras Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fundus cameras market report based on product, end use, and region:

-

Product Outlook (Revenue, 2018 - 2030)

-

Mydriatic fundus cameras

-

Tabletop

-

Handheld

-

-

Non- mydriatic fundus cameras

-

Tabletop

-

Handheld

-

-

Hybrid fundus cameras

-

ROP fundus cameras

-

-

End Use Outlook (Revenue, 2018 - 2030)

-

Hospitals

-

Ophthalmology Clinics

-

Ophthalmic & Optometrist Offices

-

-

Regional Outlook (Revenue, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global fundus cameras market size was estimated at USD 370.9 million in 2024 and is expected to reach USD 392.5 million in 2025.

b. The global fundus cameras market is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2030 to reach USD 535.0 million by 2030.

b. North America dominated the fundus cameras market with a share of 37.4% in 2024. This is attributable to the high awareness of eye disorders, increasing chronic disorders, and technical advances in digital and handheld devices.

b. Some key players operating in the fundus cameras market include Carl Zeiss Meditec, Inc.; Kowa Company Ltd.; Optomed Oy (Ltd.); Optovue Incorporated; CenterVue SpA; NIDEK Co., Ltd.; Topcon Medical Systems, Inc.; Clarity Medical Systems, Inc.; and Canon, Inc.

b. Key factors that are driving the fundus cameras market growth include increasing eye disorders and supportive government regulations.

b. The non-mydriatic cameras accounted for the largest industry share of 49.4% in 2024, and the segment is further expected to witness substantial growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.