- Home

- »

- Pharmaceuticals

- »

-

Gastroesophageal Reflux Disease Therapeutics Market, 2030GVR Report cover

![Gastroesophageal Reflux Disease Therapeutics Market Size, Share & Trends Report]()

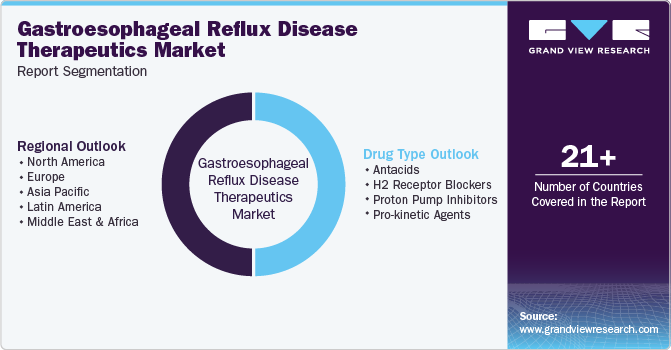

Gastroesophageal Reflux Disease Therapeutics Market Size, Share & Trends Analysis Report By Drug Type (Antacids, H2 Receptor Blockers, Proton Pump Inhibitors, Pro-kinetic Agents), By Region (North America, Asia Pacific), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-778-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

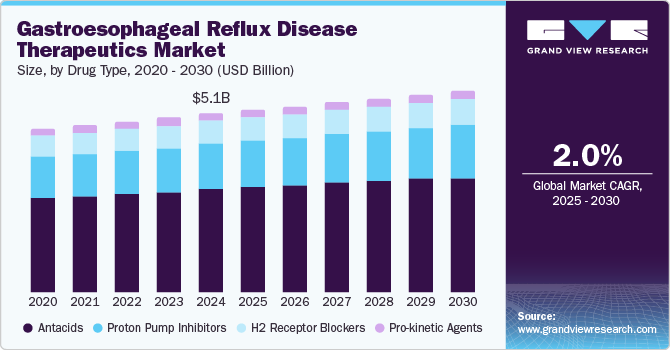

The global gastroesophageal reflux disease therapeutics market size was estimated at USD 5.11 billion in 2024 and is projected to grow at a CAGR of 2.0% from 2025 to 2030. Lifestyle changes, including urbanization and dietary habits, further contribute to the rising prevalence of GERD. A 2024 BMC study conducted in Iran reported a 10.99% prevalence rate, pointing to lifestyle factors such as high sugar intake and low physical activity as significant triggers. Moreover, 45.3% of participants engaged in insufficient physical activity, underscoring the correlation between sedentary lifestyles, processed food consumption, and increased GERD symptoms. These trends necessitate effective therapeutic interventions to manage the growing patient population.

The rising prevalence of gastroesophageal reflux disease (GERD) significantly drives the therapeutics market, with approximately 13.98% of the adult population globally affected by this condition. Notably, regional variations influence demand, with prevalence rates soaring to 22.40% in Turkey and as low as 4.16% in China. This growing incidence correlates with an aging population in the U.S., where it is projected that around 20% of citizens will be aged 65 and older by 2024. This demographic is more susceptible to GERD due to higher rates of obesity, diabetes, and other chronic conditions, necessitating tailored therapeutic solutions to effectively address their specific needs.

Increasing public awareness surrounding GERD has also fueled demand for over-the-counter medications. A 2023 population-based survey revealed that 40% of U.S. citizens reported experiencing GERD symptoms at some point, with 33% experiencing symptoms in the past week. This heightened awareness has spurred consumers to seek immediate relief through antacids and proton pump inhibitors, a trend expected to persist into 2024 due to ongoing awareness campaigns. As more individuals recognize the available treatment options, the market for GERD therapeutics is poised for significant growth.

Government initiatives also play a critical role in promoting the GERD therapeutics market. In 2023, the World Health Organization launched a global initiative aimed at reducing gastrointestinal diseases through increased research funding and public health campaigns. Various national health departments are now implementing educational programs to raise awareness of GERD risk factors and encourage healthier lifestyles. It is anticipated that several countries will enhance their healthcare policies to support early diagnosis and treatment of GERD, further facilitating market growth in response to increasing healthcare expenditures and awareness efforts.

Drug Type Insights

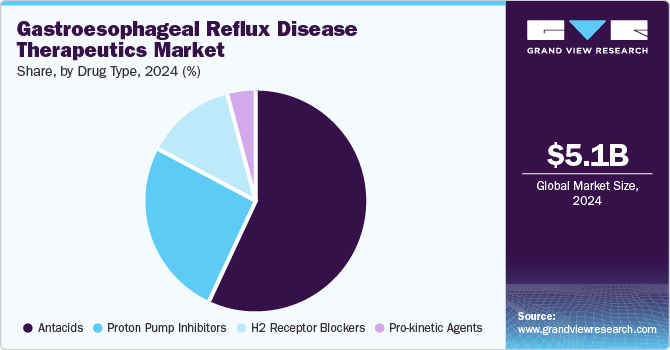

Antacids dominated the market and accounted for a share of 56.7% in 2024, fueled by the effectiveness of antacids in delivering rapid relief from heartburn and acid indigestion. As over-the-counter (OTC) medications, they are easily accessible, cost-effective, and favored for self-medication. Their rising popularity is fueled by increased GERD prevalence and lifestyle factors contributing to acid-related disorders.

H2 receptor blockers are projected to grow at the fastest CAGR of 2.2% over the forecast period due to the efficacy of these medications in reducing stomach acid production, offering longer-lasting relief compared to antacids. Their widespread availability as over-the-counter options enhances accessibility for consumers seeking treatment for mild to moderate GERD symptoms, further contributing to their increasing popularity.

Regional Insights

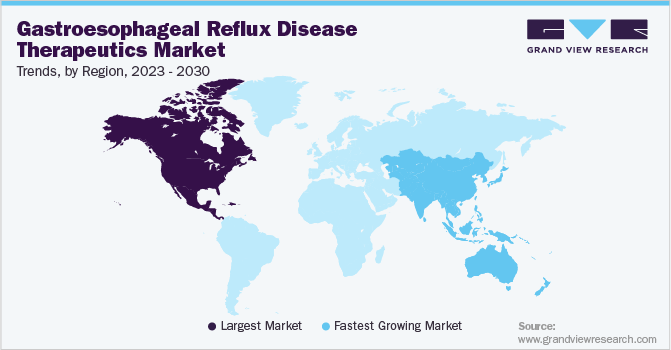

North America gastroesophageal reflux disease therapeutics market dominated the global market with a revenue share of 38.4% in 2024. Market growth in the region is propelled by lifestyle factors, including obesity and dietary habits. The robust healthcare infrastructure, substantial investments in research and development, and increased awareness of GERD symptoms collectively enhance the demand for effective therapeutic options in this sector.

U.S. Gastroesophageal Reflux Disease Therapeutics Market Trends

The gastroesophageal reflux disease therapeutics market in the U.S. dominated North America with the largest revenue share in 2024. The demand for GERD therapeutics in the U.S. is further stimulated by enhanced public awareness campaigns, a rising trend toward self-medication, and the accessibility of advanced treatment options. These factors collectively contribute to the growing market for effective GERD management solutions.

Europe Gastroesophageal Reflux Disease Therapeutics Market Trends

Europe gastroesophageal reflux disease therapeutics market held substantial market share in 2024, owing to a marked increase in GERD prevalence attributed to lifestyle changes and dietary habits. Enhanced healthcare spending, continuous research initiatives, and public health campaigns aimed at elevating GERD awareness are driving demand for effective therapeutic interventions across European nations.

The gastroesophageal reflux disease therapeutics market in Germany is expected to grow rapidly over the forecast period, driven by a strong healthcare infrastructure and a high prevalence of GERD within its population. The nation benefits from advanced pharmaceutical research and development, coupled with rising public awareness of available treatment options, which collectively fuel demand for tailored, effective therapeutic solutions that meet patient needs.

Asia Pacific Gastroesophageal Reflux Disease Therapeutics Market Trends

Asia Pacific gastroesophageal reflux disease therapeutics market is expected to register the fastest CAGR of 5.1% over the forecast period. The region is witnessing swift urbanization, shifting dietary habits, and increasing obesity rates. Enhanced healthcare investments and growing awareness of GERD symptoms and treatment options are propelling market expansion, establishing it as a significant growth area within the global therapeutics landscape.

The gastroesophageal reflux disease therapeutics market in China dominated the Asia Pacific gastroesophageal reflux disease therapeutics market in 2024. There has been a substantial rise in GERD cases linked to lifestyle changes and dietary modifications among the population. The government’s emphasis on enhancing healthcare infrastructure and promoting awareness of GERD treatment options further accelerates market growth in this sector.

Key Gastroesophageal Reflux Disease Therapeutics Company Insights

Some key companies operating in the market include AstraZeneca; Eisai Co., Ltd.; GSK plc.; Takeda Pharmaceutical Company Limited; and Ironwood; among others. Key players are prioritizing innovative drug development and strategic partnerships. Companies are investing in research and development to improve therapeutic options, while awareness campaigns are driving consumer demand.

-

Eisai Co., Ltd., with its proton pump inhibitor, Pariet (rabeprazole), target reflux esophagitis and non-erosive GERD. They are also developing Lemborexant, currently in Phase II trials, to improve treatment options.

-

GSK plc provides a variety of medications for gastroesophageal reflux disease, including proton pump inhibitors and H2 receptor antagonists. The company emphasizes research and development to create innovative therapies that effectively alleviate GERD symptoms and enhance overall gastrointestinal health for patients.

Key Gastroesophageal Reflux Disease Therapeutics Companies:

The following are the leading companies in the gastroesophageal reflux disease therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- AstraZeneca

- Eisai Co., Ltd.

- GSK plc

- Takeda Pharmaceutical Company Limited

- Ironwood

- Johnson & Johnson Services, Inc.

- SFJ Pharmaceuticals

- Sebela Pharmaceuticals

- Phathom Pharmaceuticals, Inc.

- Camber Pharmaceuticals, Inc.

View a comprehensive list of companies in the Gastroesophageal Reflux Disease Therapeutics Market

Recent Developments

-

In October 2024, Camber announced the successful launch of eight new generic products in Q3, enhancing its portfolio with high-quality, cost-effective alternatives to brand-name medications.

-

In July 2024, Phathom Pharmaceuticals announced FDA approval for VOQUEZNA® (vonoprazan) 10 mg tablets, offering a new treatment for heartburn associated with Non-Erosive GERD, benefiting millions of affected adults.

-

In July 2024, AstraZeneca announced an approximately USD 30 million investment to expand its Global Innovation and Technology Centre in Chennai, creating approximately 1,300 skilled positions by 2025.

-

In June 2024, Takeda expanded its partnership with Partners In Health to enhance health equity in Massachusetts, aiming to dismantle systemic barriers and strengthen local health workforce capacity.

Gastroesophageal Reflux Disease Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.22 billion

Revenue forecast in 2030

USD 5.77 billion

Growth rate

CAGR of 2.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Drug type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

AstraZeneca; Eisai Co., Ltd.; GSK plc.; Takeda Pharmaceutical Company Limited; Ironwood; Johnson & Johnson Services, Inc.; SFJ Pharmaceuticals; Sebela Pharmaceuticals; Phathom Pharmaceuticals, Inc.; Camber Pharmaceuticals, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gastroesophageal Reflux Disease Therapeutics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gastroesophageal reflux disease therapeutics market report based on drug type and region:

-

Drug Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Antacids

-

H2 Receptor Blockers

-

Proton Pump Inhibitors (PPIs)

-

Pro-kinetic Agents

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."