- Home

- »

- Pharmaceuticals

- »

-

Gaucher Disease Drugs Market Size & Share Report, 2030GVR Report cover

![Gaucher Disease Drugs Market Size, Share & Trends Report]()

Gaucher Disease Drugs Market Size, Share & Trends Analysis Report By Type (Type 1, Type 2, Type 3, Others) By Therapy (Enzyme Replacement Therapy, Substrate Replacement Therapy, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-599-1

- Number of Report Pages: 84

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Gaucher Disease Drugs Market Trends

The global Gaucher disease drugs market size was valued at USD 1.65 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 2.6% from 2023 to 2030. An increase in the number of patients with rare diseases, increasing investment in the healthcare sector, and growing awareness about GD are expected to drive the market during the forecast period. Gaucher disease is an autosomal recessive metabolic disorder and the most common lysosomal storage disorder. According to the National Gaucher Foundation (NGF) of the U.S., Gaucher disease affects almost 1 in every 40,000 live births in the general population.

Genetic conditions are caused by mutations in the GBA gene, leading to reduced production of glucocerebrosidase and a consequent accumulation of glucocerebroside. This excess lipid accumulates in the brain, bone marrow, lungs, kidney, liver, and spleen, which obstructs normal body functions. The market is likely to exhibit modest growth during the forecast period. The rising incidence of lysosomal storage disease and increasing efforts to identify more GD patients are among the primary growth stimulants for the market.

Several government and global organizations' awareness programs and initiatives are being carried out worldwide to spread awareness about rare diseases. For instance, in July 2023, the Australian government announced USD 3.3 Million to support around 2 million citizens suffering from rare diseases. That will provide them with support to create new educational programs and spread awareness.

The global economies are now more concentrated on the healthcare sector and the welfare of their people. Thus, there is a surge in investments to support patients with rare diseases to improve people's standard of living. For instance, in March 2023, the Government of Canada announced support of around USD 1.5 Billion for three years to provide affordability and effective as well as authentic drugs for patients of rare diseases.

The lack of drugs in the late-stage pipeline and the rising treatment cost limit the market from realizing its utmost potential. There remains a high unmet need to develop improved treatments that combat neuronopathic complications at reduced costs and convenient administration schedules. Nevertheless, increasing investments in research and development activities related to rare diseases are projected to shape the future of the market.

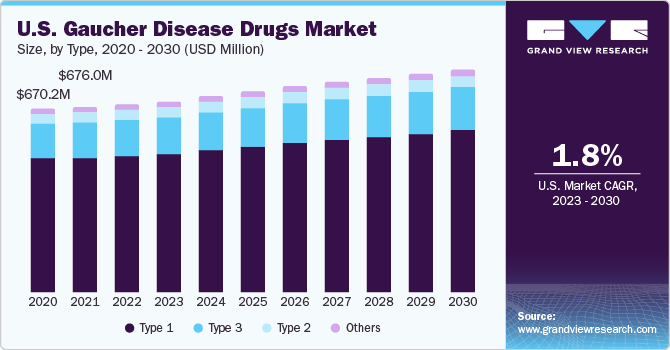

Type Insights

Type 1 segment accounted for the largest revenue share of 72.6% in 2022, owing to its rising prevalence in patients. Type 1 disease is the most common disease among all three types. According to National Organization for Rare Disorders (NORD) in March 2020, type 1 alone accounts for more than 90% of cases of GD. The condition does not affect the central nervous system (CNS), making it non-neuronopathic. This disorder can develop anytime between childhood and adulthood; the average life expectancy is 70 years. The segment is estimated to retain its position until 2030 owing to the increasing adoption of treatment for this type.

Type 2 and 3 are neuronopathic diseases, causing CNS complications during the disease course. Infants with type 2 GD rarely survive beyond two years due to lack of treatment and severity of disease progression. The type 3 segment is expected to grow at the fastest CAGR of 2.75% over the forecast period. This growth can be attributed to its gigantic presence in the eastern part of the world. According to NGF, type - 3 is more common than type - 1 in the Middle East, India, China, and Pacific Rim.

Other rare forms of the disease include the perinatal lethal form and the cardiovascular form. The perinatal lethal form is the most severe disease, causing life-threatening complications in infants or fetuses. Cardiovascular form affects the heart, primarily causing calcification of heart valves.

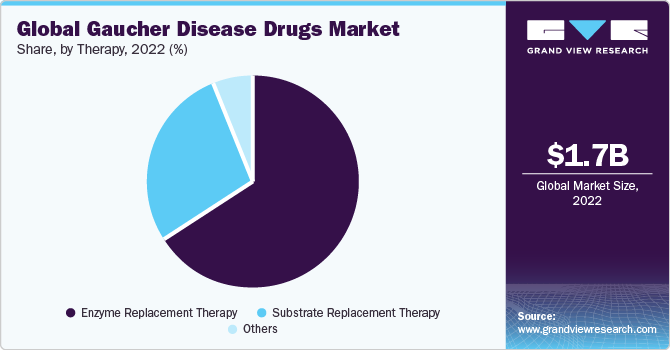

Therapy Insights

Based on therapy, the global Gaucher disease drugs market can be segmented into Enzyme Replacement Therapy (ERT), Substrate Replacement Therapy (SRT), and others. ERT had the largest revenue share of over 65% in 2022. However, the market is expected to grow slowly in the forecast period owing to the upcoming substitutes of ERT and higher treatment costs. According to NGF, the cost of ERT can go up to USD 2,00,000 or more each year.

SRT is expected to grow at the fastest CAGR of 9.3% owing to the ease of treatment, as SRT is an oral medication. Moreover, SRT is cost saving as compared to other ways of treatment. The U.S. Food and Administration (FDA) approved the first SRT in 2003 for Gaucher disease. As of now, the U.S. FDA has approved two oral SRT drugs, namely: Cerdelga and Zavesca, for patients of GD.

Regional Insights

North America had the largest revenue share of around 45% in 2022 owing to rising awareness about Gaucher disease, advanced healthcare infrastructure, and access to treatment. According to a report published by NORD in March 2020, the U.S. alone has approximately 6000 people living with GD. Organizations such as the National Gaucher Foundation of the U.S. and the National Gaucher Foundation of Canada are spreading awareness among people about GD. North America was followed by Europe in the revenue share owing to the presence of an Ashkenazi Jewish population and better infrastructure facilities to treat GD and other rare diseases.

Asia Pacific is expected to grow at the fastest CAGR of 3.4% in the forecast period. This growth can be backed by the rising healthcare infrastructure facilities and government initiatives to spread awareness about rare and life-threatening diseases. For instance, the Australian government is running a Life Saving Drug Program (LSDP) program to pay for medicines for patients with life-threatening and ultra-rare diseases. Medicines for GD are also listed in the LSDP.

Key Companies & Market Share Insights

Collaborations for the development and commercialization of therapeutics drive the market. Companies focus on launching authentic treatment therapies and substitutes for existing therapies. For instance, in January 2022, Freeline announced FDA clearance of its International New Drug (IND) application for its gene therapy FLT201. This therapy has been approved as an investigational gene therapy and is expected to be a transformative treatment for Gaucher disease patients. In December 2020, Lilly announced the acquisition of Prevail Therapeutics, which will help Lilly to establish a gene therapy program to develop treatments for patients with Gaucher disease. In August 2020, Centogene N.V. and Evotec SE announced extending their Gaucher disease-related drug discovery partnership. This extended partnership is expected to accelerate drug and medical solution discovery for Gaucher disease.

In April 2018, Amerigen Pharmaceuticals Limited and Dipharma S.A. announced the approval of their Miglustat 100 mg capsules by the U.S. FDA. It is anticipated work as monotherapy for patients with type 1 Gaucher disease. The market players are also doing mergers and acquisitions to get a competitive advantage. For instance, in January 2017, Janssen acquired Actelion, a type-1 Gaucher disease treatment-approved company, to add complementary therapeutics and promising late-stage pipeline candidates to its portfolio.

Key Gaucher Disease Drugs Companies:

- Sanofi

- Takeda Pharmaceutical Company Limited

- Pfizer Inc

- Johnson & Johnson Services, Inc.

- ERAD Therapeutic

Gaucher Disease Drugs Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.69 billion

Revenue forecast in 2030

USD 2.03 billion

Growth rate

CAGR of 2.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, therapy, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Sanofi; Takeda Pharmaceutical Company Limited; Pfizer Inc; Johnson & Johnson Services, Inc.; ERAD Therapeutic

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gaucher Disease Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global Gaucher disease drugs market report on the basis of type, therapy, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Type 1

-

Type 2

-

Type 3

-

Others

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Enzyme Replacement Therapy

-

Substrate Replacement Therapy

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global Gaucher disease drugs market size was valued at USD 1.65 billion in 2022 and is expected to reach USD 1.69 billion by 2023.

b. It is anticipated to expand at a CAGR of 2.6% during the forecast period. The Gaucher disease drugs market is likely to exhibit modest growth during the forecast period. The rising incidence of the disease and increasing efforts for the identification of more GD patients are among the primary growth stimulants for the market.

b. Enzyme replacement therapy (ERT) dominated the Gaucher disease drugs market in 2022. ERT will remain the preferred therapy through 2025, which can be backed by the strong commercial performances of Cerezyme, Vpriv, and Elelyso.

b. Some of the key players operating in the Gaucher disease drugs market are Sanofi Genzyme, Shire, Pfizer, and Johnson & Johnson. Sanofi Genzyme dominated the market with a nearly 65.0% share in 2022.

b. Rising incidence of the disease and increasing efforts for the identification of more GD patients are among the primary growth factors for the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."