- Home

- »

- Advanced Interior Materials

- »

-

GCC Heat Treating Market Size, Share, Growth Report, 2030GVR Report cover

![GCC Heat Treating Market Size, Share & Trends Report]()

GCC Heat Treating Market (2023 - 2030 ) Size, Share & Trends Analysis Report By Material (Steel, Cast Iron, Others), By Equipment (Fuel-fired Furnace, Electrically-heated Furnace, Others), By Process, By Application, By Country, And Segment Forecasts

- Report ID: GVR-3-68038-070-5

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

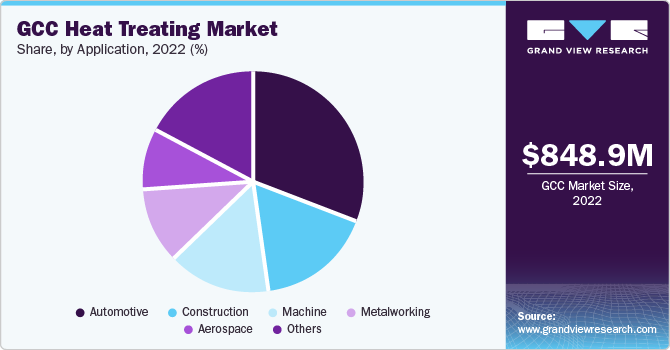

The GCC heat treating market size was valued at USD 848.9 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.7% from 2023 to 2030. The rise in demand for heat-treating units from numerous industrial equipment, including automotive and aerospace, is expected to drive the market over the coming years. Prospective growth in crude steel material in emerging economies such as the UAE and Saudi Arabia is also projected to spur market demand.

The rapidly growing automotive industry in the Middle East and Africa is a key driver for the market. Prominent economies such as UAE and Saudi Arabia witness high demand for affordably priced vehicles owing to rapid urbanization, change in consumption trends, availability of affordable vehicles, strategic business targets of manufacturers, and changing lifestyles. Therefore, increased demand for passenger vehicles is predicted to facilitate demand for heat treating services and equipment in the region.

The Gulf region, including Qatar, UAE, Saudi Arabia, Bahrain, Kuwait, and Oman, has been traditionally considered tax havens. However, since 2018, Gulf Cooperation Council (GCC) members signed an agreement to introduce a value-added tax (VAT) of 5.0% on the supply of goods and services. Stringent government regulations and frameworks in the metal treating market are expected to affect the overall market directly or indirectly.

GCC member states are expected to show moderate growth in terms of demand for heat treatment. The presence of luxury automotive companies and rising investments in the regional aerospace industry are projected to favor market growth. Industrial automation, fueled by the trend of Industry 4.0, is expected to offer a competitive edge to manufacturers. Government intervention and favorable socioeconomic conditions are also expected to propel demand.

The aerospace industry also contributes to the heat treating market in the GCC region. Heat treating is crucial for manufacturing aircraft components that require high strength, durability, and resistance to extreme conditions. With the growth of the aerospace industry in countries like UAE and Qatar, the demand for heat treating services has also increased.

Material Insights

The steel segment held the largest market share of 60.9% in 2022. Heat-treated steel is extensively used in construction applications, including structural components, reinforcing bars (rebars), and precast elements. The growth of the construction sector has directly contributed to the increased demand for heat-treated steel in the region. The GCC countries are major producers and exporters of oil and gas, with a significant presence of oil refineries and petrochemical plants. Heat-treated steel is essential for various applications in this industry, including pipelines, pressure vessels, storage tanks, and drilling equipment. The expansion and maintenance of oil and gas facilities have fueled the demand for steel material.

The cast iron segment is expected to grow at the fastest CAGR of 4.1% during the forecast period. Cast iron finds utilization across an extensive spectrum of manufacturing applications, and through heat treating, its properties can be augmented to suit specific objectives. With the expansion and diversification of the manufacturing sector, there might be an elevation in the requirement for heat-treated cast iron materials.

Process Insights

The hardening & tempering segment held the largest market share of 27.0% in 2022. Hardening and tempering are some of the most commonly used processes for steel, cast iron, and other metal alloys. The segment is projected to grow at a significant rate on account of the increasing use of these processes in various end-use industries such as automotive, manufacturing, energy, and construction. Surging automotive production in key economies and increased demand for reduction in the overall weight of the vehicle are expected to drive segment growth over the forecast period.

The case hardening segment is expected to grow at the fastest CAGR of 4.3% over the forecast period. The case hardening process is a distinct type of heat treatment used to generate a hard, wear-resistant surface layer on the material, all while retaining a durable and ductile core. This technique is frequently employed on steel components to enhance their surface hardness, wear resistance, and overall performance.

Equipment Insights

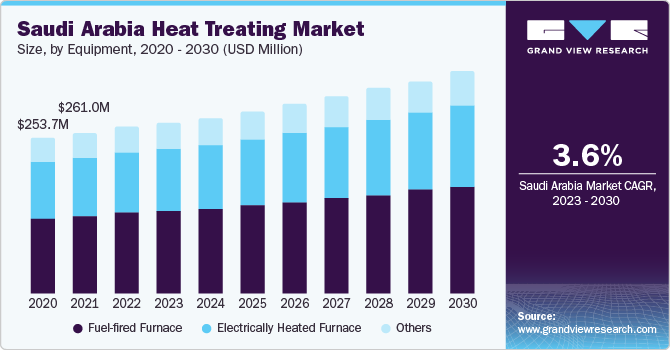

The fuel-fired furnace segment held the largest revenue share of 53.1% in 2022. Fuel-fired furnaces are commonly used in heat treating processes to provide the necessary heat for treating materials, particularly metals. The market is anticipated to be driven by rising demand for processed metal in construction, automotive, and aerospace industries, specifically in Saudi Arabia and UAE. Shifting consumer preference for natural gas-fired furnaces and a rise in demand for heat treating equipment from numerous industrial application areas are projected to propel market growth by 2025.

Application Insights

The automotive segment held the largest revenue share of around 31.2% in 2022. The sector is expected to be a major contributor to regional revenue growth by 2030, owing to the increasing reach of various automotive manufacturers in Saudi Arabia, UAE, Oman, and other GCC member states. The automotive sector in the GCC is primarily fueled by high consumer disposable income, growing population, availability of various promising financing options from private players and governments, and ongoing and upcoming infrastructure developments. All these factors subsequently benefit the demand for heat treating solutions.

The aerospace application segment is also projected to contribute significantly to the overall market. Considerable domestic demand for aircraft from member states such as UAE and Saudi Arabia has encouraged various international players to establish a production hub in the region. There has been steady growth of the GCC aviation and aerospace industry over the last two decades. Investments in space exploration have greatly benefited demand for aircraft parts, equipment, and services. UAE has been trying to establish itself as a regional center for commercial as well as civil space activities and this will have a positive impact on demand for heat treating services and equipment in the sector.

Country Insights

Over the past few years, GCC countries have been among prominent revenue-generating countries in the global market for heat treating. Economic growth in member states like Saudi Arabia and UAE, along with technological investments, are projected to have a positive impact on the regional market. Saudi Arabia is anticipated to contribute significantly to revenue growth owing to the presence of luxury automotive companies, rising investments in aerospace, and several macroeconomic factors. In terms of revenue, UAE accounted for the second largest market share of 22.8% in 2022 and Yemen is expected to grow at the fastest CAGR of 5.8% over the forecast period.

Qatar, Oman, and Bahrain are also projected to showcase steady growth in the market. This can be attributed to favourable government policies, positive outlook for taxes on imports and exports of goods, the influx of foreign investors in MEA, and several other macroeconomic and socio-economic factors.

Key Companies & Market Share Insights

The GCC market boasts of a strong competitive landscape made up of prominent players considering various business strategies, such as geographical extension and R&D efforts. Multinational companies have been focusing on several developing regions and countries of late, dedicating resources and investments in these markets. This also allows them to gain a competitive advantage over others and strengthen their market position.

The leading manufacturers are engaged in the development and implementation of new strategies for increasing their market share. Apart from capacity expansion, mergers, acquisitions, and new material developments, integration across different stages of the value chain is one of the strategies adopted by key players to help them gain a competitive advantage over other manufacturers.

Key GCC Heat Treating Companies:

- Bluewater Thermal Solutions

- American Metal Treating

- General Metal Heat Treating

- Shanghai University Heat-treatment Co., Ltd

- Pacific Metallurgical, Inc.

- Nabertherm GmbH

- Unitherm Engineers Limited

- SECO/WARWICK, INC. ALLE

- Triad Engineering Inc.

- Bodycote

- FTV Proclad (U.A.E.) L.L.C

- Trinity Holdings Limited

- Rawabi Holding

- Fluor Corporation

- Easa Saleh Al Gurg Group (ESAG)

- Gesellschaft für Wärmetechnik mbH

Recent Development

-

In January 2022, Honeywell International Inc. inaugurated a new production facility in Jubail, Saudi Arabia, outfitted with Callidus Flare technology. This technology is specialized in manufacturing products utilizing thermal combustion for the oil and gas industry. The range of flares produced encompasses basic utility flares to high-performance ultra-low steam flares.

-

In January 2021, Solar Atmospheres announced that it had received approval from GE Aviation for its vacuum heat treatment and brazing services. As a result, customers in need of vacuum heat treatment and brazing services can now opt for these services across all of the company's locations.

GCC Heat Treating Market Report Scope

Report Attribute

Details

Revenue forecast in 2023

USD 870.1 million

Revenue forecast in 2030

USD 1,138.3 million

Growth rate

CAGR of 3.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, process, equipment, application, country

Country scope

Saudi Arabia; UAE; Oman; Qatar; Bahrain; Kuwait; Yemen

Key companies profiled

Bluewater Thermal Solutions; American Metal Treating; East~Lind Heat Treat, Inc.; General Metal Heat Treating; Shanghai University Heat-treatment Co., Ltd.; Pacific Metallurgical, Inc.; Nabertherm GmbH; Unitherm Engineers Limited; SECO/WARWICK, INC. ALLE; Triad Engineering Inc.; Bodycote; FTV Proclad (U.A.E.) L.L.C; Trinity Holdings Limited; Rawabi Holding; Fluor Corporation; Easa Saleh Al Gurg Group (ESAG); Gesellschaft für Wärmetechnik mbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

GCC Heat Treating Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the GCC heat treating market report based on material, process, equipment, application, and country:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Steel

-

Cast Iron

-

Others

-

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardening & Tempering

-

Case Hardening

-

Annealing

-

Normalizing

-

Others

-

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Fuel-fired Furnace

-

Electrically Heated Furnace

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace

-

Metalworking

-

Machine

-

Construction

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Gulf Cooperation Council

-

Saudi Arabia

-

UAE

-

Oman

-

Qatar

-

Bahrain

-

Kuwait

-

Yemen

-

-

Frequently Asked Questions About This Report

b. The GCC heat treating market size was estimated at USD 848.9 million in 2022 and is expected to be USD 870.1 million in 2023.

b. The GCC heat treating market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.7% from 2023 to 2030 to reach USD 1,138.3 million by 2030.

b. Saudi Arabia dominated the market in 2022 by accounting for a share of 32.1% of the market owing to the presence of luxury automotive companies, rising investments in aerospace, and several macroeconomic factors.

b. Some of the key players operating in the GCC heat treating market include Bluewater Thermal Solutions Llc, American Metal Treating, Inc., East-Lind Heat Treat, Inc., General Metal Heat Treating, Inc., Shanghai Heat Treatment Co., Ltd., Pacific Metallurgical, Inc., Nabertherm Gmbh, And Triad Engineers.

b. Rise in demand for heat-treating units from numerous industrial applications, including automotive and aerospace, is expected to drive the market over the coming years. Prospective growth in crude steel production in emerging economies such as the UAE and Saudi Arabia is also projected to spur market demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.