- Home

- »

- HVAC & Construction

- »

-

GCC Steel Utility Poles Market Size & Share Report, 2030GVR Report cover

![GCC Steel Utility Poles Market Size, Share & Trends Report]()

GCC Steel Utility Poles Market Size, Share & Trends Analysis Report By Application (Electricity Transmission & Distribution, Lighting, Telecommunications), By Pole Size (Less Than 6 Meter, 6 to 15 Meter), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-058-3

- Number of Report Pages: 75

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

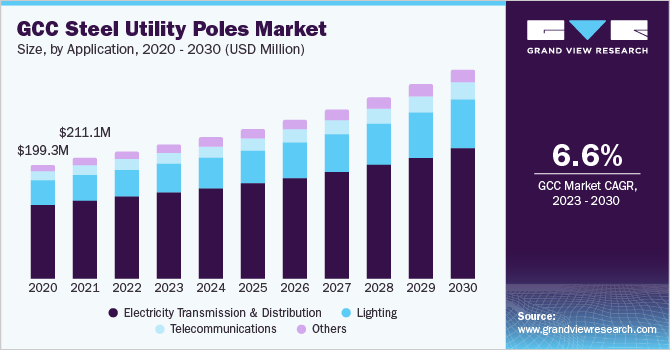

The GCC steel utility poles market size was valued at USD 221.71 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030. The increasing length of the electricity transmission & distribution network due to rising urbanization and economic growth across the GCC countries is driving the growth. In addition, the governments across the GCC countries are focusing on redeveloping existing roads, public areas, and tunnels, among others, and introducing smart lighting for enhanced convenience. This trend is further projected to create demand for steel utility poles.

The rise in urbanization and increasing adoption of smart city initiatives attributing to increasing investment by governments across GCC countries is likely to boost the development of road infrastructure, consequently driving the steel utility pole market. For instance, the government of Qatar has announced that the country will complete the electrification of the public transportation system by 2030 and establish smart transportation and eco-friendly logistics. As of Jan 2022, Lusail City and Msheireb Downtown are under the smart city development program.

The utility poles are used to support a variety of public utilities, including fiber optic cable, electrical cable & overhead power lines, and other equipment such as streetlights and transformers. The installation of steel utility poles is rising due to its variety of benefits, such as its strength, flexibility, and environmental friendliness.

Other alternatives, including wooden and composite utility poles, are available in the market. Wooden utility poles decay over time and are prone to catch fire. Composite utility poles can be easily mass-produced and are strong. However, their mass-to-energy absorption rate is low, which makes steel poles an ideal choice for utility lines that are close to forests and roads.

Application Insights

The GCC steel utility poles market in terms of applications was led by the electricity transmission & distribution segment and is projected to maintain dominance showcasing a CAGR of over 6% during the forecast period. Steel utility poles are preferred for electricity transmission and distribution applications due to their durability, strength, and resilience to harsh environmental conditions. Steel utility poles support medium and low-voltage distribution lines that deliver electricity to homes, businesses, and other buildings. These poles can be designed in different shapes and sizes to fit different applications.

Growth of the electricity transmission & distribution segment can be credited to increasing investments in the expansion and modernization of power lines. For instance, in July 2022, the Dubai Electricity and Water Authority (DEWA) announced an investment of about USD 10.8 billion in electricity and water projects in the next five years. Moreover, in November 2021, Bahrain’s Electricity and Water Authority (EWA) signed an agreement with Nokia to modernize its distribution network with a private LTE network for improved performance and efficiency.

The lighting segment is anticipated to witness the highest CAGR of around 8% over the forecast period due to an upsurge in demand for decorative street lighting across the GCC countries. In addition, an emerging trend of road infrastructure beautification across the region is opportunistic for the market's growth. For instance, in September 2021, the Supervisory Committee of Beautification of Roads and Public Places, Qatar, commenced installing 1,440 decorative light poles on Corniche Road. These poles are locally manufactured by using indigenous raw materials.

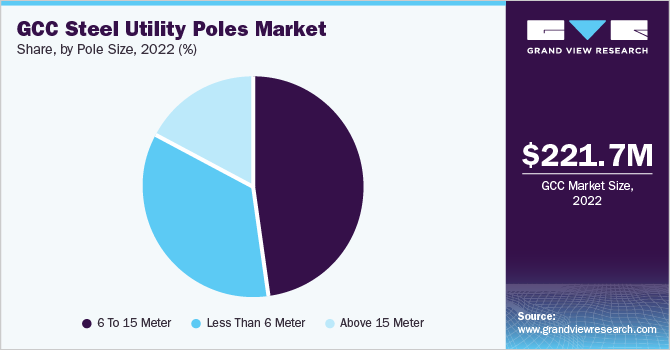

Pole Size Insights

The 6 to 15 M segment led in 2022, accounting for a market share of over 47%. In contrast, the less than 6 M steel utility poles segment is likely to grow at the fastest CAGR of around 7% during the forecast period. The poles with a height between 6 to 15 meters are commonly used in urban and suburban areas to apply overhead power lines, which help in the transmission and distribution of electricity and can withstand heavy loads and high winds.

Moreover, in August 2022, Saudi Electricity Projects Development Company announced the completion of the electrical interconnection project between the Al-Qassim and Medina regions. This is the longest 380kv overhead transmission line in Saudi Arabia, with a direct length of about 420 kilometers. Such projects are fueling the demand for overhead power distribution poles, contributing to the growth of the 6 to 15 M segment.

On the other hand, the growth of the less than 6 M steel utility poles segment is credited to the rising demand for shorter utility poles across the residential and urban areas, where smaller poles are needed to support streetlights, traffic signals, signage, and other types of equipment.

Country Insights

Saudi Arabia accounted for the largest market share of more than 45% in 2022 and is expected to grow at a CAGR of almost 6% during the forecast period. The factors, including higher electric power consumption due to the growing population and burgeoning economy of Saudi Arabia, primarily contribute to the growth. For instance, according to the Ministry of Environment, Water and Agriculture, Saudi Arabia, the country reported electricity consumption of 301,561.350 GWh in 2021, an increase from the earlier consumption of 289,330.880 GWh for 2020. The country is focusing on enhancing the maintenance and operation of power plants and augmenting their power transmission & distribution capacity to meet the ever-increasing demand for electric power.

The UAE is anticipated to register growth at the highest CAGR of over 7% during the forecast period. Rapid urbanization, industrialization, and demand for power generation have driven the growth of the UAE steel utility poles market. In addition, under the Energy Strategy 2050, the UAE is aimed to increase the clean energy contribution in the total energy mix from 25% to 50% and reduce the carbon footprint of power generation by 70% by the year 2050. This focus on renewable energy generation, transmission, and distribution is projected to augment the demand for steel utility poles in the country.

Key Companies and Market Share Insights

The major players in the steel utility poles business focus on the development of high-quality steel poles at reasonable prices to have a competitive edge in the market. Companies are focusing on integrating advanced steel pole production techniques to enhance their offerings. In addition, the GCC region's market players are collaborating with the governments on various infrastructure development programs to generate new revenue streams further. For instance, in January 2021, Ashghal, the Public Works Authority signed two contracts with local utility pole suppliers to provide 2,600 decorative lighting poles to improve Doha Corniche and Central Doha areas within the works of the Supervisory Committee of Beautification of Roads and Public Places in Qatar. Some prominent players in the GCC steel utility poles market include:

-

Al- Babtain Power & Telecommunication Co.

-

Energya

-

Europoles Middle East LLC

-

galvacoat.ae

-

Galvanco

-

Hapco

-

HAS Engineering L.L.C

-

Hidada Ltd.

-

Metrosmart International Trading & Contracting W.L.L.

-

Orbix International LLC

-

Saleh and Abdulaziz Abahsain Co. Ltd. (Omega Company)

-

Techno Pole Industries LLC

GCC Steel Utility Poles Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 233.4 million

Revenue forecast in 2030

USD 364.6 million

Growth Rate

CAGR of 6.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in million units, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, pole size, country

Regional scope

GCC

Country scope

Saudi Arabia; Qatar; The UAE; Rest of the GCC

Key companies profiled

Al- Babtain Power & Telecommunication Co.; Europoles Middle East LLC; Galvanco; Energya; Hidada Ltd.; Hapco; HAS Engineering L.L.C.; Orbix International LLC; Metrosmart International Trading & Contracting W.L.L.; Saleh and Abdulaziz Abahsain Co. Ltd. (Omega Company); galvacoat.ae; Techno Pole Industries LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

GCC Steel Utility Poles Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the GCC steel utility poles market report based on application, pole size, and region:

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Electricity transmission & distribution

-

Lighting

-

Telecommunications

-

Others

-

-

Pole Size Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Less than 6 meter

-

6 to 15 meter

-

Above 15 meter

-

-

Country Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Saudi Arabia

-

Qatar

-

The UAE (United Arab Emirates)

-

Rest of GCC

-

Frequently Asked Questions About This Report

b. Key factors that are driving the GCC steel utility poles market growth include increasing urbanization trends in the region, rise in investments towards smart city projects and manufacturing process with lower levels of greenhouse gas emissions among others.

b. The GCC steel utility poles market size was estimated at USD 221.71 million in 2022 and is expected to reach USD 233.4 million in 2023.

b. The GCC steel utility poles market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 364.6 million by 2030.

b. Saudi Arabia dominated the GCC steel utility poles market with a share of more than 40% in 2022. This is attributed to increasing investments towards smart city projects in the region.

b. Some key players operating in the GCC steel utility poles market include Al- Babtain Power & Telecommunication Co., Galvanco, Europoles Middle East LLC, Energya, Hidada Ltd., Hapco, HAS Engineering LLC, Orbix International LLC, galvacoat.ae, Metrosmart International Trading & Contracting W.L.L., Saleh and Abdulaziz Abahsain Co. Ltd. and Techno Pole Industries LLC among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."