- Home

- »

- Medical Devices

- »

-

Gas Chromatography Market Size & Share Report, 2030GVR Report cover

![Gas Chromatography Market Size, Share & Trends Report]()

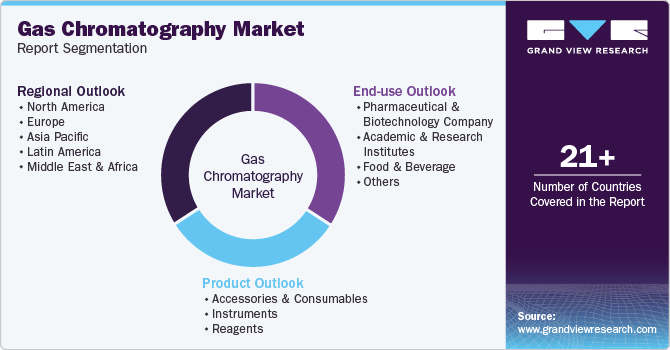

Gas Chromatography Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Accessories & Consumables, Instruments), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-970-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gas Chromatography Market Summary

The global gas chromatography market size was estimated at USD 4.04 billion in 2024 and is projected to reach USD 5.90 billion by 2030, growing at a CAGR of 6.6% from 2025 to 2030. The demand for processed and convenience foods is being driven by an expanding global population.

Key Market Trends & Insights

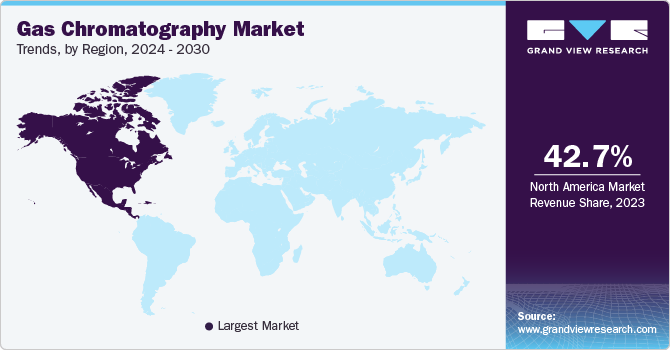

- North America dominated the global gas chromatography market with the largest revenue share of 42.7% in 2023.

- By product, the reagents segment led the market, holding the largest revenue share in 2023.

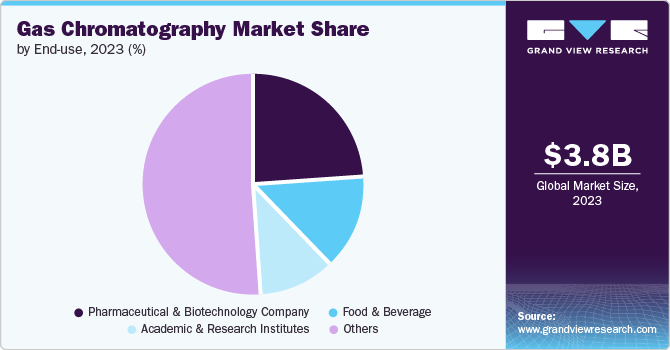

- By end use, the pharmaceutical & biotechnology company segment led the market, holding the largest revenue share in 2023.

Market Size & Forecast

- 2024 Market Size: USD 4.04 Billion

- 2030 Projected Market Size: USD 5.90 Billion

- CAGR (2025-2030): 6.6%

- North America: Largest market in 2023

“2030 global gas chromatography market value to reach USD 5.90 billion”

New and innovative technologies with enhanced sensitivity, resolution, and user-friendliness are constantly being introduced by manufacturers.

GC plays an essential role in ensuring the safety, purity, and effectiveness of drugs through the analysis of raw materials, intermediates, and finished products. For instance, FDA require strict quality control at every stage of drug development. GC is a potent analytical technique utilized for the separation and analysis of volatile compounds. This makes it particularly valuable in sectors such as pharmaceuticals, food & beverage, environmental monitoring, and petrochemicals. As technology progresses, GC finds new applications, which expands the market. Pharmaceutical industry regulations require strict quality control. The GC ensures the safety and efficacy of drugs by analyzing raw materials, intermediates, and final products. The growing demand for personalized medicine further strengthens this market driver. Governments across the globe are implementing more stringent environmental regulations in order to combat pollution. GC plays a crucial role in monitoring air, water, and soil quality, driving market growth. The growing production of crude oil and shale oil creates a demand for GC in analyzing these resources.

Product Insights

Reagents accounted for the largest market revenue share of 57.4% in 2023. Columns, liners, septa, and derivatization agents have a limited lifespan and necessitate frequent replacement to guarantee precise results. A diverse range of reagents is required for diverse applications and sample types. This variety ensures a steady supply of reagents and a consistent revenue stream for reagent manufacturers. Additionally, high-performance GC analyses require highly specific and pure reagents in order to avoid interference from contaminants and ensure accurate results and reagents fulfill these requirements

Accessories & consumables are expected to register the fastest CAGR of 6.8% during the forecast period. GC systems require a continuous supply of consumables like columns, detectors, and gases, which require periodic replacement. In addition, there is still a strong demand for accessories like injection systems and detectors designed for specific purposes.

End-use Insights

The pharmaceutical & biotechnology company segment dominated the market in 2023. The growth in this segment is driven due to role of GC of analyzing outcomes, verifying material purity, detecting contaminants, and monitoring composition during synthesis to meet set standards. Confirmation of quality and adherence to set specifications is necessary for final drug products before they are marketed.

In Pharmaceutical & biotechnology is projected to grow at the fastest CAGR over the forecast period. GC is used in drug discovery and development processes. It enables scientists to differentiate and recognize possible drug options in complex mixtures, helps to study how drugs are processed in the body, essential for understanding their effectiveness and possible side effects, and supervises the quality of drug options as they progress through development

Regional Insights

North America gas chromatography market dominated the market in 2023 with share of 42.7%due to its strong pharmaceutical and biotechnology industry. Stringent rules in the U.S. and Canada require strict quality control for medications, making it necessary to use GC to analyze raw materials, intermediates, and finished products. North America is home to top research universities and institutions that prioritize investment in state-of-the-art technologies.

U.S. Gas Chromatography Market Trends

The global gas chromatography market in the U.S. dominated the North America market in 2023. The regulatory bodies require pharmaceutical companies in the U.S. to utilize advanced analytical tools to adhere to regulations. Gas chromatography is essential for maintaining quality control, discovering new drugs, and identifying impurities, leading to a strong demand for GC equipment and supplies in the U.S.

Europe Gas Chromatography Market Trends

Europe gas chromatography market was identified as a lucrative region in 2023. Gas chromatography (GC) plays a vital role in monitoring the environment by examining pollutants in samples of air, water, and soil and European countries are leading the way in enforcing strict environmental laws to address pollution of the air, water, and soil. For instance The European Environment Agency (EEA) released a report on Air quality in Europe 2024 indicating improvement in air quality, but EU standards remain unfulfilled in various European regions. GC helps to ensure adherence to these regulations.

UK gas chromatography market is expected to grow rapidly in the coming years due to strict regulations and a growing pharmaceutical industry, alongside environmental monitoring, as well as ensuring food safety by detecting contaminants and residues using GC technology.

Germany gas chromatography market held a substantial share in 2023. Germany excels in environmental sustainability and has strict regulations for controlling air, water, and soil pollution. It also has a strong and developed pharmaceutical and chemical sector that heavily depends on GC for the development and quality control of new drugs.

Asia Pacific Gas Chromatography Market Trends

The growing healthcare system in Asia Pacific is leading to the increased utilization of gas chromatography in the region. India gas chromatography market is expected to grow rapidly in the coming years. India is known for its agricultural business and land. Gas chromatography has effectively been utilized for the analysis of organic pollutants like volatile organic compounds and for the analysis of chlorinated pesticide residues in agricultural products. Moreover, it is also utilized for evaluating the makeup and standard of fertilizers. Agriculture is one of the few industries that has experienced continuous growth, so this leads to increasing demand of GC in India. In addition

China gas chromatography market held a substantial share in 2023. China is working to fight environmental pollution by adopting tougher regulations to address air, water, and soil pollution. For instance China has increased the severity of penalties for environmental crimes, especially related to any pollution, and has seen positive results. GC is a reliable tool for monitoring the environment through the analysis of contaminants in samples from the environment.

Key Gas Chromatography Company Insights

Some of the key companies in the gas chromatography market include GE Healthcare, Shimadzu Corporation, Thermo Fisher Scientific, Inc., Agilent Technologies, Bio-Rad Laboratories, Inc, and others. Key players are undertaking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Thermo Fisher provides a wide range of GC instruments, including Benchtop GCs. Research-grade GCs, and portable GCs.

-

Dani Instruments SpA manufactures gas chromatography instruments and related products.

Key Gas Chromatography Companies:

The following are the leading companies in the gas chromatography market. These companies collectively hold the largest market share and dictate industry trends.

- GE Healthcare

- Shimadzu Corporation

- Thermo Fisher Scientific, Inc.

- Agilent Technologies

- Bio-Rad Laboratories, Inc

- Dani Instruments SPA

- W. R. Grace & Co.-Conn

- Restek Corporation

- Buchi

Recent Developments

-

In April 2024, Valmet announced the acquisition of Siemen’s Process Gas Chromatography (PGC) & Integration business. GCs are used to measure chemical composition in evaporable liquids and gases in all the production stages. The acquisition is expected to strengthen Valmet’s process automation segment with process GC and analyzer systems offerings.

-

In March 2022, Thermo Fisher Scientific announced the launch of Gas Chromatography (GC) and Gas Chromatography (GC)-Mass Spectrometry MS instruments to offer improved customer experience, simplified operations, and easy adoption.

Global Gas Chromatography Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.29 billion

Revenue forecast in 2030

USD 5.90 billion

Growth Rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Germany; Italy; Spain; France; Denmark; Sweden ;Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; KSA; UAE; Kuwait; South Africa

Key companies profiled

GE Healthcare; Shimadzu Corporation; Thermo Fisher Scientific, Inc.; Agilent Technologies; Bio-Rad Laboratories, Inc; PerkinElmer, Inc; Dani Instruments SPA; W. R. Grace & Co.-Conn; Restek Corporation; Buchi

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Gas Chromatography Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gas chromatography market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Accessories & Consumables

-

Fittings and tubing

-

Auto-sampler accessories

-

Flow management and pressure regulator accessories

-

Others

-

-

Instruments

-

Systems

-

Auto-samplers

-

Fraction collectors

-

Detectors

-

-

Reagents

-

Analytical gas chromatography reagents

-

Bioprocess gas chromatography reagents

-

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical & Biotechnology Company

-

Academic & Research Institutes

-

Food and Beverage

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.