- Home

- »

- Clothing, Footwear & Accessories

- »

-

GCC Office Supplies Market Size, Industry Report, 2030GVR Report cover

![GCC Office Supplies Market Size, Share & Trends Report]()

GCC Office Supplies Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Paper Supplies, Writing Supplies, Filling Supplies, Desk Supplies), By Distribution Channel, By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-593-3

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

GCC Office Supplies Market Size & Trends

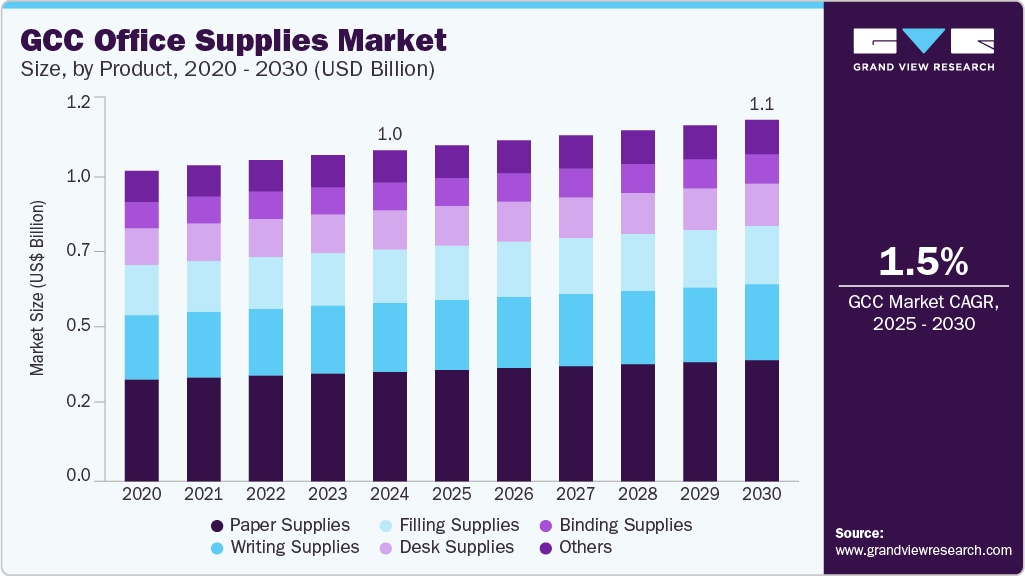

The GCC office supplies market size was estimated at USD 1.03 billion in 2024 and is projected to grow at a CAGR of 1.5% from 2025 to 2030. The expansion of the education sector in the GCC and the broader Middle East region is a primary driver of the office supplies market. Increased enrollment in higher education institutions, fueled by substantial government investments in educational infrastructure, has heightened demand for stationery and office supplies used in schools and universities.

According to an article published in February 2025, The Kingdom of Saudi Arabia has advanced its internationalization of higher education through new branch campuses and global partnerships such as the Technology and Design University as part of the New Murabba project. This strategic move aligned with Vision 2030 to diversify the economy, attract international talent, and establish itself as a regional academic hub. Growth in this sector supports the domestic consumption of essential items such as pens, notebooks, and printing materials and stimulates demand for specialized office equipment required for academic facilities.

Economic diversification efforts across GCC countries further strengthen this market. Governments are actively reducing reliance on oil revenues by attracting multinational corporations and expanding office spaces within major business hubs such as Riyadh, Dubai, and Doha. According to an article published by the Middle East Council on Global Affairs in May 2024, GCC nations, particularly Kuwait, emphasized the importance of economic diversification to reduce resource dependence, enhance macroeconomic stability, and foster resilience against shocks. Saudi Arabia and the UAE have made significant progress through reforms and digital adoption, while Kuwait and other countries are expected to follow. The proliferation of new commercial office buildings and business districts in the region increases the need for office supplies, including paper, writing utensils, and printing services, to support daily operations of these organizations.

Rising disposable incomes and a burgeoning youth demographic contribute significantly to increased consumption of office and stationery products in both educational and corporate sectors. As wealth levels improve, consumers and organizations are more inclined to invest in quality supplies, driving overall market growth. The ongoing development of office spaces and leasing activities in key cities, supported by government initiatives and the influx of multinational businesses, directly boost demand for office supplies necessary for operational efficiency.

Furthermore, businesses in the GCC are increasingly seeking customized office stationery solutions to enhance brand recognition and corporate identity. This trend towards personalization and brand differentiation is fostering innovation within the market, encouraging suppliers to offer tailored products that meet specific corporate needs. Collectively, these factors underpin the robust growth prospects of the GCC office supplies market, positioning it as a key segment within the region’s expanding commercial landscape.

Product Insights

Paper supplies dominated the market and accounted for a share of 33.1% in 2024. The region’s expanding educational institutions and growing youth population are driving increased demand for paper-based stationery, such as notebooks and classroom supplies. Concurrently, government and corporate investments in economic diversification foster the growth of multinational companies, boosting office supply needs. E-commerce platforms enhance accessibility to these products, while coating institutes improve paper quality for printing and packaging.

Writing supplies are projected to grow significantly over the forecast period. The improving education system and rising literacy rates drive demand for school stationery, supported by high regional student numbers. The Bahrain Economic Development Board in 2022 highlighted high demand for education, requiring increased investment. The Kingdom also offers high-quality opportunities, tax advantages, and VAT exemption for education investors and providers, supporting investment opportunities, tax benefits, and VAT exemption. Growing employment and expanding corporate sectors in the region are increasing office supply needs, while rising disposable incomes and consumer awareness boost demand for high-quality, eco-friendly, and innovative writing products. Government initiatives such as Saudi Arabia’s Vision 2030 and youthful demographics further sustain the market’s growth, complemented by product innovation and targeted marketing strategies. Hybrid work models and remote learning are sustaining the demand for reliable writing stationery, supported by rising disposable incomes and innovation in product durability.

Distribution Channel Insights

Offline distribution channels led the market with a revenue share of 89.8% in 2024. In the GCC region, offline stores-including supermarkets, hypermarkets, stationery shops, and retail outlets-offer extensive product assortments and personalized service through direct sales interactions, benefitting from the rising disposable income in the region. According to an article published by Zawya in April 2025, Qatar’s rising disposable incomes boosted consumer spending across key sectors, highlighting the country’s expanding, resilient market. Offline stores stores are widespread and accessible across urban and suburban areas, catering to diverse customers such as corporate clients and educational institutions. Steady income growth and government support positioned Qatar as a leading Gulf consumer economy. Retailers benefit from advanced logistics infrastructure, omni-channel strategies, and varied store formats to ensure comprehensive market coverage and product availability.

Online distribution channels are anticipated to witness lucrative growth over the forecast period. Online distribution channels significantly boost office supply demand in the GCC by offering convenience, accessibility, and a wide product range at competitive prices. The growing e-commerce industry in the region supports this trend. Platforms such as Amazon.ae, Noon.com, and B2B portals facilitate bulk and individual purchases, while omni-channel strategies and mobile commerce expansion enhance market reach. Improved logistics, targeted digital marketing, and the rise of remote work further increase online demand for office supplies across the region.

End Use Insights

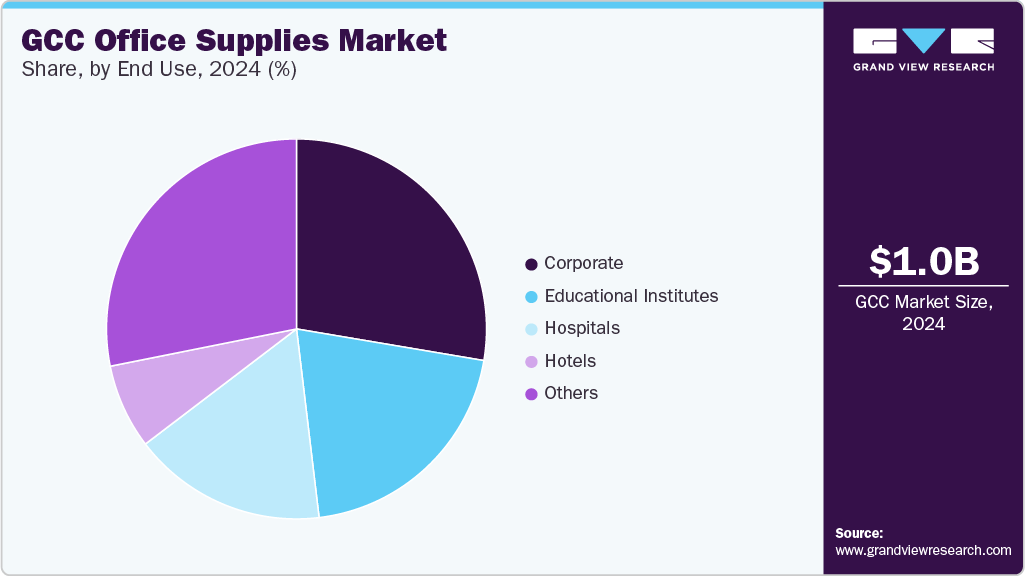

The corporate segment held the largest revenue share of 27.7% in 2024. Improved logistics and streamlined import processes are boosting the demand for office supplies, supporting economic diversification and workforce growth. Increasing investments by global players in the region are expected to facilitate new office setups, advanced office solutions, and eco-friendly supplies, further aiding market growth. For instance, in February 2025, the GCC Secretary General received a delegation from Japan’s Keidanren at the Riyadh headquarters, highlighting strengthening bilateral relations. The meeting discussed the progress of the GCC-Japan Free Trade Agreement negotiations, the Joint Action Plan for 2024-2028, and opportunities for enhanced cooperation in trade, energy, investment, and cultural exchange. across the region.

Educational institutes is projected to grow at the fastest CAGR of 1.6% over the forecast period. The expansion of educational institutions in the GCC, driven by government policies encouraging foreign university campuses, has significantly boosted demand for office supplies. In May 2025, during the GCC Ministers’ Meeting in Kuwait, the Secretary General emphasized that GCC leaders prioritized higher education as a key development pillar, with over 300 universities and 1.8 million students, driving regional competitiveness through increased research, funding, and global partnerships. Growing literacy rates, improved education systems, and rising disposable incomes further increase demand for school and office supplies such as pens, notebooks, and eco-friendly materials. Moreover, the growth of EdTech complements traditional supplies, ensuring sustained market expansion, as the education sector remains a key driver of office supply growth in the GCC.

Country Insights

Saudi Arabia Office Supplies Market Trends

The Saudi Arabia office supplies market dominated the GCC market with a revenue share of 21.3% in 2024. Saudi Arabia's Vision 2030, fostering economic diversification in sectors like IT and financial services, along with growing private sector employment is expanding the office supplies market. In November 2024, the Minister of Human Resources and Social Development of Saudi Arabia announced a 35% increase in private sector Saudi employees over five years, reaching 2.34 million. The unemployment rate among Saudis dropped to 7.1% in Q2 2024 from 12.3% in Q2 2019, reflecting significant labor market improvements. Digital transformation and hybrid work models drive demand for both traditional and tech-enabled supplies. Government-led infrastructure, education reforms, and rapid urbanization, particularly in Riyadh and Jeddah, further fuel this market growth.

Bahrain Office Supplies Market Trends

The office supplies market in Bahrain is projected to grow at the fastest CAGR of 2.0% over the forecast period, driven by the increase in FDIs in manufacturing and financial services that have fostered business and infrastructure development. In May 2024, Bahrain's Ministry of Finance reported a 5.7% year-on-year increase in inward FDI stock, reaching BHD 17.3 billion in 2024. This growth was driven by a 2.6% real GDP increase, with non-oil activities contributing 86% and sectors like Information and Communication growing significantly. Moreover, the accelerated shift to remote work has also boosted demand for home office furniture. The rising prominence of e-commerce in the country is further supported by a strong entrepreneurial ecosystem, nurturing startups and SMEs that require new office infrastructure.

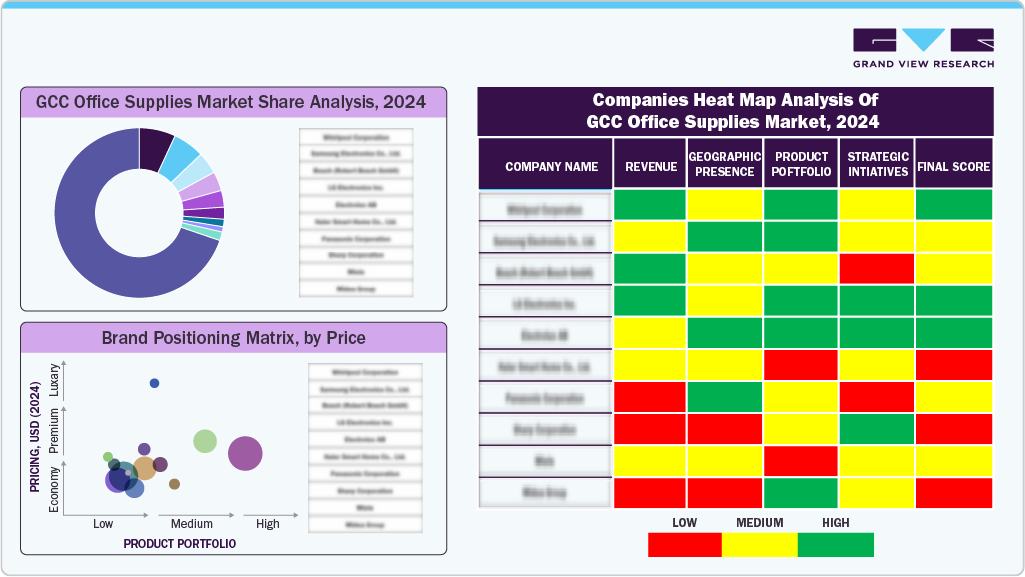

Key GCC Office Supplies Company Insights

Some key companies operating in the market include KOKUYO Co.,Ltd.; Pentel; 3M; Newell Brands; Faber-Castell; BIC; and ACCO Brands; among others. The market is competitive, driven by innovation, sustainability, and e-commerce expansion. Key players focus on IoT integration and eco-friendly products such as BIC’s recycled stationery, while leveraging brand building and targeting commercial/educational infrastructure to overcome digital challenges.

Major GCC distributors such as Nishat General Company and EZOrder shape the office supplies market significantly. They ensure extensive product availability and diversity through wide regional coverage. Their focus on supply chain efficiency, with services such as next-day delivery, improves procurement. This fosters competitive dynamics, supports emerging trends in eco-friendly products, and contributes to market resilience, driving steady growth.

-

BIC offers diverse writing instruments, lighters, razors, and correction products globally. BIC emphasizes innovation, sustainability through recycled materials and recycling programs, and digital writing. Its philosophy prioritizes high-quality, affordable, and essential products that bring simplicity and joy to everyday life.

-

Pentel is a global company operating in writing and art instruments, renowned for inventing the 1963 fiber-tipped Sign Pen and innovations such as EnerGel. Manufacturing across six countries, Pentel offers diverse products, emphasizing quality, sustainability via Recycology, and fostering creativity, maintaining a strong global market presence.

Key GCC Office Supplies Companies:

- KOKUYO Co.,Ltd.

- Pentel

- 3M

- Faber-Castell

- BIC

- ACCO Brands

- Newell Brands

Recent Developments

-

In April 2025, Kuwait Mart launched its online shopping platform designed for speed and convenience, which offers a curated selection from local and international suppliers. The platform aims to address e-commerce challenges in Kuwait, including delivery and payment, by offering a user-friendly interface and reliable services.

-

In December 2024, TTS partnered with Al Gurg Stationery in the UAE to enhance educational resource delivery. This collaboration provides schools with rapid access to materials and offers Continuing Professional Development (CPD) workshops for teachers, aiming to improve learning outcomes and support educators in integrating new tools.

-

In November 2024, APP Group showcased its diverse range of paper, stationery, and office supplies at the Paperworld Exhibition in Dubai. The company highlighted products from Indonesian and Chinese mills, emphasizing quality, innovation, and sustainability. APP’s exhibit featured office, specialty, and packaging papers, demonstrating its commitment to various industry needs.

GCC Office Supplies Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.13 billion

Growth rate

CAGR of 1.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, andtrends

Segments covered

Product, distribution channel, end use, country

Regional Scope

GCC

Country scope

Bahrain; Kuwait; Oman; Qatar; Saudi Arabia; United Arab Emirates

Key companies profiled

KOKUYO Co.,Ltd.; Pentel; 3M; Newell Brands; Faber-Castell; BIC; ACCO Brands

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

GCC Office Supplies Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the GCC office supplies market report based on product, distribution channel, end use, country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Paper Supplies

-

Notebooks and Notepads

-

Printing Paper

-

Others

-

-

Writing Supplies

-

Pens & Pencils

-

Highlighters & Markers

-

Others

-

-

Filling Supplies

-

File Folders

-

Envelopes

-

Others

-

-

Desk Supplies

-

Desk & Drawer Organizer

-

Paperweights & Stamp Pads

-

Others

-

-

Binding Supplies

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Corporate

-

Educational Institutes

-

Hospitals

-

Hotels

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Bahrain

-

Kuwait

-

Oman

-

Qatar

-

Saudi Arabia

-

United Arab Emirates

-

Frequently Asked Questions About This Report

b. The GCC office supplies market size was estimated at USD 1.03 billion in 2024.

b. The GCC office supplies market is projected to grow at a compound annual growth rate (CAGR) of 1.5% from 2025 to 2030.

b. Paper supplies dominated the market and accounted for a share of 33.1% in 2024. The region’s expanding educational institutions and growing youth population are driving increased demand for paper-based stationery, such as notebooks and classroom supplies. Concurrently, government and corporate investments in economic diversification foster the growth of multinational companies, boosting office supply needs. E-commerce platforms enhance accessibility to these products, while coating institutes improve paper quality for printing and packaging.

b. Some prominent players in the GCC office supplies market include KOKUYO Co.,Ltd.; Pentel; 3M; Newell Brands; Faber-Castell; BIC; ACCO Brands

b. The expansion of the education sector in the GCC and the broader Middle East region is a primary driver of the office supplies market. Increased enrollment in higher education institutions, fueled by substantial government investments in educational infrastructure, has heightened demand for stationery and office supplies used in schools and universities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.