- Home

- »

- Communications Infrastructure

- »

-

Content Delivery Network Market Size, Industry Report, 2033GVR Report cover

![Content Delivery Network Market Size, Share, & Trends Report]()

Content Delivery Network Market (2026 - 2033) Size, Share, & Trends Analysis Report By Service (Standard CDN, Video CDN), By Solution (Web Performance Optimization, Media Delivery, Cloud Security), By Service Provider, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-543-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Content Delivery Network Market Summary

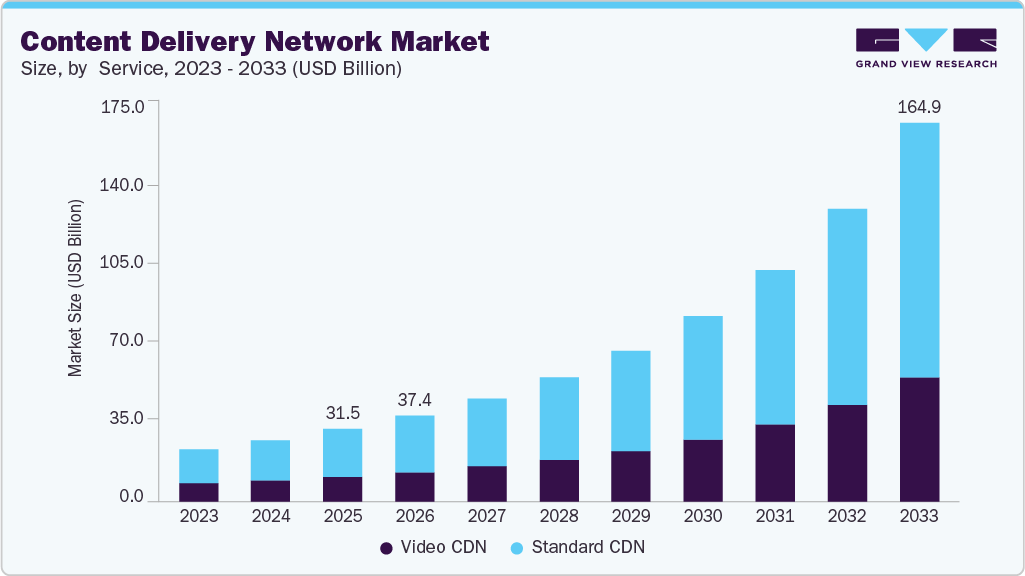

The global content delivery network market size was estimated at USD 31.52 billion in 2025 and is projected to reach USD 164.90 billion by 2033, growing at a CAGR of 19.7% from 2026 to 2033. The market growth is driven by increasing online content consumption, fueled by the continued expansion of digital media, streaming services, and e-commerce platforms.

Key Market Trends & Insights

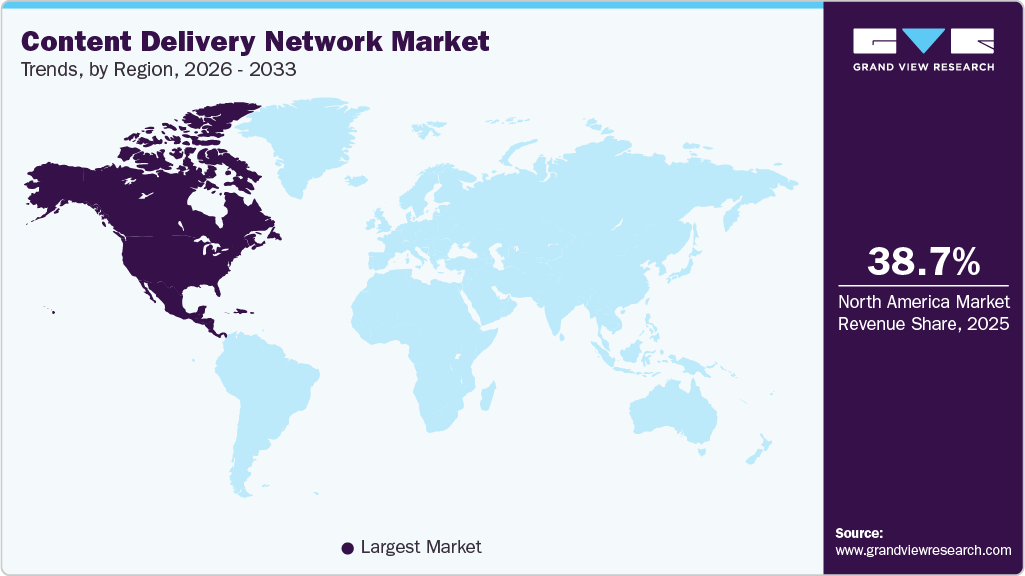

- North America content delivery network dominated the global market with the largest revenue share of 38.7% in 2025.

- The content delivery network industry in the U.S. is expected to grow significantly over the forecast period.

- By service, video CDN segment led the market and held the largest revenue share of 65.4% in 2025.

- By solution, web performance optimization segment held the largest revenue share in 2025.

- By service provider, traditional commercial CDN segment led the market and held the largest revenue share in 2025.

- By end use, media and entertainment segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 31.52 Billion

- 2033 Projected Market Size: USD 164.90 Billion

- CAGR (2026-2033): 19.7%

- North America: Largest market in 2025

The increasing global penetration of the internet, particularly in emerging regions, is further strengthening demand for CDN services to deliver optimal performance. Growing expectations for fast, high-quality online experiences are driving greater reliance on CDNs to enhance site and app performance. In the media and entertainment industry, CDNs are widely used to deliver audio and video more smoothly. As content consumption keeps changing and demand for high-quality, original content grows, companies rely more on efficient CDN solutions to improve network performance and deliver content quickly.The growing demand for Over-the-Top (OTT) and Video-on-Demand (VOD) services is increasing the need for reliable, high-speed content delivery and is expected to support market growth. The global e-commerce industry is also developing as consumer behavior continues to change. CDN solutions play an important role in e-commerce by ensuring smooth platform performance and giving customers quick access to the information they need to make informed purchase decisions. In addition, more consumers are moving from traditional television to video content delivered over cellular networks, leading to greater adoption of CDN solutions to improve streaming quality. Meanwhile, the growing use of IoT- and AI-based digital solutions across industries is encouraging market players to develop customized, industry-specific CDN offerings.

The growing use of OTT and VOD services requires broadcasters to deliver low-latency data and improve the quality of video streaming. Continued investments in network infrastructure worldwide, particularly in emerging markets such as India, have strengthened connectivity, bandwidth, and coverage. For instance, in August 2025, Nokia announced that Netplus had deployed Nokia’s latest 400G routing technology and SDAN platform to scale its high-speed broadband and IPTV services across Punjab and other cities, enabling more immersive services for nearly two million users while ensuring long-term network efficiency. These improvements ensure that consumers can stay connected, receive real-time updates, and easily access ready-to-use media content. As a result, broadcasters are increasingly focused on enhancing content delivery and providing diverse data across multiple applications. The market has also expanded significantly in recent years due to increasing demand for online content delivery, driven by the growth of digital media consumption, the expansion of e-commerce, and the increasing importance of web performance optimization for businesses. In addition, trends such as 5G adoption, the rise of IoT, and the continued development of cloud-based services are expected to accelerate market growth further.

Service Insights

The video CDN segment dominated the market and accounted for the revenue share of 65.4% in 2025, driven by the fast growth in online video consumption and the expanding popularity of OTT and VOD platforms. As millions of users stream HD, 4K, and live video content daily, broadcasters and streaming providers increasingly rely on video CDNs to ensure low-latency delivery, minimal buffering, and consistent playback quality. Developments further support this trend, for example, when building its support for live streaming, Netflix extended its Open Connect CDN to deliver live content to millions of viewers globally by placing thousands of CDN servers close to users and optimizing how video segments are delivered so that playback remains smooth even under high demand. This involved using personalized manifests and edge caching to balance load and maintain high quality across devices and network conditions. At the same time, improvements in global connectivity, including broadband upgrades and 5G rollouts, are enabling faster data transmission and higher-quality streaming across devices. The rise in mobile video usage, with advancements such as edge computing and expanded PoP deployments by CDN providers, is further strengthening the need for strong video CDN services capable of handling massive traffic volumes and delivering seamless viewing experiences worldwide.

The standard CDN segment is anticipated to grow at a significant CAGR during the forecast period, driven by the increasing need for efficient and reliable web content delivery across websites, applications, and enterprise platforms. Standard CDNs help distribute static content, images, scripts, and software downloads closer to end users, reducing latency, improving website load times, and enhancing the overall user experience. Key market drivers include the fast growth of e-commerce platforms, online education, and corporate web services, where consistent performance and uptime are important for business operations. In addition, the increase in mobile internet use and cloud services has expanded the need for standard CDN solutions, as businesses need networks that can easily scale and handle more traffic during busy periods.

Solution Insights

The cloud security segment is anticipated to witness significant growth over the forecast period, due to the growing need to protect data, applications, and content moving across distributed CDN environments. As more businesses shift their workloads and media delivery pipelines to the cloud, securing these assets against breaches, unauthorized access, and evolving cyberattacks has become a top priority. Growth in this segment is further driven by factors such as the increasing volume of online traffic, the increase in DDoS attacks targeting high-visibility websites, stricter data protection regulations, and the need to safeguard edge locations where CDN nodes operate. The expansion of streaming services, online gaming, and e-commerce also adds pressure on CDN providers to integrate strong security layers, ensuring safe and uninterrupted content delivery for users worldwide.

The media delivery segment accounted for significant revenue share in 2025. As online content consumption continues to grow, CDNs have become important for delivering large media files smoothly and ensuring that viewers can stream videos without interruptions. New formats such as AR, VR, and ultra-high-resolution content are increasing expectations for speed and quality, pushing CDNs to handle much higher bandwidth and keep latency low. This growth is supported by several drivers, including the rising popularity of streaming platforms, the shift toward real-time and interactive content, and increasing demand for consistent viewing experiences across devices and regions. Expanding internet penetration and improvements in mobile networks also contribute to the stronger need for reliable media delivery solutions.

Service Provider Insights

The traditional commercial CDN segment dominated the market and accounted for the largest revenue share in 2025. Traditional CDN providers offer a wide range of solutions that help speed up network performance, accelerate content delivery, and support efficient media distribution, capabilities that many large enterprises still depend on for reliable digital experiences. The ongoing global growth in data consumption, especially for high-quality video, gaming, and dynamic web content, has further pushed these providers to optimize delivery and expand their infrastructure to meet demand. For example, established CDN leaders like Akamai and Cloudflare continue to invest in global points of presence and advanced routing technologies to serve traffic faster and more reliably. In September 2024, Cloudflare launched the Speed Brain, which was designed to make millions of web pages load up to 45% faster by preloading likely next pages into the browser cache, resulting in near instant loading and smoother browsing experiences for users worldwide. These ongoing innovations show how traditional CDN providers remain central to supporting fast, reliable, and scalable digital experiences in growing global traffic demands.

The cloud CDN segment is anticipated to grow at a significant CAGR during the forecast period. This growth is driven by the growing need to deliver websites, apps, and digital media quickly and reliably, especially as more businesses shift their operations online. Cloud CDN providers use large networks of distributed servers to store and deliver content from locations closer to users, which helps reduce delays and ensures smoother performance. In recent years, cloud CDNs have also adopted smarter technologies, such as better caching for dynamic content and predictive prefetching, to keep up with heavier traffic and increasing expectations for fast, uninterrupted digital experiences.

End Use Insights

The media and entertainment segment dominated the market and accounted for the largest revenue share in 2025. This is mainly because the media & entertainment industry is rapidly moving to digital delivery, with a growing need for online streaming, video-on-demand (VOD), and other high-quality content that must be delivered quickly and smoothly to viewers everywhere. As people spend more time watching online video and live broadcasts, CDN providers are focusing on technology that supports high-resolution streams, low latency, and reliable playback across devices. For instance, in November 2025, Telefónica partnered with Ateme to roll out a cloud-native media processing platform built on Google Cloud, enabling more scalable and higher-quality delivery of its VOD library. The new setup allows Telefónica to stream large volumes of content, including 4K titles, more efficiently across mobile devices, smart TVs, and other platforms, improving both agility and viewing quality.

The e-commerce segment is anticipated to grow at a significant CAGR during the forecast period. This growth is mainly due to the need for faster, more dependable online shopping experiences as customers expect quick page loads and smooth checkouts, no matter where they are. CDNs help e-commerce sites achieve this by storing website content such as images and product pages closer to users, which speeds up loading times and improves overall site performance. They also keep platforms stable during heavy traffic periods, such as festive sales, while protecting them from cyberattacks that could interrupt shopping and harm customer trust. Better site speed can also boost search rankings and increase conversion rates, making CDNs a valuable tool for online retailers aiming to improve customer experience and grow their sales. As online shopping becomes more dynamic and interactive, the demand for fast, secure CDN-backed delivery continues to increase across the e-commerce sector.

Regional Insights

North America content delivery network market held a largest share of 38.7% of the global market in 2025. This strong position is mainly due to the growing use of 4K displays and the region’s high internet penetration, both of which create a strong foundation for fast and efficient content delivery. The widespread adoption of cloud services, rollout of faster data networks, and growing use of smartphones also continue to push demand for CDN solutions. In addition, rising leisure spending, especially on streaming, gaming, and online entertainment, has played a key role in boosting CDN adoption across the region.

U.S. Content Delivery Network Market Trends

The U.S. content delivery network industry is expected to grow at a significant CAGR over the forecast period of 2026 to 2033. In the U.S., CDN adoption continues to grow as businesses across sectors look for faster and more reliable ways to deliver digital content. The growth in streaming platforms, online gaming, e-learning, and large-scale enterprise applications has made it important to move data quickly and smoothly across long distances. For instance, in November 2025, Amazon Web Services announced it would invest up to USD 50 billion to enhance AI and supercomputing resources for U.S. federal agencies.

This includes building new data centers and offering advanced cloud services such as AWS GovCloud and Amazon SageMaker AI, showing a big support in the country’s cloud and computing infrastructure. As audiences expect high-quality video, real-time updates, and uninterrupted access, CDNs have become a core part of the digital ecosystem, helping companies reduce delays, manage heavy traffic, and improve user experiences. The strong technology infrastructure in the U.S., along with steady investments in cloud services and edge computing, further supports the growing reliance on CDN solutions.

Europe Content Delivery Network Market Trends

The content delivery network market in Europe is expected to grow at a significant CAGR over the forecast period. There is an increasing demand for high-quality digital content delivery across various industries in Europe, including media and entertainment, e-commerce, gaming, and enterprise services. This demand stems from the growing popularity of online streaming services, the proliferation of e-commerce platforms, and the growing dependence on digital solutions for business operations.

The UK content delivery network market is expected to grow at a significant CAGR over the forecast period. The increase of high-definition video streaming, live events, and cloud-based services has driven the need for strong CDN solutions capable of ensuring seamless delivery of digital assets to end users.

The content delivery network market in Germany is expected to register a significant CAGR over the forecast period. The proliferation of mobile devices and the growing adoption of cloud-based services have contributed to the surge in data consumption, fueling the need for strong CDN infrastructure and thereby supporting market growth.

Asia Pacific Content Delivery Network Market Trends

The content delivery network market in the Asia Pacific is anticipated to witness a fastest CAGR of 21.6% over the forecast period, due to the presence of emerging economies, such as India and China. The growing number of people and viewers engaging with online gaming has boosted the need for better networking technology to handle increased media consumption. Regional government initiatives, such as Digital India, have supported faster and more secure data delivery, which is expected to drive greater use of CDN solutions.

The Japan content delivery network market is expected to grow significantly in the coming years. The domestic market has witnessed significant developments in recent times, reflecting the country's growing reliance on digital infrastructure. With a strong technological landscape and increasing internet penetration, Japanese businesses across various sectors are turning to CDNs to optimize digital content and service delivery.

Content delivery network market in China held a significant market share in 2025. CDNs are witnessing high demand in China for optimizing content delivery across the country’s expansive geographical expanse. Enterprises use their distributed network infrastructure and local caching capabilities to ensure expedited and enhanced user experiences while mitigating bandwidth and server hosting expenses.

Key Content Delivery Network Company Insights

Key players operating in the content delivery network industry are Akamai Technologies, Alibaba Cloud, Amazon Web Services, Inc., ARYAKA NETWORKS, INC., CacheFly, CDNsun s.r.o., Cloudflare, Inc., Fastly, Gcore., Google LLC, Imperva, and others. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

-

Akamai Technologies is a U.S. internet and cloud services company known for one of the world’s largest content delivery networks (CDNs), helping deliver web content, media streaming, and applications quickly and securely across the globe. It offers content delivery, cloud computing, and cybersecurity solutions to enterprises, supported by a vast edge infrastructure in more than 130 countries. Akamai plays a major role in accelerating and protecting digital experiences worldwide.

-

Alibaba Cloud, also known as Aliyun, is the cloud computing arm of the Alibaba Group, offering a wide range of services such as elastic computing, data storage, databases, big data, security, and content delivery network (CDN) solutions to businesses worldwide. It operates global data centers and serves e-commerce, gaming, media, and enterprise customers. Alibaba Cloud’s CDN helps speed up and secure the delivery of digital content across regions.

Key Content Delivery Network Companies:

The following are the leading companies in the content delivery network market. These companies collectively hold the largest market share and dictate industry trends.

- Akamai Technologies

- Alibaba Cloud

- Amazon Web Services, Inc.

- ARYAKA NETWORKS, INC.

- CacheFly

- CDNsun s.r.o.

- Cloudflare, Inc.

- Fastly

- Gcore.

- Google LLC

- Imperva

- Lumen Technologies

- Microsoft Corporation

- proinity LLC

- Tencent Cloud.

Recent Developments

-

In September 2025, Orange and Synamedia announced a partnership to expand multi-CDN delivery by combining Orange’s telco-grade CDN with Synamedia’s Quortex Switch platform. The solution helps content providers seamlessly integrate multiple CDNs, extend coverage into new markets, especially the Middle East and Africa, and improve streaming quality with intelligent traffic routing and low-latency delivery.

-

In March 2025, Qwilt partnered with Corix to improve content delivery in North America and Europe using Qwilt’s Open Edge technology. The partnership adds more than 6.2 Tbps of network capacity and brings faster, high-quality edge delivery to millions of users. It also helps Qwilt expand globally, reduce network congestion, lower delays, and provide smoother, more reliable online experiences.

-

In February 2024, Akamai launched its Gecko initiative to bring cloud computing directly to its edge network, allowing companies to run workloads closer to users and improve performance for latency-sensitive applications. This move embeds generalized compute into Akamai’s global edge footprint to support use cases like gaming, streaming, and real-time data processing, strengthening its CDN and edge cloud offerings.

Content Delivery Network Market Report Scope

Report Attribute

Details

Market size in 2026

USD 37.38 billion

Revenue forecast in 2033

USD 164.90 billion

Growth rate

CAGR of 19.7% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2026 to 2033

Report application

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service, solution, service provider, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Akamai Technologies; Alibaba Cloud; Amazon Web Services, Inc.; ARYAKA NETWORKS, INC.; CacheFly; CDNsun s.r.o.; Cloudflare, Inc.; Fastly; Gcore.; Google LLC; Imperva; Lumen Technologies; Microsoft Corporation; proinity LLC; Tencent Cloud

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Content Delivery Network Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the content delivery network market report based on service, solution, service provider, end use, and region:

-

Service Outlook (Revenue, USD Billion, 2021 - 2033)

-

Standard CDN

-

Video CDN

-

-

Solution Outlook (Revenue, USD Billion, 2021 - 2033)

-

Web Performance Optimization

-

Media Delivery

-

Cloud Security

-

-

Service Provider Outlook (Revenue, USD Billion, 2021 - 2033)

-

Traditional Commercial CDN

-

Cloud CDN

-

Peer to Peer CDN

-

Telecom CDN

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Advertising

-

E-Commerce

-

Media and Entertainment

-

Gaming

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global content delivery network market was valued at USD 31.52 billion in 2025 and is expected to reach USD 37.38 billion in 2026.

b. The global content delivery network market is expected to grow at a compound annual growth rate of 19.7% from 2026 to 2033 to reach USD 164.90 billion by 2033.

b. The Video CDN segment dominated the global market in 2025 and accounted for a revenue share of 65.4% The sustained surge in online video consumption is a key driver for the growing demand for CDNs in video delivery.

b. The web performance optimization segment dominated the content delivery network market in 2025 and accounted for a revenue share of 39.7%. Web performance optimization solutions, which focus on enhancing website loading times, reducing latency, and optimizing content delivery, have become essential for businesses seeking to provide superior user experiences, driving substantial revenue growth in the market.

b. Some key players operating in the content delivery network market include Akamai Technologies; Alibaba Cloud; Amazon Web Services, Inc.; ARYAKA NETWORKS, INC.; CacheFly; CDNsun s.r.o.; Cloudflare, Inc.; Fastly; Gcore.; Google LLC; Imperva; Lumen Technologies; Microsoft Corporation; proinity LLC; Tencent Cloud; among others.

b. The growing demand for Over the Top (OTT) and Video-on-Demand (VOD) services will ensure continuous content delivery over a high-speed data network and is expected to boost the growth of the market over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.