- Home

- »

- Medical Devices

- »

-

Gastroretentive Drug Delivery Systems Market Report, 2030GVR Report cover

![Gastroretentive Drug Delivery Systems Market Size, Share & Trends Report]()

Gastroretentive Drug Delivery Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Floating, Expandable), By Dosage (Tablets, Capsule, Gel, Liquid), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-415-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

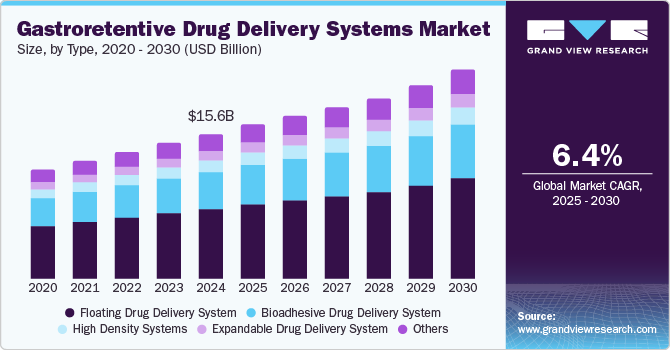

The global gastroretentive drug delivery systems market size was estimated at USD 15.6 billion in 2024 and is projected to grow at a CAGR of 6.4% from 2025 to 2030. Market growth is driven by an increasing global prevalence of gastric disorders, including peptic ulcer disease and H. pylori infections. Approximately 4 million individuals worldwide are affected by peptic ulcer disease annually, with a lifetime prevalence ranging from 5% to 10% in the general population. This rising incidence intensifies the demand for effective treatment options, creating substantial market opportunities for gastroretentive drug delivery systems (GRDDS) as pharmaceutical companies strive to address these pressing healthcare needs.

Research indicates that individuals over the age of 70 exhibit longer gastric retention times compared to younger demographics. This characteristic suggests that gastroretentive systems may offer enhanced therapeutic benefits for older adults, who are often more susceptible to gastric disorders. As the population ages, the development of tailored gastroretentive solutions adaptable to this demographic becomes critical.

Furthermore, studies show that females generally experience slower gastric emptying compared to males, influencing the effectiveness of GRDDS. Pharmaceutical companies are increasingly recognizing these variances, motivating them to invest in research and development focused on creating specialized GRDDS that cater to these diverse patient populations. This personalized approach to drug delivery enhances treatment efficacy, appealing to healthcare providers and patients alike.

Advances in controlled-release methods and improvements in bioavailability have rendered gastroretentive systems more efficient and attractive to pharmaceutical entities. By reducing dosing frequency and improving therapeutic outcomes, GRDDS enhance patient adherence, which is especially vital in chronic disease management. As firms continue to allocate substantial resources toward developing advanced gastroretentive systems, the market is poised for continued expansion, driven by evolving healthcare demands and technological advancements. For instance, in September 2024, Lonza inaugurated the Innovaform Accelerator in Colmar, enhancing co-innovation for pharmaceutical applications with advanced formulation and encapsulation technology, streamlining the delivery of challenging active pharmaceutical ingredients.

Type Insights

Floating drug delivery systems (FDDS) dominated the market and accounted for a share of 47.0% in 2024. By maintaining buoyancy in the stomach, these systems extend gastric retention time, facilitating controlled drug release and improved plasma concentration. This is advantageous for narrow absorption-window drugs, reducing therapeutic fluctuations and enhancing patient compliance through decreased dosing frequency, thus promoting FDDS adoption.

Bioadhesive drug delivery systems are expected to grow at the fastest CAGR of 7.1% over the forecast period, aided by their capability to enhance drug absorption by adhering to the gastric mucosa. This extended residence time improves bioavailability, facilitates targeted delivery, reduces dosing frequency, and ultimately enhances patient compliance and therapeutic outcomes.

Dosage Insights

Tablets held the largest revenue share of 37.4% in 2024 as they improve drug bioavailability, particularly for those absorbed in the stomach, by extending gastric retention time and minimizing dosing frequency, thereby enhancing patient compliance and therapeutic efficacy. Furthermore, advancements in formulation technologies enable the creation of gastroretentive tablets tailored to specific gastric conditions, favored by manufacturers and healthcare providers.

Liquid drug delivery systems are projected to grow at the fastest CAGR of 7.8% over the forecast period. Liquid formulations facilitate rapid absorption, making them ideal for drugs with narrow absorption windows. They enable precise dosing, enhancing patient compliance, particularly among the elderly and pediatric populations. Incorporating gastroretentive technologies allows for sustained release and prolonged gastric retention, maximizing therapeutic efficacy and minimizing side effects in modern pharmaceuticals.

Distribution Channel Insights

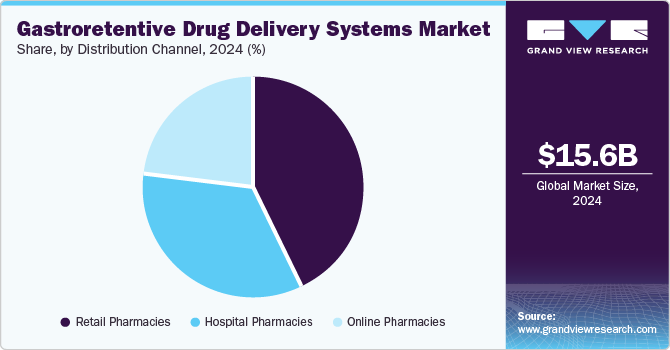

Retail pharmacies led the market with a revenue share of 43.3% in 2024. GRDDS improve drug bioavailability and reduce dosing frequency, enabling retail pharmacies to serve a growing patient base seeking effective gastric disorder treatments. The accessibility of gastroretentive formulations enhances adherence to prescribed therapies, driving market growth amid rising gastrointestinal disease prevalence and expanding product offerings in retail environments.

Online pharmacies are expected to witness the fastest growth of 7.3% over the forecast period. The growth of e-commerce has enabled patients to easily access gastroretentive formulations that may require specific handling. Online platforms offer comprehensive product information and customer reviews, facilitating informed purchasing. Increased gastrointestinal disorder prevalence drives demand, allowing online pharmacies to provide a diverse range of gastroretentive products and enhance patient satisfaction.

Regional Insights

North America gastroretentive drug delivery systems market dominated the global market with a revenue share of 41.3% in 2024. Market growth in the region is driven by the high prevalence of gastrointestinal disorders such as gastric ulcers and GERD. Enhanced research and development investments by pharmaceutical companies, coupled with an advanced healthcare infrastructure, foster innovation in drug delivery technologies and promote improved patient compliance in treatment.

U.S. Gastroretentive Drug Delivery Systems Market Trends

The gastroretentive drug delivery systems market in U.S. dominated the North America market with a revenue share of 81.7% in 2024. Increased investments in R&D by pharmaceutical companies are advancing innovation in drug delivery technologies in the U.S. Enhanced healthcare infrastructure and rising patient awareness are additionally driving demand for gastroretentive formulations, thereby improving patient compliance and overall therapeutic outcomes for healthcare providers.

Europe Gastroretentive Drug Delivery Systems Market Trends

Europe gastroretentive drug delivery systems market held substantial market share in 2024. The European market benefits from improved healthcare infrastructure and increased research activities. Economic advancements in countries such as Germany and France are driving healthcare spending, while the entry of international pharmaceutical manufacturers fosters the development of innovative gastroretentive formulations to meet growing demand in the region.

The gastroretentive drug delivery systems market in Germany is expected to grow in the forecast period. Economic growth in Germany has resulted in heightened healthcare expenditure, paving the way for the entry of international drug manufacturers. Furthermore, the increasing prevalence of gastrointestinal disorders is driving demand for innovative drug delivery solutions in Germany.

Asia Pacific Gastroretentive Drug Delivery Systems Market Trends

Asia Pacific gastroretentive drug delivery systems market is expected to register the fastest CAGR of 6.8% in the forecast period. Increasing investments in healthcare and heightened awareness of innovative drug delivery technologies are driving demand in countries such as Japan and India. The growing prevalence of gastrointestinal disorders, alongside intensified research and development activities, along with expanding pharmaceutical markets and improved regulatory frameworks, contribute to rapid sector growth in the region.

The gastroretentive drug delivery systems market in China dominated the Asia Pacific market in 2024. The Chinese government’s emphasis on enhancing healthcare access and quality has increased demand for advanced drug delivery technologies. Moreover, heightened awareness of innovative treatments among both patients and healthcare providers is facilitating the adoption of gastroretentive systems in the country.

Key Gastroretentive Drug Delivery Systems Company Insights

Some key companies operating in the market include Catalent, Inc; Lonza; Evonik Industries AG; Colorcon; Quotient Sciences; among others. Key players are prioritizing product innovation and strategic partnerships, investing in R&D while expanding market presence.

-

Lonza offers specialized excipients and formulation solutions, leveraging its polymer technology expertise to develop gastroretentive formulations that improve drug bioavailability and meet the demand for effective oral therapies.

-

Evonik Industries AG specializes in innovative excipients for GRDDS via its EUDRAGIT line, enhancing therapeutic efficacy and patient compliance through improved gastric retention and controlled release.

Key Gastroretentive Drug Delivery Systems Companies:

The following are the leading companies in the gastroretentive drug delivery systems market. These companies collectively hold the largest market share and dictate industry trends.

- Catalent, Inc

- Lonza

- Evonik Industries AG

- Colorcon

- Quotient Sciences

- AptarGroup, Inc.

- Aenova Holding GmbH

- Evotec SE

- Vectura Group Ltd

- Ashland

Recent Developments

-

In September 2024, Evonik launched EUDRACAP colon capsules for targeted ileo-colonic drug delivery, enhancing oral therapies for sensitive ingredients such as live biotherapeutics while expanding their innovative EUDRACAP portfolio.

-

In June 2024, Lonza launched the Capsugel Enprotect size 9 capsule, facilitating pre-clinical testing of acid-sensitive APIs in rodents, streamlining drug development and enhancing first-in-human timelines.

Gastroretentive Drug Delivery Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.6 billion

Revenue forecast in 2030

USD 22.7 billion

Growth rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, dosage, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Catalent, Inc; Lonza; Evonik Industries AG; Colorcon; Quotient Sciences; AptarGroup, Inc.; Aenova Holding GmbH; Evotec SE; Vectura Group Ltd; Ashland

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gastroretentive Drug Delivery Systems Market Report Segmentation

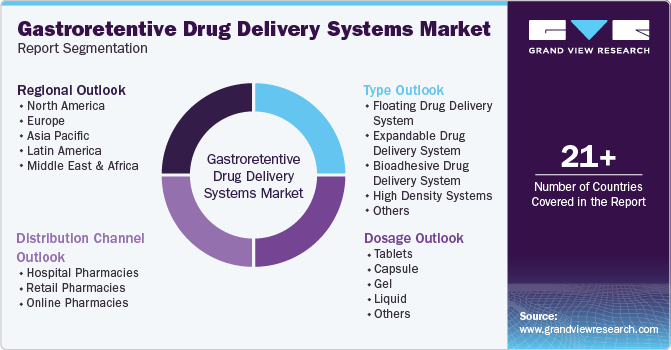

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gastroretentive drug delivery systems market report based on type, dosage, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Floating Drug Delivery System

-

Expandable Drug Delivery System

-

Bioadhesive Drug Delivery System

-

High Density Systems

-

Others

-

-

Dosage Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsule

-

Gel

-

Liquid

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.