- Home

- »

- Renewable Chemicals

- »

-

Bioadhesives Market Size, Share & Growth Report, 2030GVR Report cover

![Bioadhesives Market Size, Share & Trends Report]()

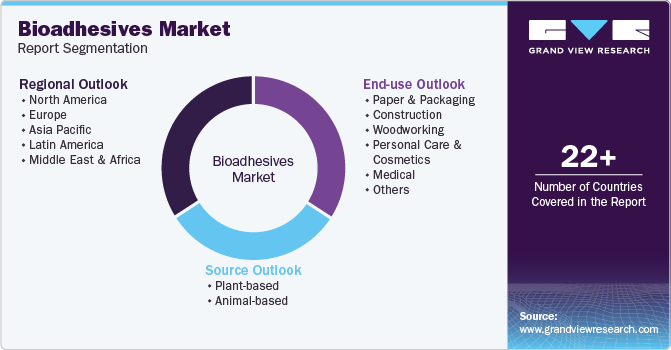

Bioadhesives Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Plant-based, Animal-based), By End Use (Packaging & Paper, Construction, Personal Care & Cosmetics), By Region, And Segment Forecasts

- Report ID: 978-1-68038-421-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bioadhesives Market Summary

The global bioadhesives market size was valued at USD 4.7 billion in 2023 and is projected to reach USD 9.4 billion by 2030, growing at a CAGR of 9.1% from 2024 to 2030. This growth is attributed to the improvements in bioadhesive formulations and their enhanced performance. In addition, there has been an increase in the formation of innovative bioadhesives with more improved characteristics.

Key Market Trends & Insights

- The North America bioadhesives market dominated the global market and accounted for the largest market share of 24.0% in 2023.

- The bioadhesives market in the U.S. led the market with a revenue share of 66.0% in 2023.

- By source, Plant-based bioadhesives dominated the market and accounted for a revenue share of 70.7% in 2023.

- By end use, Paper & packaging led the market and accounted for the largest revenue share of 35.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4.7 Billion

- 2030 Projected Market Size: USD 9.4 Billion

- CAGR (2024-2030): 9.1%

- North America: Largest market in 2023

They are available in broad categories, including naturally occurring polymeric substances that show adhesive properties and synthetic substances modified to bind biological surfaces. Glues obtained by biological intermediates such as cellulose, starch, or gelatins are also involved in this category.

The significant factor fueling the demand for bioadhesives is consumers' rising awareness of the hazardous impact that synthetic materials can have on health and their shifting preference towards natural goods. In addition, progress in the market has been helped by government regulations for environmental production and encouraging the use of products extracted from biological sources. Because of this, manufacturers have been motivated to develop cutting-edge bioadhesive items.

In addition, the growth of end-use industries, research and development, and investment contribute to the growth of the global bioadhesives market. The growing need for biomedical applications in the healthcare industry significantly fuels this growth. Furthermore, growing environmental regulations and consumer awareness of the possible detrimental impacts of synthetic goods support the worldwide bioadhesive business.

Bioadhesives are used mainly in the medical industry for processes such as wound care dressings, surgeries, transdermal drug delivery, and skin-bonded tracking systems. The rising popularity of surgical bioadhesives for suture replacements is expected to further boost the market growth. To develop novel bioadhesives for the medical sector, major industry companies are involved with continuous R&D for advancement. The availability of abundant raw materials for soy, starch, and corn-based adhesives is expected to continue to increase market growth, which, in turn, is further accompanying the industry growth.

Source Trends

Plant-based bioadhesives dominated the market and accounted for a revenue share of 70.7% in 2023. They are widely used as they are petrochemical-free and contain very low formaldehyde emissions. The increasing focus on sustainable solutions and the growing requirement for eco-friendly adhesives have increased the demand for the plant-based segment. Plant-based bioadhesives are made from various components, such as rubber, lignin, starch, and soy. Compared to other bioadhesives, they are more viscous; bioadhesives based on starch work better than those derived from plants.

Animal-based bioadhesives are expected to grow at a CAGR of 9.6% over the forecast period. These are used in certain areas, such as wound care and tissue engineering, in the healthcare sector; their uses are limited compared to plant-based bioadhesives. Furthermore, animal-based adhesives may be restricted in various businesses due to ethical concerns.

End Use Insights

Paper & packaging led the market and accounted for the largest revenue share of 35.0% in 2023.The paper & packaging sector is one of the critical sectors boosting the demand for bioadhesives. Specialty packaging, bags, cartons, filters, flexible packaging, disposables, envelopes, foil laminates, labels cigarettes, and laminating printed sheets are just a few of the packaging materials that use bioadhesives. Furthermore, adhesive components, also used for packaging in the frozen food and beverage industries, contain mineral oil, which poses no health risks.

The construction segment is expected to witness significant growth over the forecast years. They are widely used in manufacturing wood composites such as particleboard and fiberboard and wood products such as furniture, doors, and windows. They have advantages such as high bonding strength, durable nature, lower toxicity, and better water resistance ability. Moreover, sustainable building materials and green building techniques are capturing more attention in the construction sector.

Regional Insights

The North America bioadhesives market dominated the global market and accounted for the largest market share of 24.0% in 2023. This growth is attributed to the growing demand in different application segments, especially packaging & paper, and construction. The ever-increasing demand for packaging and healthcare applications drives this market.

U.S. Bioadhesives Market Trends

The bioadhesives market in the U.S. led the market with a revenue share of 66.0% in 2023, owing to initiatives by significant companies and rising demand across various sectors. Companies are investing in research and development to create bioadhesive products that meet the increasing demand for sustainable solutions. In addition, Advancements in biotechnology enable enhancements in high-performance bioadhesives, which provide durability and adhesion properties. The healthcare segment also contributes to market expansion by using bioadhesives in medical devices.

Europe Bioadhesives Market Trends

The UK bioadhesives market is expanding significantly, driven by the rising consciousness among people and regulatory frameworks aimed at reducing carbon footprints. The substantial growth in building activity also fuels the demand in industries such as plastic, painting, and coasting sectors, which will propel the bioadhesives market even higher. The government’s emphasis on sustainability and circular economy prompts industries to implement bio-based adhesives over traditional synthetic alternatives.

The bioadhesives market in Germany is expected to witness substantial growth, owing to the manufacturing of bio-succinic acid, which helped fuel the development of bioadhesives: a rapid industrial base and a commitment to sustainability. Environmental regulations and government initiative programs raise the bioadhesives market to promote using renewable resources for sustainability. In addition, Germany’s focus on enhancement and innovation with its well-established research infrastructure is leading the development of advanced bioadhesive solutions.

Asia Pacific Bioadhesives Market Trends

The Asia Pacific bioadhesives market is expected to experience substantial growth over the forecast period. This growth is attributed to the rising construction and remodeling activities, which demand bioadhesives in applications such as pipes, panels, and pavements.

The bioadhesives market in China is expected to proliferate due to increasing environmental awareness and regulations for synthetic adhesives. The government's push for sustainable development and adopting eco-friendly products in various industries, such as packaging, construction, and healthcare, has propelled the demand. Moreover, the flourishing e-commerce sector requires sustainable and sound packaging solutions, contributing to market growth.

Key Bioadhesives Company Insights

Some of the key companies in the bioadhesives market include Henkel AG & Company KGaA; DuPont De Nemours, Inc.; Arkema SA; Ashland Global Holdings Inc.; Beardow Adams Group; Paramelt BV; Jowat SE; Ingredion, Inc.; EcoSynthetix Inc.; Tate and Lyle PLC; in the market are focusing on development & to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

Arkema offers coating solutions, innovative materials, and adhesives. The company sells coating resins, additives, polymers, and other goods. It provides services to the global sports goods, automotive, cosmetics, aerospace, packaging, and electrical industries.

-

Ashland Global Holdings serves a broad spectrum of consumer and industrial markets, such as food and beverage, energy, construction, pharmaceuticals, nutraceuticals, automotive, and personal care.

Key Bioadhesives Companies:

The following are the leading companies in the bioadhesives market. These companies collectively hold the largest market share and dictate industry trends.

- Henkel AG & Company KGaA

- DuPont De Nemours Inc

- Arkema SA

- Ashland Global Holdings Inc

- Beardow Adams Group

- eBay Inc.

- Paramelt BV

- Jowat SE

- Ingredion Incorporated

- EcoSynthetix Inc

- Tate & Lyle PLC

Recent Developments

-

In May 2023, H.B. Fuller acquired Beardow Adams, a maker of industrial glue with global customers located in the United Kingdom. By broadening its customers and offering technologies and capacity for manufacturing throughout the US and Europe, the acquisition is anticipated to improve H.B. Fuller's standing in the market. The merged firm is expected to function under the worldwide business unit of H.B. Fuller's Hygiene, Health, and Consumable Adhesives, utilizing collaborations in distribution, production optimization, and innovation to tackle market trends such as food safety, sustainability, and e-commerce.

-

In October 2023, DuPont unveiled the DuPont Liveo MG 7-9960 Soft Skin Adhesive. This new adhesive is intended for use in advanced wound care dressings and the delicate and long-lasting attachment of medical devices to the skin.

Bioadhesives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.1 billion

Revenue forecast in 2030

USD 9.4 billion

Growth Rate

CAGR of 9.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, UAE, South Africa, Saudi Arabia, Kuwait

Key companies profiled

Henkel AG & Company KGaA; Du Pont De Numerours, Inc.; Arkema SA; Ashland Global Holdings Inc.; Beardow Adams Group; Paramelt BV; Jowat SE; Ingredion, Inc.; EcoSynthetix Inc.; Tate and Lyle PLC;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bioadhesives Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bioadhesives market report based on source, end use, and region.

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Plant-based

-

Animal-based

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Paper & Packaging

-

Construction

-

Woodworking

-

Personal Care & Cosmetics

-

Medical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.