- Home

- »

- Digital Media

- »

-

Game Streaming Market Size, Share, Industry Report, 2033GVR Report cover

![Game Streaming Market Size, Share & Trends Report]()

Game Streaming Market (2025 - 2033) Size, Share & Trends Analysis Report By Solutions (Web-based, App-based), By Revenue Model (Subscription, Advertisement), By Platform Solutions, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-270-4

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Game Streaming Market Summary

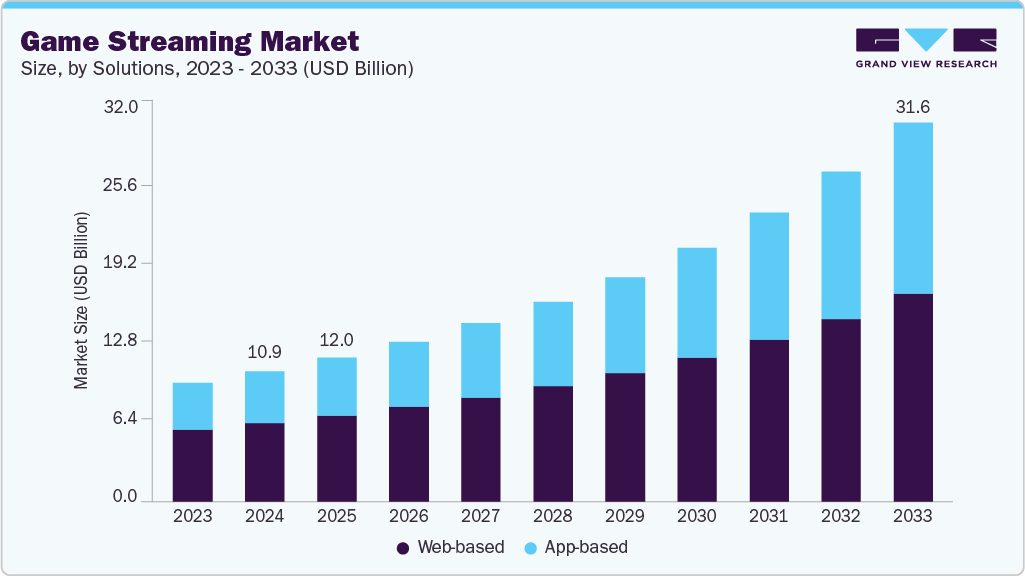

The global game streaming market size was estimated at USD 10.85 billion in 2024 and is projected to reach USD 31.63 billion by 2033, growing at a CAGR of 12.9% from 2025 to 2033. The market growth is primarily driven by the rising adoption of cloud gaming platforms, growing demand for low-latency interactive streaming, rapid expansion of esports and competitive gaming content, increasing monetization opportunities for creators and streamers, widespread penetration of high-speed internet and 5G networks, and growing investments in edge computing to support high-quality real-time gameplay streaming.

Key Market Trends & Insights

- North America game streaming industry dominated the global market with the largest revenue share of over 40% in 2024.

- The game streaming industry in the U.S. led the North America market and held the largest revenue share in 2024.

- By solutions, the web-based segment led the market and held the largest revenue share of nearly 60% in 2024.

- By revenue model, the advertisement segment led the market and held the largest revenue share of over 51% in 2024.

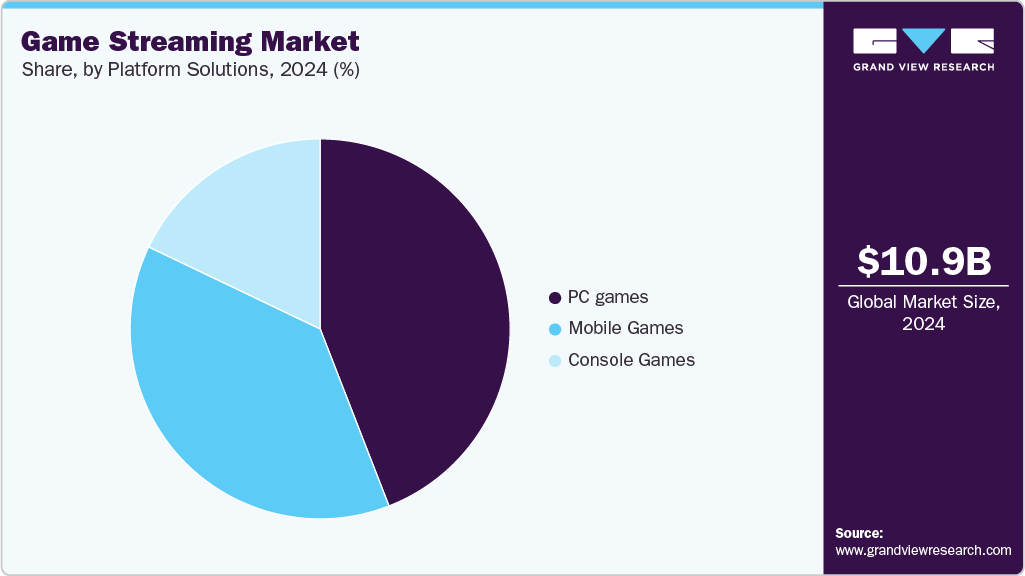

- By platform solutions, the mobile games segment is expected to grow at the fastest CAGR of over 15% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 10.85 Billion

- 2033 Projected Market Size: USD 31.63 Billion

- CAGR (2025-2033): 12.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The rapid rise in cloud gaming adoption is becoming a primary catalyst for the game streaming industry. Consumers increasingly favor subscription-based, device-independent gaming ecosystems that eliminate the requirement for high-performance hardware. In response, platform providers are strengthening cloud infrastructures and optimizing content delivery pipelines to support scalable, high-quality streaming. This transition is also prompting developers to design cloud-native game titles optimized for streaming environments. As cloud ecosystems mature, they are significantly boosting overall market penetration and user engagement.The global esports sector continues its robust expansion, substantially contributing to the surging popularity of game streaming. Large-scale competitive events attract massive global audiences, driving the need for high-quality, real-time broadcast capabilities. Simultaneously, content creators and gaming influencers are reshaping market dynamics through personalized, community-centric experiences. Streaming platforms are investing in advanced production, analytics, and monetization tools to support these creators. The combined momentum from esports visibility and creator-driven engagement is sustaining strong market growth.

Technological developments in 5G and edge computing are redefining the performance benchmarks for game streaming. High-speed mobile networks are enabling high-resolution, low-latency game streams on smartphones and other portable devices. Edge computing nodes, placed closer to users, further reduce response times by processing workloads locally. These advancements deliver smoother, more immersive gaming experiences and drive broader adoption of streaming-based gaming models. As global network infrastructure continues to evolve, it will further accelerate market expansion.

Solutions Insights

The web-based segment dominated the market in 2024, accounting for nearly 60% share, owing to its high accessibility and simple browser-based experience. Growing preference for instant play without downloads or specialized hardware significantly boosted adoption among casual and first time gamers. Advancements in browser technologies such as WebRTC and improved rendering engines strengthened streaming quality and stability. Providers increasingly use web delivery to offer smooth cross device access across PCs, tablets, and mobile devices. With developers shifting toward lightweight, device-agnostic streaming models, the web-based segment is set to maintain strong growth momentum.

The app-based segment is expected to post a significant CAGR from 2025 to 2030, supported by the accelerating shift toward mobile-first game streaming experiences. Growing adoption of high performance smartphones is enabling users to enjoy high quality streams without relying on dedicated hardware. Streaming platforms are expanding their app offerings with interactive features, personalized recommendations, and streamlined interfaces to strengthen user engagement. The rapid rollout of 5G networks is further boosting on the go streaming by lowering latency and improving overall consistency. As platforms continue to enhance app compatibility across mobile, tablet, and smart TV environments, the app-based segment is set to become a key driver of market growth.

Revenue Model Insights

The advertisement segment accounted for the largest market share in 2024, driven by the rising monetization of viewer traffic and increased advertiser demand for high engagement digital formats. Streaming platforms are leveraging targeted ad placements, interactive ad units, and brand partnerships to capitalize on growing audience volumes. The surge in viewership from esports events, creator led streams, and casual gaming content has further strengthened advertising revenues. Advancements in data analytics are enabling more precise audience targeting, improving advertisement effectiveness and return on investment for brands. With platforms prioritizing scalable advertisement supported revenue models, the advertisement segment is positioned to maintain its leadership in the coming years.

The subscription segment is expected to post a significant CAGR from 2025 to 2030, driven by rising consumer demand for uninterrupted, ad-free streaming experiences. Users are increasingly opting for subscription models that offer exclusive content, early access to gameplay streams, and premium creator interactions. Platforms are enhancing subscription value through bundled benefits such as loyalty rewards, cross-platform access, and multi-tier pricing options. The growing willingness of gamers to pay for personalized and immersive experiences is strengthening recurring revenue streams for providers. As platforms continue to refine their subscription offerings, the segment is set to become a key contributor to sustained market expansion.

Platform Solutions Insights

The PC games segment accounted for the largest share of the market in 2024, driven by the continued popularity of high performance, graphics intensive titles that attract substantial streaming audiences. The ability of PCs to support advanced customization, modding, and competitive gameplay significantly boosts user engagement on streaming platforms. PC centric esports tournaments are further elevating global viewership and reinforcing the segment’s leading position. Streaming creators also prefer PC setups due to stronger processing capabilities and smooth integration with professional grade broadcasting tools. With demand rising for premium, visually rich gaming experiences, the PC games segment is expected to retain its dominant role in the market.

The mobile games segment is expected to post a significant CAGR from 2025 to 2030, fueled by the rising demand for accessible, on the go gaming experiences. Increasing penetration of affordable smartphones and steady improvements in mobile processing capabilities are enabling users to stream high quality gameplay more seamlessly. Streaming platforms are intensifying their focus on mobile users by refining app interfaces, expanding interactive features, and tailoring monetization models to mobile engagement patterns. The rollout of 5G networks is further accelerating adoption by reducing latency and enhancing real time streaming performance. As mobile gaming continues to lead global player activity, the mobile games segment is positioned to emerge as one of the strongest growth drivers in the market.

Regional Insights

North America game streaming industry dominated the market with a global share of nearly 40% in 2024, supported by strong consumer adoption of cloud gaming and widespread high-speed broadband access. Leading platforms expanded their content portfolios and strengthened infrastructure to address the growing demand for premium streaming experiences. Rising esports viewership and creator-led engagement further accelerated user activity across the region. Continuous platform investments in low-latency delivery and advanced streaming technologies are reinforcing competitive advantages. As innovation accelerates, North America is well positioned to maintain its leadership throughout the forecast period.

U.S. Game Streaming Market Trends

The U.S. game streaming industry dominated the market with a share of over 52% in 2024driven by a large base of active gamers and early adoption of premium streaming services. High penetration of advanced devices and robust network infrastructure continues to support strong platform usage. U.S.-based companies are investing heavily in content integration, monetization frameworks, and ultra-low-latency delivery capabilities. These strategic enhancements are strengthening engagement across both mainstream and niche gaming audiences. Consequently, the U.S. is expected to remain the dominant force within the global game streaming ecosystem.

Europe Game Streaming Market Trends

The Europe game streaming industry is expected to grow significantly from 2025 to 2033, fueled by rising interest in cloud-based gaming and increasing cross-platform content consumption. Expanding fiber and 5G deployments are significantly improving streaming reliability and speed across major economies. Esports participation is gaining momentum, further elevating viewership and user engagement on regional platforms. Governments and enterprises are also investing in digital entertainment and connectivity infrastructure, strengthening market readiness. As these factors converge, Europe is positioned to emerge as one of the fastest-growing regions globally.

Asia Pacific Game Streaming Market Trends

Asia Pacific game streaming industry is anticipated to register the fastest CAGR from 2025 to 2033, driven by strong mobile gaming adoption and accelerating digital transformation. Affordable smartphones and a rapidly expanding youth gamer population are fueling high-volume streaming activity. Ongoing 5G network rollout by governments and telecom operators is enhancing real-time streaming quality across urban and emerging markets. Regional platforms are adapting to mobile-centric consumption patterns with localized content and interactive features. With surging user engagement, Asia Pacific is set to become the most dynamic and influential growth engine in the global market.

Key Game Streaming Company Insights

Some of the key companies in the game streaming industry include Alphabet Inc. (YouTube), Amazon.com Inc., Meta Platforms Inc., NVIDIA Corp., Sony Group Corp., and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Alphabet operates game streaming platforms globally through YouTube Gaming, which supports creators, live streamers, and esports content distributors. The platform leverages YouTube’s broad audience reach and search algorithms to facilitate strong visibility for gaming content. Alphabet continues to develop streaming infrastructure, creator management tools, and features that support real time interactions and monetization. Through its scale and integrations across gaming and esports partners, Alphabet plays a significant role in shaping viewing and content distribution patterns within the game streaming industry.

-

Sony is one of the prominent player in the game streaming industry with its PlayStation cloud gaming services, which are integrated into the PlayStation Plus subscription framework. The company provides cloud access to a wide catalog of PlayStation titles, supported by its sizable global console user base. Sony is expanding its cloud delivery capabilities and working toward broader device accessibility to align with evolving consumption patterns in game streaming. Its ongoing focus on cloud oriented gaming models positions the company as a key contributor to the development of streaming based gameplay.

Key Game Streaming Companies:

The following are the leading companies in the game streaming market. These companies collectively hold the largest market share and dictate industry trends.

- Alphabet Inc. (Youtube)

- Amazon.com Inc.

- Meta Platforms Inc.

- Apple Inc.

- Genvid Holdings Inc.

- GosuGamers

- Huya

- AfreecaTV Corp.

- NVIDIA Corp.

- Parsec Cloud Inc.

- Sony Group Corp.

Recent Developments

-

In October 2025, Amazon introduced an updated version of its Luna game streaming service, featuring a new GameNight collection aimed at simplifying multiplayer gaming for families and casual players. The update enables users to join sessions through their smartphones, broadening accessibility and reducing reliance on specialized gaming hardware. Amazon continues to operate its Premium tier, which provides access to a wider catalog of AAA and independent titles for more dedicated users. By expanding its content range to address both casual and core gaming audiences, Amazon reinforces Luna’s presence in the evolving game streaming industry.

-

In August 2025, NVIDIA introduced its Blackwell architecture to the GeForce NOW platform, bringing next-generation GPU performance to cloud gaming. The update enables streaming at up to 5K resolution and 120 frames per second, supported by advanced AI features that enhance visual quality and responsiveness. NVIDIA also expanded its library through an Install to Play option, which increases the number of supported titles to more than 4,500. These enhancements strengthen GeForce NOW’s position as a leading high performance cloud gaming service across multiple device categories.

-

In June 2025, nubia partnered with Twitch Rivals at TwitchCon Europe to showcase its Neo 3 series to attendees and livestream viewers. The partnership allowed the company to highlight the phone’s gaming focused features directly to influencers, gamers, and media representatives. By engaging with a highly active competitive gaming audience, nubia strengthened its visibility in the European market. The initiative supports the brand’s strategy to expand its presence in the global mobile gaming segment.

-

In March 2025, Amazon introduced GameLift Streams to help developers deliver high quality game streaming to nearly any device with a modern browser. The service allows developers to upload their game builds to managed GPU instances and begin streaming within minutes, reducing the need for custom infrastructure. It supports a wide range of devices, including PCs, smartphones, tablets, and smart TVs, making cloud gaming more accessible to users. By simplifying deployment and scaling, Amazon strengthens its position in the market for developer-focused game streaming solutions.

Game Streaming Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.00 billion

Revenue forecast in 2033

USD 31.63 billion

Growth rate

CAGR of 12.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive sector, growth factors, and trends

Segment scope

Solutions, revenue model, platform solutions, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Alphabet Inc. (YouTube); Amazon.com Inc.; Meta Platforms Inc.; Apple Inc.; Genvid Holdings Inc.; GosuGamers; Huya; AfreecaTV Corp.; NVIDIA Corp.; Parsec Cloud Inc.; Sony Group Corp.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Game Streaming Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global game streaming market report based on solutions, revenue model, platform solutions, and region:

-

Solutions Outlook (Revenue, USD Million, 2021 - 2033)

-

Web-based

-

App-based

-

-

Revenue Model Outlook (Revenue, USD Million, 2021 - 2033)

-

Subscription

-

Advertisement

-

Others

-

-

Platform Solutions Outlook (Revenue, USD Million, 2021 - 2033)

-

Mobile games

-

PC games

-

Console games

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global game streaming market size was estimated at USD 10.85 billion in 2024 and is expected to reach USD 12.00 billion in 2025.

b. The global game streaming market is projected to grow at a compound annual growth rate (CAGR) of 12.9% from 2025 to 2033, reaching USD 31.63 billion by 2033.

b. North America dominated the game streaming market, accounting for over 40% of the market share in 2024. Platforms like Twitch, YouTube Gaming, and Facebook Gaming have become increasingly popular in North America, enabling gamers to stream their gameplay and interact with viewers, thereby driving the region's growth.

b. Some key players operating in the game streaming market include Alphabet Inc. (Youtube), Amazon.com Inc., Meta Platforms Inc., Apple Inc., Genvid Holdings Inc., GosuGamers, Huya, AfreecaTV Corp., NVIDIA Corp., Parsec Cloud Inc., Sony Group Corp.

b. Key factors that are driving the market growth include Increasing demand for on-demand entertainment and advancements in technology, and the rise of cloud gaming and high-speed internet access are key factors fueling the expansion of the game streaming market..

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.