- Home

- »

- HVAC & Construction

- »

-

Gardening Equipment Market Size, Industry Report, 2030GVR Report cover

![Gardening Equipment Market Size, Share & Trends Report]()

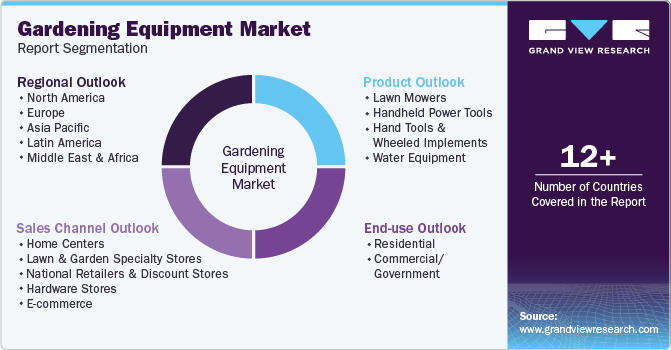

Gardening Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Lawn Mowers, Handheld Power Tools), By End Use (Residential, Commercial/Government), By Sales Channel, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-304-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Gardening Equipment Market Summary

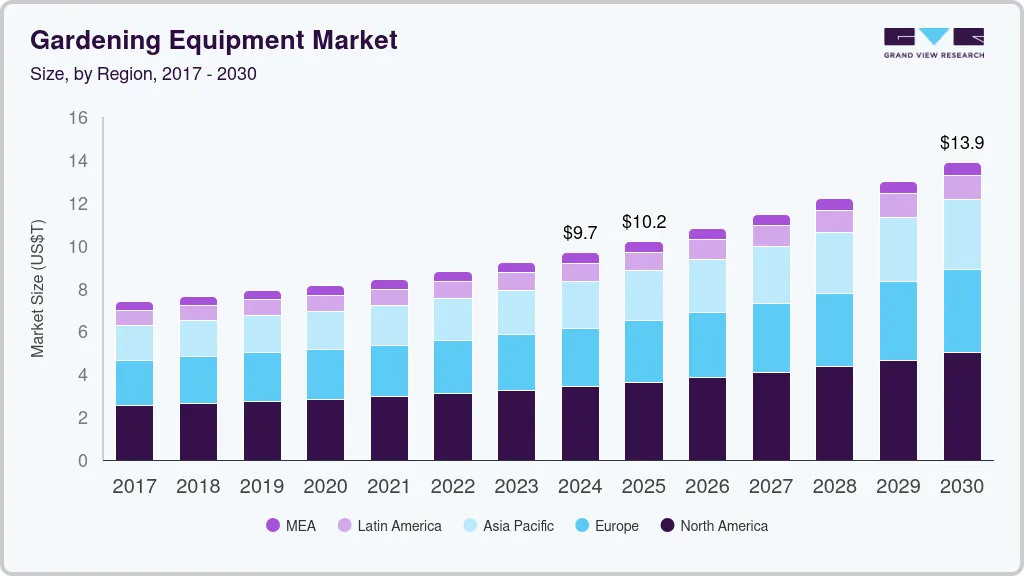

The global gardening equipment market size was estimated at USD 96.86 billion in 2024 and is projected to reach USD 138.90 billion by 2030, growing at a CAGR of 6.3% from 2025 to 2030. In addition, higher disposable income and a decline in home prices have led to an increase in real estate developments in all economies.

Key Market Trends & Insights

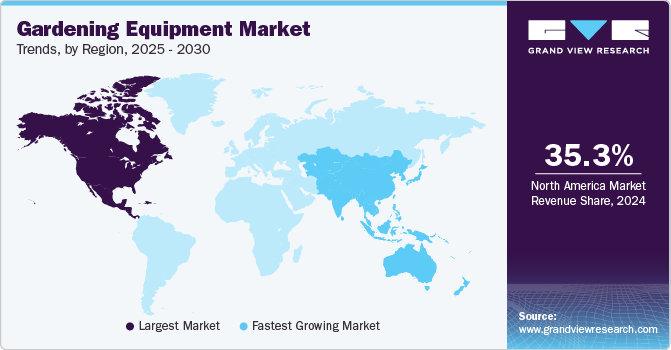

- North America gardening equipment industry dominated globally in 2024 with a revenue share of 35.26%.

- The gardening equipment industry in the U.S. held the leading share in the North American market.

- By product, the lawn mowers segment is anticipated to grow at a CAGR of 6.6% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 96.86 Billion

- 2030 Projected Market Size: USD 138.90 Billion

- CAGR (2025-2030): 6.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Over the projected period, this trend is anticipated to fuel demand for gardening equipment. Another trend among millennials to turn outside spaces into relaxing spaces with lounges, entertainment areas, outdoor kitchens, and party spots is also expected to augment the gardening equipment industry growth.

Due to the COVID-19 epidemic, the gardening equipment industry saw a modest decline in early 2020. Lower customer demand for garden and tool equipment and the temporary suspension of store outlets are both blamed for the gardening equipment industry's sluggish growth. The impact of the epidemic has been mitigated, though, by a favorable climate, a longer growing season, and gardeners' preference for online shopping. The rules encouraging people to stay at home to prevent the spread of COVID-19 have also urged people to spend a lot of time at home, propelling the demand for gardening equipment.

In the first half of 2021, the sudden surge in demand for battery-based tools, including augers, chainsaws, edgers, and trimmers, did not keep up with the production rate. In addition, OEMs worldwide were experiencing a lack of lithium-ion batteries and semiconductors, which further hindered production. Furthermore, it is anticipated that the Russian-Ukrainian conflict will reduce demand for gardening equipment powered by gas due to disrupted supply chain operations, raising raw material prices and driving up oil prices. Consequently, OEMs may raise the price of their products. These macroeconomic determinants are anticipated to decrease, but they are likely only temporary.

Over the forecast period, it is anticipated that increasing adoption of DIY landscape projects will propel market expansion. DIY projects are activities made for people from all walks of life, including enthusiasts, hobbyists, and homeowners undertaking projects like repairs and remodeling that are typically classified as home improvement. The gardening equipment industry is expected to do well as a result of the rising single-family construction investment and a growing interest in Do-It-Yourself (DIY) projects. Given the increasing popularity of DIY projects, garden equipment OEMs are introducing a product lineup that is inexpensive and user-friendly for household use. Garden trowels, spades, shovels, pruners, and other gardening hand tools are required for home renovation projects, and these tools come in a wide variety and have a wide range of applications.

Throughout the forecast period, the gardening equipment industry development is anticipated to be aided by the growing popularity of battery-powered ergonomically design tools. Gardening is a laborious task involving digging up the earth, pulling weeds, and trimming shrubs, repetitive stress through these activities can result in chronic back pain. Using garden equipment without proper knowledge, particularly by senior citizens, can cause undue strain, leading to inflammation or pain in many body areas, including the knees, wrists, and back. The demand for ergonomic designing tools among professional architects & landscapers, hobbyists, and enthusiasts is anticipated to help the market grow over the coming years.

Product Insights

In terms of product, the study captures the market size for handheld power tools, lawnmowers hand tools, wheeled implements, hand tools, and water equipment. The lawn mowers segment is anticipated to grow at a CAGR of 6.6% over the forecast period. The rapid uptake of technologically advanced equipment that provides consumers with more comfort and convenience is a factor contributing to the market rise. Edgers, trimmers, leaf blowers, and chainsaws are categorized as handheld power tools. The market is anticipated to be driven by the need for ergonomic and lightweight equipment and the post-medium-term decline in Li-ion battery prices caused by the conflict in Russian Ukraine.

Cutting & pruning tools, short-hand tools, wheeled implements, handled tools, and striking tools are the different categories for hand tools and wheeled implements. Weeders, hoes, shovels, forks, and rakes are long-handled tools. Over the forecast period, the hand tools and wheeled implements market is anticipated to grow significantly. Over the course of the projection period, it is anticipated that the growing acceptance of foldable shovels for gardening tasks will help the market expand.

Sales Channel Insights

Based on sales channel, the market is divided into lawn and garden specialty stores, home centers, hardware stores, E-commerce, and discount & retailer stores segments. OEMs rely on third-party channels for the majority of their sales. Due to the temporary closure of hardware and home center stores brought on by the COVID-19 outbreak, the third-party channel's market experienced a modest decline in sales. Over the projection period, the home center segment is anticipated to expand at a significant CAGR.

The direct channel consists of e-commerce. The growing preference of manufacturers for e-commerce platforms to increase their market presence and conduct commercial operations smoothly is anticipated to support market growth over the forecast period.

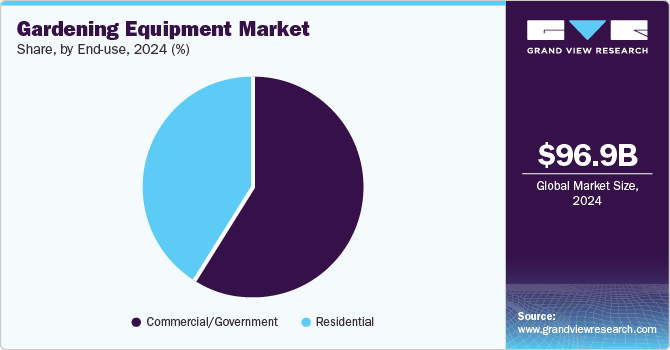

End Use Insights

Within the forecast time frame, the residential market is expected to witness an increase in the demand for gardening equipment. The rise in single-family homes and the rise in sales of gardening tools through online channels are credited with driving up demand. In addition, the popularity of do-it-yourself backyard landscaping projects has increased the demand for gardening equipment in the residential market. Over the forecast period, the market is anticipated to register the fastest CAGR.

The commercial/government segment is anticipated to register a significant CAGR during the projection period. The segment encompasses landscaping of business establishments such as lodging, hotels, government and public buildings, sports turfs, and commercial facilities. The segment's expansion is predicted to be supported by the consistent rise of the international tourist and hospitality industries.

Regional Insights

North America gardening equipment industry dominated globally in 2024 with a revenue share of 35.26%. The region has a high percentage of homeowners who invest in garden and lawn maintenance, contributing to a steady demand for gardening tools, power equipment, and accessories. The increasing popularity of urban gardening, sustainable landscaping, and community gardening initiatives further boosts market growth. The region experiences four distinct seasons, which drives demand for a variety of gardening equipment tailored to different weather conditions, such as snowblowers for winter and lawnmowers for spring and summer.

U.S. Gardening Equipment Market Trends

The gardening equipment industry in the U.S. held the leading share in the North American market. This large share is attributed to the country’s significant number of single-family homes with private gardens. The increasing focus on home aesthetics, outdoor living spaces, and backyard landscaping contributes to high consumer spending on gardening tools, power equipment, and irrigation systems. In addition, the trend of sustainable and organic gardening has gained traction, leading to increased sales of eco-friendly tools, composting equipment, and smart irrigation systems.

Europe Gardening Equipment Market Trends

Europe gardening equipment industry is expected to register a significant CAGR over the forecast period. The expansion of the industry is attributed to rising infrastructure development in European nations. Major markets like France and Spain were severely impacted by COVID-19, whereas Germany fared better since construction work was mostly unaffected throughout the lockdown. Austria, Germany, and Switzerland were less affected than Ireland, southern Europe, and the UK. The steady economic state of the nation's infrastructure industry is shown by the high GDP, which encourages increasing home investments and has a favorable effect on the gardening equipment market in Europe.

The gardening equipment industry in the UK is expected to register a significant CAGR over the forecast period. One of the key drivers of this growth is the increasing consumer preference for sustainable and eco-friendly gardening solutions. With growing environmental awareness, more consumers are shifting towards electric and battery-powered gardening tools, reducing reliance on traditional gas-powered equipment.

The Germany gardening equipment industry growth is driven by the heavy investments made by government and private enterprises in green infrastructure projects, including urban parks, green roofs, and public landscaping. The commercial landscaping sector, including maintenance services for corporate spaces, hotels, and municipal parks, is fueling demand for high-performance gardening machinery. Germany’s commitment to biodiversity-friendly landscaping has also led to increased use of pollinator-friendly gardens and native plant cultivation, supporting the market for specialized gardening tools.

Asia Pacific Gardening Equipment Market Trends

Asia Pacific gardening equipment industry is expected to register the fastest CAGR over the forecast period. The rapid economic growth in China, India, and Southeast Asia has led to an increase in disposable income, allowing more consumers to invest in premium gardening equipment. The growing preference for well-maintained outdoor spaces in residential complexes, villas, and gated communities has also contributed to market expansion.

China gardening equipment industry growth is driven by the rapidly expanding urban population, with more people moving to cities and adopting urban gardening and balcony gardening as a lifestyle trend. The increasing number of residential complexes, villas, and gated communities has driven demand for gardening tools, lawn care equipment, and outdoor maintenance products. The expanding middle-class population, with higher disposable incomes, is further fueling the purchase of premium and automated gardening solutions.

India gardening equipment industry growth is driven by rapid urbanization, which has led to limited outdoor space, increasing the popularity of balcony gardening, terrace gardens, and vertical gardening in metro cities like Mumbai, Delhi, Bangalore, and Chennai. Many urban households are investing in small-scale gardening tools, potted plant care equipment, and hydroponic systems to cultivate herbs, flowers, and vegetables at home. The rising awareness of organic farming and self-sustained food production is further driving demand for gardening kits and eco-friendly fertilizers.

Key Gardening Equipment Company Insights

To address the growing demand for gardening equipment and ensure sustained growth in a competitive market, companies in the sector are adopting a combination of strategies, including product innovations, strategic partnerships, mergers and acquisitions, and geographic expansions. By enhancing their technological offerings, collaborating with key industry players, and entering new regional and vertical markets, gardening equipment manufacturers are positioning themselves to meet the evolving needs of home gardeners, commercial landscapers, urban greening projects, and sustainable agriculture initiatives. These strategies not only strengthen their market presence but also contribute to the broader advancement of smart gardening solutions, eco-friendly landscaping tools, and automated maintenance systems, supporting the global shift toward sustainable and technology-driven horticulture.

-

Falcon Garden Tools, established in 1988, is a leading Indian manufacturer of high-quality gardening, horticulture, and agricultural tools. Falcon Garden Tools offers an extensive range of hand tools, mechanized equipment, and power tools designed to enhance efficiency in gardening and farming. Their hand tools segment includes pruning secateurs, hedge shears, loppers, trowels, weeders, and cultivators, all designed for ease of use and precision. For lawn and garden maintenance, the company provides manual and electric lawn mowers, grass trimmers, edgers, and garden sprayers, catering to both residential and commercial users.

-

Robert Bosch GmbH is a multinational engineering and technology company headquartered in Gerlingen, Germany. It has a strong presence in the gardening equipment industry, offering a wide range of battery-powered, electric, and robotic gardening tools designed for both residential and professional users. The company is particularly known for its innovative cordless and eco-friendly solutions, catering to the growing demand for low-noise, low-emission, and high-efficiency gardening tools.

Key Gardening Equipment Companies:

The following are the leading companies in the gardening equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Ariens Company

- American Honda Motor Co. Inc.

- Briggs Stratton

- Deere & Company

- Falcon Garden Tools

- Fiskars

- Husqvarna Group

- Robert Bosch GmbH

- Robomow Friendly House

- The Toro Company

Recent Developments

-

In October 2024, American Honda Motor Co. Inc. unveiled an all-new lineup of battery-powered lawn mowers, marking a significant shift from their traditional gas-powered models. This introduction includes the HRX, HRN, and HRC walk-behind mowers, as well as a zero-turn-radius (ZTR) mower, all slated for release in 2025. The new battery-powered models are designed to match the performance and reliability of their gas-powered predecessors. For instance, the HRX-BV and HRX-BE models feature a 21-inch NeXite deck known for its durability against dents, rust, and corrosion. These mowers incorporate the 4-in-1 Versamow System with Clip Director, allowing users to easily switch between mulching, bagging, discharging, and leaf shredding without additional tools.

-

In February 2024, Robert Bosch GmbH expanded its Professional 18V System by introducing the GRA 18V2-46 Professional cordless lawnmower, the first in its lineup to utilize two 18V batteries simultaneously. This design enables professionals to efficiently mow areas up to 1,000 m² when equipped with two ProCore 18V 12.0 Ah batteries. Complementing this, Bosch is launching the GAL 18V2-320 Professional, a dual charger capable of charging two 18V batteries concurrently with up to 16 amperes, fully charging two 12.0 Ah batteries in just 55 minutes. These innovations provide enhanced efficiency and flexibility for tasks ranging from maintenance to outdoor space care.

Gardening Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 102.13 billion

Revenue forecast in 2030

USD 138.90 billion

Growth Rate

CAGR of 6.3% from 2025 to 2030

Actual Data

2018 - 2023

Forecast period

2025 - 2030

Report updated

February 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, sales channel, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Netherlands; Denmark; Finland; Spain; Russia; China; India; Japan; South Korea; Singapore; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Ariens Company; American Honda Motor Co. Inc.; Briggs Stratton; Deere & Company; Falcon Garden Tools; Fiskars; Husqvarna Group; Robert Bosch GmbH; Robomow Friendly House; The Toro Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gardening Equipment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gardening equipment market based on product, sales channel, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Lawn Mowers

-

Handheld Power Tools

-

Trimmers & Edgers

-

Chainsaws

-

Leaf Blowers

-

Others

-

-

Hand Tools & Wheeled Implements

-

Long Handled Tools

-

Short-Hand Tools

-

Cutting & Pruning Tools

-

Striking Tools

-

Wheeled Implements

-

-

Water Equipment

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Home Centers

-

Lawn & Garden Specialty Stores

-

National Retailers & Discount Stores

-

Hardware Stores

-

E-commerce

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial/Government

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Netherlands

-

Denmark

-

Finland

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gardening equipment market size was estimated at USD 96.86 billion in 2024 and is expected to reach USD 102.13 billion in 2025.

b. The global gardening equipment market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2030 to reach USD 138.90 billion by 2030.

b. Lawnmowers dominated the gardening equipment market with a share of 36.8% in 2024. This is attributable to the widespread use of lawnmowers for lawn and garden maintenance in household backyards, public parks, and sports fields.

b. Some key players operating in the gardening equipment market include Honda Power Equipment, Bosch Power Tools, Kubota, Husqvarna group, Toro, MTD Products, and Ariens Company.

b. Key factors that are driving the gardening equipment market growth include growing demand from residential & commercial segments and the growing popularity of robotic lawn mowers worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.