- Home

- »

- Pharmaceuticals

- »

-

Gastroparesis Drugs Market Size And Share Report, 2030GVR Report cover

![Gastroparesis Drugs Market Size, Share & Trends Report]()

Gastroparesis Drugs Market Size, Share & Trends Analysis Report By Drug Class (Prokinetic Agents, Antiemetic Agents, And Botulinum Toxin Injections), By Disease Type, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-199-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Gastroparesis Drugs Market Size & Trends

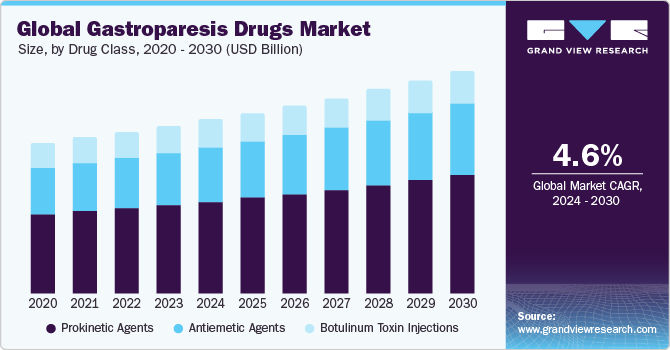

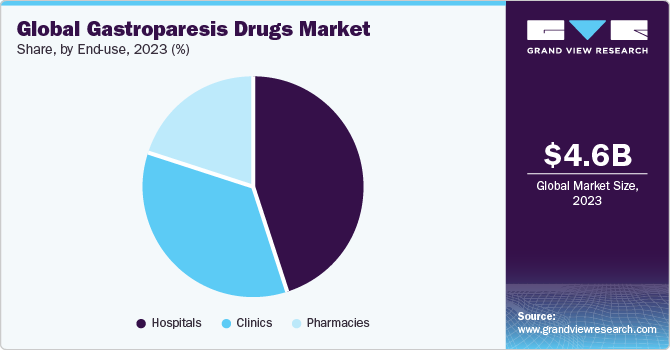

The global gastroparesis drugs market size was valued at USD 4.6 billion in 2023 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.6 % from 2024 to 2030. The growth is due to multiple factors, including the increased prevalence of diabetes worldwide due to rapid urbanization, lifestyles, and rising rates of regular alcohol and tobacco consumption. Furthermore, the introduction of innovative drugs, by the manufacturers, aimed at symptom management, particularly for nausea and vomiting, is an important driving factor.

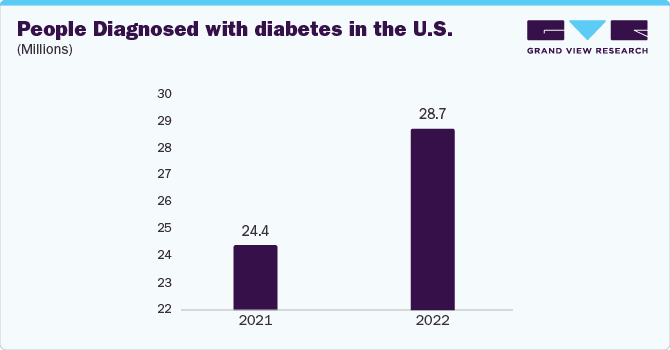

Gastroparesis is characterized by impaired stomach muscle movement leading to digestive disruptions, such as nausea, vomiting, abdominal discomfort, and blood sugar regulation and nutrient absorption complications. The increasing prevalence of diabetes is a primary driver for this market, according to the International Diabetes Federation, a substantial rise from 537 million adults with diabetes in 2021 to an estimated 643 million by 2030. This surge in diabetes cases directly impacts the incidence of gastroparesis, given that diabetes is a common cause of the condition. In addition, the rising number of surgical procedures has led to a higher occurrence of post-surgical gastroparesis, further stimulating the demand for gastroparesis drugs market.

Moreover, research and development activities by pharmaceutical manufacturers have helped advance treatment options for gastroparesis. Continuous investment in innovative drug therapies and approaches is evident, for instance, companies like Processa Pharmaceuticals, Inc., received FDA clearance to conduct a Phase 2a clinical trial for PCS12852, a promising treatment for moderate to severe gastroparesis. This commitment to addressing unmet medical needs within the gastroparesis patient population highlights the industry's dedication to providing safer and more effective solutions, thereby contributing to the robust growth of the gastroparesis drug market.

Drug Class Insights

The prokinetic agents segment dominated the market in 2023. Prokinetic agents are a category of drugs that boost the contractions of stomach muscles, which in turn helps improve the overall movement of the stomach. They are frequently prescribed to patients dealing with gastroparesis, which causes symptoms like nausea and vomiting while hindering digestion. Prokinetic agents are considered a cornerstone in treating gastroparesis due to their ability to address the underlying issue behind the condition. In addition to their role in treating gastroparesis, these drugs have also been studied for their effectiveness and safety in critical patients receiving enteral nutrition, showing positive results in reducing feeding intolerance among such patients.

Disease Type Insights

The diabetic gastroparesis segment held the largest share in 2023. This growth can be attributed to the high prevalence of diabetes worldwide. Diabetic gastroparesis is a type of gastroparesis that occurs as a complication of diabetes, affecting individuals with diabetes more significantly. The Institute for Health Metrics and Evaluation (IHME) has reported an increase in global diabetes cases, which is anticipated to surge from 529 million to 1.3 billion by 2050. At present, diabetes holds a global prevalence rate of 6.1%, positioning it as one of the top 10 leading causes of death and disability. The higher number of diabetic cases may lead to diabetic gastroparesis.

Many pharmaceutical companies and researchers are actively focusing on developing drugs that target this specific form of gastroparesis, further driving the growth of the diabetic gastroparesis segment within the market. For instance, in April 2022, Processa Pharmaceuticals initiated its Phase 2A trial for PCS12852, a potential treatment for gastroparesis.

End-use Insights

The hospital segment held the largest share in 2023. Hospitals are equipped with the necessary resources and medical expertise to handle the complex and varied needs of gastroparesis patients, including severe cases that may require surgical interventions or specialized care. This all-encompassing approach and the ability to deliver coordinated care contribute to the hospital segment's prominence in the market.

Regional Insights

North America accounted for the largest market share in 2023. This growth is attributed to the high prevalence of gastroparesis, which can largely contribute to a rising number of diabetes cases, which is more prevalent in this region. Additionally, a substantial prediabetic population, favorable reimbursement policies, and increasing awareness about the condition further contribute to the growing incidence of gastroparesis. According to the CDC's June 2022 report, an estimated 96 million adults aged 18 and older have prediabetes, encompassing 38.0% of the entire U.S. adult population. North America's advanced healthcare infrastructure and increasing pharmaceutical industry are important in supporting the development, accessibility, and distribution of gastroparesis medications. This robust healthcare system facilitates early diagnosis, comprehensive patient care, and improved access to medical treatment.

Competitive Insights

Key players operating in the market include GlaxoSmithKline Plc, Neurogastrx Inc, Bausch Health, Evoke Pharma, Theravance Biopharma, Abbott Laboratories, and AstraZeneca Plc. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives:

-

In August 2022, Processa Pharmaceuticals, Inc. initiated its Phase 2A clinical trial for PCS12852, enrolling its first patient with moderate to severe gastroparesis.

-

In February 2022, Vanda Pharmaceuticals Inc. (Vanda) shared the Phase III clinical trial outcomes, VP-VLY-686-3303, revealing the effectiveness and safety of tradipitant in addressing gastroparesis symptoms.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."